ISM SERVICES KEY POINTS:

- ISM Companies PMI slows to 55.1 from 55.2, topping expectations calling for a bigger pullback to 54.5

- The brand new orders and the employment indices lengthen their restoration, costs paid transfer down reasonably

- U.S. greenback, as measured by the DXY index, trims session losses amid financial resilience

Beneficial by Diego Colman

Get Your Free USD Forecast

Most Learn: EUR/USD Value Replace – European Union PMI Miss Nonetheless Trigger for Optimism

A gauge of U.S. enterprise providers exercise was just about unchanged in February following an sudden rebound at the beginning of the 12 months, an indication that the financial system stays extraordinarily resilient regardless of quickly rising rates of interest and persistently excessive inflationary pressures.

In keeping with the Institute for Provide Administration (ISM), its providers PMI index eased to 55.1 this month from 55.2 in January, topping consensus estimates calling for a bigger pullback to 54.5. For normal context, any worth above the 50 threshold signifies progress within the sector, whereas readings under that degree denote contraction.

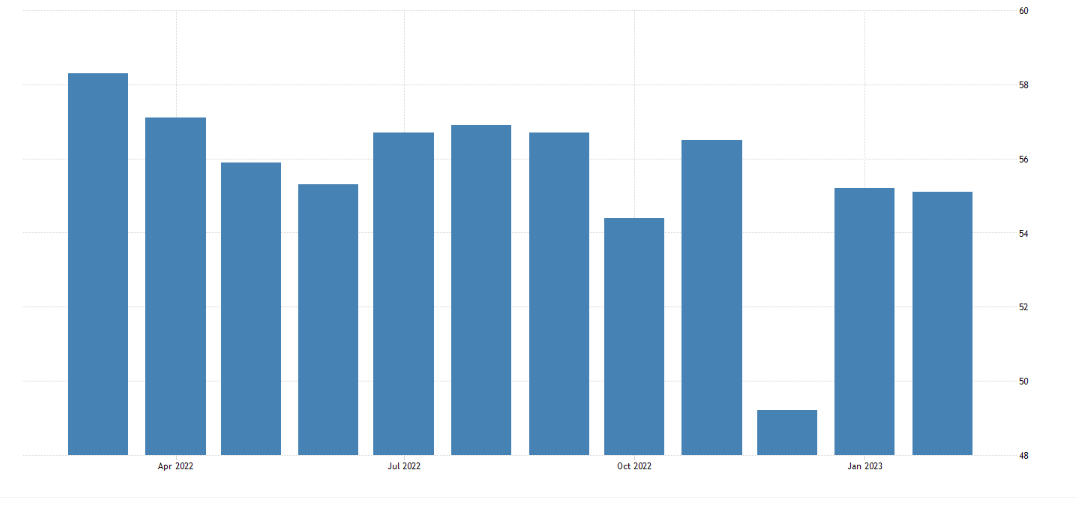

ISM SERVICES PMI AT A GLANCE

Supply: DailyFX Financial Calendar

Trying underneath the hood, the non-manufacturing sector was supported by power within the new orders and employment indices, with the previous climbing to 62.6 from 60.4 and the latter advancing to 54.00 from 50.00 beforehand. In the meantime, costs paid extended their retrenchment, sliding to 65.6 from 67.8, indicating motion towards equilibrium, a welcome growth for the Federal Reserve

