Sundry Images

Thesis

Keysight Applied sciences (NYSE:KEYS) is a number one supplier of digital design and take a look at options for varied industries, similar to communications, aerospace and protection, automotive, vitality, and semiconductor. The corporate reported its fourth quarter and full 12 months 2023 monetary outcomes final November, which confirmed a decline in each income and earnings in comparison with the prior 12 months. The corporate attributed the weak efficiency to macroeconomic challenges that affected its buyer segments, particularly within the communications and industrial segments. Keysight additionally gave a downward steering for its Q1 2024 quarter, with an natural income decline of 15% and EPS decline of 25% YoY.

Nonetheless, we consider that the corporate has a long-term development potential, supported by secular developments similar to 5G, AI, EV, autonomous methods, and digital well being. Moreover, the corporate is reworking its portfolio to software program and companies, which is able to allow new markets and generate excessive margin recurring income. We additionally just like the operational excellence of the corporate, which is leading to working margin enlargement, 12 months after 12 months. On this article, we are going to discover the corporate’s development technique and monetary efficiency and assess if Keysight is a horny funding choice for long-term traders.

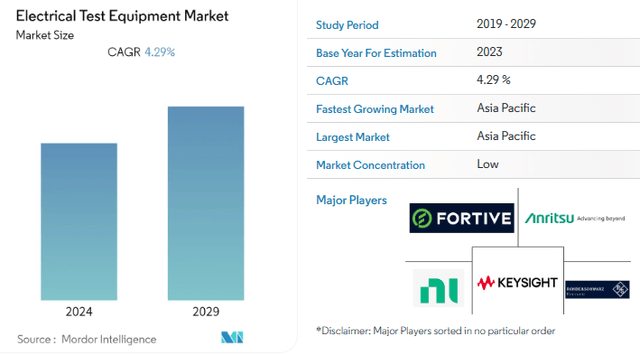

Digital Check Gear Market Rising at 4%

The worldwide marketplace for electrical and digital take a look at tools is anticipated to develop at a CAGR of 4.29%, reaching $17.48 billion by 2029, based on a report by Mordor Intelligence (see under).

Digital Check Gear Market (Mordor Intelligence)

The report factors out that the growing want for accuracy and velocity in designing, manufacturing, or repairing digital merchandise, in addition to the adoption of latest and related applied sciences, similar to electrical autos, autonomous driving, and 5G, as the important thing drivers of the market development. The report additionally identifies the key gamers out there, which embody Fortive Company, Keysight Applied sciences, Teradyne, Nationwide Devices, and Anritsu Company.

As per our calculations: with a 2023 income of $5.5 billion, Keysight has a management place on this market, accounting for almost 25% of the market share.

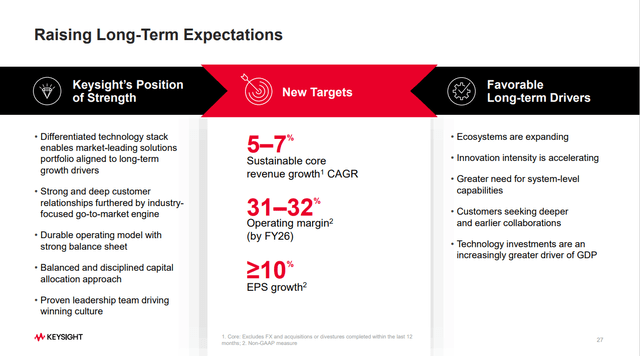

Keysight Lengthy-Time period Monetary Targets

Throughout 2023, Keysight has shared their long-term monetary targets as a part of their 2023 Investor Day (see under). The corporate tasks a 5-7% CAGR for its income, 10%+ CAGR for its EPS and 32% working margin by 2026. Our view is that Keysight is well-positioned to exceed its long-term targets, given its sturdy market management, customer-centric innovation, and operational excellence.

Keysight Lengthy Time period Targets (2023 Investor Day Presentation)

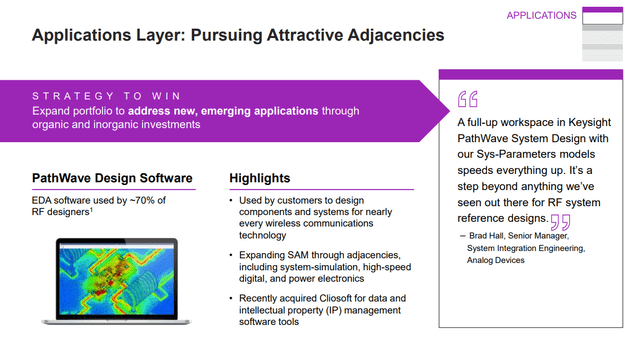

Software program + Providers Alternative

A key pillar of Keysight’s development technique is the Software program + Providers alternative. Keysight goals to develop its enterprise by increasing the software program portion of its product portfolio, so as to goal new functions out there and generate recurring and better margin income. The corporate has a various vary of software program merchandise, similar to digital design automation (EDA), simulation, measurement, and analytics, that assist its clients innovate quicker, enhance efficiency, and decrease prices. The corporate additionally gives varied companies, similar to calibration, restore, consulting, and training, that enhances its buyer loyalty and satisfaction.

