zorazhuang/iStock through Getty Photos

Kinder Morgan, Inc. (KMI) and Williams Corporations, Inc. (WMB) are the 2 largest pure pure fuel pipelines within the US. Most pipelines are MLPs (Grasp Restricted Partnership) however KMI and WMB are each C-Corps.

With costs for pure fuel at all-time highs in Europe and elsewhere, the query is which firm will profit probably the most from the surge in costs and extra importantly the elevated volumes that ought to end result from extra NG going abroad.

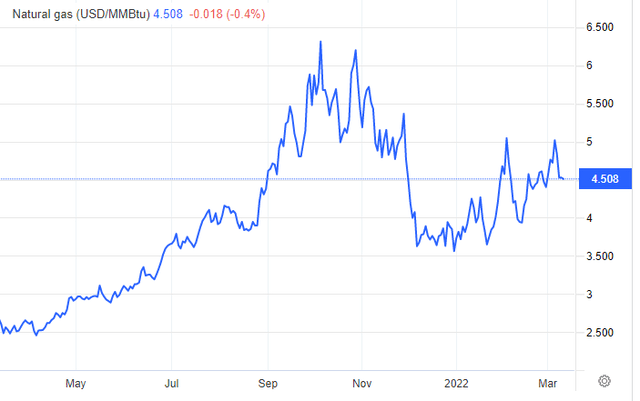

This is a chart displaying the value of pure fuel over the past 12 months:

EIA

Over that point interval, costs for NG (Pure Gasoline) costs have elevated by 70% and could also be headed increased with the Russia/Ukraine battle.

On this article, I’ll look at the worth of every firm relative to the NG market and one another.

Listed here are 5 funding factors to think about when deciding whether or not to put money into Kinder Morgan or Williams Co.

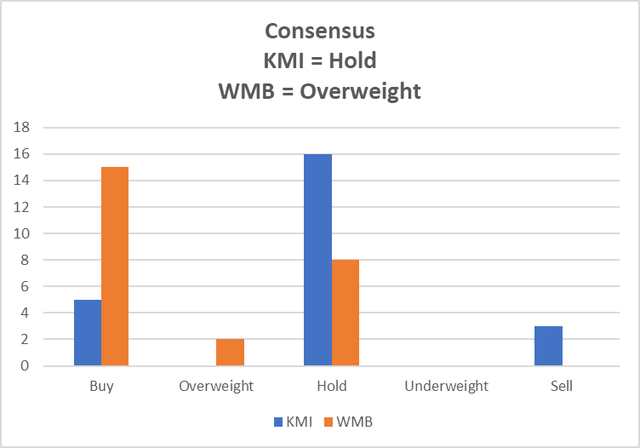

1. Investment Analysts like WMB greater than KMI.

If we take a look at the newest rankings by Wall Road analysts we see that Williams Firm is rated Obese and Kinder Morgan as Maintain.

WMB has no Underweights or Sells, an indication that they’re thought of to be properly regarded by just about all analysts.

MarketWatch and writer

From these analysts, WMB has 3 times the variety of Purchase suggestions as KMI and then again, KMI has twice the variety of Holds as WMB. This may point out a powerful choice for WMB.

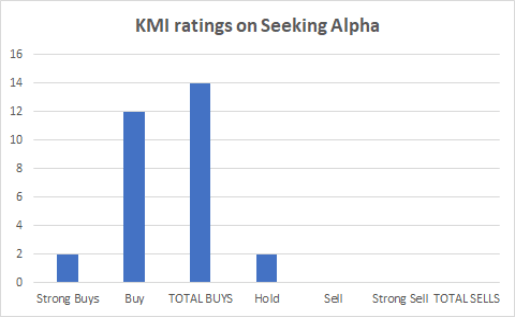

However on Looking for Alpha itself, KMI is very really helpful with 14 buys, 2 holds and no Sells since January 1, 2022. Clearly, Looking for Alpha contributors suppose rather more extremely of WMI than most Wall Road analysts do.

