ArLawKa AungTun/iStock by way of Getty Photos

Searching for a dividend inventory with a large moat? Check out Iron Mountain Included (NYSE:IRM), the world’s largest information storage firm. For years, bears have tried to make the case that paper storage would go the way in which of the buggy whip, because of the international digitization of information.

Nevertheless, IRM’s earnings inform the other story. Storage income continues to develop, as do different earnings metrics. IRM had “natural storage rental income progress of 11% in Q1 ’23, reflecting continued advantage of pricing mixed with optimistic quantity developments and knowledge middle progress.” (IRM web site.)

Firm Profile:

IRM is the worldwide chief for storage and data administration companies. It’s a actual property funding belief (“REIT”) serving over 225,000 organizations all over the world, with an actual property community of over 90 million sq. toes throughout ~1,450 amenities in roughly 50 nations. It companies greater than 225,000 organizations all over the world, together with 95% of the Fortune 1000. It was based in 1951.

IRM’s World Information Middle Enterprise operates in 21 knowledge facilities throughout 19 international markets, both straight or by means of unconsolidated joint ventures. its ALM enterprise gives hyperscale and company IT infrastructure managers with companies and options that allow the decommissioning, knowledge erasure, processing and disposition or sale of IT {hardware} and element belongings. (IRM web site.)

Earnings:

IRM had an all-time file complete quarterly Q1 income of $1.31B in Q1 ’23.

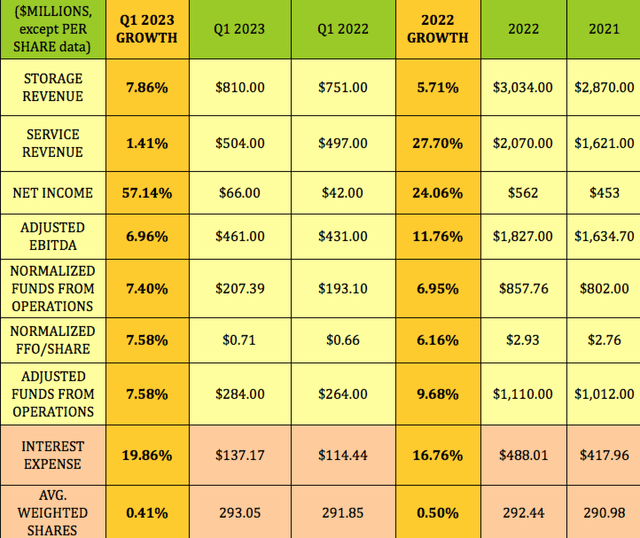

Storage income continued to develop in Q1 ’23, rising ~8%, after climbing 5.7% in full yr 2022. Service income was up 1.4%, after rising practically 28% in 2022.

Adjusted EBITDA, NFFO (normalized funds from operations), NFFO/share, and AFFO (adjusted funds from operations) all rose ~7% – 7.6% in Q1 ’23, whereas Curiosity expense jumped 20%. The share depend was roughly flat, because it was in full yr 2022.

Web Earnings surged 57% in Q1 ’23, after rising ~28% in 2022.

Administration signed 52 megawatts of recent leases in Q1 2023, with a single hyperscale buyer in 2 offers for a complete of 44 megawatts. That is over 50% of its steering for 2023 of 80-plus megawatts.

Adjusted EBITDA was up 11.8% in 2022, with NFFO rising ~7%, NFFO/share up ~6%, and AFFO up 9.7%. Like most different corporations, IRM had a major rise in Curiosity expense in 2022 – it was up 16.8%:

Hidden Dividend Shares Plus

Segments:

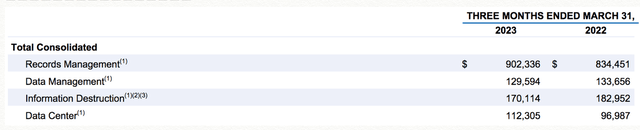

Administration has invested within the Information Middle enterprise lately. This section has continued to develop – income was up 15.5% in Q1 ’23. The Information Administration section’s income grew ~8%, whereas Information Administration declined 3%; and Info Destruction section income declined 7%.

