“September is the worst month of the 12 months for Equities, interval; median return for 500 since 1928 is -1.56% “. This was the warning from the Goldman Sachs analysis division a couple of days in the past after a troublesome month for inventory indices. To be honest, the sentiment has improved quite a bit since this observe was launched and the US500, for instance, has risen 3.75% within the final 4 periods. It’s now down just one.61% in August, whereas the US100 is down 1.87% and the US30 is down 1.88%, removed from final week’s lows. However our focus is on September.

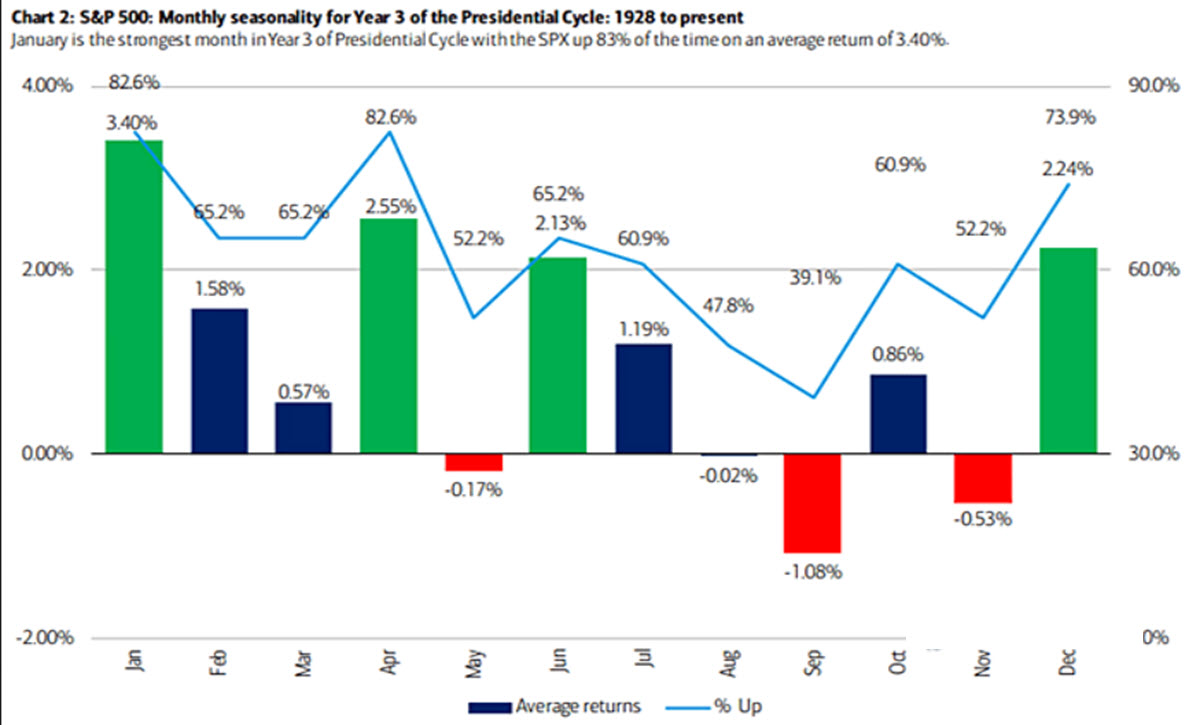

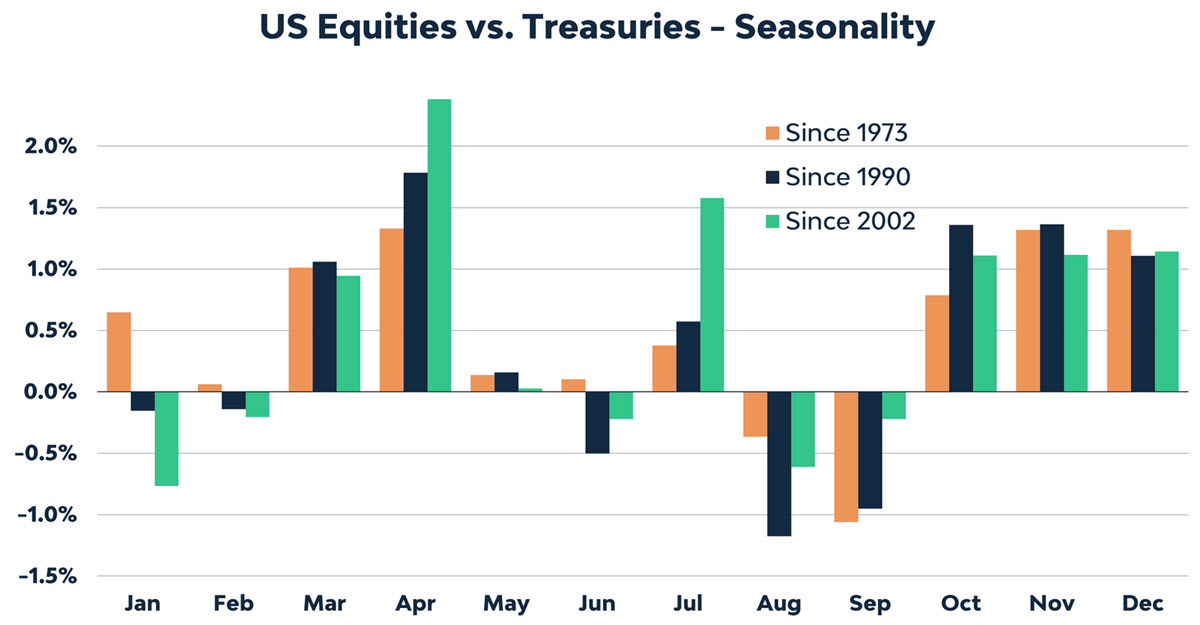

On this regard we discovered the above attention-grabbing examine by BOFA ML, which teams the returns of the US500 by month within the third 12 months of a US presidential time period, which we’re in now with elections developing subsequent 12 months. As you may see September is unquestionably the worst performing month with an common return of -1.08% since 1950, and generally – excluding December, the month of the Santa Claus rally – we’re not anticipating to a very cheerful interval forward with November as a adverse month. 61% of the time there was a adverse end result on the month. Extra usually, as proven within the chart under, equities undergo when in comparison with mounted revenue, bonds – as mentioned in our publish yesterday – and have a comparatively adverse efficiency in each August and September.

