malerapaso

Persevering with my sequence of articles that pay due consideration to intricately calibrated fairness methods on the intersection of things, at this time I wish to focus on the JPMorgan Diversified Return U.S. Fairness ETF (NYSEARCA:JPUS). In accordance with its web site, it’s

Designed to supply home fairness publicity with potential for higher risk-adjusted returns than a market cap-weighted index.

That is an formidable proposition. However the very essence of investing is to know that expectations and actuality diverge regularly. And alas, that is the case with JPUS.

Regardless of having a number of sturdy durations since its launch in September 2015, JPUS was neither able to outperforming the iShares Russell 1000 ETF (IWB), which is the fund that tracks its benchmark, on an annualized foundation, nor delivering extra snug risk-adjusted returns (my metrics of alternative are the Sharpe, Sortino, and Treynor ratios). It’s true that there’s one thing to admire about its issue combine (i.e., a price tilt), however I’d abstain from establishing a Purchase thesis utilizing this premise solely.

Total, whereas I imagine JPUS is a automobile able to minimizing losses and taming volatility at instances, it’s powerful to discover a purpose why I ought to provoke protection with a Purchase ranking.

What’s the foundation for JPUS’ technique?

Launched in 2015, JPUS is managed passively, with the premise for its technique being the JP Morgan Diversified Issue US Fairness Index. From web page 1 of the abstract prospectus, we all know that its parts “are chosen primarily from the constituents of the Russell 1000 Index.” Concerning the components thought of within the course of, the next particulars are offered:

The principles based mostly proprietary multi-factor choice course of makes use of the next traits: worth, momentum, and high quality. The Underlying Index is designed so that every of the person traits is given equal enter in safety choice.

So in essence, it appears it is a principally large-cap echelon-centered technique with an element trifecta at its core.

JPUS efficiency: a number of vivid spots, however principally unimpressive

There’s something to understand about JPUS’ efficiency, with its maybe most vital achievement being the truth that it beat IWB and the iShares Core S&P 500 ETF (IVV) in 2021 and 2022. This suggests that the ETF was not solely able to benefiting from the capital rotation to cyclicals but in addition provided some safety amid the gloomiest days of the financial policy-driven bear market.

| 12 months | JPUS | IVV | IWB |

| 2021 | 29.08% | 28.76% | 26.32% |

| 2022 | -8.48% | -18.16% | -19.19% |

Knowledge from Portfolio Visualizer

That is mirrored within the draw back seize ratio as effectively.

| Metric | JPUS | IVV | IWB |

| Draw back Seize | 93.44% | 100% | 101.54% |

Knowledge from Portfolio Visualizer. IVV was chosen as a benchmark

Nevertheless, neither its compound annual development charge nor risk-adjusted returns measured utilizing the Sharpe, Sortino, and Treynor ratios delivered over the October 2015-July 2024 interval have been interesting sufficient. That’s to say, JPUS underperformed each IVV and IWB. One other downside is the utmost drawdown (delivered in the course of the March 2020 pandemic-driven sell-off), which, surprisingly, seemed to be the deepest within the group.

| Metric | JPUS | IVV | IWB |

| Begin Stability | $10,000 | $10,000 | $10,000 |

| Finish Stability | $26,712 | $33,661 | $32,598 |

| CAGR | 11.77% | 14.73% | 14.31% |

| Commonplace Deviation | 15.87% | 15.75% | 15.99% |

| Greatest 12 months | 29.08% | 31.25% | 31.06% |

| Worst 12 months | -8.48% | -18.16% | -19.19% |

| Most Drawdown | -25.95% | -23.93% | -24.57% |

| Benchmark Correlation | 0.95 | 1 | 1 |

| Sharpe Ratio | 0.67 | 0.84 | 0.81 |

| Sortino Ratio | 1.01 | 1.32 | 1.26 |

| Treynor Ratio | 11.21% | 13.3% | 12.8% |

Knowledge from Portfolio Visualizer. IVV was chosen as a benchmark

How does JPUS’ issue combine stack up in opposition to that of IVV?

Above, I’ve illustrated that JPUS’ historic efficiency was clearly inadequate for a Purchase thesis. However returns are, in fact, not the one parameter a thesis can theoretically be based mostly on. A method centered on returns solely is clearly a myopic and dangerous one. A way more essential ingredient is the issue story, or, to be exact, the query of whether or not the issue proportions are enough for the present market narrative. Right here, there may be positively one thing to understand about JPUS, however these info are nonetheless inadequate to justify a bullish stance.

