24K-Manufacturing

Expensive readers/followers,

In my current article on Canadian Photo voltaic Inc. (CSIQ), I outlined the the reason why I prefer to have some publicity to renewable vitality in my portfolio. Immediately I need to cowl a renewable vitality large – Iberdrola, S.A. (OTCPK:IBDRY) and present you why I believe it makes a very good funding.

Notice: The native shares of Iberdrola denominated in EUR commerce on the Madrid trade below the ticker IBE. As a European, these are the shares I desire. For American buyers, there may be additionally an ADR denominated in USD.

Overview

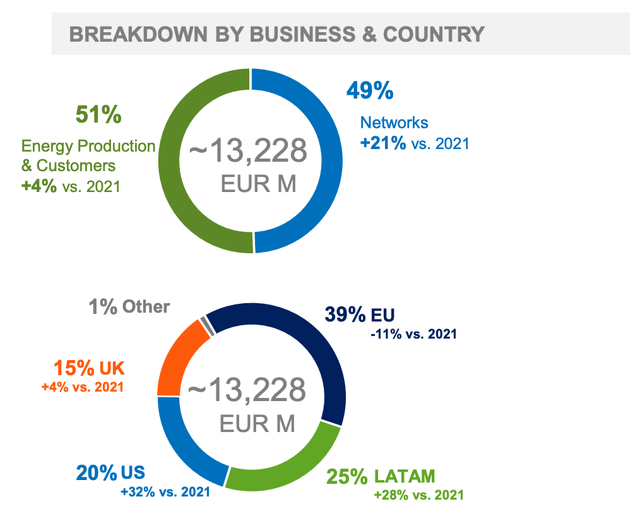

Iberdrola, S.A. is a Spanish-based utility firm with international operations. It’s one the biggest and greenest fully-integrated electrical utility firms on the earth, with revenues of over EUR50 Billion and EUR13 Billion in EBITDA. The corporate operates in two major segments – vitality manufacturing and networks with revenues break up equally between the 2 segments. When it comes to geographical presence, the corporate is closely current in Spain, Brazil, the UK, the USA, and Mexico, with nearly all of income coming from their native Spanish market.

Iberdrola Investor Presentation

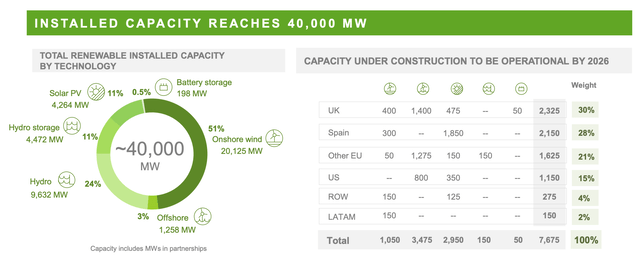

When it comes to vitality manufacturing, I need to level that Iberdrola is very clear and a frontrunner in renewables. They deserted coal a couple of years in the past, and nearly all of their manufacturing comes from renewables (60%), adopted by nuclear (20%) and pure gasoline (20%). Notably, the corporate is the second-largest producer of wind vitality globally (after Danish Orsted), so it comes as no shock that almost all of their put in capability in renewables comes from onshore wind (51%), adopted by Hydro at 24%.

The corporate is well-diversified, which permits it to steadiness risky renewables with extra secure conventional income streams akin to nuclear and distribution networks. It additionally makes the corporate extraordinarily well-positioned for the renewable future. Iberdrola is a number of years forward of its friends within the transition to renewables, as 80% of their manufacturing already comes from zero emission sources with zero publicity to coal.

Iberdrola Investor Presentation

The corporate’s CAPEX plan is huge, as they proceed to broaden their renewables and networks. In 2022 alone, the corporate invested EUR 10.7 Billion (up 13% YoY) primarily into EU renewables and U.S. and Brazil Networks. The corporate additionally has 7.6 MW of renewables below development, with anticipated supply between 2023 and 2026. The bulk (47%) of this new capability will come from on-shore wind strengthening their virtually unrivalled presence within the sector.

