petekarici/iStock Unreleased by way of Getty Photographs

Funding thesis

I provoke my protection of Simply Eat Takeaway.com N.V. (OTCPK:JTKWY) with a purchase ranking following my in-depth analysis of the corporate and the meals supply trade. Whereas I’m fairly bearish on the firm’s long-term prospects and aggressive place, the present undervaluation presents important draw back safety, even when the corporate had been to underperform my conservative estimates.

Simply Eat is a big participant within the world on-line meals ordering and supply sector. Whereas it capitalized on the pandemic-induced surge in demand and exhibited spectacular progress within the final 5 years, latest challenges have solid doubts on its sustained success. The final 1.5 years have been marked by declining metrics. The person base, restaurant companions, and order volumes have dwindled, signaling potential buyer attrition and market share erosion.

The intensification of competitors, notably from Uber (UBER), Deliveroo (OTCPK:DROOF), and DoorDash (DASH), poses a big risk. Rivals are reporting optimistic progress and sustaining market share, whereas Simply Eat faces hurdles in each areas. The corporate’s growth technique, notably its acquisition of Grubhub within the US, has not borne fruit as anticipated, resulting in substantial market share loss and challenges within the American market.

Regardless of quick profitability enhancements, future progress prospects stay unsure. The European meals supply trade presents progress potential, however the firm’s capability to take care of its market share and deal with competitors raises considerations. I deem administration’s long-term targets as overly optimistic.

Regardless of these important challenges and my doubts concerning its long-term success, the inventory’s present undervaluation presents a short- to medium-term funding alternative. Conservative projections, contemplating an EBITDA a number of of 7x, point out important upside potential and a really respectable margin of security.

A struggling chief within the meals supply trade

Simply Eat Takeaway.com is a outstanding multinational on-line meals ordering and supply platform, serving as a bridge between hungry prospects and an unlimited community of eating places throughout the globe. Established via the merger of Simply Eat and Takeaway.com and the acquisition of Grubhub, the corporate boasts an in depth attain in numerous markets, making it one of many world’s largest and most complete meals supply platforms.

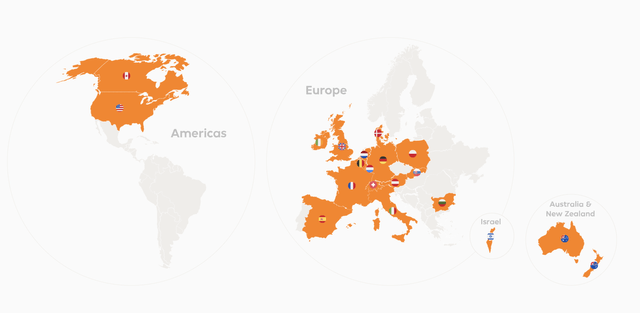

Simply Eat’s worldwide presence (Simply Eat Takeaway.com)

Working in quite a few international locations, Simply Eat presents customers the comfort of shopping an array of culinary choices, inserting orders on-line, and having their favourite dishes delivered to their doorsteps. The platform’s user-friendly interface, seamless ordering course of, and various restaurant choice contribute to its recognition and progress and have helped it turn out to be one of many main gamers within the European meals supply trade.

The corporate was one of many largest beneficiaries of the COVID-19 pandemic as this resulted in folks massively rising meals supply exercise as consuming exterior of the home was typically not attainable attributable to lockdowns. In consequence, the corporate has been in a position to develop revenues at a CAGR of over 26% over the past 5 years, massively rising its dimension and increasing its operations, permitting it to report FY22 income of over €5.5 billion and seeing 61 million lively customers on its platforms yearly.

Nonetheless, the final 1.5 years have been tougher than some other interval in its comparatively quick historical past as COVID-19 tailwinds disappeared and the corporate faces elevated competitors from the likes of Uber, Deliveroo, DoorDash, and plenty of different rivals. In consequence, the corporate has been struggling for traction, each when it comes to progress and profitability.

Wanting on the final 5 years might give buyers an unjustified bullish narrative, whereas in actuality, the enterprise has been struggling fairly a bit for traction over the past 1.5 years, each when it comes to progress and profitability, with it shedding customers, eating places on its platform, and order quantity declining. For instance, the variety of customers on the Simply Eat platform declined 6% YoY in 2022 and one other 7% within the first half of 2023. As historical past has proven, shedding customers is rarely a optimistic sign and may alarm buyers, particularly if the underlying trade and rivals reported optimistic progress.

