Japanese Yen, USD/JPY, Financial institution of Japan – Market Alert:

- Japanese Yen sinks as Financial institution of Japan leaves coverage unchanged

- Markets eyed extra coverage normalization, which didn’t occur

- USD/JPY shoots in the direction of key falling trendline from October

Really useful by Daniel Dubrovsky

Get Your Free JPY Forecast

The Japanese Yen weakened over 2 p.c within the aftermath of January’s Financial institution of Japan financial coverage announcement. If losses are sustained, this may find yourself being the most effective single-day efficiency for USD/JPY since March 2020. Allow us to take a better have a look at what occurred right here.

Effectively because it seems, nothing a lot in any respect. The BoJ left all coverage settings unchanged this month. This consists of the coverage stability fee (maintained at -0.1%) and the 10-year bond yield goal of about 0%. Policymakers additionally talked about that they might persist with bond purchases with a level of flexibility. That underscored the central financial institution’s intention to proceed with yield curve management as deliberate.

To grasp why the Yen swiftly weakened right here, you must return to what occurred in December. Final month, the central financial institution shocked markets by widening the yield curve band round 0% to plus/minus 50 foundation factors. That was from +/- 25bps. The central financial institution additionally elevated asset purchases to JPY9 trillion every month from 7.3 trillion prior.

Really useful by Daniel Dubrovsky

Methods to Commerce USD/JPY

Markets seen this because the central financial institution taking steps nearer towards coverage normalization. Skipping ahead to final week, a narrative from Yomiuri Shimbun elevated hypothesis that the central financial institution might take additional steps towards coverage tightening. As such, merchants had been closely skewed in the direction of some additional adjustment at this time. When that didn’t occur, these bets had been unwound.

So, the place to for USD/JPY? Effectively, the foreign money appears weak within the close to time period as markets will doubtless proceed unwinding less-dovish bets which were build up for the previous few weeks. Because it stands, the BoJ stays very dovish in comparison with its main friends. As such, the main focus will shift to exterior elements forward.

Over the remaining 24 hours, United State retail gross sales, PPI and industrial manufacturing might supply additional clues concerning the well being of the economic system. Softer figures might see markets proceed specializing in a Fed pivot. That will assist USD/JPY come down barely.

Market Response to Financial institution of Japan

Chart Created in TradingView

Japanese Yen Technical Evaluation

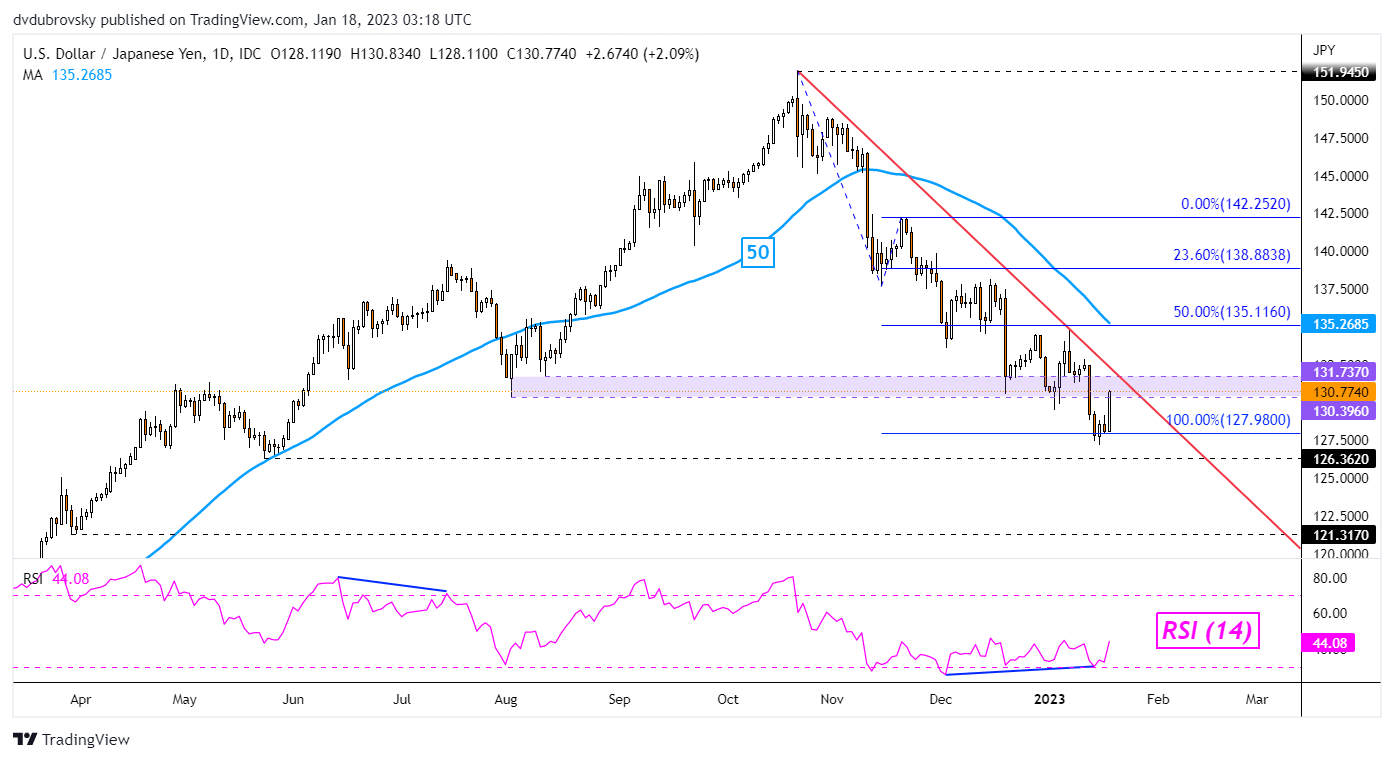

USD/JPY has bounced off the 100% Fibonacci extension degree at 127.98 following the Financial institution of Japan. This follows persistent optimistic RSI divergence, which was already displaying draw back momentum fading. That’s leaving the pair going through the previous 130.39 – 131.73 assist zone. The latter could now maintain as new resistance. Hold a detailed eye on the falling trendline from October, which might preserve the draw back bias. In any other case, extending good points locations the give attention to the 50-day Easy Shifting Common (SMA).

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX workforce

Subscribe to E-newsletter

USD/JPY Day by day Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, comply with him on Twitter:@ddubrovskyFX