Looking for Alpha and writer

WMB has had solely 5 rankings on Looking for Alpha in that point interval and so they had been 1 Purchase and 4 Holds.

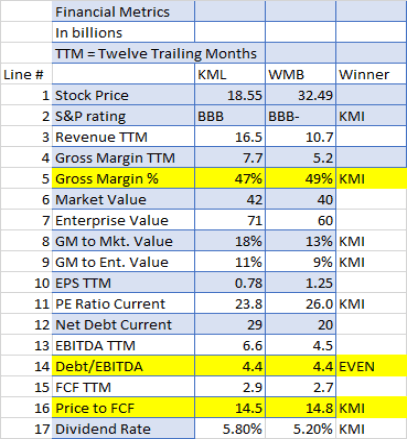

2. Monetary metrics present KMI very barely higher than WMB.

In terms of monetary metrics these two corporations are about as whilst I’ve seen. KMI reveals probably the most “Winners” however by very small margins. It might be tough to select one firm primarily based upon these metrics alone,

Looking for Alpha and writer

Have a look at how shut the Gross Margin % is together with the Value to FCF (Free Money Move). And the Debt/EBITDA is precisely the identical. I see no actual distinct benefit to both firm primarily based on monetary metrics.

3. Historic income and free money circulation outcomes are additionally about the identical.

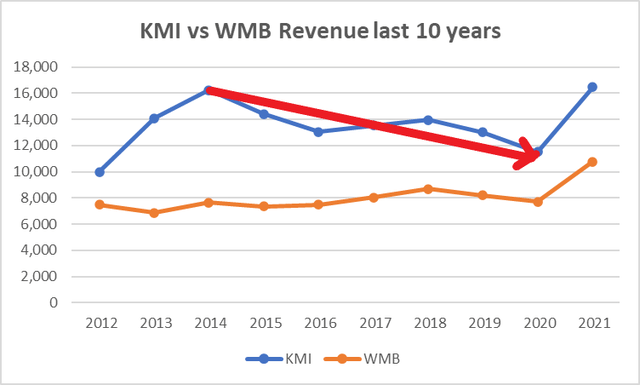

As I proceed my evaluation, I discover that on a 10-year income foundation KMI had a giant income drop of greater than 25% between 2014 and 2020 whereas WMB was pretty regular. From 2020 to 2021 each corporations had a surge in income setting new income information.

Looking for Alpha and writer

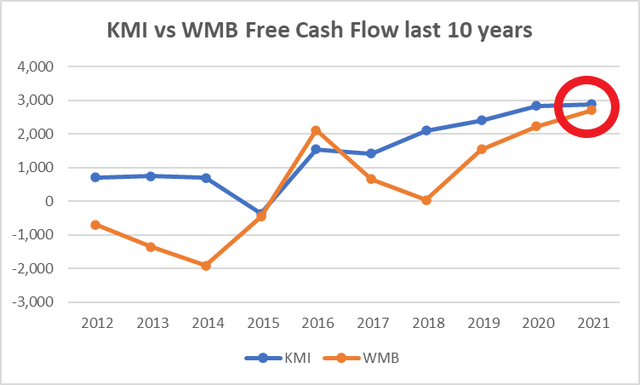

Free Money Move was the identical factor – up and down till ending up at about the identical stage in 2021.

Looking for Alpha and writer

So as soon as once more, no breakaway numbers that would set off an funding resolution between KMI and WMB.

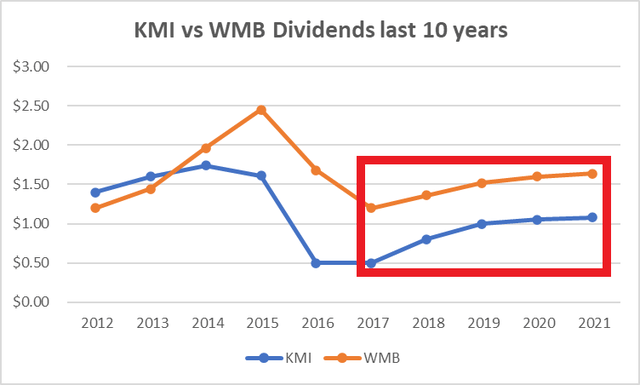

4. Dividend progress favors neither Kinder Morgan nor Williams Firm.

Within the continuation of a theme, there’s little or no to decide on between the 2 corporations by trying on the previous 10-year document of dividend funds. Each had issues up till 2017, then started to extend the dividends on an everyday and substantial foundation.

