Maksim Safaniuk/iStock Editorial via Getty Images

“Arrows of neon and flashing marquees out on Main Street

Chicago, New York, Detroit and it’s all on the same street

Your typical city involved in a typical daydream

Hang it up and see what tomorrow brings”

– Grateful Dead

When I first wrote about Hub Group (NASDAQ:HUBG) back in February of this year, it was just prior to the Russian invasion of Ukraine and a lot of focus was on supply chain issues and the impacts expected on the first quarter earnings. It was clear that at that time, while the stock was trading in the $75-$80 range, that HUBG was successfully navigating the supply chain and logistics issues that were impacting many other trucking and transportation companies. With the company’s ongoing focus on yield improvement, operating efficiency, and fixed cost leverage, the growing freight demand led to record quarterly diluted EPS of $2.48 in Q421.

The company’s growth has been ramping up over the past several years due to a focus on integrity, and a culture of quality service and innovation, especially with respect to the use of technology. And Hub Group is much more than just a trucking company. The company offers intermodal transportation, truck brokerage services, logistics, fleet maintenance, and specialized equipment. From the investor relations website, this is the company profile:

For over 50 years, Hub Group has serviced customers across multiple industries with innovative solutions and a commitment to service. We provide transportation and logistics management solutions that combine our own assets, strategic relationships and cutting edge technology to support each of our customers’ needs.

Back then I rated the stock a Buy at $78 with 20% potential upside, but also cautioned at the end of my article that things could go wrong which might change that perspective. In fact, this is what I had said at the time (remember it was just before the war on Ukraine started).

Given the current state of world affairs and the volatility in the market that has been ongoing since the beginning of the year, growth in the supply chain business could slow down again. If the general economic conditions worsen due to global geopolitical conflict, another harmful variant of COVID, or some other unknown calamity, the demand for HUBG services could decline and cause a disruption in future cap ex expansion.

Not that I was being prescient, but it did occur to me at the time that the supply chain issues that were causing disruption to the broader economy could get worse before it got better, and in fact that is what has happened since then. The first quarter earnings were quite positive, however, and the outlook for the remainder of the year as of the April 28 earnings report, was for an increase in expected revenues of $5.3B to $5.5B and full year diluted earnings of $9-$10 per share. Another record was reported with diluted earnings per share (EPS) of $2.58.

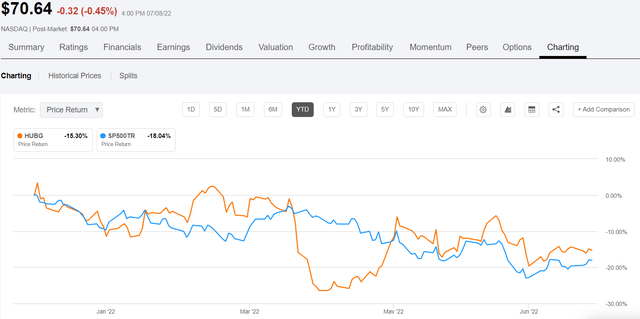

The market was expecting a poor quarter from HUBG, and the stock price plummeted ahead of the Q1 report but then recovered back to around $70 post earnings, where it has more or less traded in a range since then. The stock is just slightly ahead of the S&P 500 on a YTD basis.

HUBG price chart (SA charting tool)

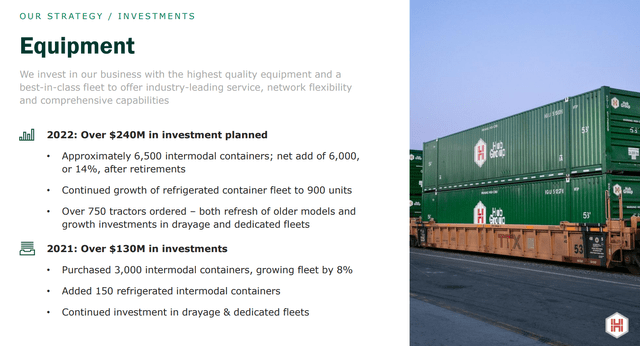

Now that we are nearing the second quarter earnings report, the stock remains priced for a downturn in the business going forward. The current forward P/E sits at a low 7.38 and short interest is only around 3% as of July 8, 2022. The current stock represents a good value for growth at a reasonable price given the company’s expectations and their recent track record of growing quarterly earnings to new records. In addition, the plans for continued investment in capital equipment and technology innovation going forward is powering them towards $6B in revenues by 2025.

Equipment investment (April 2022 Investor presentation)

Their Competition is Struggling

Another factor that I believe is likely to work in HUB Group’s favor is the combination of factors including labor shortages (inability to hire new truck drivers in particular), higher gas prices, and new laws like California’s Assembly Bill 5, that are forcing some smaller trucking companies to lose business which HUBG can then swoop in and take over.

Also, HUBG has been growing through acquisitions and they have cash available to pursue additional opportunities should it make sense. Since 2018, there have been 3 successful acquisitions including:

- CaseStack in 2018, which added consolidation and warehousing to enable cross-selling to small and mid-size customers.

- NonStop Delivery in 2020, adding high-service residential final mile delivery and additional cross-sell potential.

- ChopTank Transport – providing refrigerated market expertise and added scale in brokerage services, along with yet more cross-selling opportunities.

