Gold broke down this morning below $1800, losing its modest gains for the year (but still outperforming bonds, stocks, and crypto YTD). This move comes amid geopolitical chaos, monetary policy uncertainty (rate-cut expectations soaring), and recession fears growing.

Nevertheless, Baupost’s Seth Klarman said in his latest note to investors that:

“I’m a fan of gold. I think gold’s valuable in a crisis.”

And we suspect few believe we are not in crisis currently.

So why has gold been hammered, and what happens next?

Goldman’s Mikhail Sprogis and his commodities research team believe a ‘wealth shock’ has subdued Gold’s rally and raised their target price for the precious metal to $2500.

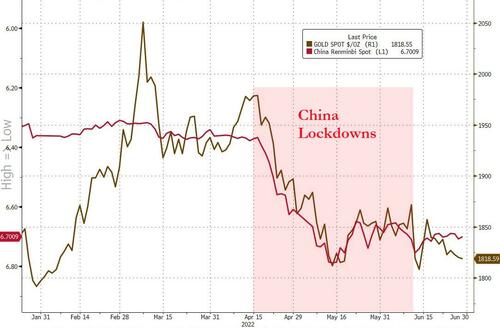

While it is tempting to blame gold’s recent weakness on a lack of investment demand due to higher US rates, we view gold’s sell-off this quarter as in line with a weaker CNY and primarily reflecting the impact of lockdowns on the Chinese economy.

There is little doubt to us that Chinese lockdowns had a large impact on spot gold demand in China, with gold jewelry sales falling by 30% YoY in April. The re-introduction of Chinese lockdowns represented a significant hit to the Chinese economy and the PBOC allowed for some CNY depreciation to ease financial conditions. As the CNY dropped, gold followed it lower.

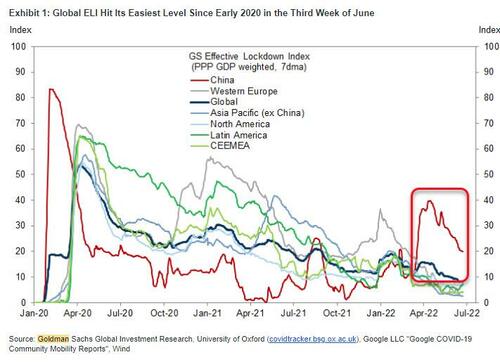

The positive news is that lockdowns are easing in China…

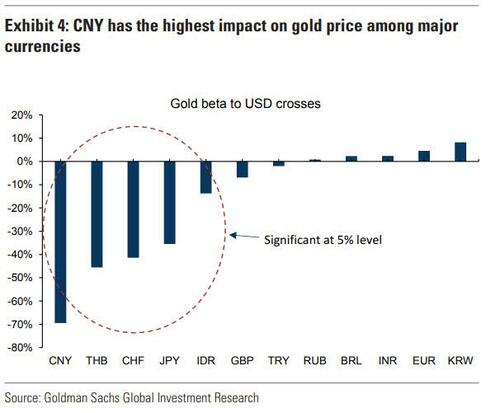

This is not surprising since we find that, historically, the CNY has the largest impact on gold among major currencies…

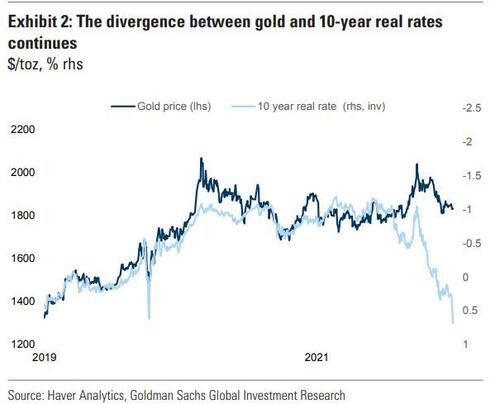

This negative Wealth effect for gold was amplified by a liquidation of short-term-oriented futures and ETF positions,which are very sensitive to trends in the dollar. In turn, the gold real rates correlation remains broken as higher real rates now go hand-in-hand with greater ‘Fear’ of a DM recession which is, on net, positive for gold investment demand, in our view.

Reversal of the Wealth shock will allow focus to shift back to Fear and geopolitical drivers: We believe that the Wealth shock to gold will reverse as China is gradually coming out of lockdowns with growth set to receive a boost from policy support.

In addition, an increasing lack of confidence in a US soft landing should boost Fear demand for gold.

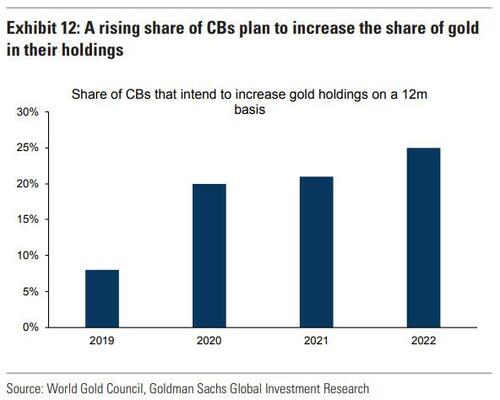

Any transparency on Russian gold purchases should raise the market’s conviction on an upcoming structural geopolitical boost to CB gold demand.

In essence, we believe the bullish gold case was merely delayed rather than derailed. Due to little structural change to our model inputs, we keep our gold price upside but delay the price path.

Finally, we see gold ETF purchases resuming now that the speculative part of the positioning has been cleaned up. The risk to this view would be a continuation of the wealth/liquidity shock until its magnitude matches March 2020 or October 2008. This could lead to a temporary fall in the gold price as market participants cut all positions to increase their dollar liquidity and meet margin calls.

We revise our 3, 6 and 12m targets to $2,100/2,300 and $2,500/toz, from $2,300/2,500 and $2,500/toz.

Finally we circle back to Seth Klarman’s insights:

“If the world turns to hell, the war expands and gets worse, God forbid a nuclear weapon is used, I think people are going to say: ‘How do I know what anything’s worth anymore? I’m going to make sure I have some gold because I don’t want to not have money at a time of desperation.’ It may never come to that, but I think it’s prudent to have a little bit of your portfolio in gold.”

“The market has come to believe in an omniscient Federal Reserve, and it’s no such thing. These guys don’t really know what they’re doing in any deep way. It’s a giant financial experiment, and we’re at the mercy of their experiment that maybe is right now in the process of going wrong, so God help us.”

God help us, indeed!