- Apple’s Q2 2023 earnings forecast exhibits a decline in income and earnings per share, indicating vulnerability to the difficult macroeconomic surroundings

- Nonetheless, the corporate’s money pile and low EPS expectations might doubtlessly assist propel the inventory larger within the brief time period

- Let’s take a deep dive into the corporate’s financials with InvestingPro

After the wave of better-than-expected monetary outcomes from tech corporations helped push the to its greatest month since January, the world’s largest firm, Apple (NASDAQ:), might preside the make-it-or-break-it second the market has been holding its breath for.

The behemoth tech firm is about to announce Q2 2023 earnings tomorrow after the market closes, with analysts forecasting a 4.6% YoY decline in income and a 6% YoY decline in earnings per share.

These numbers present that even Apple might not be resistant to the headwinds introduced by the present difficult macroeconomic surroundings. This comes as Apple prepares to launch its newest iPhone fashions, that are anticipated to hold premium value tags.

Because the Fed’s rate-hike cycle approaches its ending with none indication of a pivot within the brief time period, assessing the impacts of extended larger capital prices on the monetary well being of main international corporations shall be important for predicting the market’s course.

With our InvestingPro instrument, we are going to take deep dive into Apple’s financials to higher perceive the place we stand proper now. Readers can do the identical for nearly each firm out there simply by utilizing the next hyperlink.

Apple’s Financials

InvestingPro customers would know that Apple has had nineteen adverse EPS expectation revisions during the last 90 days towards solely ten optimistic, implying that analysts are pricing in a higher chance of a adverse than a optimistic shock tomorrow.

Supply: InvestingPro

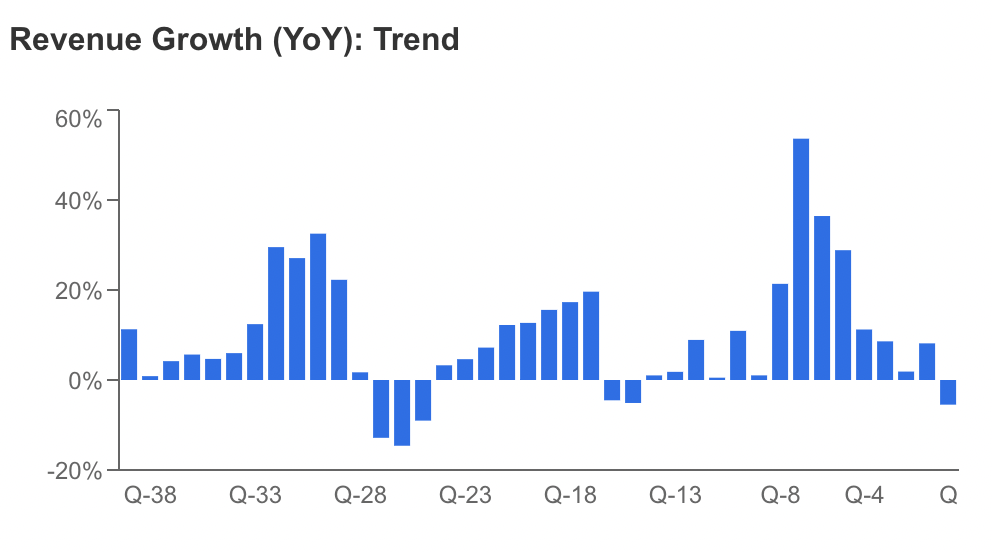

One of many principal causes for these revisions is that the slowdown in shopper spending has negatively impacted Apple’s income progress. Regardless of the corporate’s sturdy monetary efficiency lately, there are rising issues that high-priced merchandise could develop into much less engaging to shoppers in a weaker economic system.

Supply: InvestingPro

Moreover, modest efficiency in consumer-facing providers corresponding to Apple Music and TV+ might restrict the corporate’s skill to enhance progress charges inside its Providers phase.

