airdone/iStock by way of Getty Photographs

Thesis Abstract

Markets ended 2023 on a really robust be aware, reaching new highs. However what can we count on as we transfer into 2024?

After all, from a technical perspective, it is fairly evident to everybody that the market appears overstretched. But that is no assure that we are going to get a considerable sell-off.

Even when we do dump from right here, I consider it could be a dip price shopping for, as there may be one unrelenting pressure that’s going to push markets excessive in 2024: liquidity.

Total, the stage is ready not just for charge cuts by the Fed but in addition for charge cuts by most central banks. We’re additionally starting to get proof that QT may come to an finish quickly, and it is also seemingly that the TGA can be emptied out as we transfer into the November elections.

Barring a return of inflation or a black swan-like occasion, the stage is ready for additional upside in 2024. I am going to focus on this risk too.

Liquidity Outlook

Sure, it is all about liquidity, or no less than it has been for the final 10 years. Valuations could also be sky-high relative to historical past, however so is the Fed’s stability sheet.

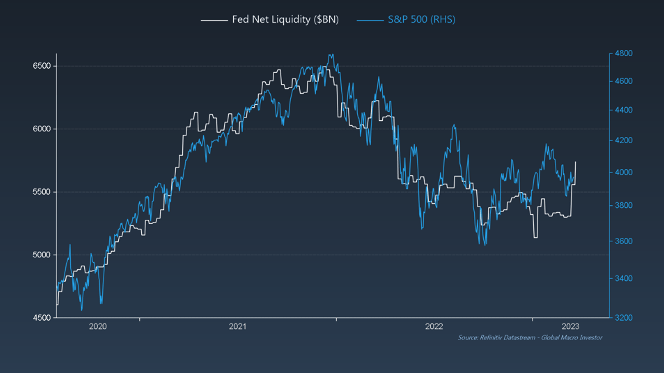

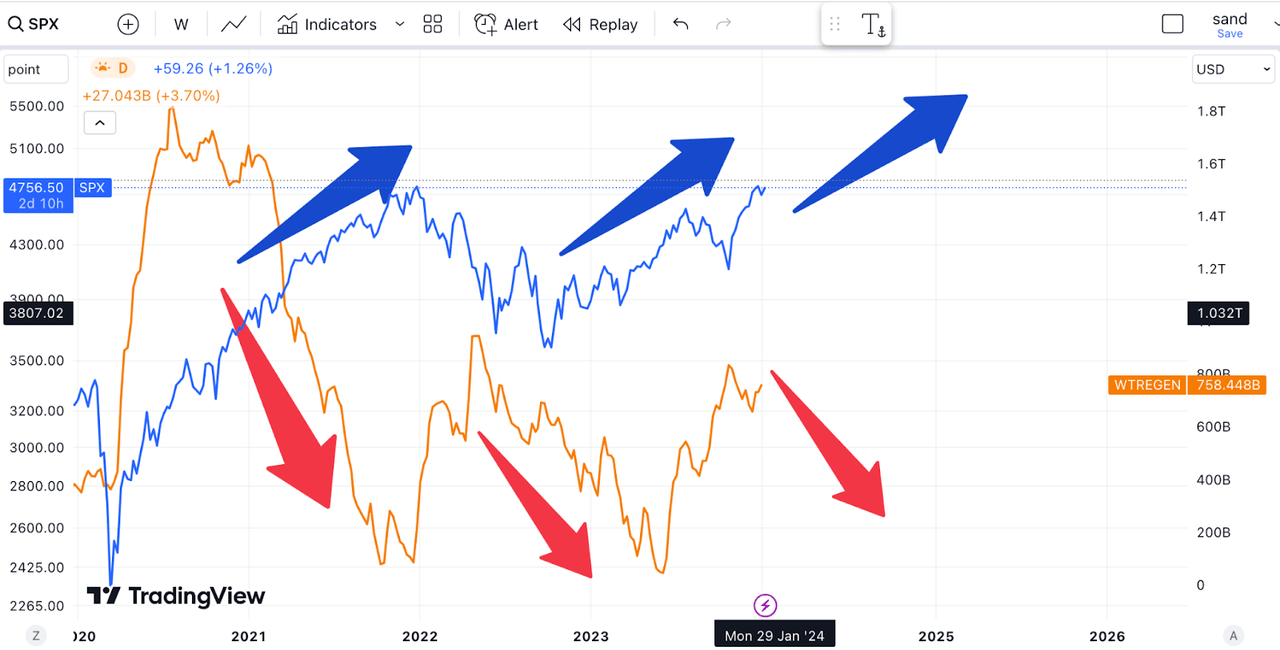

Fed Liquidity and S&P500 (Refinitiv)

There’s clearly a really robust correlation between the Fed liquidity and the S&P 500. When liquidity is rising so do asset costs.