Financials

Iberdrola, S.A. reported their 2022 ends in February. Briefly, the outcomes barely beat expectations and there have been no actual surprises. EBITDA (which is the important thing metric for the corporate) elevated by 10% YoY to EUR13.2 Billion pushed primarily by a constructive efficiency within the networks phase in Brazil (due larger tariffs) and the U.S. (because of larger tariffs and a constructive one-off in New York). The New York one-off accounted for about 40% of the year-on-year progress in EBITDA, so even with out it the expansion was stable.

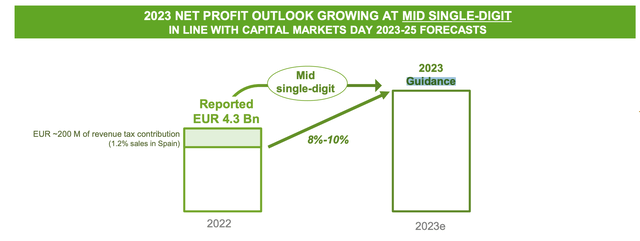

For 2023, administration guides in the direction of an 8-10% enhance in earnings. Iberdrola, S.A. expects that the rise might be pushed by a manufacturing enhance in hydro and wind and new investments of over EUR10 Billion which can greater than offset the rise in monetary prices and the impact of a newly launched income tax in Spain (1.2% of income in Spain). Trying past this yr, the renewable area will possible proceed to develop, as most governments within the West are pushing for sustainable vitality manufacturing by introducing numerous new legal guidelines and rules. The vitality disaster in Europe will solely velocity up the transition.

Iberdrola Investor Presentation

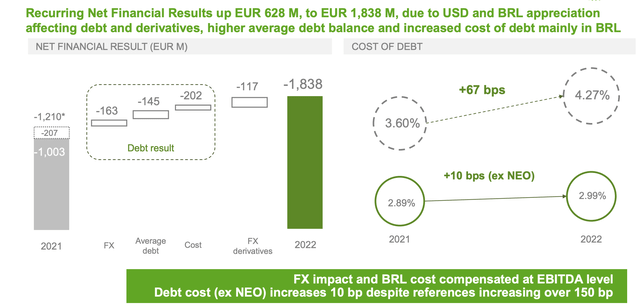

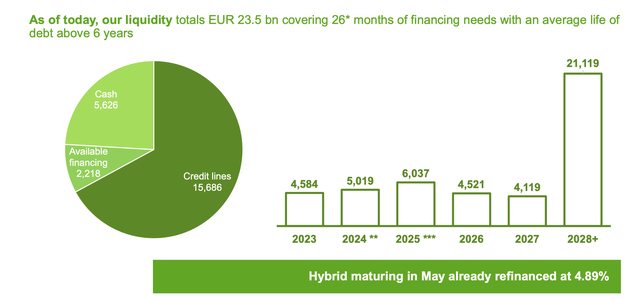

Concerning financing, the general weighted common rate of interest on their debt elevated by 67 bps to 4.27% in 2022. This isn’t stunning on condition that charges are rising worldwide. The rise for Iberdrola was primarily fueled by Brazilian charges on their BRL denominated loans. If we exclude Brazil, their price of debt is simply 10bps larger, regardless of a rise of over 150bps in reference charges.

Iberdrola Investor Presentation

Debt on their steadiness sheet is BBB+ rated and unfold over time, and their liquidity of EUR24 Billion, of which EUR6 Billion is in money, is sufficient to cowl over two years of financing wants. Nearly all of their debt is denominated in EUR (40%), adopted by USD (27%), GBP (15%) and BRL (13%). The corporate’s Adj. internet debt/EBITDA is 3.3X.

Iberdrola Investor Presentation

The corporate has set a dividend ground much like that of its friends, as described of their 2022 annual report:

Within the 2020-2025 Plan, Iberdrola established a minimal shareholder remuneration of EUR 0.40 per share for the years 2020-2022. On this regard, on the finish of January 2023, Iberdrola paid a retribution for the 2022 monetary yr amounting to EUR 0.18 gross per share (+5.9% vs 2021). The assist that Iberdrola shareholders proceed to indicate to the Group’s administration is noteworthy, since virtually 80% of them selected to obtain the dividend in shares. In gentle of the outcomes posted, on the subsequent Common Shareholders’ Assembly, Iberdrola will suggest a supplementary remuneration of EUR 0.31 gross per share, which can end in a complete shareholder remuneration amounting to EUR 0.49 gross per share, towards 2022 earnings, offered it’s authorised within the Common Shareholders’ Assembly.

