Iryna Mylinska

Funding Thesis

After final 12 months’s spin-off from Prudential (PRU), Jackson Monetary (NYSE:JXN) has been actively increasing its identify recognition amongst buyers because it continues its quest to develop its shareholder base to spice up its valuation. Though its ticker chart solely spans 14 months, the corporate has been in operation for over 60 years, partly as a division of PRU, throughout which period it has turn out to be the business chief within the annuities market, because of its unparalleled distribution community of unbiased monetary advisors conversant in its model.

Resulting from this novelty as a standalone firm, comparatively small market cap, lack of protection, and information circulation, the corporate stays underfollowed. Nonetheless, its governance high quality, main market place, and danger strategy stay unchanged. These elements mixed to create a sexy funding alternative at a low worth that can flip into double-digit good points because the inventory market turns into conversant in the Jackson identify.

Our purchase suggestion displays JXN’s main place within the mounted annuities market and its sizeable share available in the market for variable annuities, powered by its strong distribution and market channels underpinned by a stable again workplace infrastructure.

Income Developments

The vast majority of JXN’s earnings come from the administration charges related to its annuity merchandise. This line merchandise has remained comparatively flat all through the years, with minor fluctuations as a consequence of modifications within the common worth of annuity accounts, arising primarily as a consequence of modifications in rates of interest. JXN has to speculate closely in debt devices to pay for its annuity obligations, whose worth is delicate to rate of interest modifications. However, fluctuations in bond costs are, on common, much less unpredictable than strikes in equities markets, and this consistency helps to clean out substantial fluctuations in JXN’s price income.

JXN wants to take care of massive derivatives holdings important to retain its capital base whereas catering to shoppers with a better tolerance for danger. These monetary derivatives enable JXN to offer annuities with various danger traits (together with fairness publicity), rising its product providing and attracting new shoppers.

Honest worth modifications of those derivatives are recorded within the income line, underpinning the income volatility image of final 12 months when fairness markets tumbled from the earlier 12 months’s highs. Regardless of upwards and downward swings in hedging devices, the impression on money circulation is proscribed.

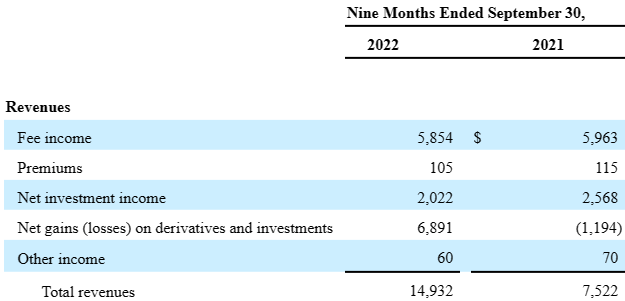

The graph under reveals JXN’s income by section, demonstrating comparatively flat Payment Earnings and way more risky Web Positive aspects on Derivatives pushed by final 12 months’s market selloff.

JXN Income

Stability Sheet

As a security measure towards losses, monetary establishments are required to maintain a sure amount of money and different high quality property available. These liquidity necessities fluctuate relying on the kind of establishment and the character of its enterprise. With the current market turmoil in thoughts, administration is assured that the corporate has sufficient money to fulfill regulatory capital and liquidity necessities. Most of JXN’s property are invested primarily in high-quality company bonds, authorities securities, and mortgage-backed securities, enhancing its risk-based capital protection. Most of its liabilities are contract liabilities to its policyholders and beneficiaries.

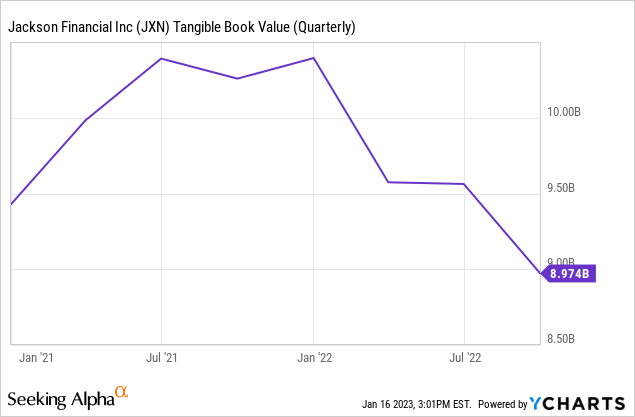

In current quarters we noticed each fairness and bond costs go down, placing stress on monetary establishments’ steadiness sheets, together with JXN, whose capital was impacted by unrealized capital losses, offsetting its hedge good points.

Though increased rates of interest negatively have an effect on GAAP earnings within the brief run by way of increased unrealized losses, the upper charges are anticipated to have a optimistic impression in the long term by rising curiosity earnings on its debt investments. Increased rates of interest additionally improve the attractiveness of annuity merchandise. Till now, we see a restricted impression on the corporate’s working money flows, as losses stay restricted to non-cash honest worth measurements.

Dividend and Valuation

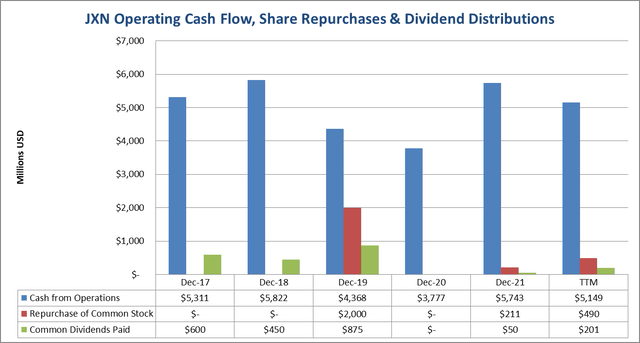

Dividends and buybacks present that administration is assured in its capacity to take care of its capital whereas offering shareholders with good returns. Nevertheless, score businesses have been involved that administration’s dedication to returning cash to buyers could impede its capability to take care of an sufficient capital cushion in case one thing surprising occurs, e.g., an unexpected antagonistic occasion impacting liquidity. Each monetary establishment has to stroll this positive line, and the way in which administration returns capital to buyers is by no means troubling. Share repurchases and dividends are solely a fraction of the corporate’s working money flows, as proven within the desk under.

JXN Working Money Stream, Dividends, and Share Repurchases (In search of Alpha)

Thus, the 6% dividend yield is just not as a result of the corporate pays out some huge cash however as a result of the inventory is undervalued. The ahead non-GAAP P/E ratio (which adjusts for non-cash spinoff write-offs) at present stands at 2.3%, 77% under the business median. Its present market cap is a fraction of tangible ebook worth. The shares are so undervalued that small share repurchases budgets are making an enormous distinction in share depend. Since going public, the corporate purchased 12.5% of the entire shares excellent, utilizing merely $500 million. In truth, final 12 months, the corporate generated sufficient money to purchase again all its shares. I believe that this undervaluation of the market worth will hold development at double-digit charges for years to come back.

Abstract

JXN celebrated its first 12 months as a standalone firm final September. Nonetheless, its legacy goes again to the Nineteen Sixties earlier than being acquired by Prudential, the place it prospered as a market chief within the annuity underwriting enterprise. This allowed JXN to hit the bottom operating with no disruption in its insurance coverage companies or operations and no runoffs of legacy insurance coverage insurance policies regardless of market disruptions. Its dividend distribution and share buybacks are merely a continuation of its governance coverage applied when it was a subsidy of Prudential.

The excessive yield is just not a results of a excessive payout ratio however as an alternative of an undervalued inventory. As JXN builds its identify as a standalone firm, I anticipate capital good points over the subsequent 2-3 years with its robust elementary development and rising dividend distribution.