Scott Olson

March twenty sixth ended up being a extremely incredible day for shareholders of Krispy Kreme (NASDAQ:DNUT). It is because, after asserting a significant growth of a partnership that the corporate has with restaurant big McDonald’s (MCD), shares spiked, closing up 39.4%. It is unclear the precise influence this can have on the corporate transferring ahead. Nonetheless, it possible will assist the corporate to considerably improve its income over the following a number of years. As for what this implies for present traders, is a little more difficult. The very fact of the matter is that the inventory is just not notably attractively priced right now. That is very true after factoring within the surge in value that shares skilled. This might imply underperformance for traders for a while. However for these with a really long run horizon, it is possible that further upside may very well be on the desk.

A giant deal

On March twenty sixth of 2024, shares of Krispy Kreme shot up 39.4%. This got here in response to a press launch issued by the corporate. In it, the corporate made clear that, beginning within the second-half of this yr, it’s going to start providing three of its doughnuts on the market in choose McDonald’s eating places all through the US. This follows a pilot program that concerned 160 McDonald’s places in Lexington and Louisville, Kentucky that clearly confirmed optimistic outcomes for each it and its associate within the enterprise. It is unclear precisely what number of McDonald’s places this shall be rolled out to by the top of the yr. However by the top of 2026, the corporate plans to have these doughnuts on the market all through the entire restaurant’s places nationwide.

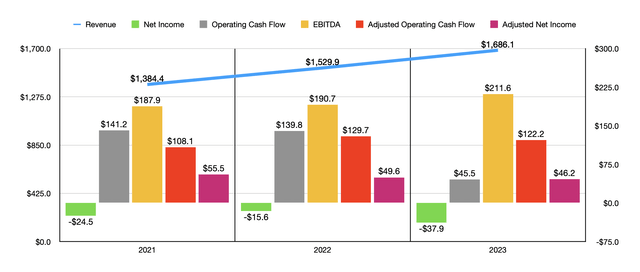

Writer – SEC EDGAR Information

To be clear, this isn’t a maneuver that Krispy Kreme is being compelled to make. The corporate clearly has a deal with on the best way to develop. Within the chart above, as an illustration, you’ll be able to see income, earnings, and money flows during the last three fiscal years. Income has risen properly, climbing from $1.38 billion to $1.69 billion. It’s true that the agency has generated a constant web loss over this five-year window. However adjusted working money movement and EBITDA have been pretty strong throughout this window of time.

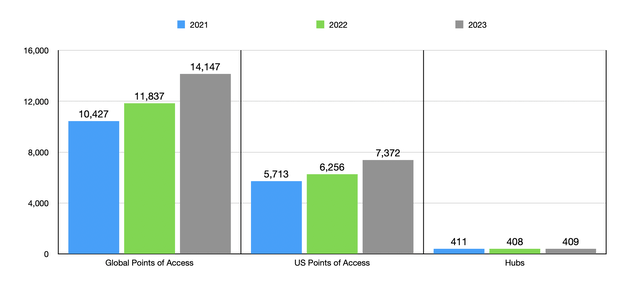

Whereas value will increase have definitely performed a job in a few of its growth, an enormous a part of the expansion of the agency has come from an increase within the variety of places it has in operation. They’ve grown from having 10,427 places on the finish of 2021 to having 14,147 by the top of the 2023 fiscal yr. It’s value noting, nevertheless, that not each location is similar. As an alternative of classifying these places as eating places or shops, the corporate classifies them as ‘World Factors of Entry’.

Writer – SEC EDGAR Information

Examples embody Scorching Gentle Theater Retailers and different Hubs, which the corporate describes as immersive and interactive experiential retailers that additionally function native manufacturing amenities for its huge community. The everyday store right here prices between $2 million and $5 million to ascertain. Given this excessive value, the corporate has additionally experimented with different codecs. It has smaller retailers and kiosks that shouldn’t have any manufacturing capabilities that it operates. These are known as Recent Retailers and so they as an alternative obtain contemporary doughnuts delivered every day from Hub places. The everyday funding right here is between $0.1 million and $1 million per location.

