Marcus Z-pics/iStock through Getty Photos

Lifeway Meals (NASDAQ:LWAY) is the US chief in milk kefir merchandise.

The corporate instructions a big share of this rising market and has expanded gross sales virtually constantly since going public within the early Nineties.

In my newest firm evaluate, I issued a Maintain ranking on the inventory one 12 months in the past. The explanation was an absence of gross margin power and an elevated market value, even assuming margin restoration.

One 12 months after the article, the inventory trades 100% increased. The explanation has been margin restoration and hypothesis a couple of potential sale of the corporate to incumbents.

On this evaluate, I discover that the margin restoration has been industry-wide however that the corporate has benefited from it and managed different bills. I dissect the expansion expectations embedded within the inventory value and evaluate them to historic income development.

I conclude that Lifeway is an thrilling firm, however its market value continues to be extreme from an operational standpoint. The value is just not as aggressive from a possible acquisition standpoint, however I desire to not speculate on such points.

The good CPG restoration

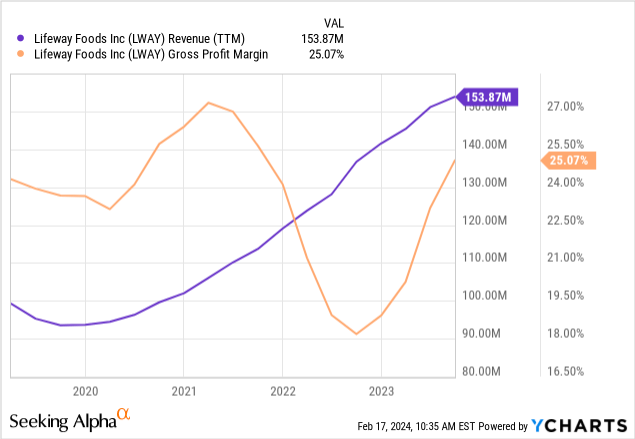

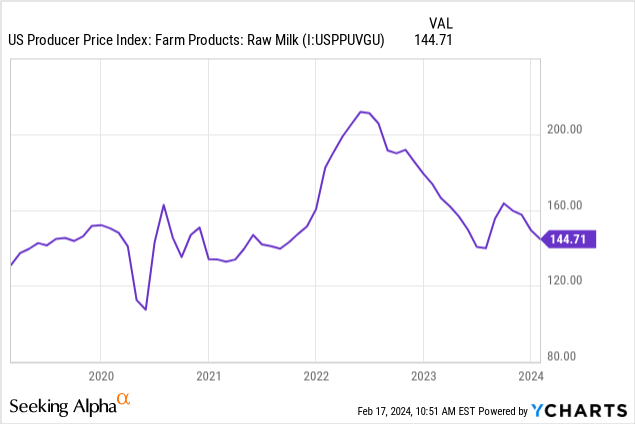

Lifeway is a development story; the pandemic helped it develop way more. Nevertheless, the inflationary pressures of late 2021 and early 2022 dented the corporate’s gross margins. The explanation, as seen within the second chart under, was the rise in milk costs.

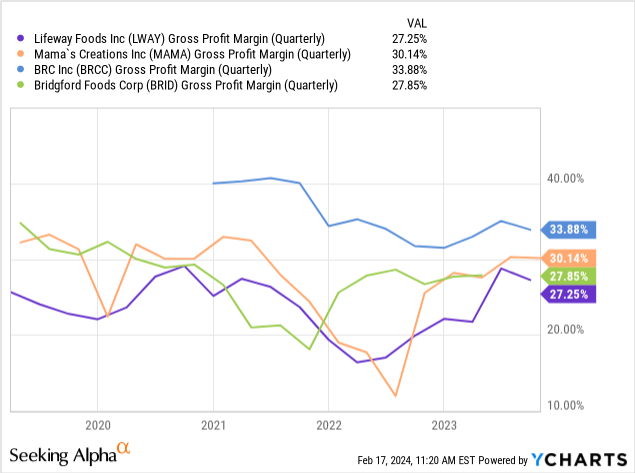

CPG firms can’t increase gross margins past sure limits until their model is outstanding. The reason being that their merchandise are proven on cabinets near opponents’ and various merchandise. Additional, when there are enter value shocks, firms may determine to briefly take in them to be able to defend market share. As seen within the third chart under, the margin fall and restoration have been shared amongst many small and mid-cap CPG manufacturers, in all probability on the {industry} stage.