Whereas demand for meals supply has not fallen as considerably as was typically feared by analysts, competitors within the trade has heated up as demand has eased off. Whereas Uber reported double-digit order progress for its supply section in the newest quarter and noticed progress speed up sequentially, Simply Eat nonetheless reported a 4% GTV (Gross Transaction Worth) decline on high of an 8% decline within the year-ago quarter. Clearly, the Simply Eat enterprise is having a tougher time at this time in comparison with Uber and it’s important buyers look intently on the enterprise developments, which create a combined image.

For FY22, Simply Eat additionally noticed its orders decline to 657 million, down 15% YoY and decline one other 12% within the first half of 2023. But, these declines had been largely anticipated for this yr and the decline in orders was barely offset by a better common order worth on account of excessive inflation.

Much more essential, the corporate additionally misplaced 30,000 eating places on its platform as this quantity declined from 310,000 on the finish of 2021 to 280,000 on the finish of 2022. For a meals supply platform, a big providing of eating places is essential to attracting extra customers and setting your self other than the competitors. As Simply Eat is shedding eating places on the platform, its aggressive place weakens, and these are essential features to think about for buyers.

Each analysts and Simply Eat administration appear to deal with the corporate’s enhancing profitability profile and cling on to the earnings progress it has proven over the past decade, whereas I anticipate the corporate to battle to get its GTV progress above 10% once more, that means its long-term targets are extremely opportunistic and out of attain.

The corporate goals to generate a optimistic money stream by FY24, however it won’t be overly important even when it reaches this goal. I see no straightforward approach to obtain substantial profitability right here, and the easiest way to succeed in it’s by focusing its efforts on the better-performing areas in Western Europe and the UK and promoting its operations within the US, Australia, and Southern Europe. The corporate’s worldwide growth efforts have been unsuccessful, limiting its TAM, however I’ll talk about this additional on this article.

Total, I’m fairly bearish on the corporate and do not view it as a horny funding at this time as I imagine the corporate has no important aggressive benefit, will probably be shedding market share to rivals over the subsequent couple of years, and doesn’t see a approach to substantial profitability together with significant progress. Sure, I anticipate the corporate to increase its margins over the subsequent couple of years, however important bottom-line profitability will take longer. For my part, present estimates by each administration and analysts are too opportunistic.

A powerful market place in Europe however the US is lagging, and the corporate is prone to exit Southern European international locations

As we speak, Simply Eat is the trade chief in a number of European international locations just like the Netherlands, the UK, and Germany. Because the UK is the biggest meals supply trade in Europe, Simply Eat’s market share right here is essential and the newest information reveals that it holds a really stable 45% market share, intently adopted by Deliveroo which additionally sits within the 40% vary, with Uber coming in at third place.

In the meantime, one of the promising European meals supply markets is Germany as this one is seeing fairly spectacular progress attributable to elevated adoption of the service. As we speak, Simply Eat is favorably positioned to learn from this progress however is going through powerful competitors from Uber, which is quickly increasing its operations within the nation.

Total, the corporate’s European operations look stable because it holds very respectable market shares in these markets. The corporate at this time operates throughout most international locations in Western/Northern Europe and has a foothold within the US via Grubhub, in addition to operations in Australia and Southern Europe.

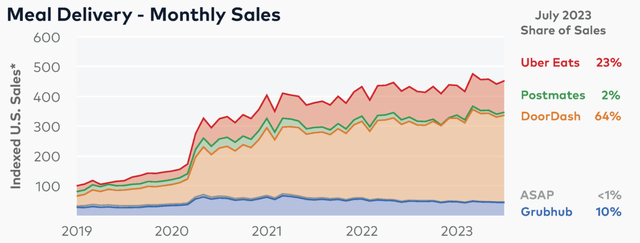

Simply Eat acquired Grubhub again in 2020 for a staggering €6.4 billion as a part of its world growth technique however it has not been a cheerful one as Grubhub has been struggling over latest years to battle off rivals like Uber and DoorDash. Whereas the corporate nonetheless held an 18% market share within the US meals supply market on the time of the acquisition, this has now fallen to simply 10% as of July 2023, that means it misplaced 8% in market share in simply two years.

Bloomberg second measure

Following these market share losses and weak market place, Grubhub has been a drag on the group outcomes for Simply Eat. Within the newest quarter, Grubhub reported a 12% decline in GTV in opposition to optimistic progress within the Northern Europe operations and solely a 1% decline within the UK.

