On Wednesday night, I joined Phil Yin on CGTN America to debate Boeing (NYSE:) Earnings, the Fed, Markets and extra. Because of Phil and Ryan Gallagher for having me on. Within the phase I referenced Mel Books well-known line, “it’s good to be the King!” from his 1981 movie “Historical past of the World half I.” Discover out why “it’s good to be the king” and why “competitors is for suckers” right here:

On Tuesday, I used to be tentatively scheduled to be on Fox Enterprise. It was pushed again to a later date, however right here had been my ready present notes and a couple of picks (positions we personal from decrease ranges):

Common Market:

Just a little overbought. Just a little exuberant. Just a little due for a pullback, however 1 large downside:

We haven’t introduced within the final of the adamant bears (who’ve been pounding the desk brief for the total >40% rally off the October 2022 lows).

As soon as we flip the ultimate holdouts (most likely one other few p.c upside within the indices), we will count on a wholesome pullback of 5-7% in Late Feb/March interval.

Very onerous to get too aggressive brief/apocalyptic after we are simply breaking out to new highs following 2 years of 0% returns and sideways consolidation:

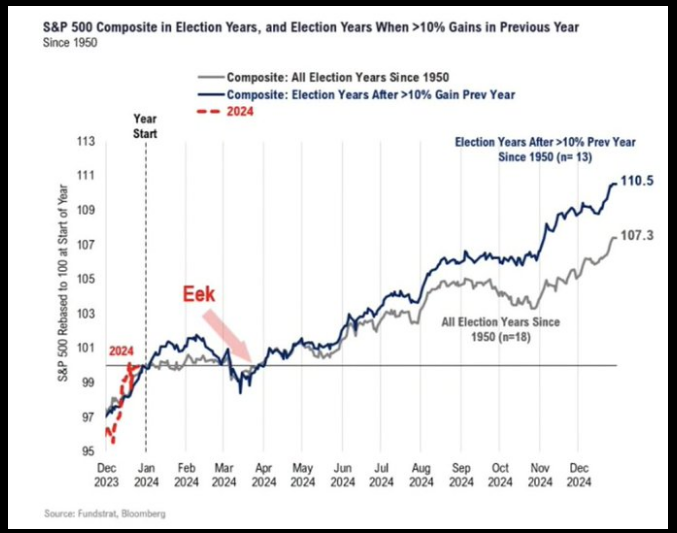

Avg. Pres Election 12 months returns since 1928 are 11.28%.

Regular election 12 months template:

Supply: Fundstrat

Fed Subsequent Step:

Taper the taper (cease aggressively promoting bonds on the open market to empty liquidity) PRIOR to commencing first reduce in March/Could.

Firm refinancings at decrease charges in again half of 12 months will speed up earnings expectations notably for small caps – which have essentially the most leverage and wish for refinancing.

TWO POSSIBLE “DOUBLES” FROM LOTS OF COVID TROUBLES

AAP – Advance Auto Elements (NYSE:) (nonetheless 70% off ATH):

On 11/15/2023, I got here on the present with a brand new place AAP (Superior Auto Elements):

It was buying and selling at $59.00. It’s now up over 13% ($66.85) and we imagine simply getting began:

Gross sales up final quarter 2.9% (+1.2% comp retailer gross sales).

Free Cashflow was +$148M. Money steadiness grew and paid down revolver.

New CEO Shane O’Kelly (previously ran HD Provide for House Depot (NYSE:)) is delivering on his plan to:

- Promote Canadian Operations (worldpac and carquest).

- Reduce $150M in prices. Use $50M for retention of frontline.

- Construct US pure play “blended field” professionals and DIY and return to worthwhile progress.

Individuals on the low finish hanging on to their vehicles so much longer as OEMs catering to increased finish new vehicles (avg. sticker $48,000). They want components to maintain avg 13yo automotive operating.

*Is usually a double+ from these ranges over the following 24-36 months.

SWK – Stanley Black and Decker (nonetheless ~54% off ATH):

On 9/11/2023, I got here on the present to speak about our place in SWK:

It’s up ~5% since and simply getting began on the turnaround plan:

-$2B runrate financial savings by 2025 (forward of schedule with $875M)

-Develop natural income at 2-3x market by innovation (DeWalt, Stanley, Craftsman, and so forth)

-$360M in free cashflow final quarter.

-Upgraded steerage as COVID inventories labored off to the tune of $1.7B.