As milk costs subsided, Lifeway’s margins recovered to extra historic values, round 25% for the TTM interval and even above this, near 27%, within the newest quarters. I anticipated this state of affairs to play in my newest article on Lifeway.

Acquisition rumors

For the reason that late pandemic, the corporate’s founding household has been preventing across the firm’s management and future. On the one hand, we’ve got the founder’s daughter, who has been the corporate’s CEO since 2002. On the opposite aspect, we’ve got the CEO’s mom and brother.

The latter group introduced a proxy contest to the final shareholder assembly however misplaced the director vote. Nevertheless, the corporate issued a press launch saying that it had employed the providers of an advisory agency to guage strategic options.

This was broadly learn as fueling the rumor that the corporate may very well be acquired. Danone, the dairy big, already owns 22% of the corporate and doubtless voted in favor of the present administration. The corporate, with its rising gross sales and good margins, plus focused health-conscious clients, is a superb match for a lot of CPG leaders.

This rumor has additionally fueled the inventory value, provided that pondering in a 1x or 1.5x EV/S a number of is just not loopy (the corporate now trades at a $170 million market cap and has $155 million in TTM gross sales).

It’s not my method to take a position on these developments, and subsequently, I don’t take into account these rumors sufficient to justify the present valuation.

Lengthy-term profitability

Lifeway is a development firm. The corporate offered $3 million in 1993 and is closing the 12 months at a charge of $153 million. That may be a 50x enhance, or a compounded CAGR of 14%. The desk under exhibits that the expansion charge has not been fixed, with some deceleration, however nonetheless fairly first rate.

| 1993 | 1999 | 2009 | 2019 | 2023 | |

| Income | $3M | $8M | $54M | $104M | $153M |

| CAGR | – | 18% | 21% | 6.7% | 10% |

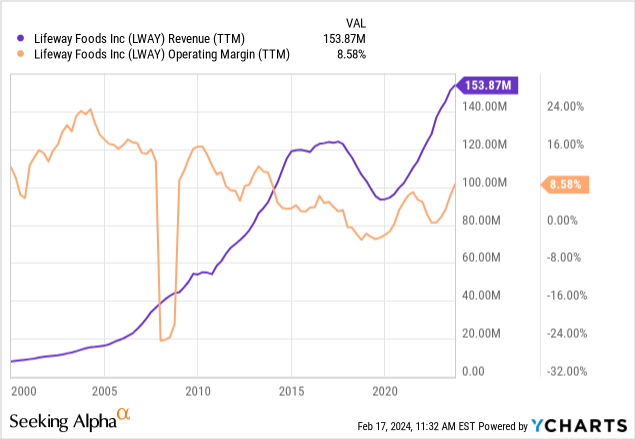

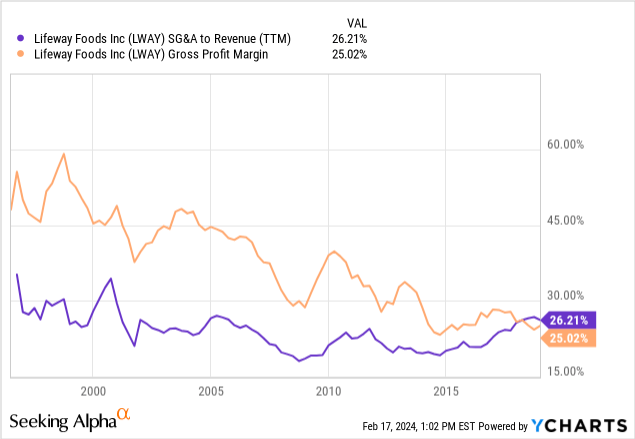

Nevertheless, Lifeway’s street to profitability differed, with margins constantly falling for many of the previous twenty years. The perpetrator has been falling gross margins, which I discover logical as the corporate expands to mass market channels, but in addition uncontrolled SG&A prices.