Keysight Software program Technique (2023 Investor Day Presentation)

We predict that the corporate is making good progress on this entrance, as its recurring software program+companies income combine elevated from 21% to 23% throughout FY 2023. Keysight has additionally strengthened its software program place by buying the French simulation firm ESI Group (OTCPK:ESIGF) final November. This acquisition will improve its software program capabilities and widen its addressable markets to focus on the early design levels of its clients. We see this a really strategic funding that can unlock new alternatives for the corporate.

Broad and Diversified Portfolio

Keysight has a diversified portfolio of merchandise and options that serve a variety of finish markets, similar to communications, aerospace and protection, automotive, vitality, and semiconductor. The corporate operates by way of two enterprise segments: Communications Options Group (CSG) and Digital Industrial Options Group (EISG). The CSG section is split into two finish markets: Business Communications, and Aerospace, Protection and Authorities. The EISG section offers options for automotive, vitality, common electronics, manufacturing, and semiconductor markets.

Keysight Enterprise Segments (2023 Investor Day Presentation)

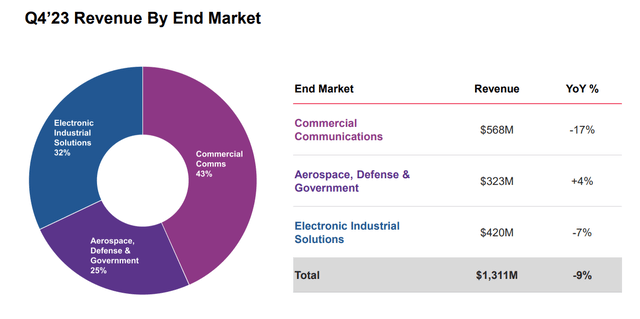

The corporate’s diversified portfolio technique permits it to scale back the chance of cyclicality in any particular person market and to grab the expansion alternatives in varied domains. As proven under, the Aerospace, Protection & Authorities finish market, which belongs to the CSG section, grew by 4% in 2023 This autumn and partially offset the steep income declines within the CSG and EISG segments.

Keysight This autumn 2023 Income by Finish Market (This autumn 2023 Earnings Presentation)

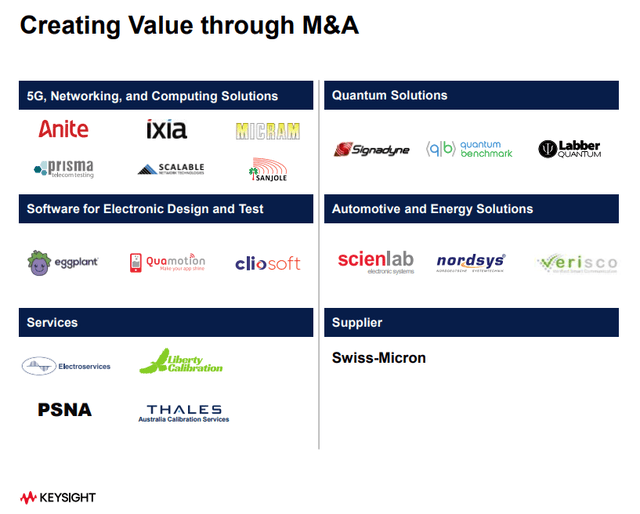

The corporate additionally actively manages its portfolio by way of strategic acquisitions and divestitures, to boost its aggressive place and to give attention to its core competencies. The corporate has accomplished a number of acquisitions prior to now few years, similar to Ixia, Eggplant, and PRISMA Telecom Testing, which have expanded its capabilities in community visibility and safety, software program testing and high quality assurance, and 5G community emulation, respectively. The corporate’s lively portfolio administration permits it to optimize its useful resource allocation and to boost its shareholder worth.

Keysight M&A Actions (Keysight 2023 Investor Day)

Wholesome Steadiness Sheet and Increasing Margins

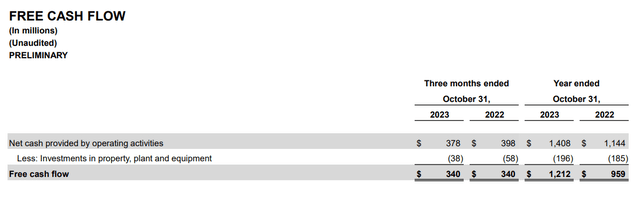

Keysight has a wholesome steadiness sheet that gives it with monetary flexibility and M&A capability. As of October 31, 2023, the corporate had $2.47 billion of money and money equivalents, and $2.03 billion of long-term debt, leading to a internet money place of $0.44 billion. It additionally generated $1.4 billion of working money stream and $1.2 billion of free money stream in 2023, representing a free money stream margin of twenty-two%(see under). The corporate’s sturdy money stream era permits it to spend money on natural and inorganic development initiatives, in addition to to return capital to shareholders by way of dividends and share repurchases. It repurchased $702 million value of shares in 2023, which is 58% of its free money stream.