At EUR 0.49 per share, the dividend yield stands at 4.6%, which is kind of excessive contemplating the standard of the corporate and in addition the truth that the dividend is more likely to develop by a excessive single-digit proportion over the following few years if administration delivers on their steerage.

Valuation

Assuming a 2023 EPS of EUR 0.715 (up 10% from EUR 0.652 in 2022), Iberdrola is at the moment buying and selling at a ahead P/E of 15.8x, which is according to its long-term historic common. The 15x P/E ratio can also be what most analysts are utilizing to worth this firm, and I believe it is spot on.

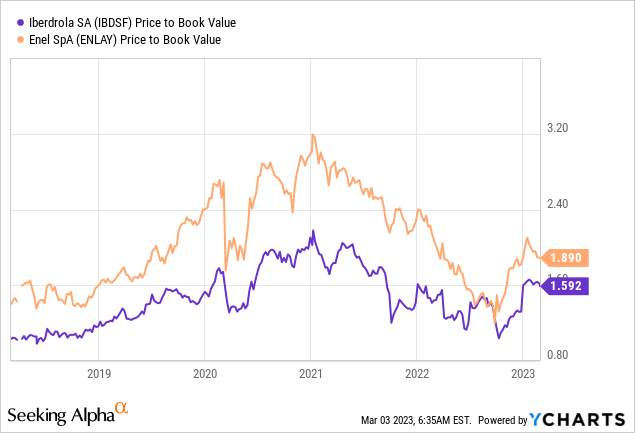

On a P/BV foundation, the corporate is at the moment buying and selling at 1.70x and under Enel at 1.89x. Wolf report argues for a 2x price-to-book in his article. I believe that is affordable given the outlook and high quality of Iberdrola’s belongings, and I actually assume that Iberdrola deserves not less than the identical (if not larger) a number of than Enel just because it has a head-start of not less than a couple of years in renewables.

Based mostly on this, Iberdrola appears pretty valued on the present worth of EUR 10.70 per share, and if administration delivers on their steerage, the inventory might attain a PT of EUR 12.70 by 2025.

With that stated, let’s take a look at what we are able to moderately count on from the corporate going ahead:

- 4.6% dividend yield (rising at 6-8% per yr)

- 8-10% EPS progress for the following two to a few years

- 0% annual return from a number of growth as the corporate is pretty valued

- -> complete return of 13.6% per yr.

Keep in mind how I generate alpha:

- Begin with a thesis why a given trade/sector ought to outperform

- keep chubby in these sectors for so long as the thesis is legitimate

- search for firms with sound fundamentals which are both undervalued or pretty valued with distinctive progress prospects

- if an organization turns into overvalued, trim the place and rotate into one other inventory/sector that’s nonetheless undervalued

- if an organization turns into more and more undervalued and the thesis remains to be legitimate, add to the place

- generate alpha and repeat.

My complete return then comes from the dividend yield, EPS progress and a number of growth because the valuation normalizes over time. I all the time goal a complete return in extra of market returns (>8%) to generate alpha.

What issues do I search for when deciding on particular person shares to purchase?

- robust and secure fundamentals

- good administration groups with a track-record of caring about shareholders

- wholesome EPS progress

- well-covered dividend

- low cost relative to friends and/or historic honest multiples

- different catalysts.

Takeaway

Iberdrola, S.A. may be very well-positioned to capitalize on the way forward for renewable vitality. It is likely one of the largest and the greenest utility firms on the earth, making Iberdrola, S.A. a really secure play for buyers. This inventory won’t 10x your cash, however it should pay you a 4.6% dividend that’s basically assured and will return one other 8-10% in worth appreciation as the corporate grows their backside line. I fee Iberdrola, S.A. as a “BUY” right here at EUR 10.70 per share, and can proceed so as to add to my present place on any main dip. I believe Iberdrola, S.A. is a good and secure firm to purchase and maintain for 5-10% years because the world transitions to renewable vitality.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.