Oct 27, 2025

November 2022. FTX collapsed.

I had funds caught on the trade. Not my whole portfolio – I’d already moved most to chilly storage – however sufficient to harm.

Three years later, I’m nonetheless ready for partial compensation based mostly on 2022 costs. In the meantime, the crypto I might have held is price 7x extra.

That’s once I realized: “not your keys, not your cash” isn’t a slogan. It’s a survival rule.

Right here’s how I retailer crypto now – and why you want a number of wallets, not only one.

The Factor No person Desires to Speak About

Quick ahead to October 2025: Trump pardons CZ. A $4.3 billion Binance high quality disappears. Everybody celebrates the regulatory reset.

Me? I’m reminded that if political connections can erase a multi-billion greenback penalty, what makes you suppose your funds are protected on any trade?

Binance paid the high quality. CZ served 4 months. Now he’s free, and the trade is stronger than ever.

Nice for crypto adoption. Horrible for anybody who thinks “too massive to fail” means “protected to belief.”

As a result of right here’s the truth: exchanges get hacked. They go bankrupt. They freeze withdrawals. And when it occurs, your “Bitcoin” is only a quantity in another person’s database.

Not your keys, not your cash.

What Exchanges Don’t Inform You

Let me hit you with some numbers that ought to scare you:

$1.4 billion stolen from exchanges and protocols in 2024. Whereas that is down from 2023, it’s nonetheless huge.

Mt.Gox (2014): $450 million gone. Customers waited 11 years for compensation – and at last began receiving partial compensation in 2024.

FTX (2022): $8 billion vanished. Sam Bankman-Fried bought 25 years. Most customers? They bought a claims quantity and are nonetheless ready. The compensation plan guarantees 118–142% of declare worth – however based mostly on 2022 costs. Bitcoin was $16,600 then. At the moment? $115,000. That’s a 7x alternative price.

Binance (a number of incidents): Regardless of being the most important trade, they’ve confronted safety challenges together with the 2022 incident that resulted in $570 million affected (later recovered by means of freezing).

And people are simply the large names you’ve heard of. Smaller exchanges? They collapse frequently.

Even when an trade doesn’t get hacked, they’ll:

• Freeze your account throughout “upkeep” (often whenever you wish to withdraw)

• Go bankrupt and tie your funds up in years of authorized proceedings

• Get regulated out of existence in sure jurisdictions

• Resolve you violated some Phrases of Service you by no means learn

The sample? You don’t management the keys. They do. And when issues go mistaken, you’re simply one other creditor hoping to get pennies again.

What FTX Taught Me

I saved crypto on FTX as a result of it was “handy.” The interface was clear. The yields have been good. Everybody I knew used it. Sam Bankman-Fried was on TV with celebrities. It felt protected.

Then one morning in November 2022, withdrawals stopped. Inside 48 hours, FTX filed for chapter.

My funds have been locked. No entry. No warning.

The FTX chapter course of revealed that buyer funds had been used for dangerous buying and selling at Alameda Analysis. The crypto wasn’t sitting in wallets. It was gone, gambled away.

The worst half? It was fully preventable. If I’d spent a number of hundred {dollars} on {hardware} wallets and adopted correct safety, these funds would nonetheless be mine – and value 7x extra at this time.

What Really Retains Your Crypto Secure

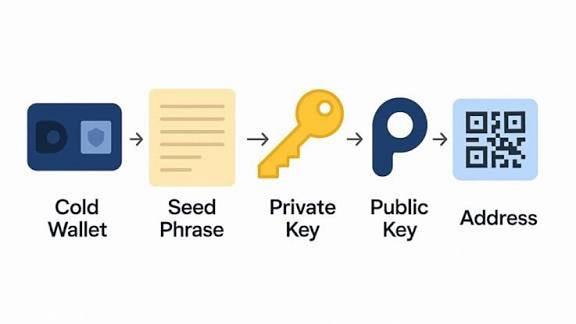

A {hardware} pockets (additionally known as a chilly pockets) is a bodily system that shops your non-public keys offline.

Consider it like this:

• Scorching pockets (trade, cellphone app): Your keys are on-line, linked to the web, weak 24/7.

• {Hardware} pockets: Your keys by no means contact the web. Hackers can’t entry what isn’t on-line.

Whenever you wish to ship crypto, the transaction will get signed on the system itself, then broadcast. Your non-public keys by no means go away the {hardware}.

Even when your laptop is contaminated with malware, even for those who’re utilizing public WiFi, even when somebody’s watching your display – they’ll’t steal your keys.

It’s not foolproof. Nothing is. But it surely’s the closest factor to “unhackable” that exists in crypto.

