Sean Gallup/Getty Photographs Information

Since our final replace, ‘Increased Steerage To Value In,‘ Infineon Applied sciences AG’s (OTCQX: IFNNY) (OTCQX: IFNNF) inventory value has declined by greater than 10%. Since 2022, the corporate has been considered one of our prime alternatives, and we consider it’s now again to an thrilling entry level. Submit Q3 outcomes, right here on the Lab, we report the next damaging very important takeaways:

- Profitability barely declined quarter on quarter with an adjusted gross morning from 48.6% in Q2 to 46.2% in Q3;

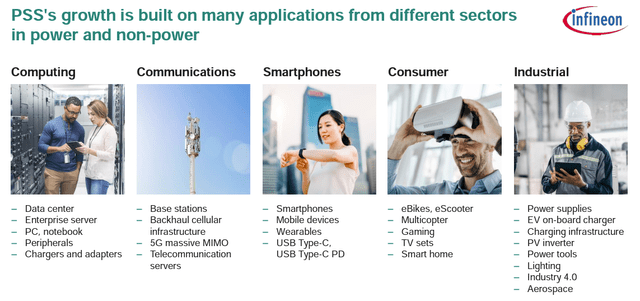

- A damaging MIX impact as a consequence of decrease top-line gross sales within the best-performing section (PSS division). As a reminder, in 2022, PSS achieved a core working revenue margin of 27.9% in comparison with a gaggle common of 23.6%.

Right here on the Lab, earlier than shifting ahead with our supportive purchase, we be aware that the above two damaging traits may reverse within the coming quarters. Why? Wanting on the first level, the gross margin evolution anticipates increased idle prices. Associated to the product MIX, having listened to the Q&A analyst name, administration believes that PSS restoration will doubtless materialize in 2024 because of the uplift anticipated in cyclical sectors.

Infineon PSS end-markets

Supply: Infineon Applied sciences Q3 outcomes presentation

Why is Infineon a purchase?

Other than the secular progress development that we already analyzed in our initiation of protection coupled with our automotive upside, right this moment we report the next upside:

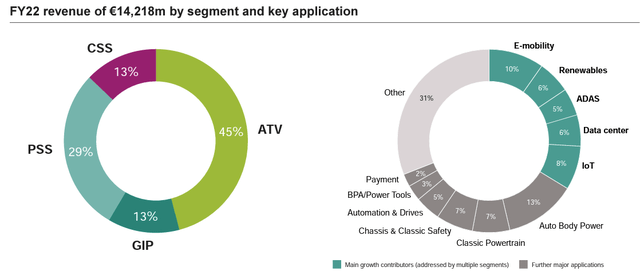

- The corporate is a prime ten world semiconductor participant with a diversified GEO and gross sales publicity. Assuming income progress as indicated by the administration, an ongoing working leverage, and a good product MIX, we’re not anticipating a decline in margins even when we forecast decrease pricing energy and/or CAPEX underutilization. This balanced portfolio offered a stable margin of security in case of an financial slowdown (Fig 1). We estimate a restricted underutilization of €400 million with a step up from H1 at €180 million. That is primarily as a consequence of weaker demand in CSS and PSS gross sales;

- To help Infineon’s state-of-the-art facility, the corporate introduced an enlargement of the Kulim manufacturing facility. This lab might be used to provide 200mm SiC and may present a further €7 billion top-line gross sales potential by the top of the last decade (Fig 2). The corporate anticipates being in a greater price place vs. the closest opponents. Right here on the Lab, we consider this is because of manufacturing facility scale and constructing price. Asian prices are half value vs. Europe/US;

-

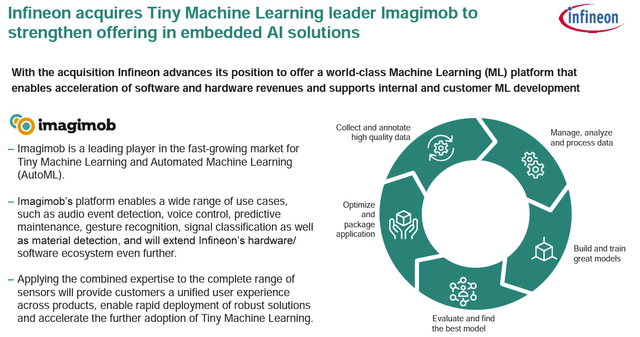

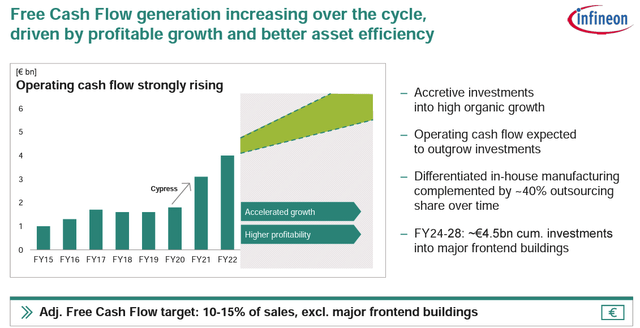

After buying Cypress in 2020, the corporate is now a chief within the IoT and energy methods. Right here on the Lab, we anticipate a stable progress price of AI even in additional conventional sectors (automotive, healthcare, and industrial). Nevertheless, with the present Infineon portfolio, merchandise will emerge in varied sub-segments, resembling safety, related safe methods, connectivity, sensors, and so on. We consider Infineon will present new methods for additional progress and larger performance attain. In 2022, Infineon had €1.1 billion in gross sales; in our numbers, we offer gross sales of roughly €2.75 billion in 2027. Exterior acquisitions may also help this. Lately, Infineon acquired a number one improvement suite participant referred to as Imagimob (Fig 3), and we consider the corporate is well-positioned to leverage its prime standing in programmable chips. There’s a rising want for chips for machine studying options. Regardless of a qualitative market evaluation, what’s crucial to emphasise is the truth that Infineon FCF remarkably elevated because the Cypress add-on. Wanting on the newest steering, Infineon elevated its yearly FCF to €1.2 billion (from earlier estimates of €1.1 billion – Fig 4).

Infineon in a Snap

Fig 1

Infineon new CAPEX

Fig 2

Infineon acquisition

Fig 3

Infineon FCF evolution

Fig 4

Conclusion and Valuation

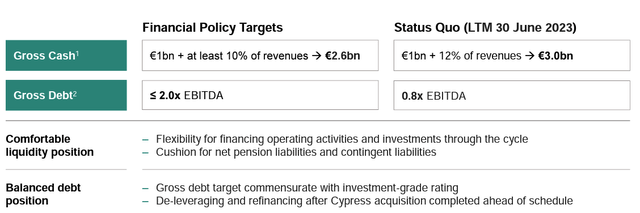

Combining all these parts and contemplating Infineon’s observe report in cross-selling merchandise, the corporate is poised for a stable progress price within the industrial and shopper electronics markets. Power transition and Energy and Sensors Techniques with IoT new design may present a secure progress base over the mid-to-long time period horizon. With a rock-solid steadiness sheet, Infineon is buying and selling at a 2024 P/E 14x. This isn’t justified vs. its historic common (20x). Submit Infineon’s Q3 outcomes, we depart our EPS broadly unchanged and reiterated our €48 per share goal value ($51 in ADR). There are additionally dangers to our chubby, resembling disruptions of recent applied sciences, Wall Road considerations round margins, restricted pricing energy as a consequence of competitors, and FX fluctuation, particularly €/$.

Infineon Debt

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.