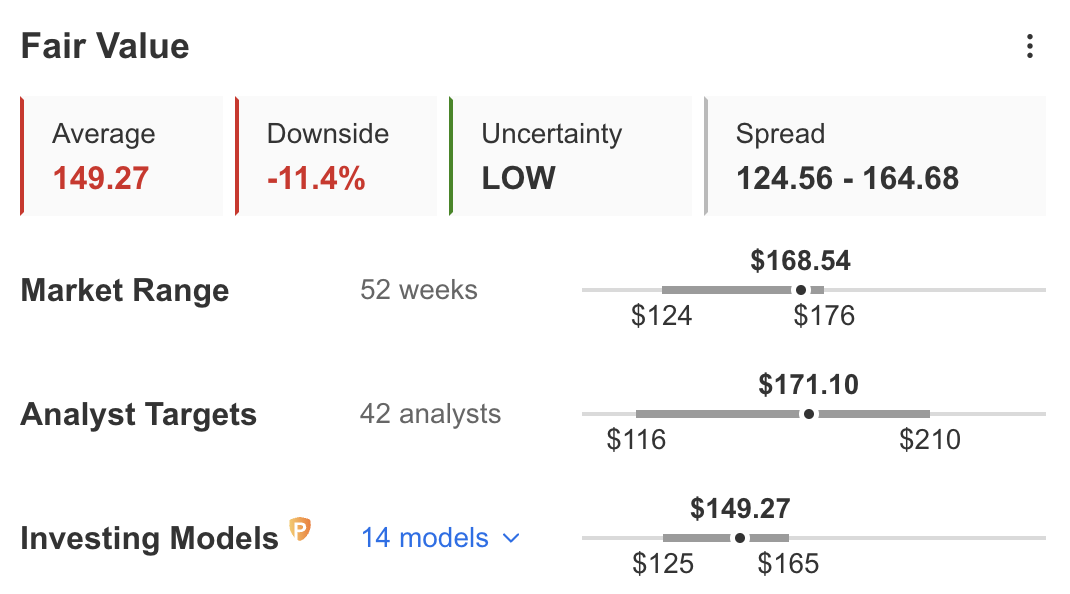

That is why InvestingPro evaluates that the corporate is buying and selling at a excessive premium, with analysts’ Honest Worth estimates averaging an 11.4% draw back over the following 12 months.

Supply: InvestingPro

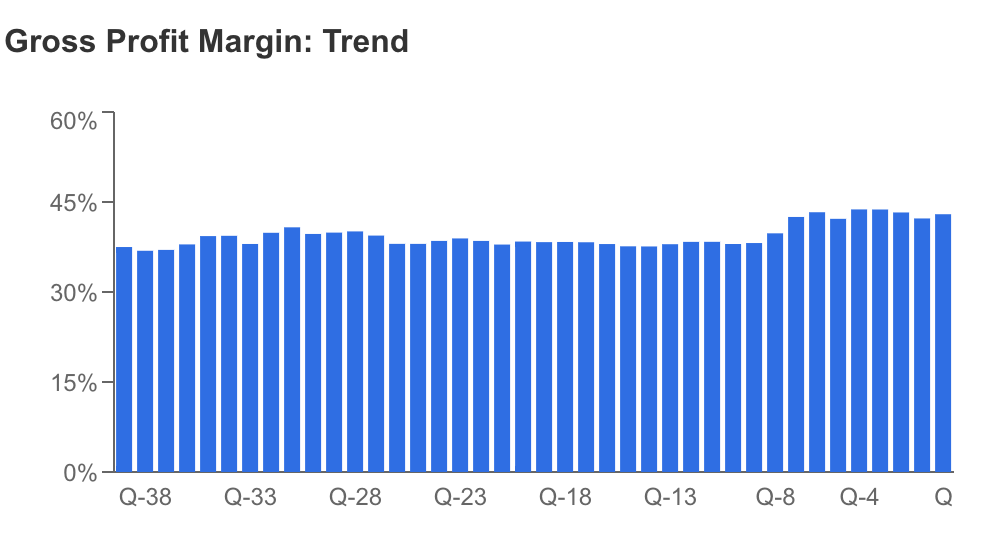

On the flip aspect, the behemoth firm has been in a position to continue to grow its margins, benefiting from the mixture of upper inflation with nonetheless resilient financial exercise.