What does this imply precisely?

In easy phrases, Fed liquidity will be said as: Fed Stability Sheet – Treasury Normal Account – Reverse Repo.

A bigger stability sheet provides to liquidity whereas decreasing it, QT, is dangerous for liquidity. A rise within the TGA sucks funds out of the economic system, however when it’s drawn down, it’s a internet optimistic. The identical goes for the RRP facility.

Regardless of greater charges and QT in 2023, liquidity really went up, which will be attributed to the drawdown within the RRP and in addition the Fed’s Financial institution Time period Funding Programme.

As we enter this 12 months, we will count on extra forces to maintain liquidity up.

US Price Cuts

Although traders have been anticipating this for some time, the Fed, and maybe extra importantly Powell, made this official in December, acknowledging that charge cuts are on the horizon.

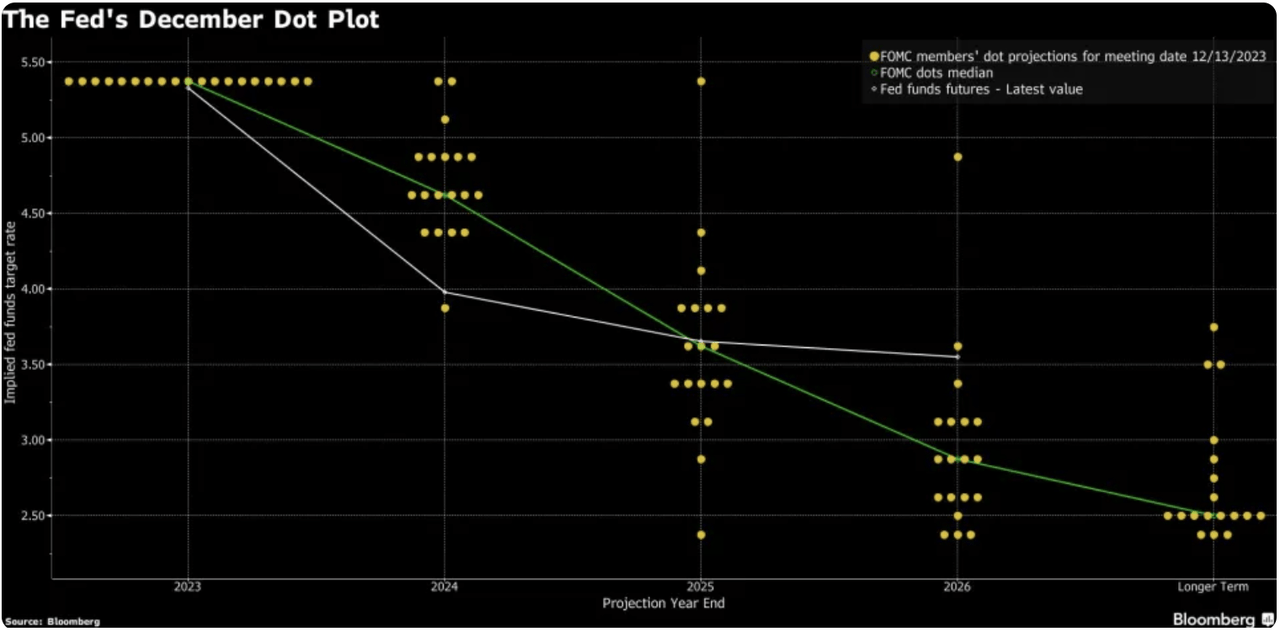

Fed Dot Plot (Bloomberg)

The December Dot Plot reveals that three charge cuts are seemingly in 2024, though the market is already pricing in additional. This would be the first step in easing liquidity.

World Price Cuts

Some traders are beneath the impression that different Central Banks, such because the ECB in Europe and the BoJ in Japan, is likely to be extra cautious in slicing charges, however the newest knowledge popping out from these nations strongly helps extra charge cuts.