How I Retailer Crypto Now (The Multi-Layer Technique)

After FTX, I redesigned my whole method. Right here’s the system I exploit:

Layer 1: Lengthy-Time period Chilly Storage

What I exploit: A number of {hardware} wallets from completely different producers

Why a number of units:

• Major Ledger Nano X: Primary Bitcoin and Ethereum holdings

• Major Trezor Mannequin T: Backup + completely different safety structure

• If one firm has a vulnerability, the opposite protects my holdings

Storage:

• Units in separate safe places

• Restoration phrases saved individually from units

• By no means multi function place

What goes right here:

• Bitcoin and Ethereum long-term holdings

• Any crypto I gained’t contact for years

• Nearly all of my portfolio

Why this works:

• Offline = unhackable by distant assaults

• Diversified throughout producers

• Bodily separation prevents single level of failure

Layer 2: Lively Chilly Storage

What I exploit: Secondary {hardware} pockets

Why separate from long-term storage:

• I don’t wish to continuously entry my foremost chilly wallets (safety threat)

• This pockets is for crypto I’d transfer in 3–12 months

• Used for staking by means of official pockets apps

What goes right here:

• Crypto I’m staking (incomes 3–17% APY)

• Positions I’d commerce inside the 12 months

• Medium-term holdings

Why this works:

• Can stake immediately from {hardware} pockets (by means of Ledger Dwell/Trezor Suite)

• Stability between safety and accessibility

• Staking rewards with out trade threat

Layer 3: Change Holdings

What I exploit: Two exchanges (Binance + Coinbase)

Wait, didn’t you simply say exchanges are dangerous?

Sure. However right here’s the truth: you want exchanges for sure issues.

What I carry on exchanges:

• Buying and selling capital

• Stablecoins incomes yield (at the moment 4–8% APY)

• Small quantities of altcoins not supported by {hardware} wallets

My trade guidelines:

• Hold minimal quantities

• Cut up between two exchanges (diversification)

• Withdraw instantly after shopping for

• Allow all safety features

Why this method:

• I can purchase crypto when alternatives come up

• Earn staking rewards on stablecoins

• If one trade collapses, I don’t lose every thing

The {Hardware} Wallets I Really Belief

I’ve examined each main {hardware} pockets. Some are clunky. Some have horrible interfaces. Listed here are those I’d suggest.

Fast Comparability

💰 Worth

• Ledger Nano X: $149

• Trezor Mannequin T: $169

• Tangem Pockets: $50

• Ledger Nano S Plus: $79

🪙 Cash Supported

• Ledger Nano X: 5,500+

• Trezor Mannequin T: 1,500+

• Tangem Pockets: 6,000+

• Ledger Nano S Plus: 5,500+

📱 Connectivity

• Ledger Nano X: Bluetooth + USB ✅

• Trezor Mannequin T: USB solely

• Tangem Pockets: NFC (faucet to cellphone) ✅

• Ledger Nano S Plus: USB solely

🔐 Type Issue

• Ledger: USB system with display

• Trezor: USB system with touchscreen

• Tangem: Card (like bank card)

• Ledger: USB system with display

⭐ My Ranking

• Ledger Nano X: 9/10 (finest total)

• Trezor Mannequin T: 9/10 (finest for chilly storage)

• Tangem Pockets: 7.5/10 (finest for novices)

• Ledger Nano S Plus: 8/10 (finest worth)

Ledger Nano X – Greatest Total ($149)

That is what I exploit for staking and positions I’d transfer inside a 12 months.

What I like:

• Helps 5,500+ cryptocurrencies (principally every thing)

• Bluetooth connectivity (you should utilize it along with your cellphone)

• Ledger Dwell app is intuitive

• Constructed-in battery lasts weeks

• Can stake ETH, ADA, SOL, DOT immediately from the system

What I don’t like:

• Not absolutely open-source (Ledger’s safety chip is proprietary)

• Barely pricier than funds choices

Who it’s for: Anybody who desires to stake crypto, use DeFi often, or wants cell entry.

Get it right here: [Ledger Official Store]

2. Trezor Mannequin T – Greatest for Chilly Storage ($169)

That is what I exploit for long-term Bitcoin and Ethereum storage.

What I like:

• Totally open-source ({hardware} and software program)

• Colour touchscreen interface

• No Bluetooth (some see this as safer for chilly storage)

• Shamir Backup assist (can break up restoration phrase)

• Sturdy status in Bitcoin group

What I don’t like:

• Helps fewer cash than Ledger (1,500+ vs 5,500+)

• No Bluetooth means much less handy for energetic use

Who it’s for: Lengthy-term holders who prioritize most safety and open-source verification.

Get it right here: [Trezor Official Store]

3. Tangem Pockets – Greatest for Newbies ($50)

A card-based {hardware} pockets that works with NFC (faucet to cellphone). Best to make use of, however restricted performance.

