- Dividend season is right here and firms are on the brink of pay out

- For those who’re on the lookout for last-minute dividend alternatives, look no additional

- IBM, Barclays and Dorian LPG are set to problem dividends quickly

Because the dividend season kicks into excessive gear within the US, buyers are actively in search of firms which can be beneficiant in sharing their income. Let’s dive into three standout firms, every approaching their final day to purchase shares eligible for dividends, which is simply across the nook.

Main the pack, now we have Barclays (NYSE:) and Worldwide Enterprise Machines (NYSE:), each catching the attention with their promising dividend yields. Whereas Barclays impresses with a gorgeous 5.09% yield, IBM follows intently behind with a stable 4.63% yield. IBM’s long-term dividend efficiency is especially noteworthy, boasting a constant monitor file of rewarding buyers for a formidable 27 years.

However that is not all; one other firm stepping as much as share its income is Dorian LPG (NYSE:), providing a exceptional $1 per share dividend, translating to an excellent 13.54% dividend yield. With a sturdy dividend payout ratio of 127.92%, its dedication to buyers is crystal clear.

With dividend alternatives abound, these three firms are definitely ones to observe because the clock ticks all the way down to the final day to seize shares eligible for dividends.

Barclays: Dividends and Nice Upside Potential

Shifting our focus to Barclays’ current quarterly , which had been unveiled on July 27, we noticed optimistic numbers total. Nonetheless, on the day of the announcement, the inventory worth dipped simply over 5%.

This decline might be linked to the revision of curiosity margin forecasts, dropping from 3.2% to three.15%, which suggests a doable peak. However, Barclays stays an attractive choice, particularly contemplating its above-average honest worth ratio.

Forecasts Vs. Precise Earnings

Supply: InvestingPro

In the case of dividends, mark your calendars for August 10, as it is the final day to purchase shares and be eligible for the dividend cost, which stands at $2.7 per share.

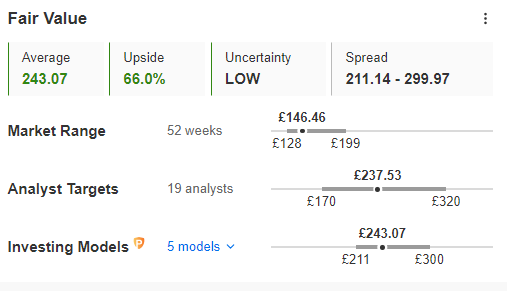

Furthermore, what’s actually catching consideration is the remarkably excessive honest worth index, signaling a formidable upside potential of greater than 60%.

Honest Worth Barclays

Supply: InvestingPro

2. Dorian LPG: A Correction Is Probably

Dorian LPG makes a speciality of transporting liquefied petroleum gasoline (LPG) utilizing its personal fleet of tankers. Just lately, the demand for the corporate’s providers has surged, notably after sanctions had been imposed on Russia, resulting in a pointy enhance in LPG imports from the US to Europe.

In consequence, america has emerged as one of many main suppliers of gasoline to the Previous Continent, utterly altering the dynamics from the earlier yr.

Since 2020, the corporate’s inventory worth has been following a powerful upward pattern, setting new historic highs within the vary of $30 per share.

Dorian LPG Value Chart

Current fell under market expectations, which could be signaling the start of a corrective motion for the corporate’s inventory. Analysts are eyeing a possible goal just under $27, the place sturdy native assist and the upward pattern line converge.

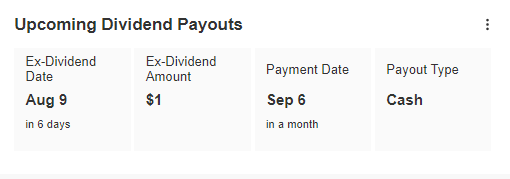

For buyers keen on capturing the dividend, mark August 9 in your calendar as it’s the final day to purchase shares and qualify for the payout. The dividend stands at a gorgeous $1 per share.

Upcoming Dividend Payouts

Supply: InvestingPro

IBM: Inverted Head-And-Shoulders Formation Coming to Fruition?

Coincidentally, the ex-date (the final day to purchase shares and qualify for dividends) for IBM is similar as Dorian LPG, which is August 9. IBM, the U.S. IT large, intends to distribute earnings of $1.6 per share, ensuing within the beforehand talked about yield of 4.63%.

On the technical entrance, there’s an intriguing improvement to be careful for – a long-term inverted head-and-shoulders formation that has been taking form since 2018. This sample might probably result in important market actions, making IBM a inventory to keep watch over within the coming days.

IBM Value Chart

On this state of affairs, the essential issue to observe is the break of the neckline located across the $150 per share worth stage. As soon as this stage is breached, it might pave the way in which for larger ranges, with the preliminary goal set at $175.

IBM stands to learn from the continuing AI and semiconductor growth, which supplies long-term assist for the inventory. Nonetheless, to return to an NVIDIA-like uptrend, the market might be on the lookout for considerably improved quarterly ends in the upcoming months.

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it’s not meant to encourage the acquisition of belongings in any approach, nor does it represent a solicitation, supply, advice, recommendation, counseling, or advice to take a position. We remind you that every one belongings are thought-about from totally different views and are extraordinarily dangerous, so the funding resolution and the related threat are the investor’s personal.