Keysight Free Money Movement 2023 (This autumn 2023 Earnings Presentation)

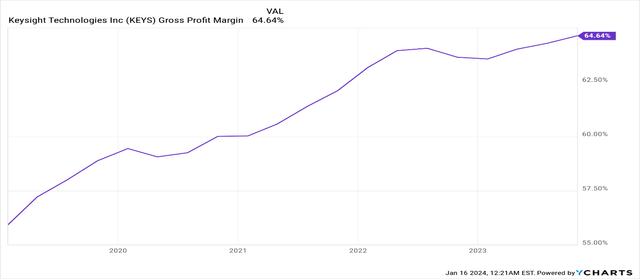

Keysight additionally has spectacular gross margins which might be mirrored in its differentiated merchandise and options, in addition to its operational effectivity. The gross margin was 65% in 2023 This autumn, up from 63% in 2022, which is above business averages. It was pushed by its favorable product combine, particularly its CSG section, which had a gross margin of 68% in 2023 This autumn. The corporate additionally benefited from its value discount and productiveness enhancement measures, similar to provide chain optimization, and automation. See under the gross margin trajectory for the final 5 years.

Gross Revenue Margin Trajectory (YCharts)

The corporate’s excessive gross margins allow it to spend money on R&D (16% of income in 2023), whereas sustaining a wholesome and increasing working margin trajectory (see under)

Keysight Working Margin (This autumn 2023 Earnings Presentation)

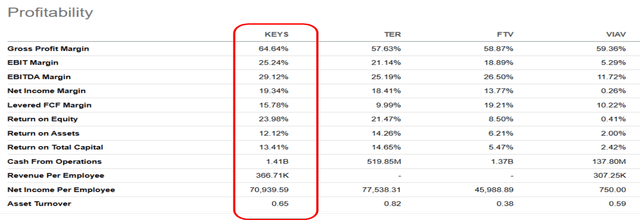

Keysight’s superior operations and income make it a frontrunner amongst its friends, with the very best profitability measures amongst them (these corporations are listed as rivals within the firm’s annual report). We anticipate its profitability to extend additional because it transitions to a software program + companies mannequin.

Peer Profitability Comparisons (Looking for Alpha)

The Valuation is Truthful

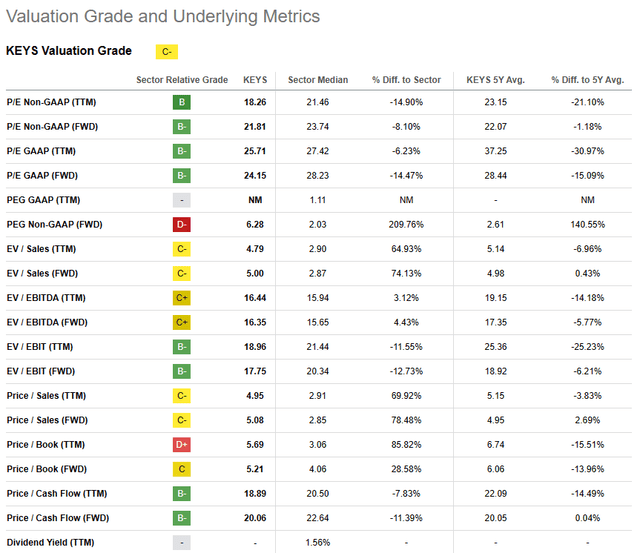

We predict that Keysight is buying and selling at a good valuation, given its profitability and development prospects. The corporate’s P/E ratio is at 18x which is close to sector median. The valuation multiples counsel that the market is recognizing its sturdy place within the electronics take a look at business, its short-term macro headwinds, in addition to its potential to learn from its investments in software program and different rising applied sciences.

Keysight Valuation Metrics (Looking for Alpha)

Quant Rankings additionally signifies that it’s a maintain which we utterly agree with (see under).

Keysight Quant Ranking (Looking for Alpha)

Conclusion

Keysight’s enterprise efficiency is dealing with some momentary challenges on account of unfavorable macroeconomic situations. And it appears to be like like these situations are more likely to persist for a couple of extra quarters. Nonetheless, we stay optimistic about Keysight’s long-term prospects, as the corporate advantages from sturdy market demand, revolutionary options, and a rising software program+companies enterprise. The corporate tasks a 5-7% CAGR for its income and 10%+ CAGR for its EPS in the long run, which we consider are modest estimates and could possibly be surpassed with a profitable execution of its technique.

Subsequently, we are going to maintain an in depth eye on the corporate’s outcomes and replace our ranking accordingly if the enterprise picks up velocity or the inventory turns into extra interesting for an entry.

We fee Keysight as a Maintain for now.