For instance, Japan’s inflation additionally reveals indicators of rapidly abating. In Tokyo, Core CPI fell to 2.1% YoY in December, down from 2.3% in November. Japan’s wages have additionally been falling, which is able to contribute to easing inflation. I used to be shocked that the BoJ is likely to be in retailer.

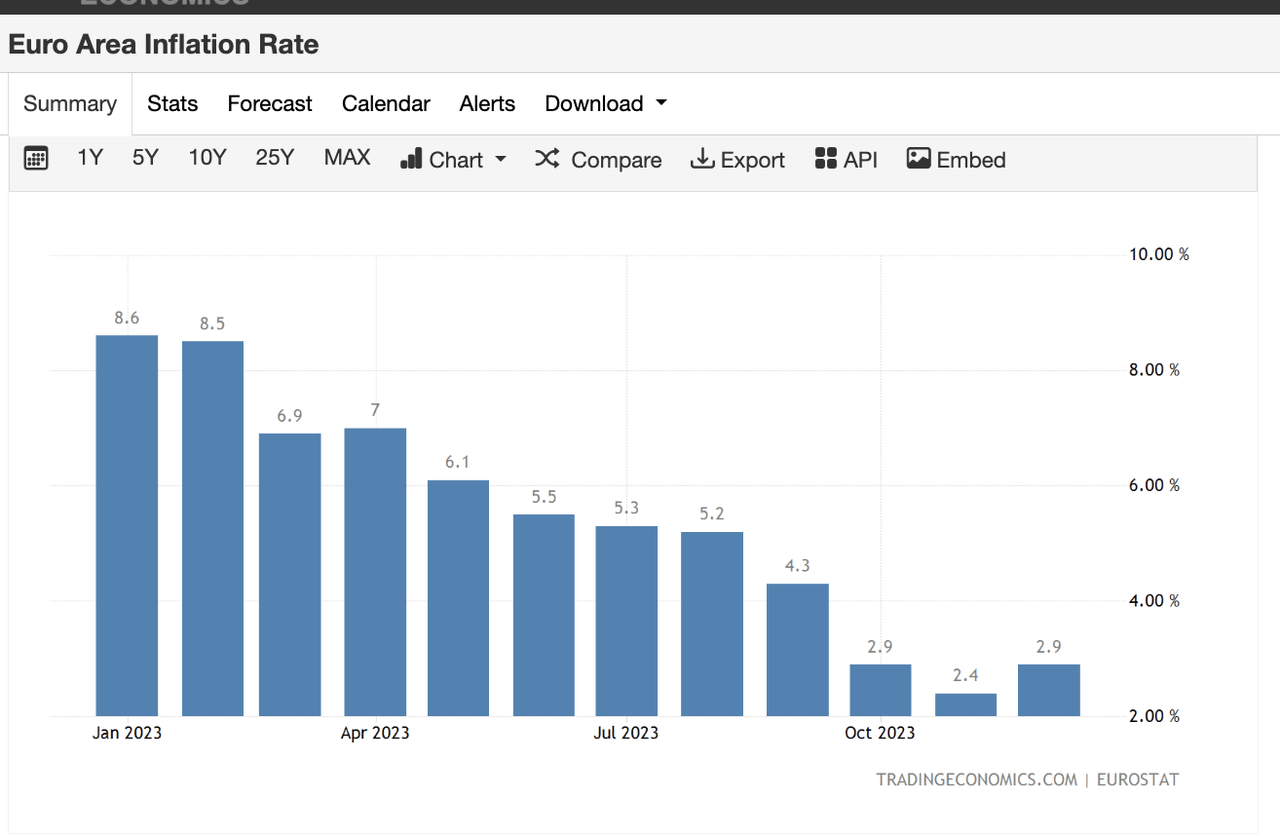

In the meantime, the Eurozone can be preventing quickly falling inflation. The newest figures got here in at 2.9%, under the expectations of three%.