IRM web site

Steerage:

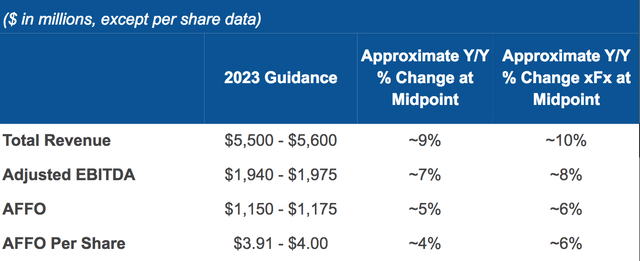

Administration reiterated its 2023 steering, which requires midpoint progress of ~9% in Income, ~7% in Adjusted EBITDA, ~5% in AFFO, and ~4% in AFFO/Share. Administration expects a ~1% headwind for foreign money in income, EBITDA, and AFFO, with ~2% in AFFO/share in 2023:

IRM web site

Dividends:

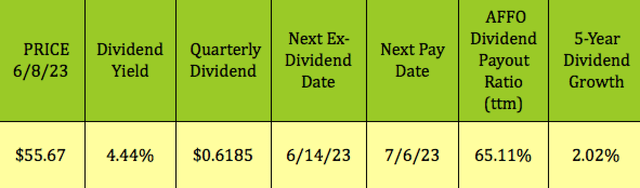

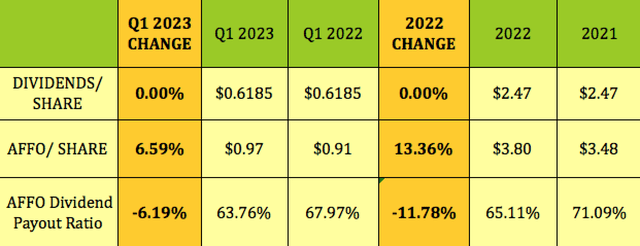

At its 6/8/23 worth of $55.67, IRM yields 4.44%. It isn’t a dividend progress inventory, with a low 2% common 5-year progress determine. Administration has maintained the quarterly dividend at $0.6185 since This autumn 2019.

IRM goes ex-dividend subsequent on 6/14/23, with a 7/6/23 pay date.

Hidden Dividend Shares Plus

The 6.6% rise in AFFO/share improved IRM’s dividend payout ratio by ~6%, dropping it 63.76% in Q1 ’23, vs. ~68% in Q1 ’22. Full yr 2022 had an excellent bigger enchancment of 11.8%, to a 65.11% payout ratio:

Hidden Dividend Shares Plus

Taxes:

“At December 31, 2022, now we have federal internet working loss carry forwards of $63.5 million, which will be carried ahead indefinitely, of which $57.1 million is anticipated to be realized to cut back future federal taxable revenue. We’ve got belongings for overseas internet working losses of $81.9 million, with numerous expiration dates (and in some instances no expiration date), topic to a valuation allowance of roughly 56.0%.” (IRM 2022 10-Okay.)

Profitability & Leverage:

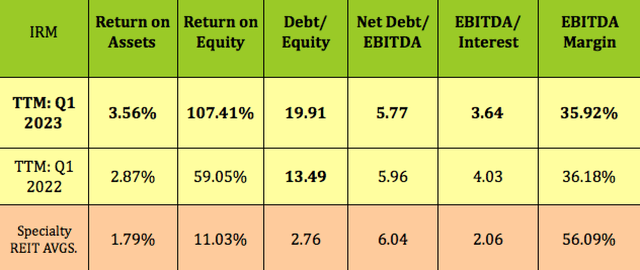

ROA improved a bit in Q1 ’23, whereas ROE soared, attributable to 57% progress in Web Earnings, vs. a decrease Fairness base.

Administration elevated debt in 2022, from $11.7B to $13.3B. Administration invested $302M in Q1 ’23: $274M in progress capex, and $28M in upkeep capex.

Web Debt/EBITDA improved in Q1 ’23, to five.77X, vs. 5.96 in Q1 ’22, whereas Debt/Fairness jumped from 13.49X to 19.91X, because of the decrease fairness base. Administration has a goal leverage vary, of 4.5 to five.5X.

Understand that the Specialty REIT sub-industry is a mixture of many several types of companies. One of many conventional issues with analyzing IRM is that it has a novel enterprise – it is not fairly a Tech firm, neither is it a typical REIT.

Hidden Dividend Shares Plus

Debt & Liquidity:

IRM had ~$1B in liquidity, as of three/31/23, with Web Lease adjusted leverage of 5.1X, its lowest degree since 2017. 75% of its debt is fastened charge, at a weighted common rate of interest of 5.3%, and a 5.7 yr common maturity.