ISM SERVICES PMI CHART

Supply: TradingEconomics

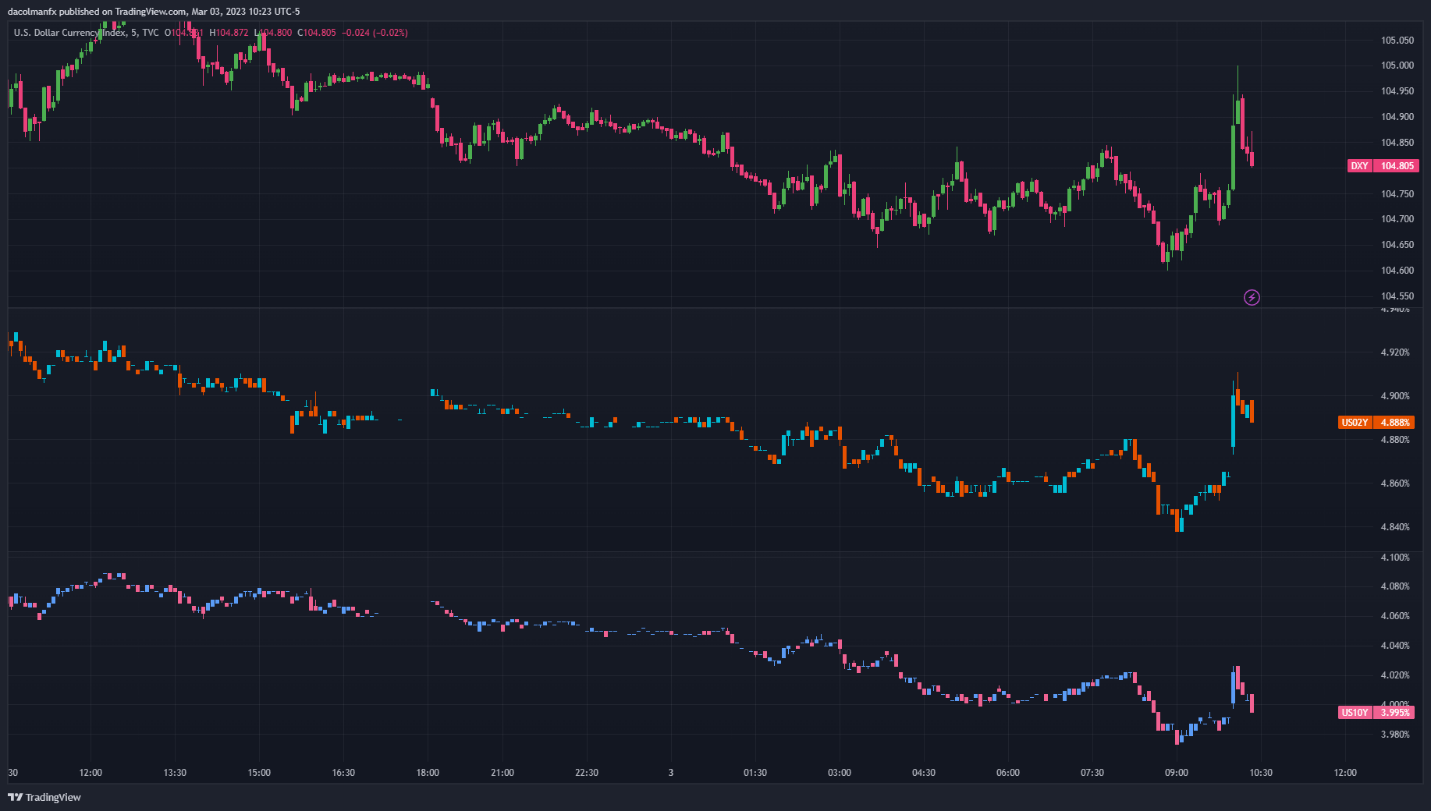

Instantly after the survey outcomes crossed the wires, the U.S. greenback, as measured by the DXY index, trimmed some session’s losses, as Treasury yields tried to rebound, however the transfer wasn’t fully sustained.

Whereas better-than-expected exercise figures counsel that demand circumstances stay sturdy, the slide in costs paid alerts that the scenario is not going to be extraordinarily inflationary in the meanwhile, however extra information will likely be wanted to make a definitive evaluation. With that mentioned, consideration will now flip to the February U.S. employment survey, which will likely be launched subsequent Friday. This report ought to be the following necessary volatility catalyst within the FX area.

US DOLLAR INDEX VS YIELD

Supply: TradingView