Jetlinerimages

Shares of Frontier Airlines (NASDAQ:ULCC) have surged 20% following yesterday’s announcement that Spirit Airlines (NYSE:SAVE) had terminated the merger agreement with Frontier Airlines. So, Frontier Airlines is not getting what it wanted yet its share price surged. In this brief analysis I explain why and also explain why the path ahead for JetBlue and Spirit Airlines remains challenging.

Frontier Airlines Offer Was Always Mediocre

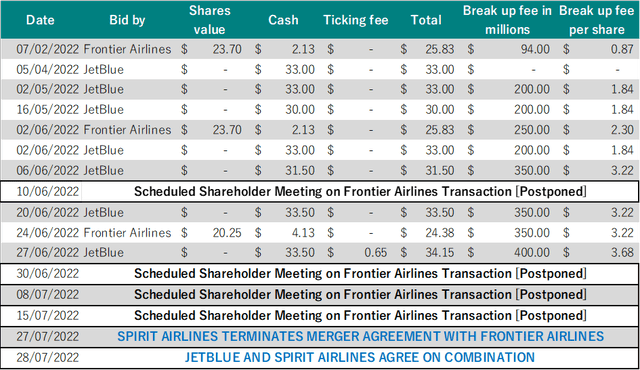

Timeline bids for Spirit Airlines (The Aerospace Forum)

I will not be discussing the entire timeline and chain of events in detail, but Frontier’s initial bid is one that failed to appreciate the prospects of Spirit’s performance in an improving market environment. Furthermore, the acquisition value to shareholder was tied to share price performance of Frontier Airlines. Since Frontier Airlines and Spirit Airlines announced their intention to combine, Frontier Airlines shares lost 12% of their value. Using yesterday’s closing price, the Frontier bid would be worth $25.69 per share which is in fact lower than their initial offer for Spirit Airlines. So, one can wonder how much of bidding war this really has been.

As JetBlue entered the game, I highlighted the prospect of a better price for shareholders as a bidding war could be sparked. One can, however, wonder how much of a bidding war there really was. JetBlue kept sweetening the deal for shareholders, while Frontier Airlines remained rather focused on improving the reverse break-up fee but not really offering a better deal to shareholders.

Eventually this led me to believe that shareholders should vote no to a merger agreement with Frontier Airlines and Seeking Alpha author Chris DeMuth Jr. thought the same. The offer from Frontier Airlines wasn’t extremely compelling to start with and compared to the JetBlue offer actually looked like a joke.

What Is The JetBlue And Spirit Airlines Deal?

For those that haven’t gone through the announcement from JetBlue, it is interesting to have a brief look at what the deal looks like.

JetBlue will acquire Spirit for $33.50 per share in cash, including a prepayment of $2.50 per share in cash payable upon Spirit stockholders’ approval of the transaction and a ticking fee of $0.10 per month starting in January 2023 through closing. This would bring the transaction value to $3.8 billion.

The combination expects regulatory approval no later than the first half of 2024 after which it would become the fifth biggest airline in the US with a market share of 9%. To gain regulatory approval, JetBlue is willing to divest assets at airports where the combined presence would meet objection from regulators or otherwise interfere with its North East Alliance.

If You Can’t Have It, Make The Other Pay For It

Over the course of the bidding war, Frontier Airlines and Spirit Airlines did not throw in the towel in their attempt to combine businesses. In fact, Spirit’s board kept favoring a combination with Frontier Airlines which led to JetBlue going hostile in its takeover attempt. As JetBlue kept improving its offer, we saw a shareholder vote being postponed twice. After that, Spirit Airlines called off a shareholder vote twice as well as chances of gaining shareholder approval slimmed. Ultimately, on the 27th of July, being the new day set for the vote Spirit Airlines terminated the agreement realizing that as much as the board wanted to combine with Frontier Airlines, shareholders would not vote in favor of it and Frontier Airlines had already said it would not improve its bid for the airline.