Euro Space Inflation (Tradingeconomics)

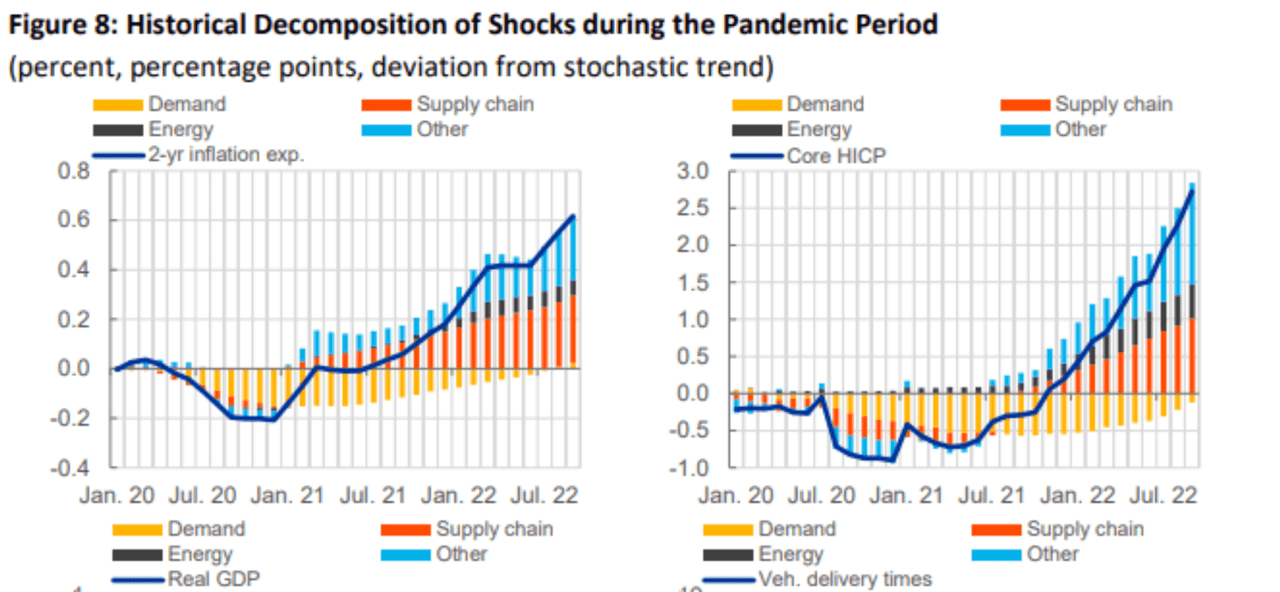

Not too long ago, the ECB additionally issued a report which highlighted that provide chain points had been the biggest contributors to inflation.

Causes of Inflation (ECB report)

If, certainly, the ECB believes that inflation is usually brought on by provide points, then it is smart to not preserve financial coverage too restrictive for too lengthy.