In consequence, the corporate has been trying to promote the enterprise for slightly over a yr however has but to search out the appropriate purchaser. Nonetheless, administration has indicated that it isn’t dashing the sale of its US operations as it’s trying to reduce the loss on the section. Nonetheless, it will most definitely are available in far beneath €2 billion, making it a horrible funding for Simply Eat. Moreover, as Grubhub continues to lose market share, I don’t see this worth go up as administration appears for the appropriate provide. The one optimistic to say right here is that Grubhub is lastly at a breakeven level, which might doubtlessly increase the worth of its operations considerably. Nonetheless, promoting Grubhub at a lack of over €4.5 billion after two loss-making years is much from a optimistic.

The sale of its US operations comes after it, earlier in 2022, already offered its stake in Brazilian meals supply agency Ifood for slightly underneath €2 billion, via which the corporate utterly exited the South American market. It’s no secret that the final couple of years after the COVID-19 pandemic have been powerful for Simply Eat as demand has dropped a bit, which has slowed its progress. Moreover, the meals supply market continues to be a tricky one to make a revenue in, which can be dragging on the Simply Eat enterprise.

Whereas it as soon as had the ambition to turn out to be a worldwide participant and the worldwide chief in meals supply, it’s protected to say that it failed at this. Its US operations clearly aren’t growing in the appropriate path, and with administration actively trying to exit the area, its world presence is more and more shrinking.

I even anticipate the corporate to lower its worldwide presence additional over the subsequent a number of years as I imagine it’ll additionally quickly exit its Australian operations and probably even southern and jap Europe in order that it may focus its efforts on rising its market share in its largest and most essential international locations in North and Western Europe.

I imagine this may be an excellent transfer by administration. Whereas this may very a lot restrict the corporate’s TAM, such a transfer of streamlining the enterprise might create extra stability, an improved funding case, and a extra sustainable enterprise mannequin as the corporate has already reached a 5% EBITDA margin in Northern Europe.

In conclusion, whereas the sum of components could also be increased than its present market cap, I imagine that is justified as I anticipate the enterprise to deteriorate additional as it’ll battle to battle off competitors and must promote operations exterior of Western Europe at lower-than-expected multiples. It’s onerous to award a valuation to all its struggling operations.

A stable trade outlook however rising competitors limits Simply Eat’s progress potential

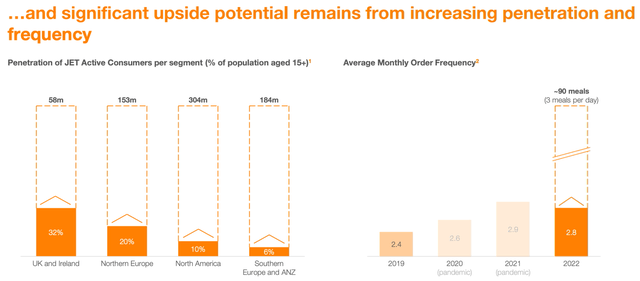

Based on information from Statista, the European meals supply trade is poised to develop at a CAGR of 12.3% via 2027. This progress will probably be primarily pushed by elevated penetration, the huge progress in grocery deliveries, and the expansion in ghost kitchens.

Probably the most important of those progress drivers is the nonetheless low penetration as penetration within the European meals supply market continues to be reasonably low at 24.9% however is predicted to develop to 36.5% by 2027. This will probably be a stable progress driver for the meals supply trade and may stay significant till the tip of the last decade.

Meals supply penetration (Simply Eat Takeaway.com)

Primarily based on an anticipated 2023 market dimension of €122 billion and the expectation of Simply Eat to report a GTV of €28 billion, Simply Eat at the moment holds a market share within the European meals supply market of 23%, that means it ought to be properly positioned to learn from the anticipated progress if it may keep this market share, which is what I view as the biggest threat right here.

Because the moat or aggressive benefit in meals supply could be very minor, it’s onerous to battle competitors as the one levers for Simply Eat embrace extra engaging pricing, a bigger providing, and better reductions for its customers. Because of this I imagine it will likely be onerous for Simply Eat to take care of its place as competitors will increase.

It’s essential to grasp right here that being the biggest in an trade with very skinny margins provides you a big benefit. As a consequence of its dimension and much better profitability, Uber is ready to provide rather more engaging buyer reductions to win market share or provide extra engaging offers to eating places to affix its platform.

Subsequently, it will likely be onerous for Simply Eat to battle off Uber specifically, which I view because the strongest world participant in meals supply. Uber additionally has bold progress plans in Western Europe the place it has already conquered the French meals supply market with a market share approaching 50%. Moreover, Uber is now absolutely targeted on different massive European supply markets like Germany, The Netherlands, and Spain, whereas it not too long ago exited the Italian market.

As Uber will increase investments to develop its share within the European meals supply market, it will likely be taking share from Simply Eat as Uber merely has superior monetary assets that are essential on this trade. Uber has rather more monetary firing energy, is already driving stable income via its supply platform, and appears to be taking market share throughout European international locations.