Administration has rolled out ecommerce and supply choices for purchasers that you simply make the most of third occasion digital channels, in addition to its personal. However on prime of this, it has additionally developed what it calls its DFD Doorways, or Delivered Recent Every day places. In these cases, the corporate arranges to put a doughnut cupboard in excessive site visitors grocery and comfort places, fast service eating places, membership membership amenities, drug shops, and different related amenities. These are sometimes the most cost effective setups, costing the corporate solely between $2,000 and $10,000 per location.

Given the low value of organising DFD Doorways, administration has invested closely within the growth of the initiative. 11,924 of the agency’s 14,147 places happen by way of DFD Doorways. That features 6,808 of the 7,372 of the agency’s places within the US. In fact, these places carry with them decrease income. Regardless of accounting for 92.3% of the entire firm’s places all through the US, DFD Doorways are chargeable for solely about 19% of the gross sales generated from the home market. The rationale why I carry up a lot element about these explicit places is as a result of that is the grouping that the 160 McDonald’s places fall beneath.

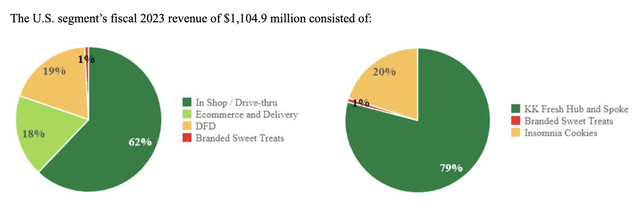

Krispy Kreme

In terms of the home market, this makes it potential to run some fascinating numbers. We do not know how a lot income Krispy Kreme will generate from its partnership with McDonald’s. A case may very well be made that McDonald’s has a particular take care of the corporate that ends in a disproportionate share of income going to it versus Krispy Kreme. However after all, that is speculative and we won’t have any concept of what the image appears to be like like till further information comes out over time. However assuming that every McDonald’s location has the identical sort of economics that Krispy Kreme’s present DFD Doorways places have, then we are able to anticipate $30,836 value of income per yr per retailer.

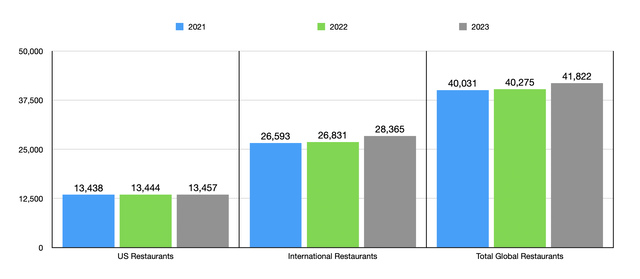

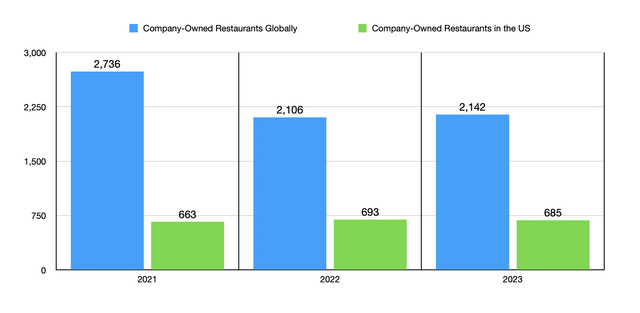

Writer – SEC EDGAR Information

Operationally talking, McDonald’s is a behemoth. Globally, the corporate has 41,822 places. 13,457 of those are positioned within the US. Of the US ones, 685 are owned and operated by McDonald’s company. There relaxation fall beneath franchise or licensing agreements. Globally, the variety of places that McDonald’s company owns is about 2,142. Seeing as how the income that McDonald’s brings in from the places it doesn’t personal is basically restricted to franchise charges, advertising and marketing charges, and extra, many of the income it generates will in all probability be related to the shops that it owns. However as long as this association boosts gross sales total, each it and Krispy Kreme stand to profit.