Delving deeper, as of August 27, there have been 362 widespread shares and REITs within the JPUS portfolio, with the overlap with IVV being at round 72.1%. Although JPUS has publicity to nearly all of the trillion-dollar firms, aside from Amazon (AMZN), its portfolio is far lighter in them. For instance, Apple (AAPL) is IVV’s largest holding with a 6.9% weight. In the meantime, JPUS has allotted simply 0.37% to it. And its key holding, Kellanova (Ok), has only a 0.52% weight. And right here comes its first relative benefit: a price tilt.

To corroborate, beginning with the market cap, as of August 28, JPUS had a weighted common of $108.7 billion, as per my calculations, whereas the S&P 500 ETF had that determine 9x bigger. And that is hardly a coincidence that its 5.1% adjusted earnings yield seemed to be a lot greater than IVV’s adjusted EY of three.7%. Apart from, there’s a huge distinction in allocations to shares with a B- Quant Valuation grade or greater: 26.3% vs. 6.2%.

It’s value clarifying that once I say ‘relative,’ I imply that for many traders who imagine the rally will proceed for the foreseeable future, these traits possible imply little. Nevertheless, for these contrarians who imagine an excellent correction is lengthy overdue, JPUS actually presents one thing.

However a price tilt and strong development publicity are antithetical in nature. So JPUS is considerably behind IVV with regards to the expansion indicators, like these offered within the desk beneath.

| Metric | JPUS | IVV |

| EPS Fwd | 6.30% | 18.27% |

| Income Fwd | 3.97% | 12.20% |

| EBITDA Fwd | 4.84% | 20.11% |

Created by the creator utilizing information from Searching for Alpha, IVV, and JPUS

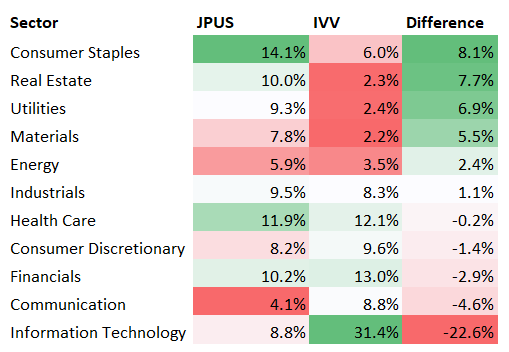

Partly, that is pushed by the sector proportions. As an illustration, in comparison with IVV (which has a sector combine near that of the Russell 1000 ETF), JPUS is considerably underweight in IT and chubby in client staples. The desk beneath, ready utilizing information from the ETFs and the iShares Core S&P Complete U.S. Inventory Market ETF (ITOT), reveals different essential variations.

Created by the creator; information from ITOT, IWB, IVV, and JPUS

JPUS’ second relative benefit is its publicity to the low volatility issue, which is once more the consequence of the sector combine.

| ETF | 24M Beta | 60M Beta | Quant Momentum B- or greater |

| JPUS | 0.81 | 0.99 | 70% |

| IVV | 1.07 | 1.06 | 71.3% |

Calculated by the creator utilizing information from Searching for Alpha and the ETFs

It’d look a bit counterintuitive assuming the technique is conscious of momentum, not low beta. Nevertheless, on web page 2 of the abstract prospectus, it’s clarified that the index

Targets fairness securities which have greater risk-adjusted returns relative to these of their sector friends over a twelve month interval. The twelve month returns are divided by the twelve month volatility of the returns to get the risk-adjusted returns.

In order volatility can also be taken into consideration, low beta is explainable. Once more, this could enchantment to traders who’re awaiting for the expansion premia to change into slimmer, or, one other approach of claiming, the market to surrender a large deal of good points. I personally don’t view this as a base-case state of affairs.

Nevertheless, with regard to high quality, I’d argue that JPUS is weaker than the S&P 500 ETF, with its weighting schema being the important thing purpose. The info beneath are what I’m basing my opinion on.

| Metric | JPUS | IVV |

| Web Revenue Margin | 14.6% | 21.5% |

| Return on Property | 7.3% | 14.3% |

| Adjusted Return on Fairness | 19.2% | 20.1% |

| Quant Profitability B- or greater | 87.9% | 94.8% |

Calculated by the creator utilizing information from Searching for Alpha and the ETFs

Ultimate ideas

JPUS is about making use of the issue trifecta in a principally mega- and large-cap universe, with the purpose being to seize the “potential for higher risk-adjusted returns than a market cap-weighted index.” And in reality, JPUS does plenty of issues proper. It presents a significant depth and breadth of publicity with out over-reliance on only a handful of market darlings which have been speeding greater, a price tilt, and principally fantastic high quality. Importantly, its expense ratio of 18 bps appears to be like razor-thin assuming the complicated factor-driven methodology. Nevertheless, neither its efficiency nor issue combine can persuade me {that a} Purchase ranking is justified.