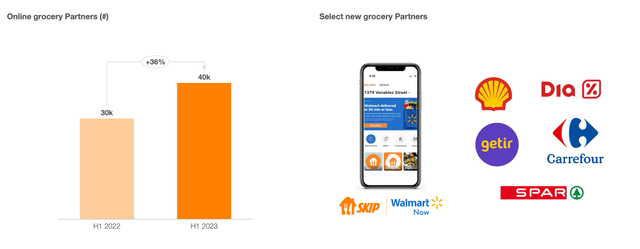

The one optimistic for Simply Eat is that it’s seeing stable momentum in grocery supply growth on its platform. Within the first half of 2023, the corporate reported a 36% enhance within the variety of on-line grocery companions. With grocery being a faster-growing vertical within the meals supply trade, I anticipate this to work in Simply Eat’s favor concerning its market share.

Grocery companion progress (Simply Eat Takeaway.com)

Administration believes it ought to be capable of double its 2022 GTV over the subsequent few years to €60 billion within the medium time period however at present progress charges and going by the trade outlook and potential for market share losses, this appears unimaginable to attain.

Utilizing administration’s FY23 outlook, we must always anticipate FY23 GTV to be flat to down barely YoY, leading to a GTV of round €28 billion. Even when the corporate had been to see considerably improved demand in FY24 and FY25, a GTV of €36 billion appears to be essentially the most optimistic state of affairs, whereas a extra probably state of affairs in my eyes ought to lead to an FY25 GTV of nearer to $32 billion.

Latest outcomes are nothing to cheer about

Latest monetary outcomes, whereas together with some optimistic developments, additionally included various critical negatives which I imagine are causes for concern, as I already indicated earlier on this article for some metrics.

Simply Eat reported its H1 2023 outcomes a few weeks in the past and reported a GTV decline of seven%. This decline for Simply Eat was largely pushed by the North American and South European areas as these reported GTV declines of 10% and 13%, respectively. In the meantime, the North European and UK enterprise segments began reporting optimistic GTV progress once more as these each reported GTV progress of three% YoY, leading to a optimistic first half for these two working areas.

GTV progress by area (Simply Eat Takeaway.com)

Nonetheless, this GTV decline reported by Simply Eat stands in sharp distinction with rivals reminiscent of Deliveroo, Supply Hero (DHERO), and Uber who all reported optimistic gross reserving progress of three%, 8%, and 12%, respectively, indicating that Simply Eat is actively shedding market share.

Moreover, Simply Eat reported detrimental progress on a number of different metrics as properly, like lively prospects declining by 7%, orders declining by 12%, and income declining by 7%. Income got here in at €2.59 billion, primarily pushed by Northern Europe. On the similar time, North America and Southern Europe continued to be a drag on the general efficiency by reporting double-digit declines.

It’s these underlying declines that fear me essentially the most. In fact, shedding market share in opposition to rivals is unhealthy, however the firm shedding lively customers, seeing a big lower in orders, and even shedding eating places on the platform are elements that may have a long-term influence, and as these develop for rivals on the similar time, this means that the Simply Eat platform is shedding energy.

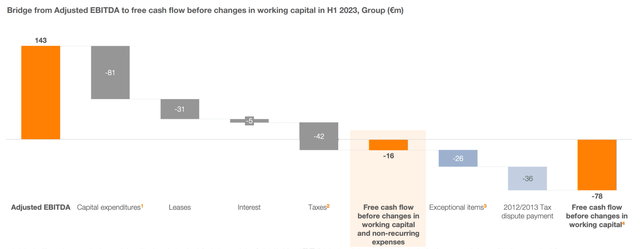

The one spotlight within the earnings report was that, regardless of the top-line weak point, the corporate was in a position to increase profitability and report a optimistic EBITDA results of €143 million in opposition to a lack of €134 million within the first half of 2022. Moreover, the corporate can be closing in on reporting a optimistic free money stream, which it ought to be capable of report by FY24.

Simply Eat FCF (Simply Eat Takeaway.com)

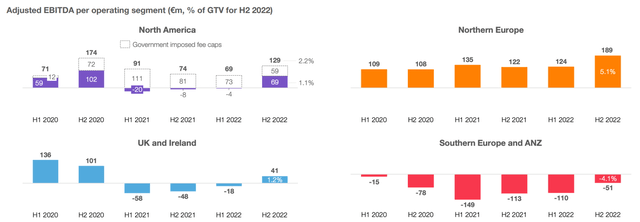

The general margin improvement for Simply Eat does additionally look stable because it has been in a position to meaningfully enhance margins over latest years throughout all its areas. After a number of years of elevated investments throughout COVID-19, the corporate has shifted its focus again to profitability, which is working properly. Nonetheless, I anticipate this enchancment fee to decelerate considerably over the subsequent couple of years as the corporate must begin a brand new funding cycle to hold on to its market share and increase operations. Subsequently, I’m projecting little margin enhancements over the subsequent couple of years.

EBITDA developments by area (Simply Eat Takeaway.com)

Outlook & Valuation

For FY23, administration now guides GTV progress to come back in between a 4% decline and progress of two%. This means that buyers ought to anticipate progress to speed up within the yr’s second half. Moreover, the FY23 EBITDA is predicted to sit down round €275 million, up from €19 million in 2022. Administration additionally maintained its long-term objectives, however as I mentioned earlier than, these appear very opportunistic.

As for my long-term expectations, for now, we must assume all segments stay as they’re, however please take into account that there’s a important chance of Simply Eat promoting a few of its operations, as mentioned earlier than. In the event that they had been to finish or promote operations in underperforming areas, this might increase its progress prospects and particularly its profitability outlook, although, on a decrease GTV base as North America, Southern Europe, and Australia account for half of its GTV as of H1 2023.

As for profitability, the corporate’s long-term EBITDA goal sits at 5%. Final quarter, this goal was met by the Western/Northern European area, and subsequently, additionally partly because of the firm’s robust place on this area, I imagine that if the corporate had been to spin off many of the underperforming areas, amongst which is Grubhub, it might report an EBITDA margin of 4%-5% (of GTV) by FY25. But, I selected to stay extra conservative in my estimates.

I imagine profitability will probably be held again by underperforming areas like North America and Southern Europe, and an EBITDA margin within the vary of two% to three% is probably going, particularly as heated competitors in key areas will power the corporate to develop prices at a sooner tempo to take care of its market share, impacting margins.

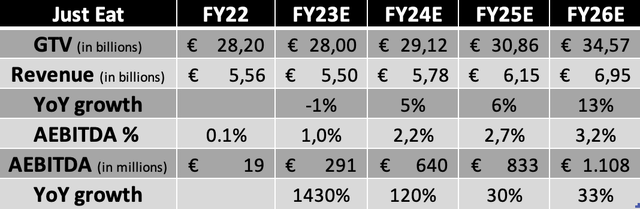

These are my monetary projections primarily based on my analysis of the corporate and the underlying trade.

Monetary estimates (Writer)

Transferring to the valuation, I imagine a conservative EBITDA a number of of 7x, which sits beneath the European inventory market common of 12x and its peer common of 9/10x, rightfully accounts for the corporate’s latest struggles, attainable market share losses and its considerably unpredictable outlook attributable to attainable area exits.

Primarily based on this a number of, I calculate a FY25 worth goal of €27. Going with an annual return of 12.5%, which might be the minimal return to aspire when investing in a high-risk inventory like Simply Eat, I imagine a present honest worth share worth sits round €20, leaving an upside of about 54% from its present depressed share worth of round €13.

Conclusion

Wanting on the firm fundamentals and developments over the past couple of years, in addition to its progress outlook, I might be urged to offer the shares an keep away from/promote ranking as I imagine there are better-positioned corporations on the market to learn from the expansion within the meals supply trade. I nonetheless imagine that is the case and am not an enormous fan of Simply Eat as a long-term funding attributable to its deteriorating fundamentals and underperformance to friends.

But, on the similar time, the present share worth and valuation, even primarily based on a conservative gross sales progress and margin growth outlook, appears reasonably engaging as a medium-term commerce of round 2/3 years. The present valuation presents important draw back safety, even when progress is available in far beneath my present estimates. There may be a lot worth on the desk right here and I imagine that the present share worth presents a horny entry level for buyers to learn from, even when I’m fairly bearish on the corporate’s prospects and long-term potential.

In consequence, I do fee shares a purchase as the present undervaluation is unjustified. For these searching for a shorter-term commerce, the present undervaluation of the shares ought to ship wonderful worth, though with a barely increased threat profile. I might advocate buyers to maintain a detailed eye on its quickly growing fundamentals.

But, for buyers searching for a long-term purchase and maintain, Simply Eat shouldn’t be the appropriate selection, and for these buyers, I like to recommend wanting additional on the likes of Uber and DoorDash as wonderful gamers within the meals supply trade.

With a 1-year worth goal of €23 and an upside of 77%, I fee Simply Eat Takeaway.com N.V. a purchase.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.