JetBlue Airbus A220 (JetBlue)

Frontier Airlines initially offered around $2.8 billion for Spirit Airlines and would assume around $3.6 billion in debt and liabilities. JetBlue is now paying $3.8 billion on a fully diluted equity basis valuing the business on $7.6 billion on an adjusted basis. That is why we might be seeing shares of Frontier Airlines surging. Oddly enough, Frontier Airlines did not win the bidding war but it will still feel like a winner as it made JetBlue pay $1 billion more than its initial offer and I am sure that if Frontier Airlines has things to say about the failed merger they will simply say that they feel their offer valued the business correctly and they wouldn’t be willing to pay a dime more while JetBlue was. So, Frontier Airlines in some way made JetBlue overpay by $1 billion and it is not like JetBlue has $1 billion lying around that it can just hand over to Spirit shareholders. JetBlue had $2.9 billion in cash and equivalents by the end of Q1 and so it will need to finance the deal with debt. I am sure that with rising interest rates, Frontier Airlines likes to see this happening. Even more so, when we consider that Frontier actually was willing to pay only $230 million to $500 million in cash while JetBlue is now going to pay multiples of that in an all-cash deal.

So, Frontier Airlines comes out as a loser of the bidding war but perfectly executed the “if you can’t have it, make the other party pay for it” strategy.

How Are JetBlue And Spirit Airlines Investors Impacted?

At the time of writing, shares of Frontier Airlines surged as much as 20% or $2.22 per share. Its market cap increased $483 million. So what does this increase reflect? It actually reflects a reversal of the $230 million that Frontier Airlines would pay in cash corrected for the dilution that existing shareholders would see when the airlines would combine. So, that makes sense if you assume that Frontier Airlines shareholders already started factoring in the dilution.

The bigger question is the impact on Spirit Airlines and JetBlue. Spirit Airlines shares are trading 5% higher at $25.50, still some $8 dollars below the offer from JetBlue and over time I expect that gap to narrow further. So, shares of Spirit Airlines offer further upside hence I am marking it as a buy. Shares of JetBlue have come under some pressure shedding $0.20 or 2.3% of its value which is not a surprise. We often see share prices of the buying party going down and for JetBlue shareholders the next question is how JetBlue is intending to finance the transaction. I currently am assuming that the base case for the financing constitutes an increase in debt brining associated increased in interest expenses that the combination should be able to service easily over time. Another option would be to dilute shareholders and that might also be why we see JetBlue stock trading down slightly. It is hard to come up with a JBLU stock forecast given that financial details on how financing will be done are currently lacking.

Why Would JetBlue Want Spirit Airlines?

What does remain is a challenging path to gain regulatory approval. Completion of the combination is ultimately expected to be completed in the first half of 2024 and JetBlue has pledged to divest its Spirit Airlines assets in regions where it benefits from the North East Alliance with American Airlines (AAL). Right now, we are seeing big news portals bringing the merger announcement as a relief on any pilot shortages. While a combined company could possibly offer more competitive wages to pilots, where JetBlue would mostly benefit is yield strength preservation as it eliminates a competitor in some markets and access to ordered fleets. The merger is not really a solution to the current pressures faced across the industry in my view, but the access to 300 delivery slots at Airbus is very important, even more so as we see pressure on the ability of OEMs to increase production to meet demand.

What remains is that from a business perspective, integrating Spirit Airlines into the JetBlue model might be complex as both airlines operate vastly different models and it might take time for this to be fully translated to the front-end even after regulatory approval is obtained.

Conclusion

That JetBlue and Spirit Airlines now intend to comply does not come as a surprise. The offer from Frontier Airlines wasn’t good to start with and it didn’t get much better over time either. As a result, shareholder support for the combination disappeared, forcing Spirit Airlines to postpone shareholder votes and ultimately terminate the merger agreement altogether. The new combination intends to combine by 2024, but gaining regulatory approval might not be easy and even after that, integrating the business will be a big challenge. Furthermore, JetBlue has to solve the problems it is facing as a stand-alone company and outline how it intends to pay for Spirit Airlines.

JetBlue and Spirit Airlines would become the fifth largest carrier with a share of 9%. Currently there are concerns about regulatory approval, but with a 9% market share gaining that approval should not be difficult on paper even more so since JetBlue says it wants to disrupt legacy carrier pricing. Whether that will happen remains to be seen, but given the current pressures in the marketplace I would say that some consolidation is preferred. At current prices, Frontier Airlines stock offers 28% upside compared to analyst targets while the spread for Spirit Airlines stock is 31% offering further upside as well. Interestingly, while I am least bullish on JetBlue stock it actually has a 38% upside according to analysts.