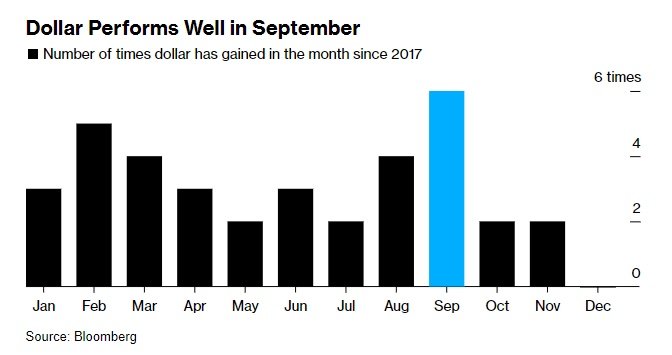

However it isn’t all dangerous information, if realizing and understanding knowledge – be it good or dangerous – will be thought-about dangerous information. In actual fact, lately, no less than for the USD, September has been a constructive month with 6 out of 6 bargains since 2017 ending the month positively with an common acquire of 1.2%, in response to knowledge offered by Bloomberg. And all of it provides up, broadly talking: race to the protected haven – promoting dangerous property.

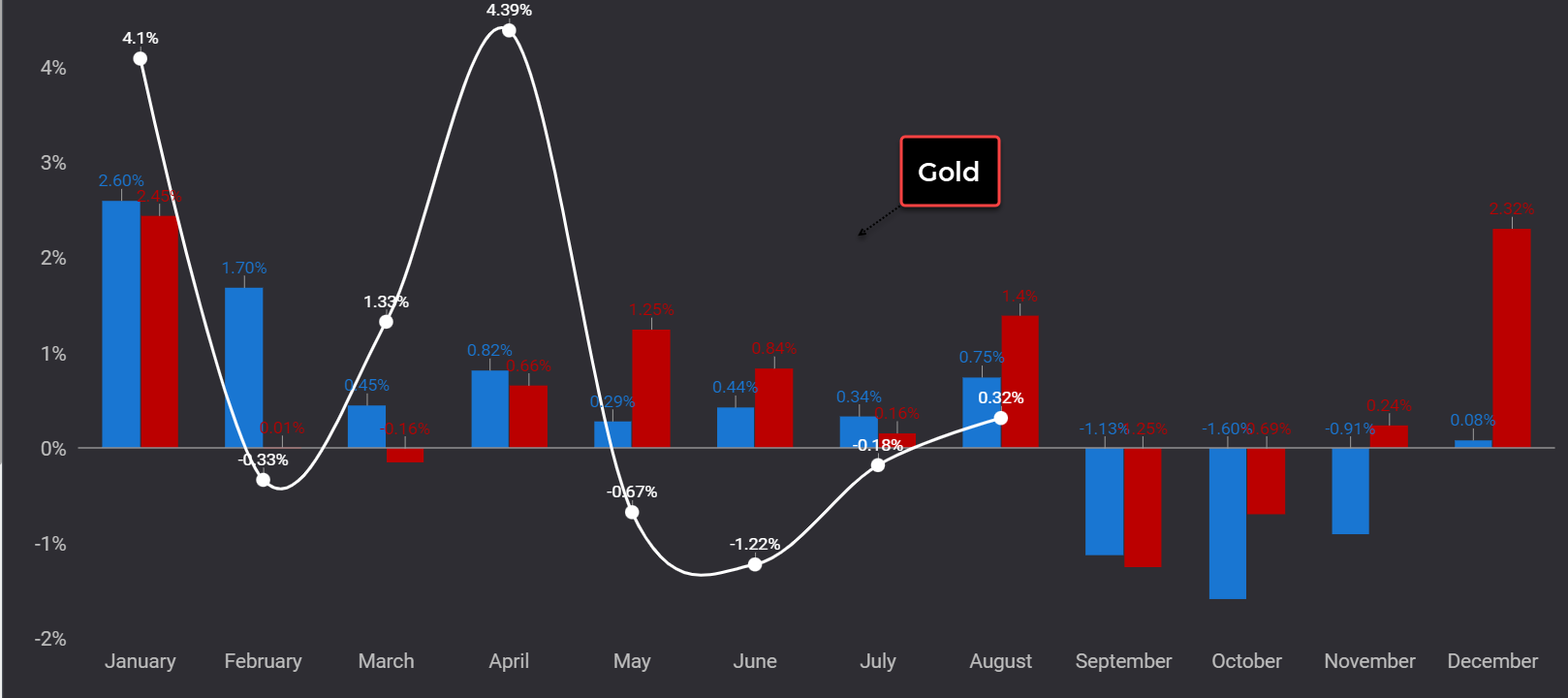

For Gold too the coming months are statistically troublesome, no less than so far as the final 5 years (blue bars) and the final 10 years (pink bars) are involved. Respectively, as you may see on this in-house examine, the common return in September was -1.13% and -1.25% respectively. The white line represents the present efficiency.

Nonetheless, whether or not historic traits are revered or not, crucial factor is to reach ready when making your funding choices.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.