Adam Smigielski/E+ by way of Getty Pictures

After including to my lengthy positions within the iShares Silver Belief (NYSEARCA:SLV) within the second half of final 12 months (see ‘SLV: Indicators Of Capitulation’ and ‘SLV: The Lengthy-Time period Bull Market Has Seemingly Resumed’), I’ve used the most recent rally to take some revenue as silver bumps up in opposition to key downtrend resistance. The chance-reward outlook has deteriorated for now, with the commodity advanced underneath draw back strain and US actual bond yields remaining close to cycle highs. Nonetheless, I stay bullish from a long-term perspective because the steel stays undervalued and I count on present tight financial situations to reverse over the approaching years.

The SLV ETF

The SLV ETF has tracked the spot worth with a median 12-month monitoring error of simply 0.48%, and will proceed to supply buyers direct publicity to the steel. With an expense payment of 0.50%, that is far decrease than the spreads on shopping for the bodily steel. SLV is the biggest and most liquid silver ETF, however has a barely increased expense ratio relative to others such because the Aberdeen Commonplace Bodily Silver Shares ETF (SIVR). Regardless of the rally in SLV property underneath administration proceed to maneuver steadily decrease, remaining 30% beneath their February 2021.

The SLV seems to be struggling to beat key down trendline resistance from the February 2021 excessive, which marked the height of the reddit-inspired squeeze. An in depth above USD22.5 is required to counsel a resumption of the bull market and arrange a run on the USD25 space.

SLV ETF Worth (Bloomberg)

Rising Actual Yields Are A Threat To Valuable Metals

Silver costs are typically pushed by financial demand and industrial demand in roughly equal measure. We will gauge financial demand by trying on the worth of gold and actual bond yields. Gold’s rally seems to be giving a inexperienced flag for additional silver upside. Whereas silver is struggling to interrupt resistance, gold has continued to rally.

Nonetheless, as I’ve famous in current gold articles (‘Gold’s Rally Is Overdone, This is How To Play It‘), this rally will not be supported by actual bond yields, which stay close to cycle highs. To be clear, by actual bond yields I’m speaking particularly about long-term US inflation-linked bond yields somewhat than the true yield calculated utilizing trailing CPI. The ten-year US inflation-linked bond yield at the moment sits at 1.3%, which displays the 10-year yield of three.5% and 10-year inflation expectations of two.2%. Because the chart beneath reveals, 10-year inflation-linked bond yields have been extraordinarily effectively correlated with gold lately. Until we see actual bond yields head sharply decrease, gold stays inclined to a draw back reversal, which might be anticipated to additionally undermine the silver worth.

Gold Worth Vs 10-12 months Inflation-Linked Bond Yields (Bloomberg)

Commodity Worth Weak point An Further Headwind

Industrial demand for silver could be gauged by trying on the broader commodity advanced. Over the long run there was a powerful optimistic correlation between silver and the Bloomberg commodity index, however current silver power has come even because the commodity advanced has fallen. Earlier durations of sharp silver features alongside commodity weak spot have given technique to draw back reversals in silver because the chart beneath reveals. Whereas there’s nonetheless potential for silver costs to proceed rising, the commodity advanced must start to get better to counsel such features are sustainable.

Silver Worth Vs Bloomberg Commodity Advanced (Bloomberg)

Nonetheless Bullish Lengthy Time period Due To Overvaluation And Financial Reversal

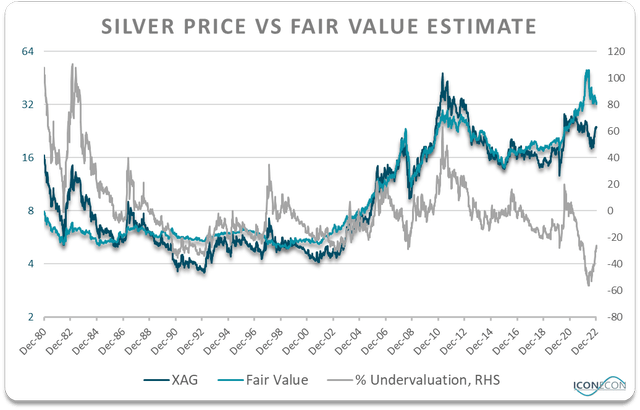

Whereas silver faces short-term dangers from rising actual yields and weaker commodity costs, the steel stays undervalued from a long-term perspective. The chart beneath reveals the worth of silver relative to its truthful worth primarily based on its long-term correlation with a 50:50 basket of gold and the commodity advanced. I’ve used this chart in a number of articles over current years to point out how silver is deeply undervalued, and whereas this diploma of undervaluation has narrowed considerably in current months, the steel nonetheless seems to be low-cost.

Bloomberg, Writer’s calculations

Moreover, whereas actual bond yields pose a headwind to financial demand for valuable metals proper now, I absolutely count on to see financial situations ease up considerably over the approaching months and years as falling headline CPI permits the Fed to concentrate on sustaining monetary stability and stopping a possible debt disaster that might outcome from excessive authorities borrowing.

Abstract

SLV faces near-term dangers as down trendline resistance from its 2021 excessive seems to be holding agency whereas excessive actual yields and falling commodity costs counsel financial and industrial demand for silver are in danger. Nonetheless, from a longer-term perspective, silver stays undervalued and will profit from the return of simple financial situations.