I maintain saying issues like “the celebration is over” and that the correction has some time to go and that “we’re within the midst of a bear market” and that these infant or two day rallies are actually only a good time to “unload some ache” and nothing extra.

However individuals don’t need to hear this. There are huge losses on the market from the highest in a number of the hottest progress shares. The concept it’s not finished but is a troublesome idea to swallow. 70% of the Nasdaq is in a 20% drawdown or worse. 20% of the Nasdaq has been greater than reduce in half. And each week it will get worse not higher. Individuals need to hear “Purchase the Dip!” Life was a lot less complicated when that was a clockwork proposition. Now the dips have dips. It’s not working in any respect. It’s really making issues worse for lots of oldsters. A inventory that will get reduce in half can get reduce in half once more after which once more. It’s so painful.

And that is what bear markets have to supply, in spades. One disappointment after one other.

So now what?

That is going to sound overly simplistic however I promise it’s the one clever factor to be stated on the matter: The bear market will finish when shares cease taking place.

I warned you it was going to be considerably unsatisfying.

It’s not terribly useful, however it’s extra helpful for you than anybody’s forecast. It’s important to belief me on this – I do know the individuals making the forecasts. All of them.

We don’t predict bear markets. We handle cash as if they’re a traditional a part of investing, occur throughout each decade and differ in size, breadth and depth relying on what they’re being attributable to. And whereas we don’t try and anticipate them, we do handle a portion of our shoppers’ accounts tactically. That is obligatory for a lot of of our households as a result of we’re speaking about individuals’s life financial savings on the road. The older you get, the extra unlikely it’s that you could rebuild a profession or proceed to greenback price common by these moments that, for youthful people, can be characterised as main shopping for alternatives.

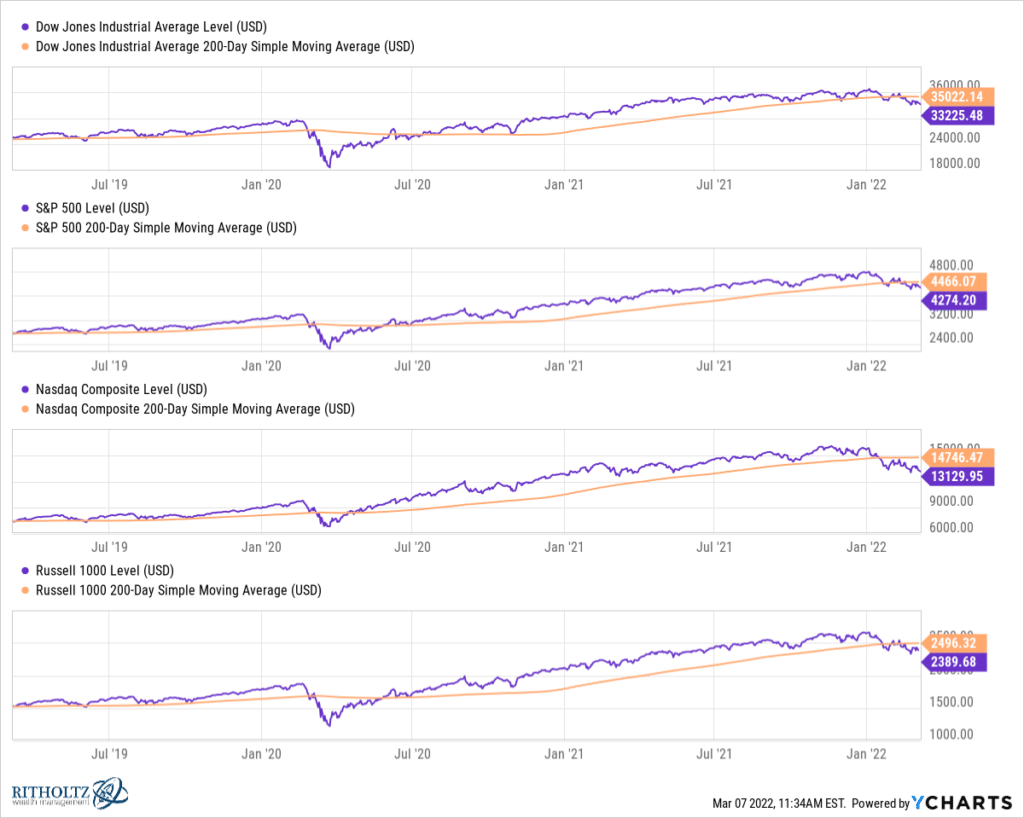

The present bear market will, in time, be seen as a kind of main alternatives for many who continued to put money into the face of all the assorted fears presently occupying the headlines. However that’s sooner or later. Proper now, it might not really feel that manner in any respect. It seems like this, a downtrend regularly sapping the investor class’s enthusiasm away, drip by drip:

In some methods, that is a lot worse than a crash. It’s a bandaid being slowly pulled off with all kinds of false hope alongside the way in which.

The index statistics haven’t but caught up with the truth of the internals – the market of shares appears and feels manner worse than the inventory market. You’ll be able to thank Microsoft and Apple for that.

Don’t be fooled by a technicality. That is the actual factor.