What I like:

• Most cost-effective possibility at $50

• Very simple (simply faucet to cellphone)

• No charging wanted (no battery)

• Helps 6,000+ cash

• Seems to be like a bank card (discreet)

• Sturdy (water/mud resistant)

What I don’t like:

• No display (should belief cellphone app)

• Can’t stake or use DeFi immediately

• Much less safe than units with screens (can’t confirm addresses on system)

• Tangem controls some features of key era

Who it’s for: Full novices who need the best doable setup, or as a backup pockets for small quantities.

Get it right here: [Tangem Official Store]

4. Ledger Nano S Plus – Greatest Funds Choice ($79)

Identical safety because the Nano X, fewer options. Good for intermediate customers on a funds.

What I like:

• Half the worth of Nano X

• Identical safety chip

• Helps 5,500+ cash

• No battery to fret about

• Bigger display than unique Nano S

What I don’t like:

• No Bluetooth (should plug into laptop)

• Smaller display than Nano X

Who it’s for: Intermediate customers who don’t want cell connectivity.

Get it right here: [Ledger Official Store]

Which Pockets Ought to You Really Get?

When you’re model new to crypto (lower than $500):

Begin with Tangem Pockets ($50). It’s easy, low cost, and will get you acquainted with self-custody.

When you maintain $500-$5,000:

Get Ledger Nano S Plus ($79). Greatest worth, full performance.

When you maintain $5,000-$50,000:

Get Ledger Nano X ($149). You want Bluetooth comfort and staking functionality.

When you maintain $50,000+:

Get each Ledger Nano X and Trezor Mannequin T ($318 complete). Cut up your holdings throughout completely different producers for max safety.

If you’d like most safety for long-term storage:

Get Trezor Mannequin T ($169). Totally open-source, no Bluetooth, excellent for chilly storage.

Why I Personal A number of Units of the Identical Mannequin

Right here’s one thing most guides gained’t inform you: I don’t simply personal completely different pockets manufacturers – I personal a number of items of the identical mannequin.

My precise setup:

• Two Ledger Nano X units

• Two Trezor Mannequin T units

• One Ledger Nano S Plus

• One Tangem (for small quantities/journey)

Complete: 6 bodily units.

Why Purchase Duplicates?

{Hardware} Failure

{Hardware} wallets can break. Screens die. Buttons fail.

When my main Ledger’s display began glitching, I merely restored my accounts utilizing the identical 24-word phrase on my backup system and continued with out lacking a beat.

Geographic Redundancy

I hold units in numerous places:

• Major units: Safe places I entry frequently

• Backup units: Separate places (completely different metropolis/member of the family’s home)

If my home burns down, I lose one system. Not all of them.

Firmware Updates

Firmware updates often trigger points.

My rule: By no means replace all units directly.

• Replace main system first

• Check for per week

• If steady, replace backup

This fashion, if an replace causes issues, I at all times have a working system.

The Price-Profit

Extra price:

• Further Ledger Nano X: $149

• Further Trezor Mannequin T: $169

• Complete: $318 for peace of thoughts

For anybody holding important crypto, spending an additional $318 on backup units is clear threat administration.

The Precept of Purposeful Isolation

Right here’s a safety idea most individuals miss: Don’t use the identical pockets for every thing.

My rule: Storage wallets keep offline. Lively wallets deal with transactions.

Why This Issues

Think about you’re interacting with a DeFi protocol. You suppose you’re approving a authentic transaction, nevertheless it’s really a phishing assault.

If all of your wallets are linked to DeFi:

• Signal malicious transaction on Pockets A → drained

• Examine Pockets B → signal related transaction → drained

• Pockets C? Identical sample → drained

When you apply practical isolation:

• Storage Pockets: By no means connects to DeFi, by no means indicators good contracts

• Staking Pockets: Solely used by means of official apps (Ledger Dwell, Trezor Suite)

• Lively Pockets: Used for DeFi, swaps, experiments

Consequence: Even when your Lively Pockets will get drained, your Storage Pockets was by no means uncovered.

My Precise Pockets Features

Chilly Storage Wallets (By no means Contact These):

• Major units: Bitcoin and Ethereum long-term holdings ONLY

• No DeFi interactions

• No good contract approvals

• Solely receives deposits

• Saved in safe places, not often accessed

Staking Pockets:

• Secondary system: Staking ONLY by means of official apps

• Ethereum, Cardano, Polkadot staking

• No exterior DeFi protocols

• No token approvals exterior official apps

Lively Pockets:

• Tertiary system: DeFi, swaps, new protocols

• This pockets interacts with good contracts

• Holds smaller quantities

• If compromised, restricted loss

Journey/Each day Pockets:

• Tangem card: Small quantities for each day transactions

• Straightforward to hold, faucet to cellphone

• If misplaced or stolen, minimal loss

Use Totally different Restoration Phrases

That is vital:

• Storage Pockets = Restoration Phrase A

• Staking Pockets = Restoration Phrase B

• Lively Pockets = Restoration Phrase C

• Journey Pockets = Restoration Phrase D

In case your Lively Pockets’s seed phrase will get compromised, your Storage Pockets stays protected.