Supply: InvestingPro

The above chart is arguably one of many metrics traders needs to be the keenest on analyzing when assessing final quarter’s efficiency after the corporate’s earnings come out tomorrow. A compression of Apple’s margins might doubtless point out that the US economic system is transferring in leaps and bounds towards a stagflationary state of affairs.

One other essential level is Apple’s Monetary Well being Rating. Whereas the metric stays optimistic relating to Profitability Well being, Value Momentum, and Money Movement Well being, the Relative Worth exhibits vital compression, implying that the corporate could be too costly in the meanwhile.

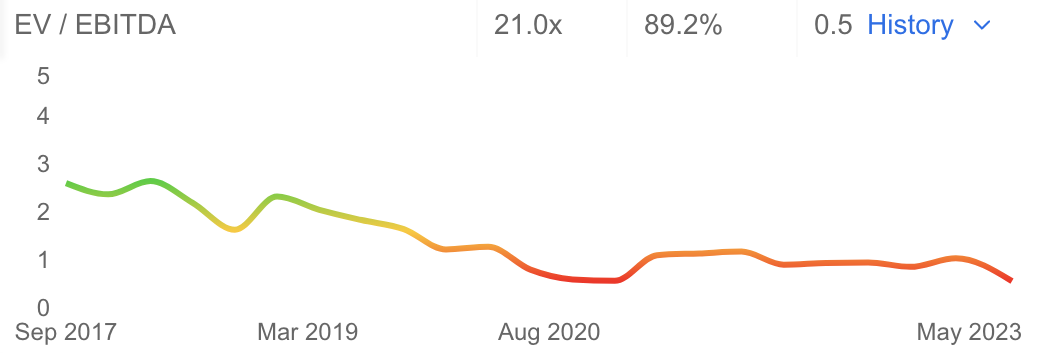

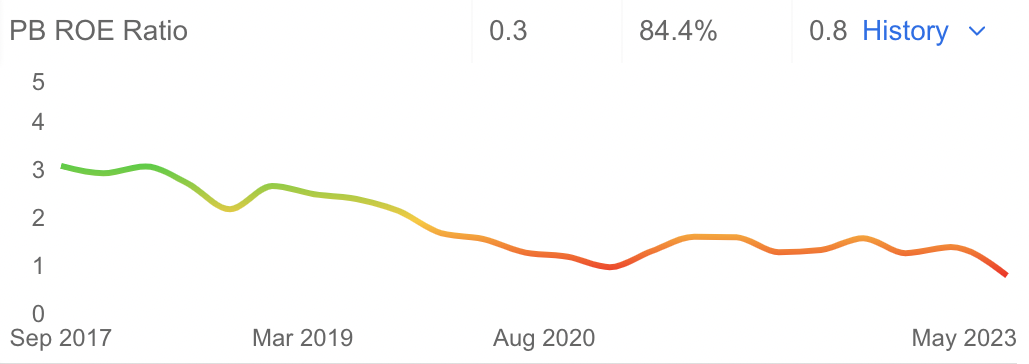

The explanation for that could be a larger EV/EBITDA (enterprise worth to earnings earlier than curiosity, taxes, depreciation, and amortization ratio) and PB/ROE (price-to-book ratio to return on fairness) ratios.

