yullz/iStock Editorial via Getty Images

The timing was not playing in our favor, but we are believers in the construction businesses for the time ahead. Here at the Mare Evidence Lab Towers, we reiterate our positive view and our buy ratings for both LafargeHolcim (HCMLF, OTCPK:HCMLY) and for HeidelbergCement (HLBZF, OTCPK:HDELY).

As a brief recap, our key takeaways for Holcim were:

- Higher government spending on infrastructure plans to revitalise business after the pandemic;

- We see Holcim as a leader in the ESG environment;

- Supportive M&A;

- And strong financial performance.

Looking at the company’s performance and the stock price appreciation, we could not be more happy. We got it right for all the above points and we confirm our thesis.

Q1 Results

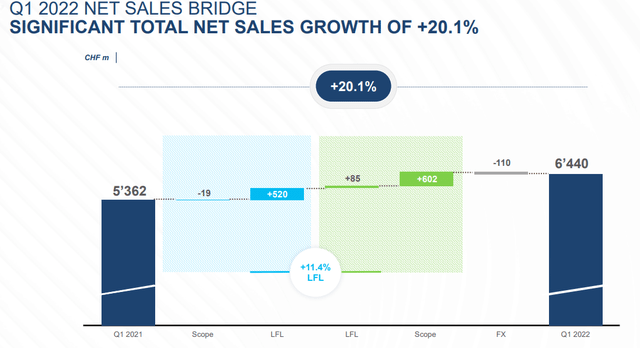

Starting with point four, Holcim reported record top-line revenue at CHF 6,440m, posting a plus +20.1%. This was driven by strong demand, supportive acquisitions (point three), and pricing power. Going down on the P&L, the company posted another record performance at the operating profit level with a Q1 that posted CHF 614m with a total growth of +16.3% at CET. Once again, a strong contribution was due to the latest acquisition, in our latest article on Holcim, we emphasised the multiple arbitrage opportunity thanks to Firestone. Indeed, the roofing business contribution was at a 17% operating profit margin.

Holcim sales trend (Q1 Results)

Our Points Two and Three

A picture paints a thousand words and we can use some to see what Holcim is doing. Jan Jenisch Holcim’s CEO said: “With sustainability at the core of our strategy, we published our first Climate Report, sharing our net-zero journey with 2030 and 2050 targets validated by the Science-Based Targets initiative. A first in our industry, it reviews our decarbonisation actions, from green building solutions, all the way to circular construction and next-generation technologies.”

ECOPact green concrete reached 10% of ready-mix sales in March 2022. Holcim is not only working at the ESG level on net-zero emission, but it also taking advantage of the favourable EU legislation in the green bond area (with extremely low-interest rates).

Holcim ESG (Q1 Results)

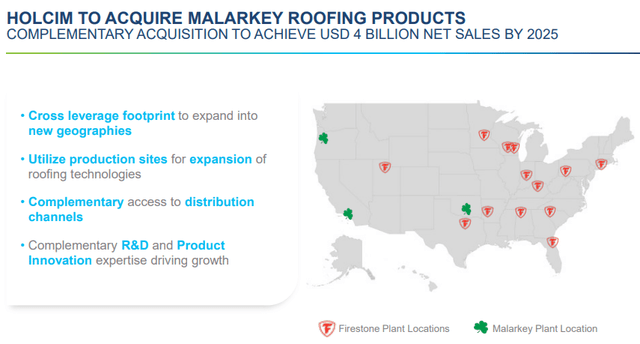

Regarding the acquisition, we see Holcim as a true value player. Malarkey is a proven growth driver and is very complementary to the Firestone acquisition. Accretive EPS starting from this year, synergies of $40 million by year three, and a better sales diversification.

Malarkey M&A details (acquisition presentation)

Conclusion and Valuation

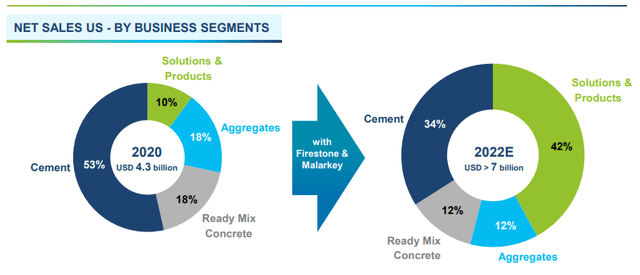

Despite the recent macro development, Holcim once again raised the bar on 2022 guidance and we are confident that they will meet their internal outlook. Our internal team is forecasting an EBITDA of 7 billion CHF thanks to a better product mix, the latest acquisition, and strong pricing power. We really like businesses which are adaptive and Holcim is certainly one of them. From a pure player in cement, aggregates, and concrete, they have decided to shift to more value-added products (image below). We value the company based on our forecast EBITDA of 6.5x and we arrive at a valuation of 67 CHF per share, implying a current upside of more than 42%. Aside from the usual risks in the construction business sector, we’d like our readers to consider the Syria litigation.

Holcim business transformation (Malarkey acquisition presentation)

Previous coverage in the construction/cement sector:

- LafargeHolcim: Multiple Arbitrage Thanks To Firestone Acquisition

- HeidelbergCement: The Best Is Yet To Come

- Looking At HeidelbergCement’s Russian Exposure