tadamichi

Introduction to IJH

iShares Core S&P MidCap ETF (NYSEARCA:IJH) is an exchange-traded fund that gives traders with publicity to U.S. mid-cap shares. Not too long ago, I coated OEF, a well-liked fund that invests within the “S&P 100” (basically the 100 largest U.S. corporations). IJH, on the opposite hand, relies on the S&P MidCap 400 Index, the fund’s benchmark index, which is constructed to incorporate corporations with an unadjusted market cap of $6.7 billion to $18 billion (per S&P’s most up-to-date USD factsheet, as of July 31, 2024).

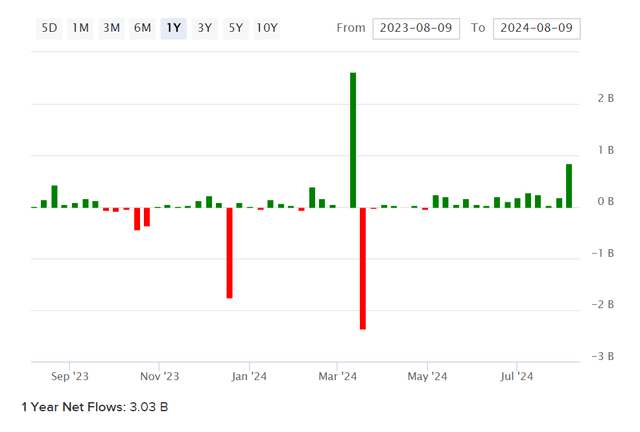

IJH is an efficient solution to replicate the efficiency of this 400-company U.S. fairness index, with a reported expense ratio of 0.05%, per iShares. As of August 9, 2024, iShares reported that IJH had belongings beneath administration of $85.1 billion, which might point out a excessive degree of recognition. This follows a yr of optimistic internet fund flows of circa $3 billion (see beneath).

ETFDB.com

I final coated IJH in June 2022, by which my base IRR estimate was 13.37% per yr. Per Searching for Alpha knowledge on the time of writing, the compound whole annual development fee is 12.38%, making my IRR estimate appear truthful looking back. Nevertheless, since then, the S&P 500 index has apparently risen on a non-total return foundation (i.e., earlier than dividends/reinvested) of 16.38%, supported in no small half by the most important corporations within the S&P 500 (by which OEF, as talked about earlier, invests extra closely). I feel it’s however worthwhile reviewing IJH to see if there’s relative worth alternative at current, particularly contemplating my OEF IRR estimate as of current (as a reference level) was about 11% in my base case.

Portfolio and Sector Exposures

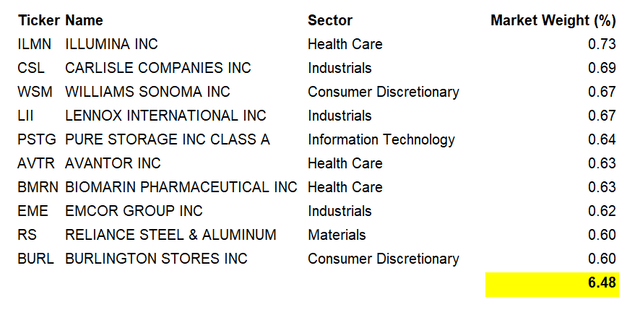

As famous, IJH seeks to duplicate the S&P MidCap 400 Index. Accordingly, there are about 400 holdings (406 to be exact) as of August 9, 2024 (a number of corporations have a number of share lessons; the everyday explanation for the nominal distinction in fairness index constituents and ETF tracker holdings). Not like the top-heavy funds above the mid-cap degree, the place a sort of Pareto precept or energy regulation appears to naturally apply, within the mid-cap vary you are likely to have far better fragmentation throughout each corporations and sectors. Some traders will like this, because it lends to far better diversification. The highest 10 holdings within the IJH portfolio are proven in my desk beneath, with an general high 10 focus of 6.48%.

Knowledge from iShares.com

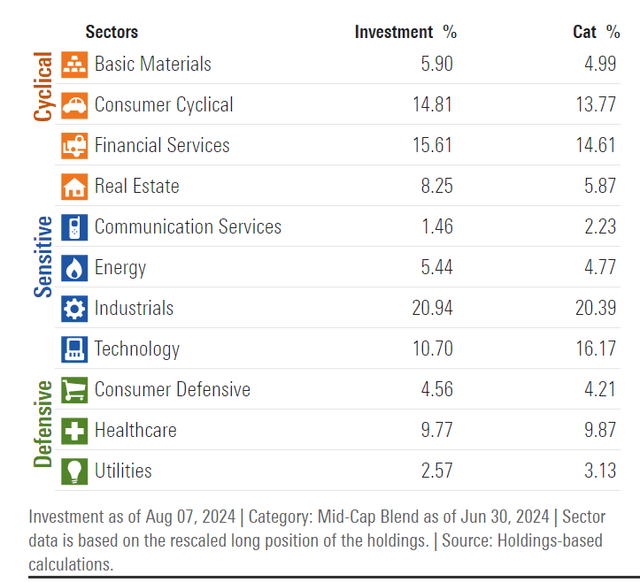

This makes IJH not depending on any single or assortment of shares. On the portfolio-wide degree, the fund strikes a steadiness throughout most sectors, with no specific bias, as proven within the chart beneath. If one have been to interrupt these down into their important classes of Cyclical, Delicate, and Defensive, you might have a break up of 44.57%, 38.54%, and 16.9%, respectively.