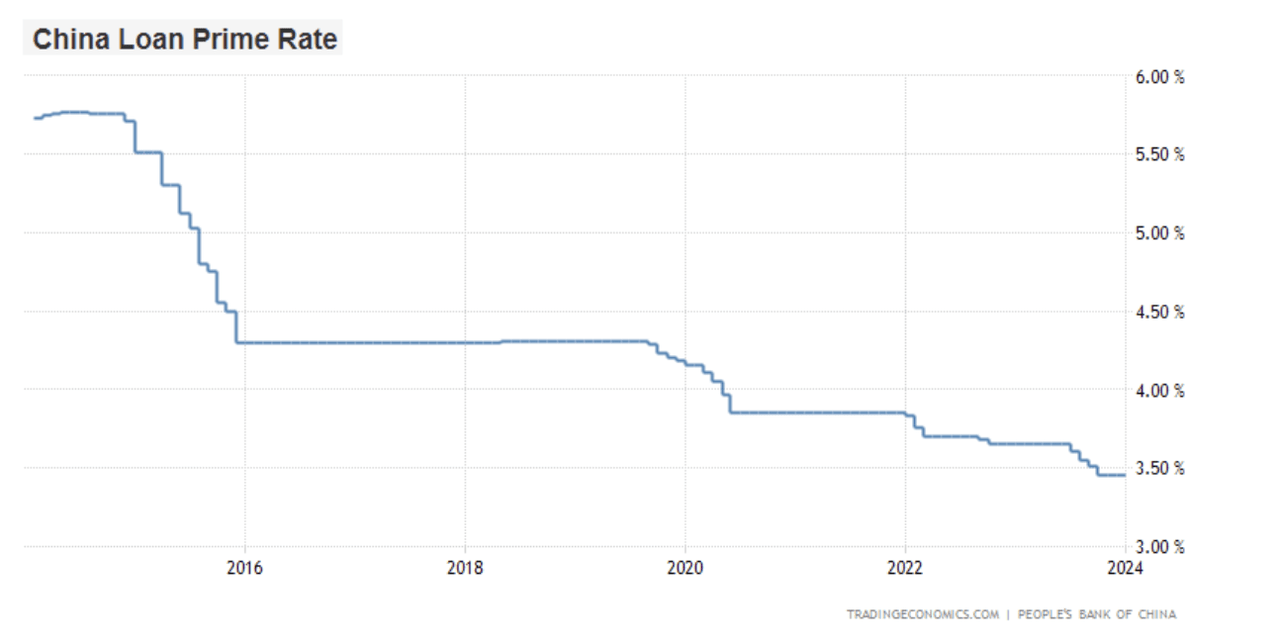

And, after all, China is nicely forward of the curve, having already issued a number of charge cuts as a response to their actual property disaster.

China Mortgage Prime Price (Tradingeconomics)

Finish of QT

The December Fed minutes revealed that no less than “a number of” of the Fed’s members are starting to debate slowing down QT.

A number of individuals remarked that the Committee’s stability sheet plans indicated that it could sluggish after which cease the decline within the measurement of the stability sheet when reserve balances are considerably above the extent judged in line with ample reserves. These individuals steered that it could be acceptable for the Committee to start to debate the technical components that will information a choice to sluggish the tempo of runoff nicely earlier than such a choice was reached in an effort to present acceptable advance discover to the general public. Supply: Lorie Logan of the Fed.

Supply: Lori Logan, Fed minutes

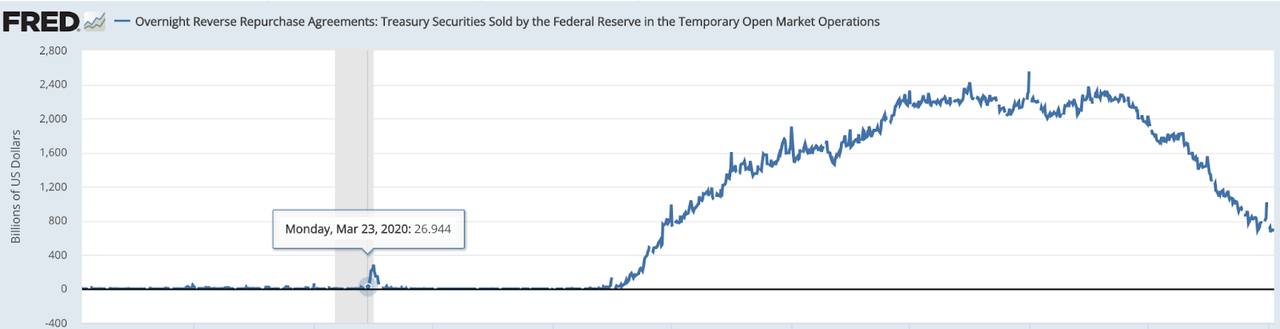

After all, this makes good sense because the Fed is now making an attempt to ease. And it additionally is smart in gentle of the truth that the Reverse Repo Facility is operating out, one thing Lori Logan additionally identified.

RRP (FRED)

TGA Drawdown

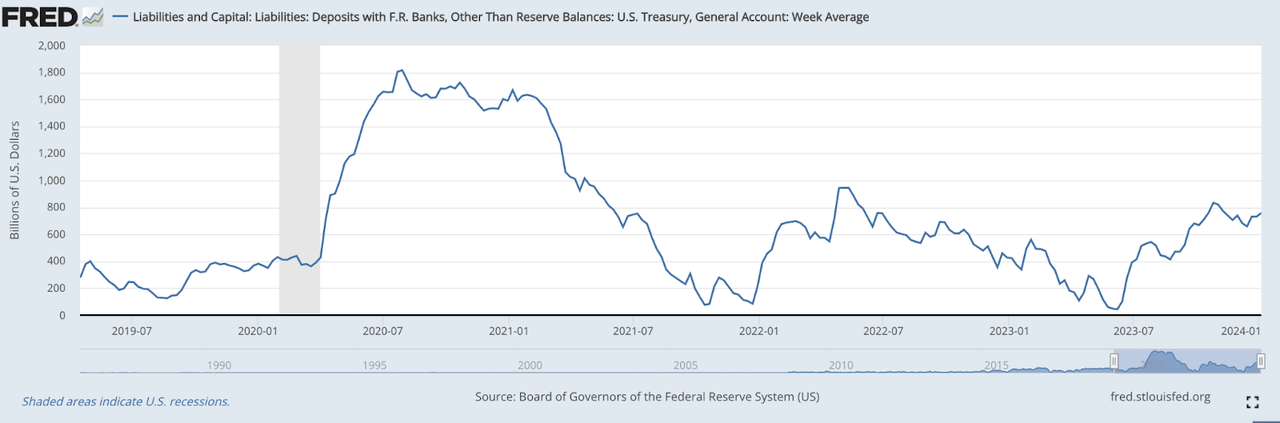

And lastly, we will count on extra liquidity to be added to the market as Janet Yellen begins to attract down the TGA.

