- European protection shares soar on struggle fears, tripling in some instances.

- US protection shares are overvalued, with some beginning to decline.

- Time to money in on protection or look elsewhere? This text explores valuations, development prospects, and dividend potential.

- Make investments like the large funds for below $9/month with our AI-powered ProPicks inventory choice device. Be taught extra right here>>

Protection shares in Europe have skyrocketed prior to now 12 months, fueled by escalating world conflicts and elevated funding from the EU and NATO. This development stands in stark distinction to the efficiency of their U.S. counterparts.

European Protection Shares Increase

- Leonardo (OTC:): This Italian firm, with a 30% stake held by the federal government, has doubled in worth since June 2023.

- Rheinmetall (OTC:): The German protection large noticed its inventory surge 87% over the identical interval.

- BAE Techniques (OTC:): The British protection chief skilled a close to 40% enhance.

- Rolls Royce Holdings (OTC:): The U.Ok.’s Rolls-Royce witnessed probably the most dramatic rise, tripling its share value from £150 to £466 in simply twelve months.

Supply: Investing.com

Reflecting this growth, the index has surged a formidable 40% prior to now 12 months.

U.S. Protection Shares Are Lagging

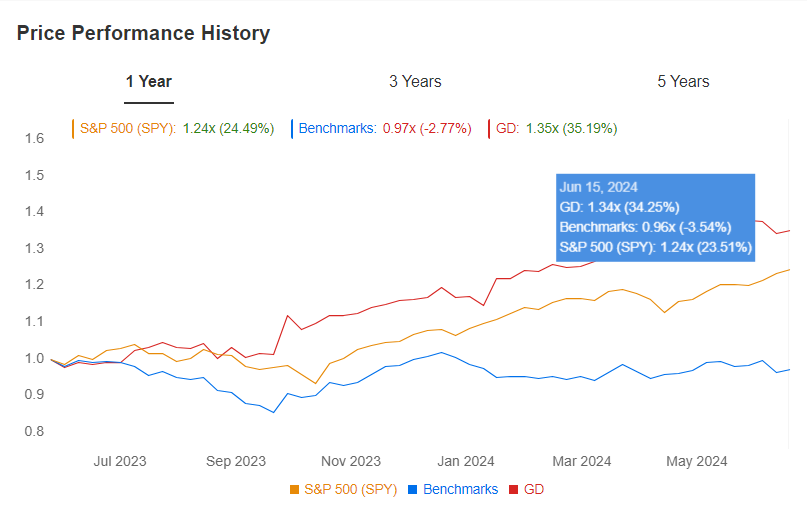

The story is kind of totally different for the Massive 5 U.S. protection corporations (Lockheed Martin (NYSE:), Boeing (NYSE:), Rtx Corp (NYSE:), Northrop Grumman Company (NYSE:), and Basic Dynamics (NYSE:)). Solely Basic Dynamics managed to outperform the . The others posted modest positive factors (RTX +6%) and even vital declines (Boeing -18%, Northrop Grumman -6%).

Apparently, U.S. protection sector indexes just like the (+14.45%) and did present constructive year-on-year efficiency. Nevertheless, these positive factors nonetheless lag behind the broader market rally.

Supply: InvestingPro

Time to Money In on Protection Shares and Look Elsewhere?

Protection shares have loved a robust run, fueled by bets on elevated navy spending, significantly in Europe. However with valuations inflated and development prospects blended, is it time to take earnings and transfer on?

This sector is notoriously risky, closely influenced by unpredictable geopolitical occasions. 2024, being an election 12 months, provides one other layer of uncertainty to the combo.

Whereas Goldman Sachs predicts a “protection spending supercycle,” with European spending rising at a 4.5% compound annual development price (CAGR) by 2027, this development is much from assured.

Excessive Multiples, Uninspiring Development

The Russia-Ukraine struggle sparked a surge in protection shares, with many massive traders piling in on the expectation of elevated spending. Consequently, valuations have turn out to be stretched, with some shares buying and selling above 36x earnings. In the meantime, development outlooks are tepid.

Morningstar analysts anticipate common income development of simply 2-5% and margins of Sept. 11% for US protection corporations over the following 5 years.

However, Dividend Revenue Potential Stays

Regardless of these issues, the sector nonetheless gives earnings enchantment. Protection corporations are likely to generate robust money flows, typically rewarding shareholders with dividends and share buybacks.

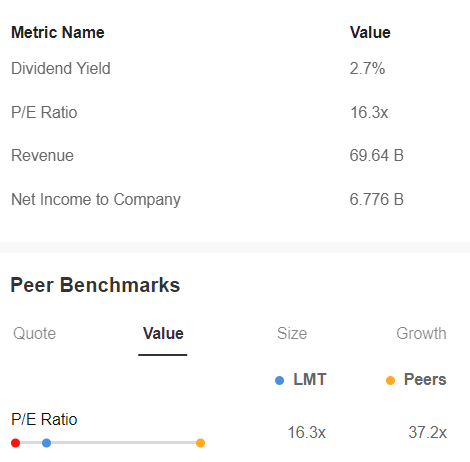

That is significantly true for US corporations, the place dividend yields could be extra enticing than their European counterparts. For instance, Lockheed Martin boasts a 2.7% dividend yield and an inexpensive P/E ratio of 16.3x, in comparison with a hefty 37.2x for its European friends.

