Japanese Yen Costs, Charts, and Evaluation

- Japanese inflation drifts decrease in December.

- The Quarterly Output Report subsequent week is vital going ahead.

Download our complimentary Q1 Japanese Yen Technical and Elementary Report

Really helpful by Nick Cawley

Get Your Free JPY Forecast

Japanese inflation cooled additional in December with headline inflation falling to 2.6% from 2.8% in November, whereas core inflation fell to 2.3% from 2.5%, in keeping with market forecasts. Japanese value pressures are at their lowest stage since mid-2022, however nonetheless above the two% central financial institution goal, and the Financial institution of Japan might want to see extra indicators of entrenched wage inflation earlier than it considers tempering its multi-year ultra-loose financial coverage.

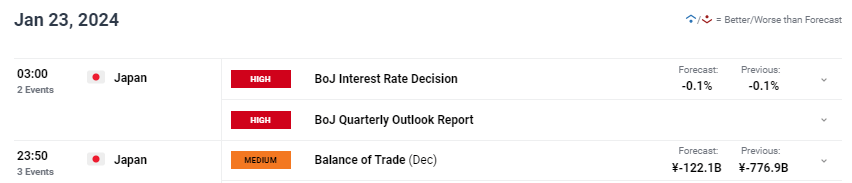

Subsequent week the Financial institution of Japan will announce its newest financial coverage resolution and the central financial institution is anticipated to depart all coverage levers untouched. The BoJ will even launch the primary Quarterly Outlook for Financial Exercise and Costs Report for 2024. This report presents the BoJ’s outlook for developments in financial exercise and costs, assesses upside and draw back dangers, and descriptions its views on the longer term course of financial coverage. This report could also be key in deciding the longer term path of the Japanese Yen.

The most recent spherical of Fed pushback towards what they understand to be extreme US charge lower expectations have boosted the US greenback for the reason that finish of final yr. The US greenback index has rallied by practically 3% since December twenty eighth, pushing it greater throughout the board. Over the identical timeframe, USD/JPY has rallied from 140.28 to a present stage of 148.05, a 6% transfer greater. USD/JPY is nearing ranges the place the Financial institution of Japan could begin to ‘verbally intervene’ to try to stifle any transfer greater. The pair touched 150.91 on November thirteenth final yr, simply three pips off the July 2022 multi-decade excessive of 151.94. Whereas the BoJ will hope {that a} weak Japanese Yen helps to import inflation, Japan’s buying and selling companions is not going to be greatest happy that their exports to Japan are being damage by the lowly stage of the Yen. The nearer the USD/JPY will get to 150, the extra probably that the Financial institution of Japan will begin to discuss potential intervention.

USD/JPY Every day Worth Chart

Retail dealer information present 29.44% of merchants are net-long with the ratio of merchants brief to lengthy at 2.40 to 1.The variety of merchants net-long is 20.95% greater than yesterday and 0.40% greater from final week, whereas the variety of merchants net-short is 4.10% decrease than yesterday and 12.37% greater from final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests USD/JPY costs could proceed to rise.

Obtain the Newest IG Sentiment Report back to See How Every day/Weekly Modifications Have an effect on the USD/JPY Worth Outlook

| Change in | Longs | Shorts | OI |

| Every day | -16% | -7% | -10% |

| Weekly | -6% | 17% | 10% |

What’s your view on the Japanese Yen – bullish or bearish?? You’ll be able to tell us by way of the shape on the finish of this piece or you may contact the creator by way of Twitter @nickcawley1.