The Setup Course of

For Ledger:

1. Unbox, plug in by way of USB

2. Arrange 8-digit PIN

3. Write down 24-word restoration phrase (CRITICAL)

4. Set up Ledger Dwell app

5. Add Bitcoin/Ethereum accounts

6. Switch small take a look at quantity ($20)

7. Verify it arrives, then switch the remaining

Complete time: 20–half-hour

For Trezor:

1. Plug in, observe touchscreen prompts

2. Arrange PIN

3. Write down 24-word restoration phrase

4. Set up Trezor Suite

5. Add accounts

6. Check switch, then transfer foremost holdings

Complete time: 20–half-hour

For Tangem:

1. Obtain Tangem app on cellphone

2. Faucet card to cellphone (NFC)

3. Create pockets (Tangem generates keys on card)

4. Write down backup card entry code

5. Switch small take a look at quantity

6. Confirm it arrives

Complete time: 10–quarter-hour (best setup)

The One Mistake That Will Price You All the pieces

Shedding or exposing your 24-word restoration phrase.

That phrase IS your crypto. If somebody will get it, they personal your funds. When you lose it and your system breaks, your crypto is gone endlessly.

What NOT to do:

• ❌ Don’t take a photograph

• ❌ Don’t retailer it digitally

• ❌ Don’t retailer it along with your {hardware} pockets

• ❌ Don’t inform anybody, ever

What TO do:

• ✅ Write it on the cardboard supplied

• ✅ Retailer in a fireproof protected

• ✅ Take into account a steel backup (survives fireplace/flood)

• ✅ Retailer backup copy in numerous bodily location

• ✅ By no means retailer all backups collectively

What I Discovered From FTX

Lesson 1: Centralization is a single level of failure

FTX wasn’t hacked. It was mismanaged. Your funds are solely as protected because the folks working the platform.

Lesson 2: “Too massive to fail” doesn’t exist in crypto

FTX was the second-largest trade. It collapsed in 48 hours.

Lesson 3: Diversification isn’t optionally available

If I’d break up my holdings correctly throughout chilly wallets and a number of exchanges, my losses would have been minimal.

Lesson 4: Liquidity issues

Having some funds accessible means you possibly can act when alternatives come up. Full chilly storage sounds protected, nevertheless it’s rigid.

Lesson 5: Self-custody is the endgame

The aim isn’t to keep away from exchanges endlessly. It’s to reduce publicity and maximize self-custody for holdings you don’t want to the touch.

My Suggestions Based mostly on Your Holdings

When you maintain lower than $500:

Begin with Tangem Pockets ($50). Easy, low cost, will get you began with self-custody.

When you maintain $500-$5,000:

Get Ledger Nano S Plus ($79). Greatest worth with full performance.

When you maintain $5,000-$50,000:

Get Ledger Nano X ($149) + backup system. You want cell entry and redundancy.

When you maintain $50,000-$500,000:

Get Ledger Nano X + Trezor Mannequin T ($318). Cut up throughout producers. Add backups of every.

When you maintain $500,000+:

Get a number of units, use practical isolation, take into account multi-sig, seek the advice of a safety professional.

The Actual Price of Not Appearing

A Ledger Nano X prices $149.

FTX taught 1000’s of individuals this lesson the laborious means. Common losses? 1000’s per particular person.

So that you’re risking 1000’s to save lots of $149.

That’s not being frugal. That’s playing with cash you possibly can’t afford to lose.

Right here’s What You Ought to Do Proper Now

When you’re holding crypto on an trade, you’re taking an pointless threat.

For most individuals: Get a Ledger Nano X ($149)

On a good funds: Get a Tangem Pockets ($50) or Ledger Nano S Plus ($79)

For severe holdings: Get each Ledger Nano X and Trezor Mannequin T ($318 complete)

Set it up this weekend. Switch your funds. Sleep higher.

Not your keys, not your cash. Don’t be taught this the laborious means.

Transparency Notice

Some hyperlinks on this article are affiliate hyperlinks. When you purchase by means of them, I earn a small fee at no additional price to you. I solely suggest merchandise I’ve personally examined and use myself. The {hardware} wallets defending my crypto proper now have been bought with my very own cash, and I sleep higher due to them.

What’s your setup? Nonetheless retaining funds on exchanges, or have you ever made the transfer to chilly storage? Drop a remark under – I learn each one.