Morningstar.com

So, one might conclude that on steadiness IJH is more likely to exhibit “financial beta”, and on a market beta foundation, I calculate the three-year, month-to-month beta (relative to the S&P 500) as being 1.17x, which type of lends to a barely riskier notion amongst traders relative to the broader market.

Valuation

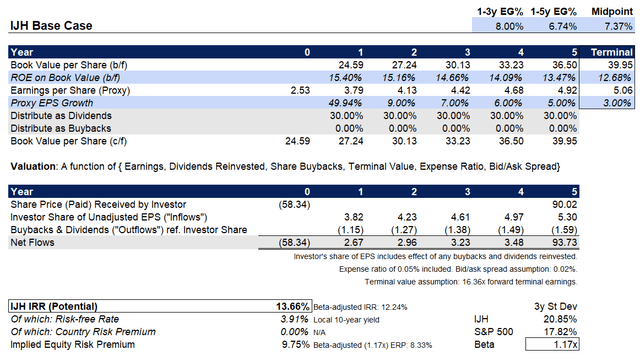

As cited earlier, the newest factsheet as of July 31, 2024, for the fund’s benchmark, is an efficient unbiased start line for consensus expectations of the fund’s earnings and near-term forecasted earnings. The factsheet studies trailing and ahead worth/earnings ratios of 24.53x and 16.36x, respectively, with a worth/e-book ratio of two.52x and an indicative dividend yield of 1.47%. These figures indicate a return on fairness of 15.40% on a ahead foundation, with a really massive EPS development within the first yr of 49.94%, although this being presumably primarily based on a decrease earnings base in mixture within the prior yr.

With inflation ranges starting to normalize, mid-cap corporations are more likely to exhibit extra secure earnings development going ahead, however the “financial beta” talked about earlier is related. The unrestricted market-cap-weighted indices just like the S&P 500 are usually over-weight “outsized winners” with pricing energy, so earnings can typically each develop shortly and maintain up strongly (if measured on a margin foundation). Mid-caps are likely to have much less pricing energy, and usually tend to be topic to financial vicissitudes. Nonetheless, the longer-term return on fairness is an efficient barometer, and helpful for making projections.

Three- to five-year common earnings development charges are anticipated to be round 11.87% per Morningstar’s consensus analyst estimates. Nevertheless, Morningstar (in contrast to S&P, a much less subjective supply) tends to regulate its earnings figures for ETFs for numerous gadgets. So, this determine is probably going much less comparable given the one-year earnings soar we’re seeing per S&P as a forecast over the subsequent yr. What we are able to say, nonetheless, is that Morningstar count on apparently robust earnings development for the IJH portfolio over the subsequent 5 years.

After yr one, I’ll take a extra conservative view of a moderating return on fairness (from 15.40% as projected by S&P, right down to sub-13% by yr six). The one- to five-year common earnings development subsequently arrives at a a lot softer 6.74%, or 8% between years one and three (midpoint: 7.37%). Holding different elements fixed, like the speed of dividends, and the earnings a number of (in calculating, for instance, the terminal worth in yr 5), the implied IRR is 13.66% for IJH in my base case. This additionally contains the expense ratio and minor bid/ask unfold (median: solely 0.02% on a 30-day foundation, given IJH’s excessive degree of recognition and thus liquidity).

Creator’s Calculations

As in comparison with my earlier protection again in June 2022, and regardless of robust efficiency since then, IJH nonetheless appears to supply an identical degree of return going ahead. Whereas it’s sometimes defined that previous efficiency isn’t any assure of future outcomes, and that’s after all true, it could appear as if current efficiency could be a sign of IJH’s potential going ahead. Additional, it could appear as if IJH is presumably even higher positioned than the mega-cap heavy fund OEF I coated just lately.

Mid-caps, with a bit larger volatility relative to the broader market, could also be extra delicate to financial and market surprises. Then again, whereas I calculate downside-only beta of 1.06x (certainly, barely extra risky on the draw back than the S&P 500), its upside beta is 1.26x on a three-year foundation, so there’s optimistic (favorable) skewness.

I feel traders will seemingly do fairly nicely with IJH at current costs, with an IRR potential of over 13%. Dangers are going to be primarily tied to the U.S. economic system’s well being. Whereas we are able to discuss in any other case summary dangers at current, such because the potential for warfare, or another macro issue not but identified, I do not understand mid-cap shares as being significantly extra uncovered than larger-cap shares besides within the occasion macro elements drive up supply-side (or “cost-push”) inflation. In a extra benign surroundings, IJH is more likely to carry out nicely, and appears to have the potential to out-perform extra top-heavy funds regardless of a decrease common portfolio return on fairness (given current costs).