ISM SERVICES PMI KEY POINTS:

- ISM services PMI falls to 54.4 in October from 56.7 in the previous month, disappointing expectations calling for a more modest pullback to 55.5

- Survey’s results suggest the U.S. economy continues to decelerate amid rapidly tightening financial conditions

- Focus now shifts to the October nonfarm payrolls report on Friday

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Fed Delivers Another Jumbo Hike. What’s Next for the U.S. Dollar?

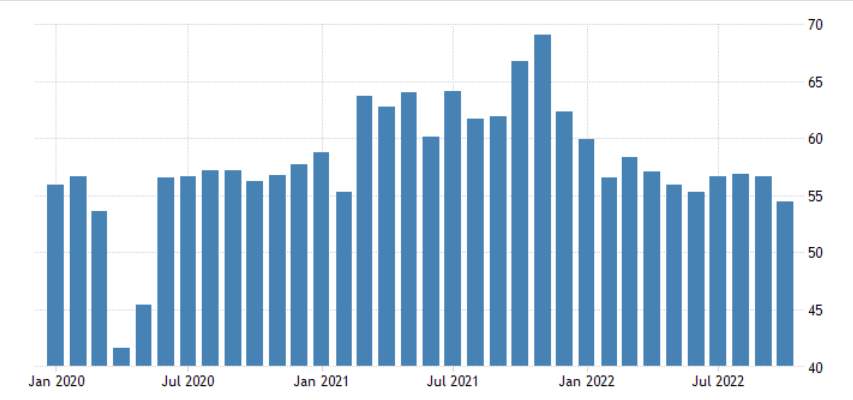

A gauge of U.S. business services activity grew for the 29th consecutive month at the start of the fourth quarter, but decelerated markedly and more than anticipated, a clear sign that the economic outlook continues to deteriorate on the back of persistently high inflation, falling real incomes, and tightening financial conditions.

According to the Institute for Supply Management (ISM), October services PMI fell to 54.4 from September’s 56.7 print versus 55.5 expected, hitting its lowest level since May 2020 when the country was digging its way out of the pandemic-induced slump. For context, any figure above 50 indicates growth, while readings below that threshold denote a contraction in output.

Looking at the internals, the slowdown in the non-manufacturing sector was partly driven by a sharp drop in new orders, which sank to 56.5 from 60.6, a disappointing outturn that points to rapidly cooling client demand amid heightened uncertainty about the future. The employment index also worsened, retreating to 49.1 from 53.0, suggesting that hiring conditions are deteriorating. While a softer labor market is not a cause for celebration, it could help the Fed bring down inflation over the medium term by weakening wage pressures.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

ISM SERVICES DATA AT A GLANCE

Source: DailyFX Economic Calendar

On the inflation front, prices paid by service providers climbed to 70.7 from 68.7, indicating that input costs are once again accelerating. If this trend is sustained, CPI readings will struggle to roll over in the coming months, prompting policymakers to slam on the brakes even harder.

With the ISM survey and the FOMC decision behind us, the focus now shifts to the October nonfarm payrolls report on Friday. According to a poll conducted by Bloomberg News, the U.S. economy created 200,000 jobs las month, after adding 288,000 workers in September.

Barring a major pullback in hiring, stocks are likely to remain biased to the downside on speculation that the Federal Reserve will not pause its tightening cycle anytime soon, but continue to push the terminal rate higher in its efforts to restore price stability. This scenario could drive the S&P 500 and Nasdaq 100 to fresh 2022 lows towards the tail end of the year.

Recommended by Diego Colman

Get Your Free Equities Forecast

ISM SERVICES CHART

Source: TradingEconomics

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist for DailyFX