TGA (FRED)

On January seventh, US lawmakers agreed on a $1.4 trillion spending funds for 2024. The TGA at the moment holds near $800 billion. Most probably, we’ll see some additional build-up in TGA, however I might count on this to be emptied out as we strategy the top of the 12 months, which is able to coincide with the US elections.

The correlation between TGA drawdown and market energy can be fairly notable.

SPX and TGA (Creator’s work)

All in all, loads of forces are at play right here that ought to assist liquidity and markets in 2024.

A phrase Of Warning

With that stated, there are a few issues that would derail this narrative. Larger inflation, little doubt, could be one.

Given the present macro context, we would wish an exogenous shock to offer us a shock in inflation. Nicely, we have really seen a pair within the final month.

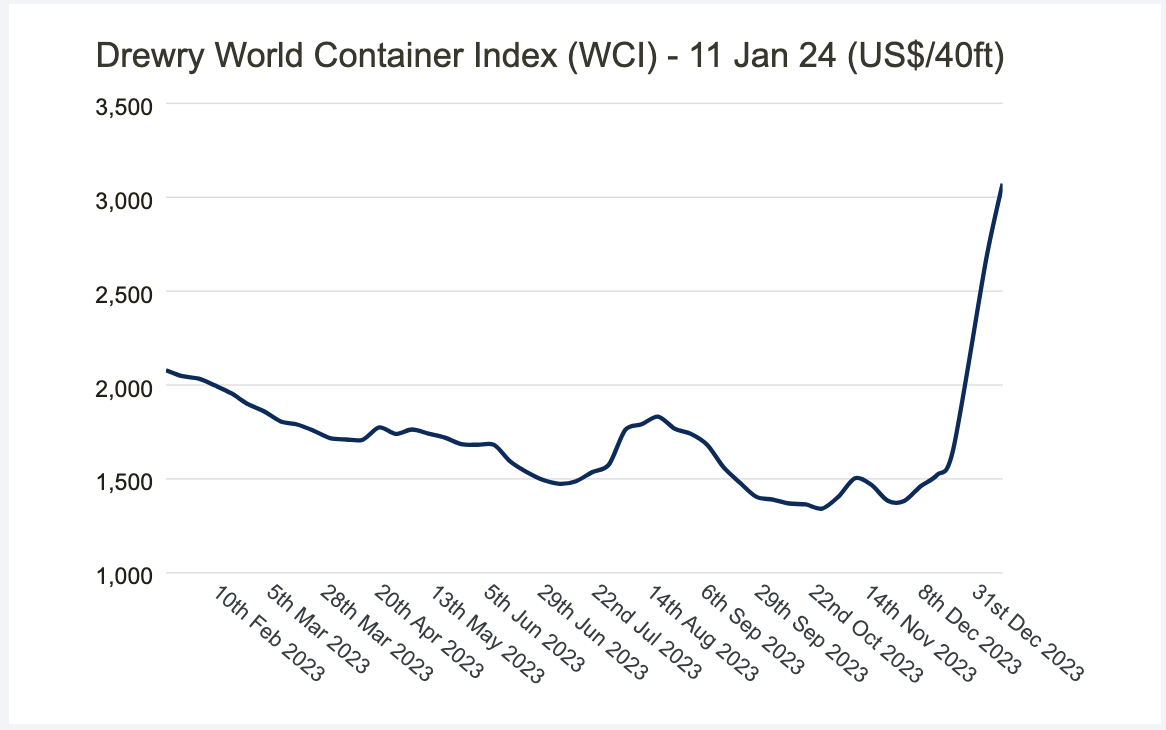

Drewry WCI (Drewry)

Freight charges have exploded within the final month because of the ongoing points within the Purple Sea, which has pressured many firms to re-route their ships. Larger freight charges translate into greater prices of products and will even translate into precise shortages, which might clearly push costs up too.

