Article written by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX 40, and S&P 500 Evaluation, Costs, and Charts

FTSE 100 drops on higher-then-expected CPI

The FTSE 100 has been declining since Friday’s five-week excessive and is being pushed decrease as UK CPI is available in higher-than-expected forward of Thursday’s Financial institution of England financial coverage assembly at which the central financial institution is anticipated to hike its charges for a thirteenth time, in all probability to 4.75%.

The index is now urgent on the 200-day easy shifting common (SMA) at 7,551 and the early June low at 7,546, a fall by way of which might open the way in which for the 1 June excessive at 7,510 to be reached forward of the Might trough at 7,433. Draw back stress ought to retain the higher hand whereas Monday’s low at 7,581 isn’t bettered. Additional resistance will be seen alongside the breached Might-to-June uptrend line at 7,630 which, due to inverse polarity, might act as resistance.

FTSE 100 Day by day Value Chart – June 21, 2023

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to E-newsletter

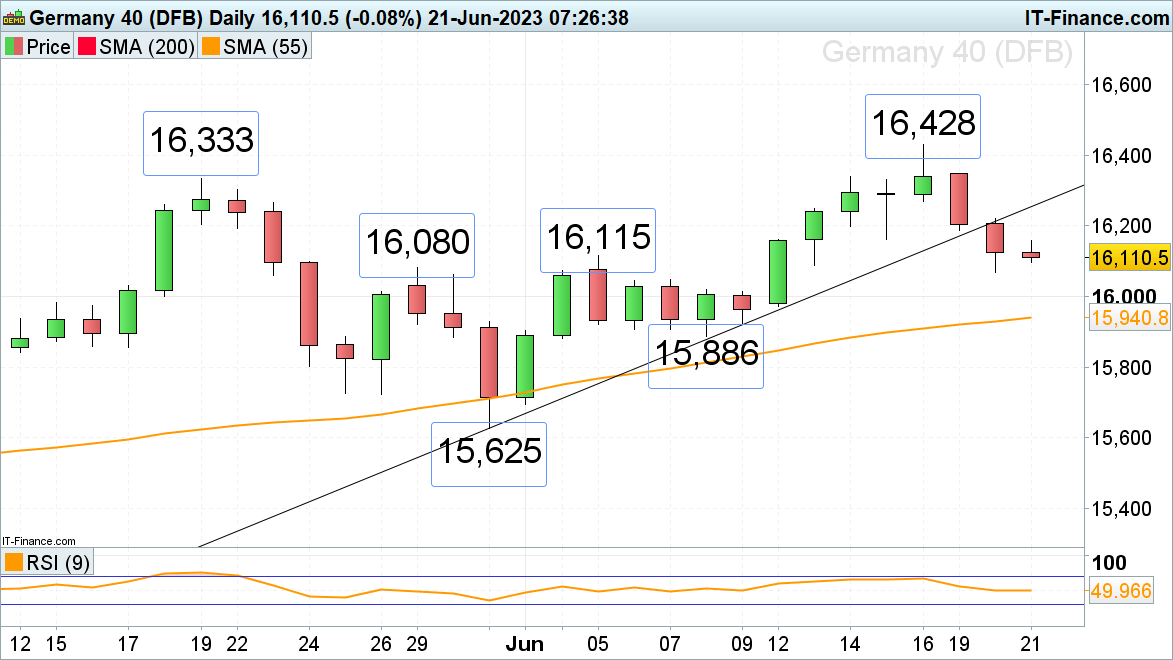

DAX 40 sees two consecutive days of decrease costs

The DAX 40 has come off Friday’s new all-time document excessive as buyers re-assess the financial outlook and future central financial institution coverage.

A slip by way of Tuesday’s low at 16,067 would put the minor psychological 16,000 degree again on the playing cards, along with the 55-day easy shifting common (SMA) at 15,941. Minor resistance above final Thursday’s low at 16,160 sits at Monday’s low at 16,187 with additional resistance seen alongside the breached Might-to-June uptrend line at 16,252.

DAX 40 Day by day Value Chart – June 21, 2023

Advisable by IG

Traits of Profitable Merchants

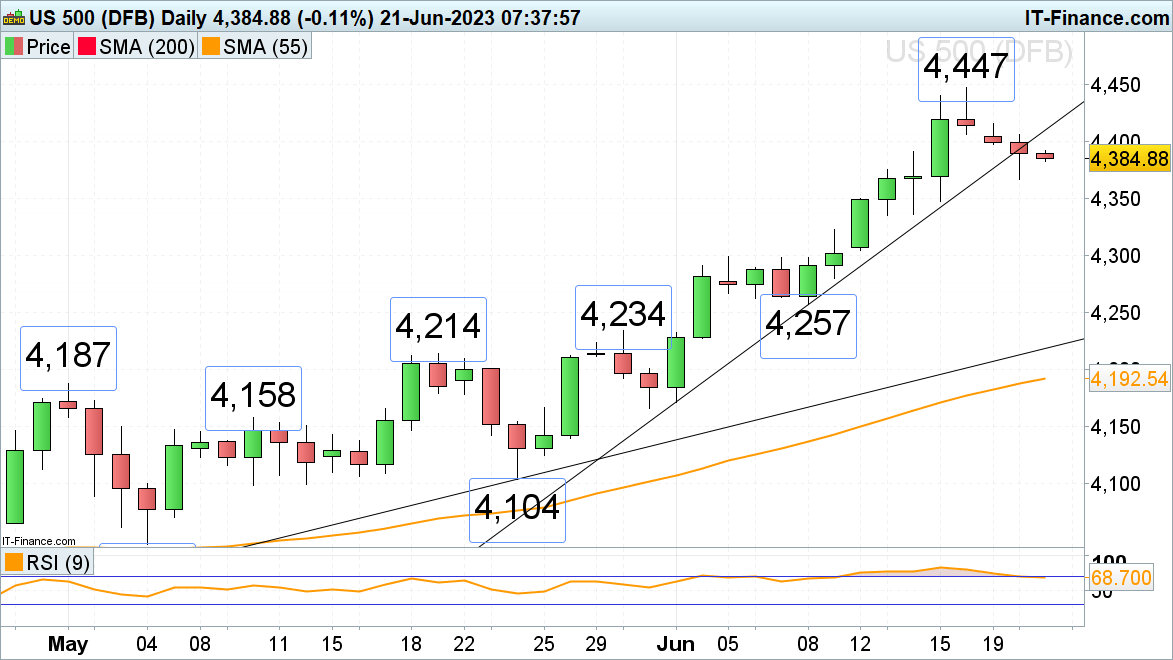

S&P 500 subdued forward of Powell testimony

The S&P 500 is seen coming off its 14-month excessive at 4,447 forward of Jerome Powell’s US Senate banking committee testimony on Wednesday and Thursday which is more likely to re-iterate the Federal Reserve’s (Fed) hawkish stance. With the index having slid by way of its June uptrend line at 4,410, a short-term draw back bias is in place. Failure at Tuesday’s low of 4,367 would put final Thursday’s low at 4,348 on the map.

Minor resistance is to be discovered across the minor psychological 4,400 mark and at Tuesday’s excessive at 4,405.

S&P 500 Day by day Value Chart – June 21, 2023