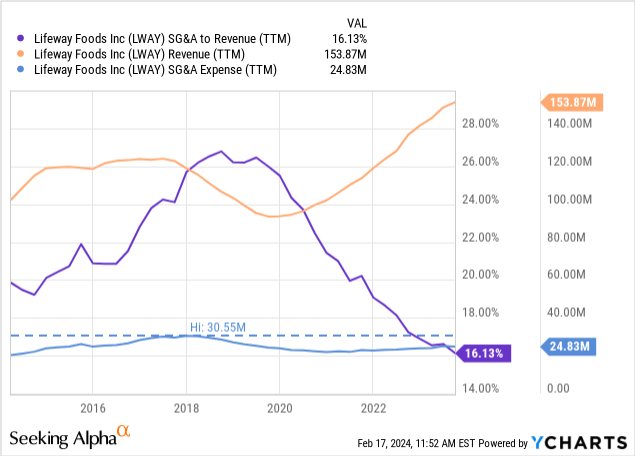

Nevertheless, issues began to alter in 2018, with gross margins stabilizing and a lot better management over SG&A prices. The whole SG&A account remained secure between $25 and $30 million, regardless of revenues rising from $100 to greater than $150 million.

Sadly, the corporate didn’t publish incomes requires many of the interval, and the 10-Okay discussions are usually not very detailed. The principle change I discovered is that the corporate modified its Senior VP of Gross sales in 2018.

General, although, the corporate is near 10% working margins right now, which places it at industry-average ranges, in line with Damodaran’s database.

As a result of the corporate can’t management its gross margins as a lot (it’s a value taker in inputs and can’t set costs manner above opponents in outputs), SG&A management will stay paramount.

Valuation and expectations

We are able to work with two eventualities. The primary is preserving its working margins at about 10%, the {industry} common. The second, extra bullish, considers that the corporate can leverage its SG&A construction going ahead, at the very least till reaching twice its present revenues.

With the corporate buying and selling at a $170 million market cap to make a ten% earnings yield, which appears important for any fairness, Lifeway ought to submit $17 million in internet earnings. That may be a lengthy shot from the present $8 million.

We assume a 30% efficient tax charge (the corporate is predicated in Illinois, which has near 10% earnings tax charges on high of the federal 21%), resulting in about $24 million in pre-tax earnings.

Beneath the primary state of affairs, this represents $240 million in revenues, or $200 million underneath the bullish second state of affairs.

From the present $153 million in revenues, reaching these income ranges would take 4 or 3 years, respectively, utilizing the corporate’s long-term income CAGR of 14%. Nevertheless, it could take 6 or 4 years utilizing a CAGR of 8%, nearer to the corporate’s efficiency for the reason that Nice Monetary Disaster.

Even bullishly assuming bettering profitability, we’re between 3 and 4 years of development for the corporate to return an honest earnings yield on its present inventory value. If profitability is the {industry}’s common, that interval extends to 4 or 6 years. And that’s with none bother within the economic system or kefir as a sought-after product.

These expectations are excessively bullish and can’t justify the present inventory value. Most likely, the inventory is buying and selling extra in keeping with a possible acquisition price ticket. Nonetheless, even underneath that state of affairs, many of the alpha has already been generated (the corporate trades at greater than 1x gross sales).

I imagine Lifeway is an effective firm, and I hope it retains rising and controlling bills, and even higher, that it will get acquired at a juicy a number of. Nevertheless, I desire to cross on the inventory, because it would not meet my hurdle charges.