Writer – SEC EDGAR Information

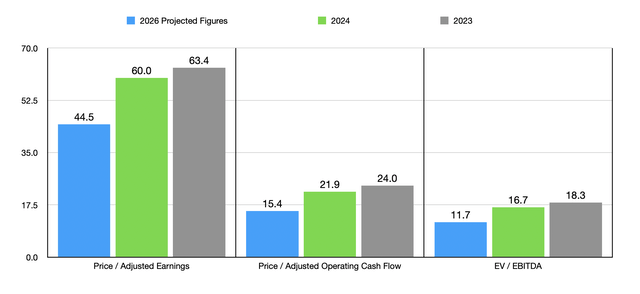

Taking the identical aforementioned economics, and assuming that the variety of McDonald’s eating places stays unchanged between now and the top of 2026, this might translate to an additional $415 million in income for Krispy Kreme on an annualized foundation. Assuming the identical margins as with the corporate at present will get, this could translate to an additional $11.4 million of adjusted web earnings annually. It also needs to work out too about $30.1 million in further adjusted working money movement and an additional $52.8 million yearly in EBITDA for the enterprise. That is on prime of any further development that the corporate may expertise outdoors of this initiative over the following few years. Even when we add these potential earnings/money flows onto the enterprise and assume that administration achieves the identical sort of revenue development in 2025 and 2026 that it expects to attain this yr, the inventory is not precisely low cost as will be seen within the chart beneath.

Writer – SEC EDGAR Information

This isn’t the primary time {that a} main chain has partnered up with one other sizable chain. Earlier this yr, as an illustration, The Wendy’s Firm (WEN) launched a brand new product known as the Pull-Aside that’s at present made by Cinnabon. I’m positive that there are different examples as effectively when you dig deep sufficient. The benefit for the small chain is that it will get further income and earnings, whereas with the ability to optimize its provide chain to attenuate manufacturing prices throughout the board. And the benefit for the massive chain is that it will get incremental income and earnings for nearly no further work. It is a traditional win-win scenario that’s unlikely to go unhealthy. As for the long run, I’ve to surprise if an acquisition may be on the desk. There is not any proof that McDonald’s is contemplating such a maneuver. And traders wouldn’t be clever to take a position {that a} transfer like this can finally come to go. However there are different indicators that present that McDonald’s is very on this area.

For starters, again in 1993, McDonald’s started its McCafe initiatives. In an article revealed in 2022, it was said that the model is now current in over 50 totally different markets and, that by the top of 2023, there could be at the very least 3,500 McCafe places in China alone. Extra just lately, McDonald’s has additionally dabbled with one other idea known as CosMc’s. It opened one location again in 2023 and is anticipated to develop the placement depend to 10 by the top of this yr. If all goes based on plan, the enterprise will increase the placement account beginning subsequent yr. Though these initiatives have largely centered round drinks, administration at McDonald’s admits that the McCafe initiative is a part of the corporate’s technique to seize a large chunk of the $100 billion a yr afternoon ‘pick-me-up event’ market.

I’d argue that little or no would go higher with these sorts of initiatives than doughnuts and different related choices. What’s extra, this isn’t only a US primarily based alternative. It is a international one. I say this as a result of, in 2022, the worldwide marketplace for doughnuts was $12.6 billion. That quantity is anticipated to develop by about 3.5% each year, ultimately hitting $17.8 billion in 2032. Add on the power to get some synergies involving drinks, and the profit that might come from having hundreds of further places, and I can see why a purchase order of a agency like Krispy Kreme, ought to this rollout go based on plan, may make sense sooner or later.

Takeaway

At this time limit, Krispy Kreme is just not precisely the most cost effective firm in the marketplace. Its income development lately has been encouraging and adjusted money movement numbers make the inventory look extra engaging from a pricing perspective. Nevertheless it’s most definitely not a deep worth play. It does appear to supply some engaging development prospects, not solely due to how effectively it has grown lately, but in addition due to the expanded partnership it has with McDonald’s. For many who do not thoughts just a little little bit of threat related to development, I’d say that this makes an honest ‘purchase’ candidate.