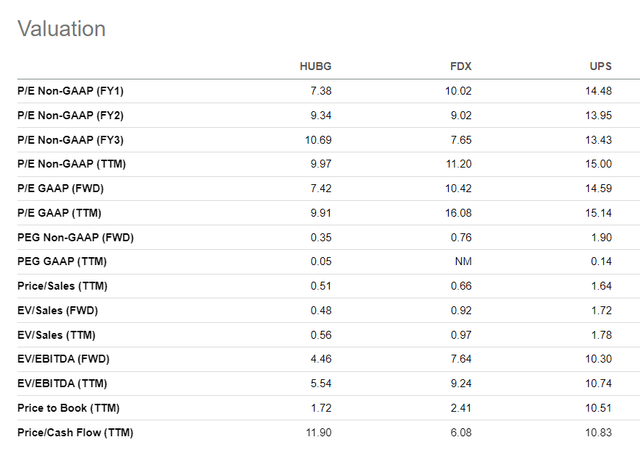

Comparing HUBG to FedEx (FDX) and United Parcel Service (UPS), it seems that HUBG is the better buy going forward and has performed better over the past year.

TR comparison of HUBG, FDX, UPS (Seeking Alpha)

Although HUBG is smaller with a market cap of $2.4B versus FDX at $59B and UPS at $161B, it has better financial metrics and good forward guidance. With no short-term debt and only $176M in long-term debt, the debt to equity ratio sits at a low 22% versus 149% for FDX and 165% for UPS. Forward diluted EPS growth for HUBG is expected to be 42% compared to 12% for FDX and 17% for UPS.

In terms of other valuation metrics like Price to Sales, Price to Book and PEG, HUBG also comes out ahead of both FDX and UPS.

HUBG Valuation (Seeking Alpha)

Strong Financial Performance

Over the 10-year period from 2011 to 2021 the Hub Group experienced 7% CAGR in revenues and 13% CAGR in EPS. Gross margins have improved from 12.2% in FY2020 to 16.6% in Q122. That performance has been driven by service line diversification, reorganization and streamlined focus on quality and accountability, investment in technology, growth of freight under management, and recent acquisitions.

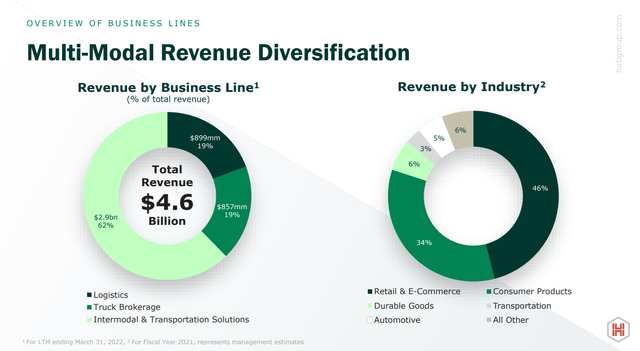

The diversification of industries and revenues by business lines offers an advantage over their peers and sets them up for continued growth into the future.

Revenue Diversification (April 2022 Investor presentation)

Intermodal and Transportation Solutions is the largest business line by revenues with $2.9B in the last 12 months ending March 31, 2022. Hub Group boasts the 2nd largest container fleet in the industry with 50,000 units in 2022 and long-term relationships with rail providers like Norfolk Southern (NSC) and Union Pacific (UNP). The Trucking operation includes 3,200 drivers and sophisticated equipment including a fully GPS-enabled fleet that leverages satellite tracking, sonar door sensors, AI, and Machine Learning.

The Logistics business brought in $900 million in LTM revenues and includes non-asset transportation, warehousing, and cross dock services. Final mile delivery is also included in this business line.

The Trucking Brokerage business line realized over $1B in revenues in the last 12 months ending March 31. Much of that revenue was due to the added scale and refrigerated services from the ChopTank acquisition and is expected to grow over the coming months.

Navigating the Future

Even though the first quarter offered good results and the forward guidance in April was still positive for growing revenues and earnings into the second half of the year, the ongoing economic and geopolitical concerns still weigh heavily on the minds of investors. During the first quarter earnings call one analyst asked the question regarding what sort of plans the company has to mitigate any downside shift in the business cycle. The reply from President and COO Phil Yeager indicated that they have not made any plans yet for such a potential downturn and believe that they have adequate tailwinds to sustain them through such a period if it were to occur:

But what do we need to do in the event of a downturn, I think we took a lot of costs out in 2019 and early part of 2020 in anticipation of a downturn that, frankly, just really didn’t happen. We did take the cost out which is, I think, one of the reasons why we’re seeing such attractive operating cost leverage as we were able to reduce those costs into what we think is a permanent state. We didn’t add a lot of cost in on the way up here; so, we think we’re going to have some cushion there. Our model is — we’re benefiting from price that’s having a strong impact on our yields. We do have — with almost all of our business in intermodal being contractual, we’ll have a tailwind carrying us through into a potential downturn. But, look, we’re going to do the same thing we did last time which is watch our bottom line carefully. We also have made some pretty big moves to diversify away some kind of pure transactional business, adding the acquisitions in the logistics side. And even in the brokerage side, the acquisition there was a business that’s serving food and beverage type customers. So, we think those two factors will also help to mitigate any downturn driven by price.

Conclusion and Recommendations

In my estimation, the potential for HUBG to outperform as a growth stock trading at a good current value is high. There is not a lot of downside risk given the strong financials, the diversity of business lines and revenue opportunities, and the tailwinds mentioned from the intermodal contracts. Of course, if the worries about a possible recession lead to further declines in the overall market and the US economy in general, then it is likely that all businesses will be negatively impacted in the near future, and the stock may take a hit if that were to occur.

My sense is that we are past the peak inflation period and inventories are starting to stabilize as supply chain constraints are starting to sort themselves out with China starting to recover and open up again. The stock is a Buy at $70 for long-term investors who are willing to hold through any difficult periods that may hurt the share price in the short term, in which case it may make sense to average down.

Sometimes the light’s all shinin’ on me

Other times I can barely see

Lately it occurs to me

What a long, strange trip it’s been