Supply: InvestingPro

As well as, InvestingPro’s honest worth tells us that the inventory is buying and selling at a reduction to its intrinsic worth, with a attainable upside of seven.1% from $459 on June 17.

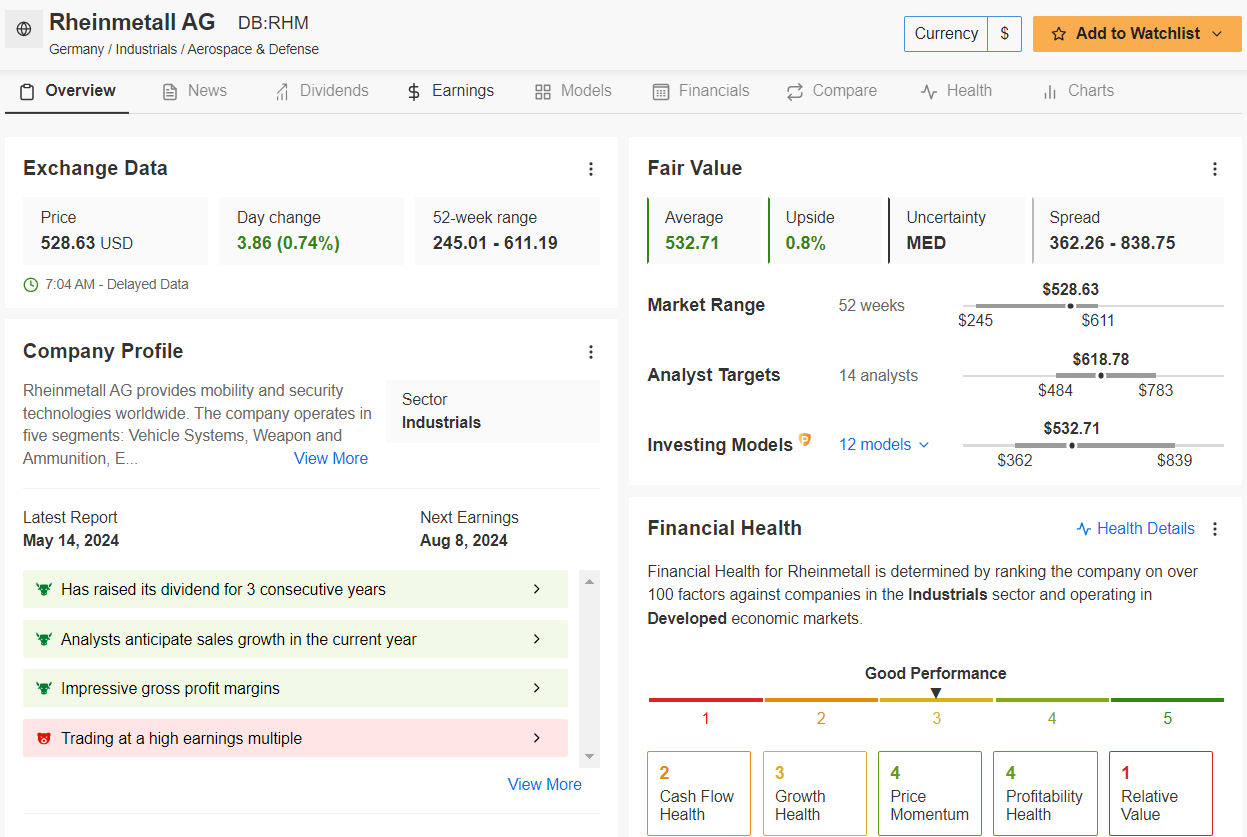

In Europe, Analysts Are Betting on Rheinmentall

European protection shares have not supplied a lot alternative these days. Thales, Airbus, and others seem pretty valued and even overvalued. Nevertheless, analysts stay optimistic about some potential for additional positive factors.

One intriguing case is Rheinmetall. This dividend-paying firm (1.2% yield, 3 years of will increase) has analysts bullish. A survey by InvestingPro exhibits a mean goal value of $618.78 for the following 12 months, representing a 17.9% enhance from its present value of $424.77 (as of June 17).

Supply: InvestingPro

Regardless of analyst optimism, Rheinmetall’s P/E ratio sits at 36.6x. Even Truthful Worth evaluation signifies restricted upside potential, suggesting the inventory is already pretty valued (lower than 1% room for development).

The Backside Line

The broader protection sector seems considerably overheated, with some shares doubtlessly weak if the euphoria fades. Then again, shopping for in now won’t ship vital future returns.

In the event you do not already maintain these shares, it may be time to shift your technique. Whereas promoting current positions may sacrifice a possible protected haven, getting into the market at present valuations won’t be probably the most enticing choice both. Take into account exploring different sectors with extra compelling development potential.

***

Turn into a Professional: Enroll now! CLICK HERE to hitch the PRO Neighborhood with a major low cost.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counseling or advice to speculate as such it isn’t supposed to incentivize the acquisition of property in any means. As a reminder, any sort of asset is evaluated from a number of factors of view and is very dangerous due to this fact, any funding resolution and the related threat stays with the investor. The creator owns shares within the firm talked about.