In March ’22, administration prolonged the maturity date of IRM’s Revolving Credit score Facility and the Time period Mortgage A from June 3, 2023 to March 18, 2027. In addition they refinanced and elevated the borrowing capability below the Revolving Credit score Facility from $1,750M to $2,250M. They elevated the web complete lease adjusted leverage ratio most allowable below Time period Mortgage A from 6.5x to 7.0x, and eliminated the web secured lease adjusted leverage ratio requirement.

In early Might, administration accomplished a non-public placement of $1B in combination principal quantity of its 7.000% Senior Notes due 2029.

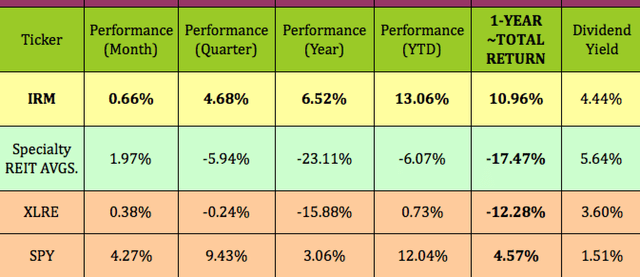

Efficiency:

IRM has outperformed the specialty REIT {industry}, the broad Actual Property sector (XLRE), and the S&P 500 (SPY) to this point in 2023. It has additionally had a a lot better complete return than all of them over the previous yr:

Hidden Dividend Shares Plus

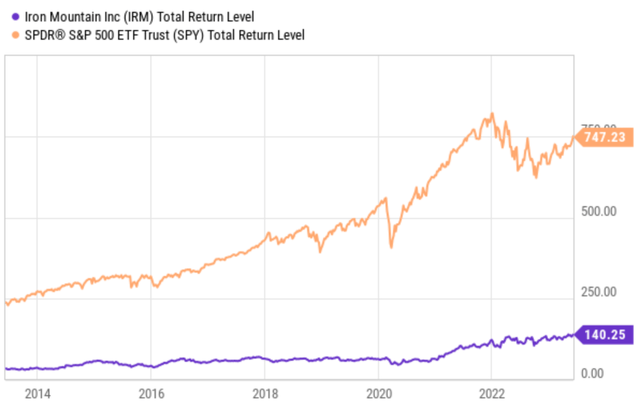

This previous yr wasn’t a fluke. Trying again 10 years, IRM’s complete return was over 5X that of the S&P 500’s:

Ycharts

Analysts’ Targets:

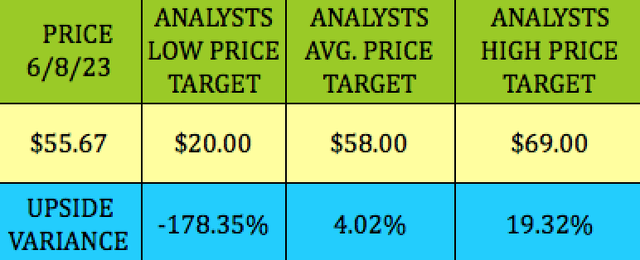

IRM acquired 2 new rankings from avenue analysts in December ’22: A sector carry out score with a $58.00 worth goal from RBS Capital Markets; and an outperform score with a $66.00 worth goal from BNP Paribas.

At $55.67, IRM is 4% under the $58.00 common worth goal, and 19% under the $69.00 highest worth goal. That low $20.00 goal could be very dated, perhaps again to the March 2020 COVID pullback.

Hidden Dividend Shares Plus

Valuations:

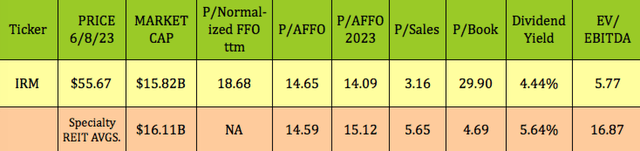

At its 6/8/23 intraday worth of $55.67, IRM is consistent with the Specialty REIT {industry} common trailing P/AFFO, whereas being a bit cheaper on a ahead P/AFFO foundation. It has a lot decrease P/Gross sales and EV/EBITDA valuations, whereas its P/Ebook is far larger, attributable to its decrease fairness base.

Hidden Dividend Shares Plus

Parting Ideas:

Put Iron Mountain Included in your watchlist and await a market pullback, or attempt promoting out of the cash places under IRM’s worth/share, to get a decrease entry level. This can be a long-term holding candidate with a large moat, so it is not shocking that Warren Buffett’s Berkshire Hathaway (BRK.A) has owned IRM prior to now.

All tables furnished by Hidden Dividend Shares Plus, until in any other case famous.