Keep in mind additionally the present fee paid by each is about the identical – 5.8% for KMI and 5.2% for WMB.

Looking for Alpha and writer

5. Pure fuel manufacturing and transport will develop by virtually 25% by 2050.

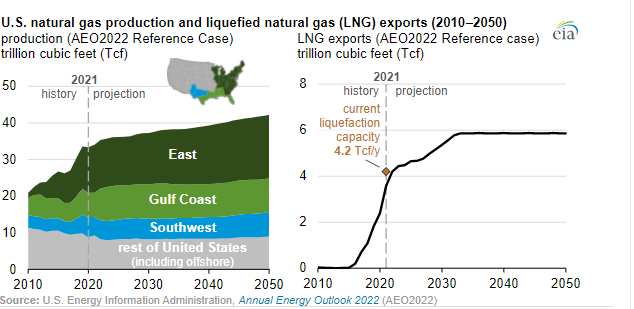

Opposite to what you would possibly hear from environmentalists, fossil gas manufacturing is projected to extend steadily till at the least 2050. Here’s what the EIA (Power Info Company) is projecting:

EIA

We challenge that annual U.S. pure fuel manufacturing will develop by virtually 25% by means of 2050 within the AEO2022 Reference case. A lot of this progress comes from the Appalachia Basin (East area) and the Mississippi-Louisiana salt basins (Gulf Coast area). Nevertheless, greater than half of this progress comes from pure fuel manufacturing in oil formations, generally known as related fuel. Supply: EIA

My guess is constructing new pipelines will probably be virtually unattainable sooner or later Subsequently, the belongings of each KMI and WMB ought to develop into extra useful over time. And income, FCF, and dividends ought to enhance additionally.

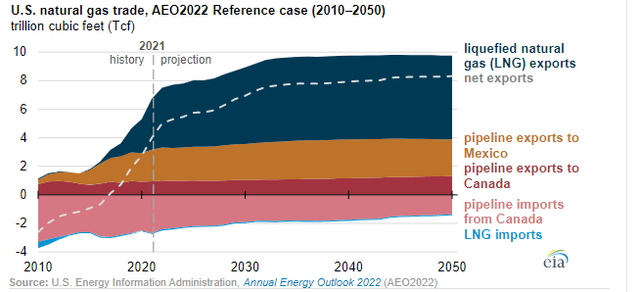

LNG (Liquid Pure Gasoline) will develop by 65% by 2033.

EIA

These LNG capability expansions, coupled with rising demand for pure fuel overseas, lead to an elevated forecast of LNG exports to five.86 trillion cubic ft by 2033 within the Reference case, up 65% from present ranges. Supply:EIA

And extra exports to Mexico and Canada too.

Most pure fuel export progress comes from LNG, however exports of pure fuel by pipelines to Mexico and Canada additionally enhance. Supply: EIA

Primarily based upon what the IEA is saying, each KMI and WMB seem to have shiny futures.

Conclusion:

After evaluating two of the biggest pure fuel pipelines, Kinder Morgan and Williams Co., it’s simple to see that each of them have completed significantly better in 2021 than in earlier years.

After comparability, neither KMI nor WMB stand out one from the opposite sufficient to select them as the one finest funding.

Nevertheless, they each look to have a shiny future primarily based upon world occasions and the EIA’s projection for NG gross sales within the US increasing steadily till at the least 2050.

I fee each Kinder Morgan and Williams Co. as buys for dividend-oriented traders searching for regular dividend will increase sooner or later.