Supply: InvestingPro

Supply: InvestingPro

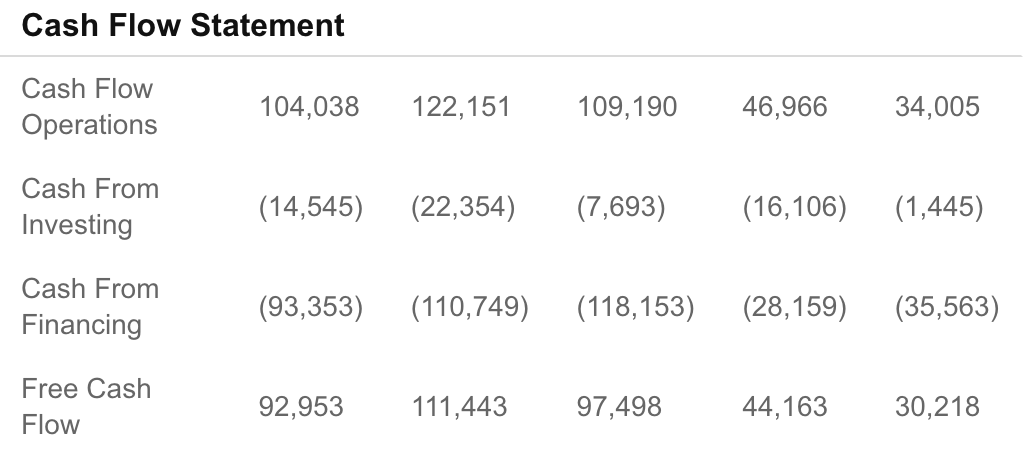

Notably, the corporate’s money flows have been trending decrease for the reason that finish of 2021 as a result of larger rates of interest.

Supply: InvestingPro

On the flip aspect, nonetheless, Apple stays the world’s richest firm by way of money reserves, with roughly $54 billion in internet money. Whereas the money pile has been dwindling, traders count on that Apple’s upcoming earnings report might reveal a rise in each share-repurchase authorization and dividend payouts, which might doubtless push the inventory larger within the brief time period.

Apple has additionally taken steps to learn from the present excessive rate of interest surroundings. The corporate’s new high-yield financial savings account has reportedly attracted $1 billion within the first 4 days of operation.

Moreover, the corporate’s EBITDA has been trending larger since topping out in September final 12 months.

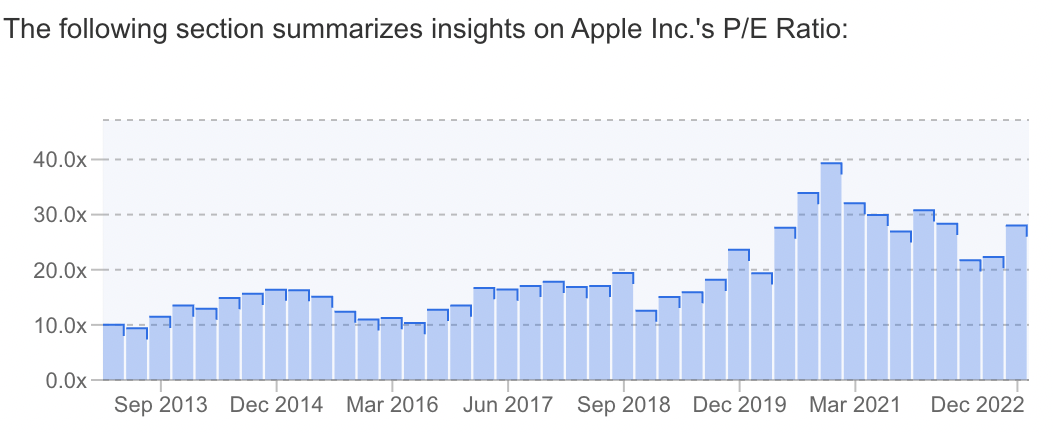

Lastly, whereas the corporate’s push for enterprise enlargement in India might take time to bear fruit, it represents an avenue for additional progress, which might assist maintain the corporate’s 28x P/E ratio for longer.

Supply: InvestingPro

Backside Line

Whereas Apple stays a protected haven to park your cash, I would not think about it an precise purchase going into earnings as a result of its present excessive premium and shrinking margins. Save from a pivot from the Fed, there is a excessive probability that the corporate’s financials will dwindle together with the broader economic system, presumably offering traders with a greater entry level sooner or later.

Discover All of the Data you Want on InvestingPro!

***

Disclosure: The writer owns Apple inventory for the long-term.