-Gross margins re-accelerating from This autumn 2022 trough of 20% to twenty-eight% final QTR. Heading in the right direction to attain 35% by 2025.

-Will probably generate ~$750M FCF in 2023 alone (turnaround 12 months).

*Is usually a double+ from these ranges over the following 24-36 months.

3.4% dividend when you wait.

Markets and Fed

After being bullish since October 2022 (and October 2023) when many strategists had been scaring folks out of their shares on the precise improper time, in final week’s podcast|videocast and word I indicated that with sentiment at heightened ranges, it could be “trickier” within the brief time period. This doesn’t change our 2024 outlook – which Barbara Kollmeyer was so sort to function in MarketWatch yesterday.

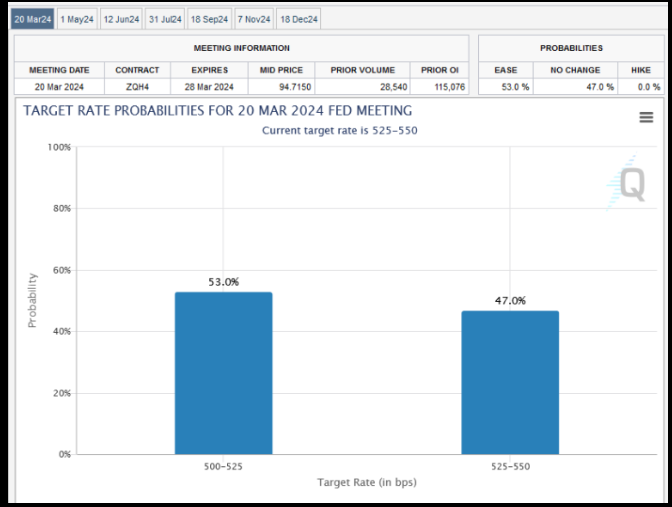

Regardless of Chair Powell waffling yesterday and implying March cuts had been not a foregone conclusion, the Fed Fund Futures had been nonetheless pricing in a 53% likelihood of the primary reduce coming in March (as of 9pm final night time):

Google (NASDAQ:) Earnings

As Barbara referenced within the MarketWatch article, we purchased Google and Amazon (NASDAQ:) in Fall of 2022 if you “couldn’t give them away.” They’ve each had monster beneficial properties however now we have no intention of promoting them within the close to time period.

Last Ideas

Final week within the podcast|videocast we mentioned a possible 5-7% pullback in late February or March timeframe. May or not it’s early? Presumably, however I wouldn’t depend on it. I believe we’ll see extra breadth enchancment earlier than a brief time period high.

Within the scheme of issues, it doesn’t matter because the 12 months ought to find yourself properly (excessive single digits to low double digits for the indices), however we wouldn’t thoughts a number of extra share factors up first with the intention to promote some calls in opposition to our longs or presumably placed on some uneven tactical shorts if the chance presents itself.

At these ranges, it makes extra sense to attend it out. If we push increased and at last flip the previous few vocal bears (who’ve been bearish for the reason that October 2022 lows and missed 40%+ since), it can make extra sense to make tactical strikes. Time will inform, however my expertise signifies the “first transfer” after a Fed assembly is usually the “improper transfer” – and thus far it’s down. We’ll see the way it performs out in coming days…

Now onto the shorter time period view for the Common Market:

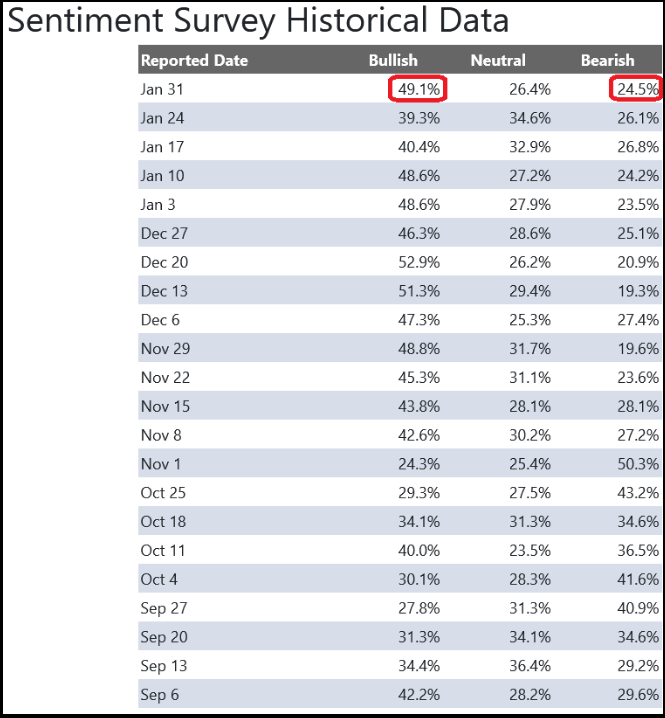

On this week’s AAII Sentiment Survey end result, Bullish P.c (Video Rationalization) jumped to 49.1% from 39.3% the earlier week. Bearish P.c ticked right down to 24.5% from 26.1%. Retail buyers are optimistic.

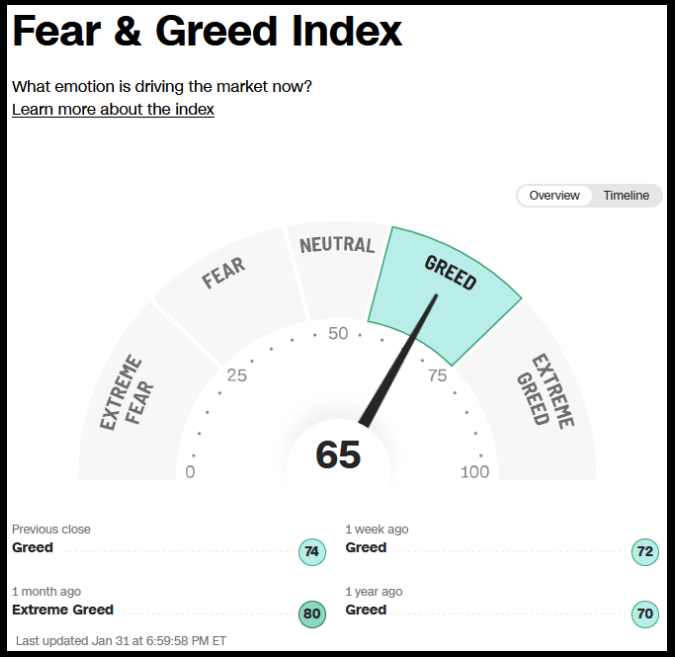

The CNN “Worry and Greed” dropped from 76 final week to 65 this week. You’ll be able to learn the way this indicator is calculated and the way it works right here: (Video Rationalization)

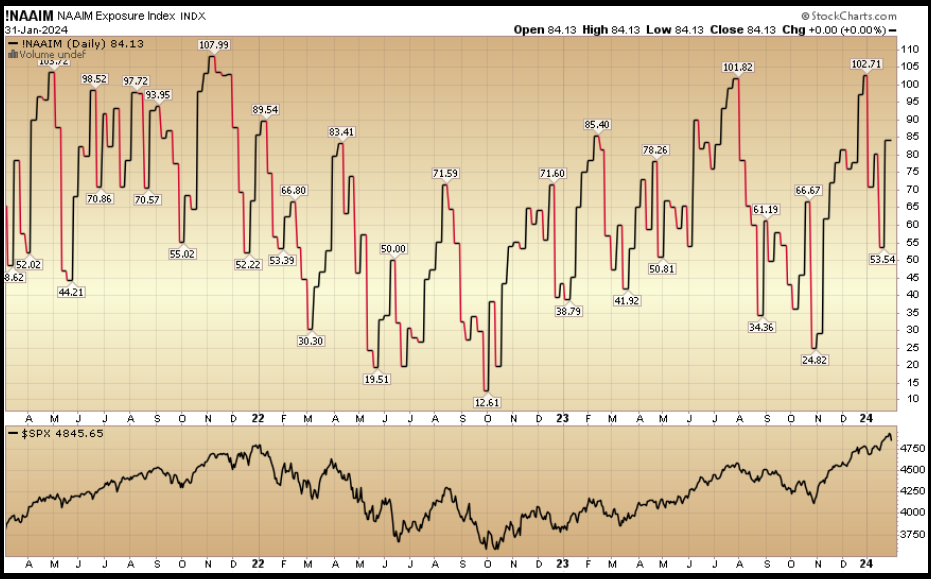

The NAAIM (Nationwide Affiliation of Lively Funding Managers Index) (Video Rationalization) rose to 84.13% this week from 53.54% fairness publicity final week.

This content material was initially printed on Hedgefundtips.com.