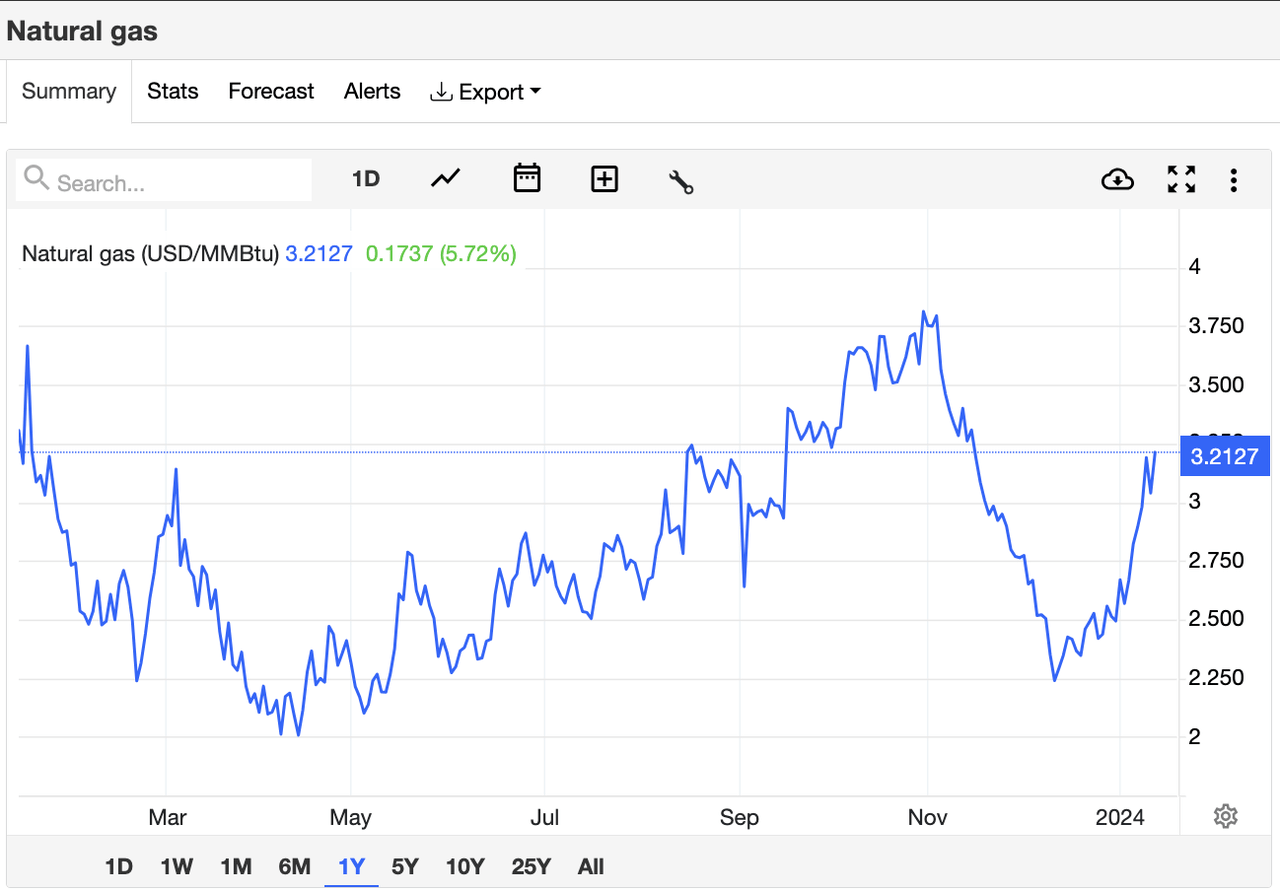

On high of that, power has been rebounding fairly nicely in the previous few weeks. Pure fuel has seen a major spike in worth as we strategy what might be a chilly winter.

Natgas (Tradingeconomics)

And, after all, I nonetheless suppose there’s some danger {that a} black swan occasion may hit the economic system, comparable to a collapse of economic actual property, which I mentioned in my final macro article.

Last Ideas

In conclusion, I stay fairly bullish available on the market for 2024, no less than for now. Extra instantly, we may see a technical pull-back, however the elementary story is that greater liquidity will assist greater asset costs. Till I see proof that liquidity may take a flip, I stay bullish.