Andrii Yalanskyi

Kimball Electronics’ (NASDAQ:KE) Q2 Outcomes missed analyst expectations, and the inventory has important dangers associated to its momentum and revisions presently. Over the long run, I consider returns from the shares may very well be fairly good. Nonetheless, the potential for short-term draw back is sufficient to cease me from investing.

Operations & Q2 Outcomes Overview

Kimball Electronics offers digital manufacturing providers, together with engineering and manufacturing options for automotive, medical, industrial, and public security purchasers. Its operations embody the total product lifecycle, beginning at design by way of to prototype and manufacturing, packaging, and distribution.

Its engineering course of contains choices for testing and fast prototyping to create viable merchandise. Moreover, its manufacturing talents embody printed circuit board assemblies (PCBAs) and customized packaging options. The agency manages a worldwide provide chain, specializing in effectivity, materials availability, and efficient supply.

Kimball’s Q2 2024 monetary outcomes confirmed a YoY 4% lower in internet gross sales, attributed to world macro headwinds and decreased shopper demand for the interval. The agency maintained steady margins regardless of the challenges by way of price construction changes. It ended Q2 with $39.9 million in money and equivalents however $321.8 million in excellent borrowings. It spent $13.2 million on capex, with whole money movement from working actions at $30.7 million.

Within the Q2 report, the management outlined its dedication to navigating the difficult financial atmosphere with a give attention to long-term progress, worldwide growth, and better buyer satisfaction. In addition they rightly expressed capital administration enhancements that have to be made, together with money movement changes by way of higher receivables and payables protocols.

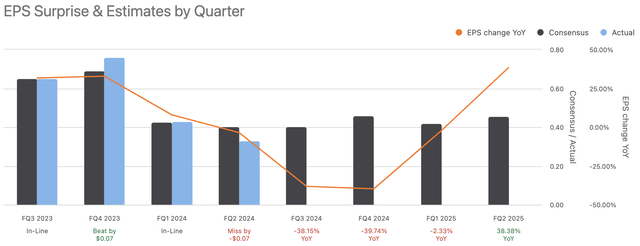

Notably, the Q2 outcomes missed analyst expectations:

Searching for Alpha

Financials

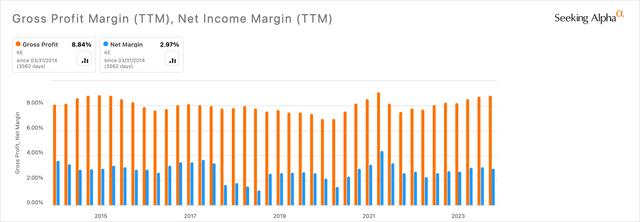

Kimball’s profitability is extra common than I would really like when contemplating investing within the inventory. Its gross revenue margin is essentially the most considerably poor space, at solely 8.84%, which is 81.86% decrease than the sector median of 48.71%. Nonetheless, its internet earnings margin of two.97% is way more promising and is definitely 34.92% larger than the sector median of two.2%. Moreover, the excessive price of products bought that’s frequent for Kimball based mostly on its previous experiences, does not imply that is essentially a weak spot when thought-about alongside its whole internet profitability. After all, the corporate might purpose to enhance its gross margin to then carry up its backside line. Nonetheless, excessive prices appear to be a standard a part of enterprise for the agency, and I’m extra centered on its internet earnings competitively.

Writer, Utilizing Searching for Alpha

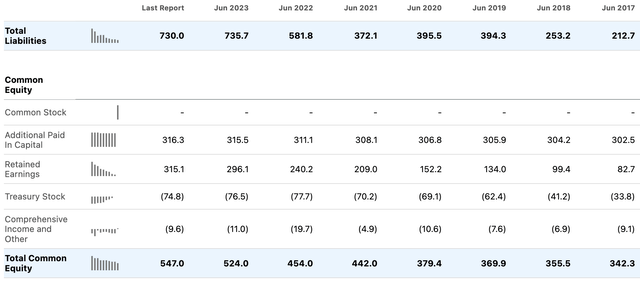

The corporate’s steadiness sheet may very well be lots stronger, and its equity-to-asset ratio is barely 0.43. That’s worse than regular for the group, contemplating it has a median ratio of 0.54 over the past 10 years.

Searching for Alpha

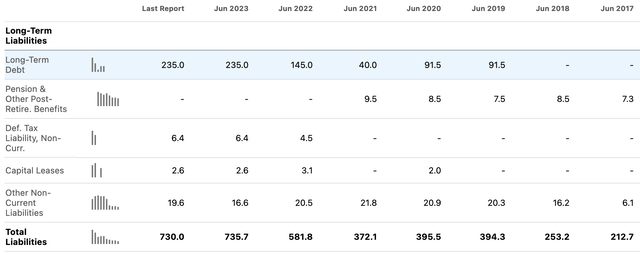

A big contributor to its whole liabilities is its long-term debt, which has risen considerably over the past 5 years:

Searching for Alpha

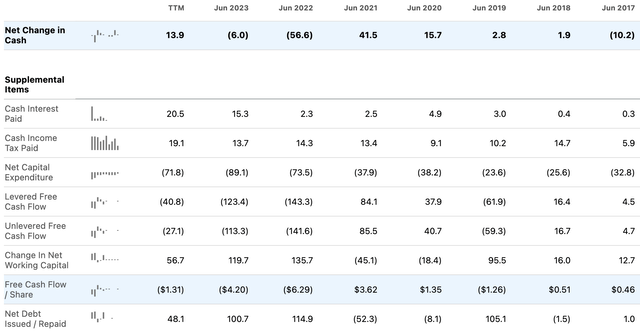

Additionally, whereas the corporate has a optimistic TTM internet change in money versus its 2023 and 2022 experiences, its free money movement per share presently is damaging and has been for the reason that 2022 report:

Searching for Alpha

KE’s progress is stronger, with 10-year income progress of 9.66% per 12 months on common and diluted EPS progress of 8.95% per 12 months on common over the identical timeframe. Its future progress shall be largely pushed by market progress in medical and automotive, superior expertise, together with automation and AI, and customization in electrical merchandise. As such, the group is well-positioned to capitalize on these rising tendencies.

Valuation

Kimball Electronics has a really sturdy valuation in the meanwhile, with a ahead P/E GAAP ratio of 13.17, which is 52.97% decrease than the sector median of 28. Its five-year TTM P/E GAAP ratio common is 13.91, 29.07% decrease than the sector’s five-year common median.

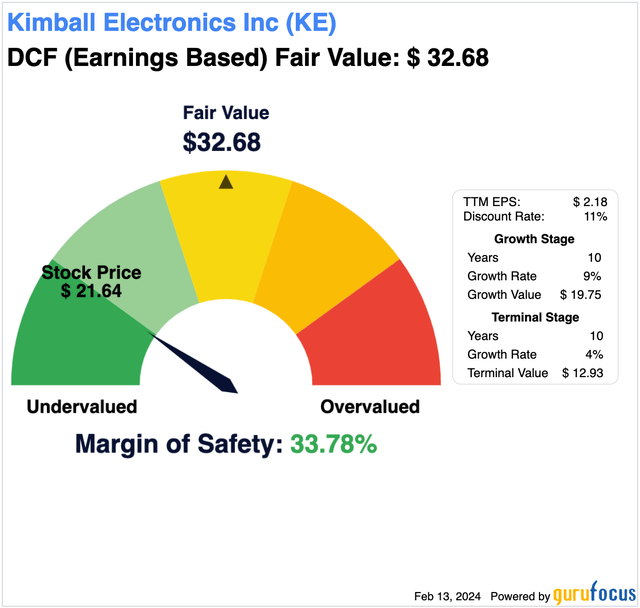

Primarily based on my discounted money movement evaluation, the inventory may very well be 34% undervalued if I contemplate the potential that the corporate can keep 9% EPS progress over the following 10 years as an annual common. I used a terminal stage progress charge of 4% and a reduction charge of 11%:

Writer, Utilizing GuruFocus

Momentum & Revision Dangers

The best dangers, as outlined by Searching for Alpha’s Quant, and the explanation the system allocates a Robust Promote ranking to it, are its low efficiency in momentum and revisions. Due to this fact, I’ll focus on the weaknesses current presently, which I consider do considerably detract from an in any other case interesting inventory.

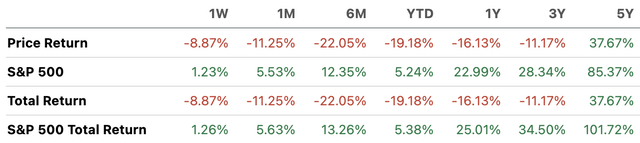

KE has a 6M value efficiency of -23.84%, which may be very poor contemplating the sector median is 6.13%. Now, notably, its 5Y common is 7.47%, which considerably improves its long-term outlook and signifies that its current outcomes may very well be momentary. KE has underperformed the S&P 500 considerably over 5 years:

Searching for Alpha

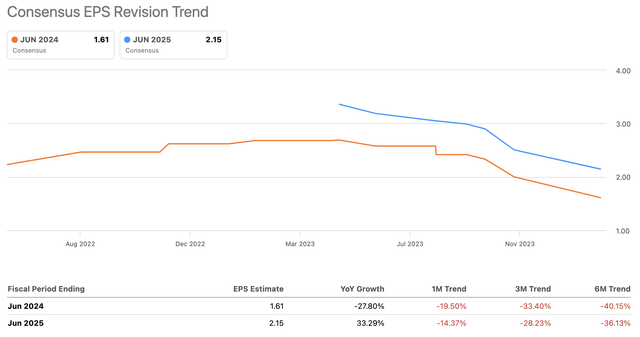

EPS estimates are additionally getting decrease over time, representing actual operational challenges forward but in addition signifying decrease investor sentiment that must be a substantial concern for potential shareholders. The following few years are more likely to see slower progress than now anticipated, and damaging returns within the quick time period will not be unlikely. Nonetheless, I do consider the long-term, 10+ 12 months holding interval ought to present first rate value appreciation.

Searching for Alpha

Conclusion

Kimball Electronics stays a worthy funding to personal. Nonetheless, shopping for it at its current value may very well be problematic within the quick time period on account of excessive dangers associated to downward momentum and poor revisions primarily. Coupled with an uncompetitive steadiness sheet and money movement assertion presently, the worth alternative is predicated on beneficial market progress and my long-term EPS expectations. Nonetheless, as a result of uncertainty surrounding these components, my analyst ranking for KE inventory is a Maintain.