US PMIs, Federal Reserve, US Dollar – Talking Points

- US ISM MANUFACTURING PMI ACTUAL 50.2 (FORECAST 50, PREVIOUS 50.9)

- US Dollar Index shifts course, slips back below 111.00

- Focus now shifts to November FOMC meeting tomorrow

Recommended by Brendan Fagan

Get Your Free Top Trading Opportunities Forecast

The ISM Manufacturing PMI for October came in above expectations ahead of the crucial November FOMC meeting. The manufacturing PMI came in at 50.2 against a consensus estimate of 50, but did fall short of the September print of 50.9. The hot print further complicates the next 24 hours for market participants, as markets continue to look for a pivot while US economic data remains strong. Perhaps most notably, the PMI report indicated that employment ticked higher in October, which goes against the Fed’s current objective of weakening the labor market. This coincided with a bump higher in JOLTS (job openings), which came in at 437,000.

US Economic Calendar

Courtesy of the DailyFX Economic Calendar

Traders will now have to digest this last batch of data ahead of tomorrow’s Fed meeting. The Fed is still waiting for inflation and labor market data to turn in their favor, with both remaining persistently stubborn. Data elsewhere has cooled significantly, most notably in the housing market. While this data slowdown will be welcomed by Federal Reserve officials, decisions taken on monetary policy ultimately rely on their dual mandate.

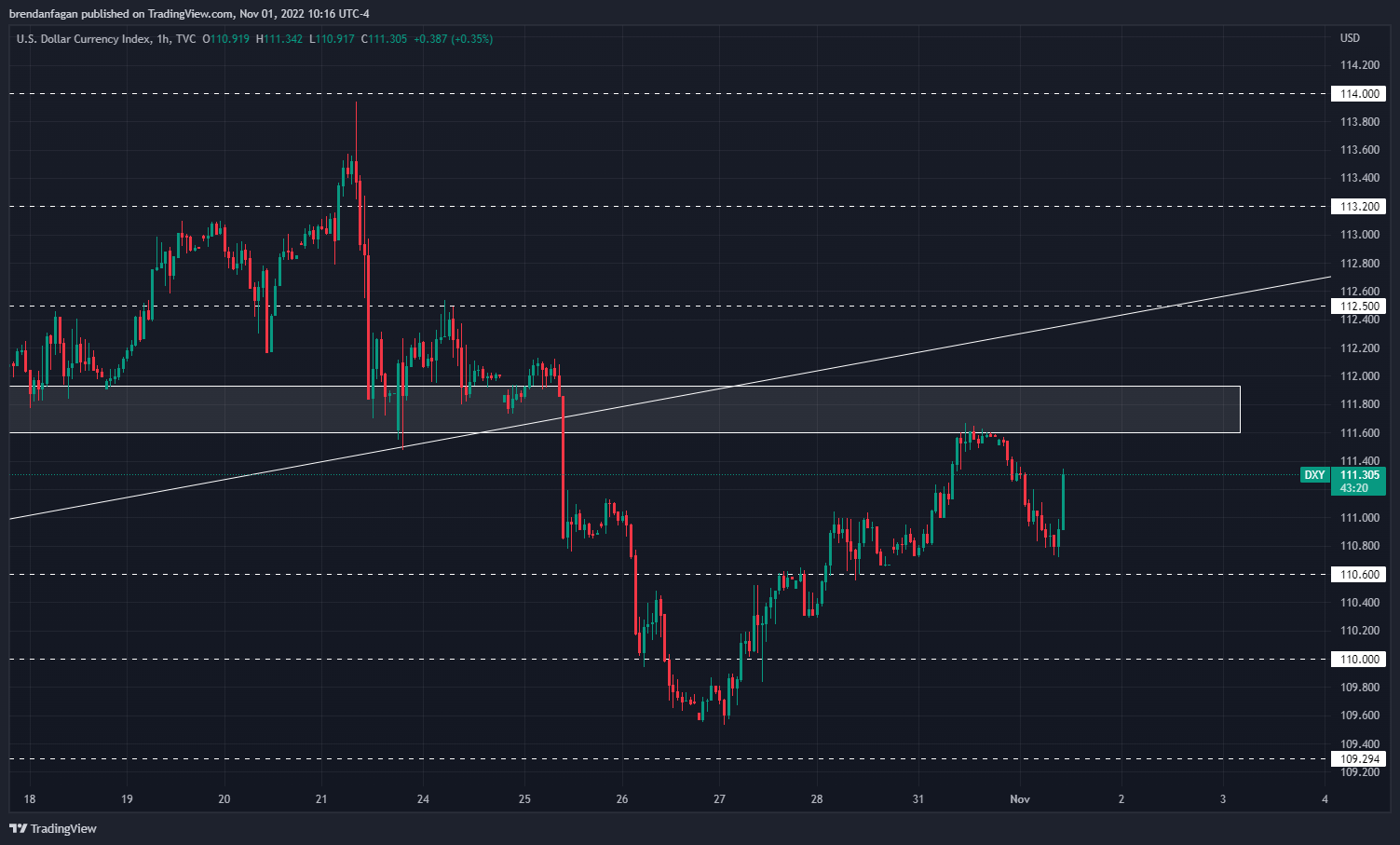

Ahead of tomorrow’s FOMC meeting, the US Dollar Index is tracking lower as traders ponder a spectrum of outcomes that may come to fruition at 2 PM EST. While tomorrow’s meeting is effectively fully priced for 75 basis points, the debate continues to rage around the December meeting. Market participants have taken down expectations for the Fed’s terminal rate, which now sits around 4.9%. This pullback in expectations has softened the Greenback, while giving equities and other risk assets room to run higher. While the Dollar caught a bid following the release of the PMI data, it remains comfortably below Monday’s highs.

US Dollar Index 1 Hour Chart

Chart created with TradingView

Attention now shifts to Fed Chair Jerome Powell, as traders eagerly await the tone of his message. Should Powell choose not to commit to anything in December and deliver a hawkish hike, the market may get caught offsides following this recent rally. This scenario could see the DXY trade back above trendline support that failed during the October 25 session, which would bring the Dollar Index back above the 113 area. Should the market sniff-out that peak hawkishness is behind us, the Dollar may extend its recent pullback.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter