Do you battle to know the foreign exchange market? You’re not alone. Many merchants get misplaced in worth adjustments, lacking out on good alternatives. This could result in massive losses and missed possibilities to earn a living.

However there’s a device that may change the whole lot: development traces. These easy instruments could make your foreign currency trading higher, providing you with clear instructions in complicated markets.

Pattern traces are key in foreign currency trading. They present worth adjustments, serving to you discover when to purchase or promote. Studying about development traces may help you see market traits early. This could make your buying and selling selections higher and enhance your earnings.

Key Takeaways

- Pattern traces require no less than three contact factors for validation.

- Steeper angles point out increased momentum in worth motion.

- Trendline flips can present vital entry factors.

- Mix development traces with different indicators for higher outcomes.

- Look ahead to breakouts with elevated buying and selling quantity.

- Use development traces throughout numerous asset lessons.

Understanding the Fundamentals of Pattern Traces

Pattern traces are key in foreign exchange chart evaluation. They information merchants via the advanced world of foreign money markets. Let’s discover the fundamentals of development traces and their function in foreign currency trading.

What Are Pattern Traces in Foreign exchange Buying and selling

Pattern traces are straight traces that join worth factors on a chart. They present a foreign money pair’s course over time. A great development line wants no less than two worth factors in the identical course.

Merchants use these traces to identify market actions. They search for upward (bullish), downward (bearish), or sideways (ranging) traits.

The Position of Pattern Traces in Technical Evaluation

In technical evaluation, development traces information merchants. They present assist and resistance ranges. This helps merchants discover the most effective instances to enter or exit the market.

Pattern traces will be drawn on any timeframe. This lets merchants see each short-term and long-term traits.

Fundamental Parts of Pattern Line Evaluation

Pattern line evaluation has a number of key components:

- Slope: Reveals the development’s power and course

- Touchpoints: The extra the rice touches the road, the stronger it’s

- Time-frame: Longer frames give extra dependable traces

- Quantity: Low quantity makes traces extra more likely to break

| Pattern Kind | Course | Slope | Buying and selling Sign |

|---|---|---|---|

| Uptrend | Rising | Optimistic | Bullish |

| Downtrend | Falling | Destructive | Bearish |

| Sideways | Horizontal | Impartial | Consolidation |

Understanding development line fundamentals helps merchants make good selections within the foreign exchange market. By studying development line evaluation, you’ll spot buying and selling possibilities and handle dangers higher.

Sorts of Foreign exchange Market Tendencies

Foreign exchange merchants should know the three primary market traits. These traits information the market and have an effect on buying and selling plans.

An uptrend means costs preserve going up, forming increased lows. This exhibits a bullish market the place patrons lead. Merchants look to purchase throughout pullbacks in an uptrend.

A downtrend exhibits costs falling, with decrease highs. This implies a bearish market the place sellers management. On this case, merchants may promote on rallies.

A sideways development, or ranging market, occurs when costs keep in a horizontal channel. This exhibits market indecision. It may be powerful for trend-following methods.

| Pattern Kind | Attribute | Buying and selling Strategy |

|---|---|---|

| Uptrend | Greater lows | Purchase on pullbacks |

| Downtrend | Decrease highs | Promote on rallies |

| Sideways | Horizontal vary | Commerce breakouts or vary |

Understanding these traits is essential for foreign currency trading success. Merchants use instruments like transferring averages and development traces to verify the market course. For instance, if the worth is above a rising 50-period transferring common, it usually means an uptrend.

Keep in mind, traits can change. An uptrend may flip right into a downtrend or a sideways market. Control these adjustments to regulate your buying and selling plan. By studying to establish traits, you’ll discover higher buying and selling possibilities within the foreign exchange market.

Methods to Use Pattern Traces for Foreign exchange Buying and selling

Pattern line drawing is essential in foreign currency trading. It lets merchants see market traits and make good selections. This half will educate you use development traces nicely in foreign exchange charts.

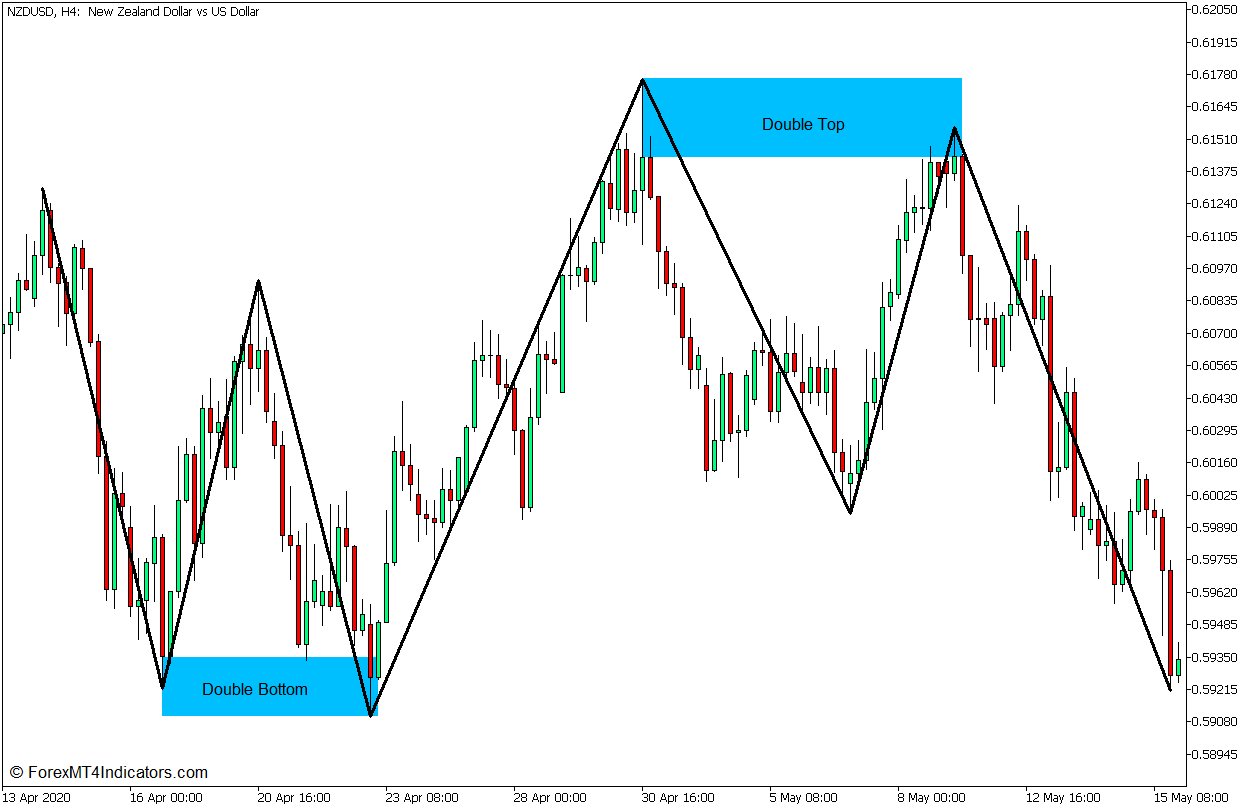

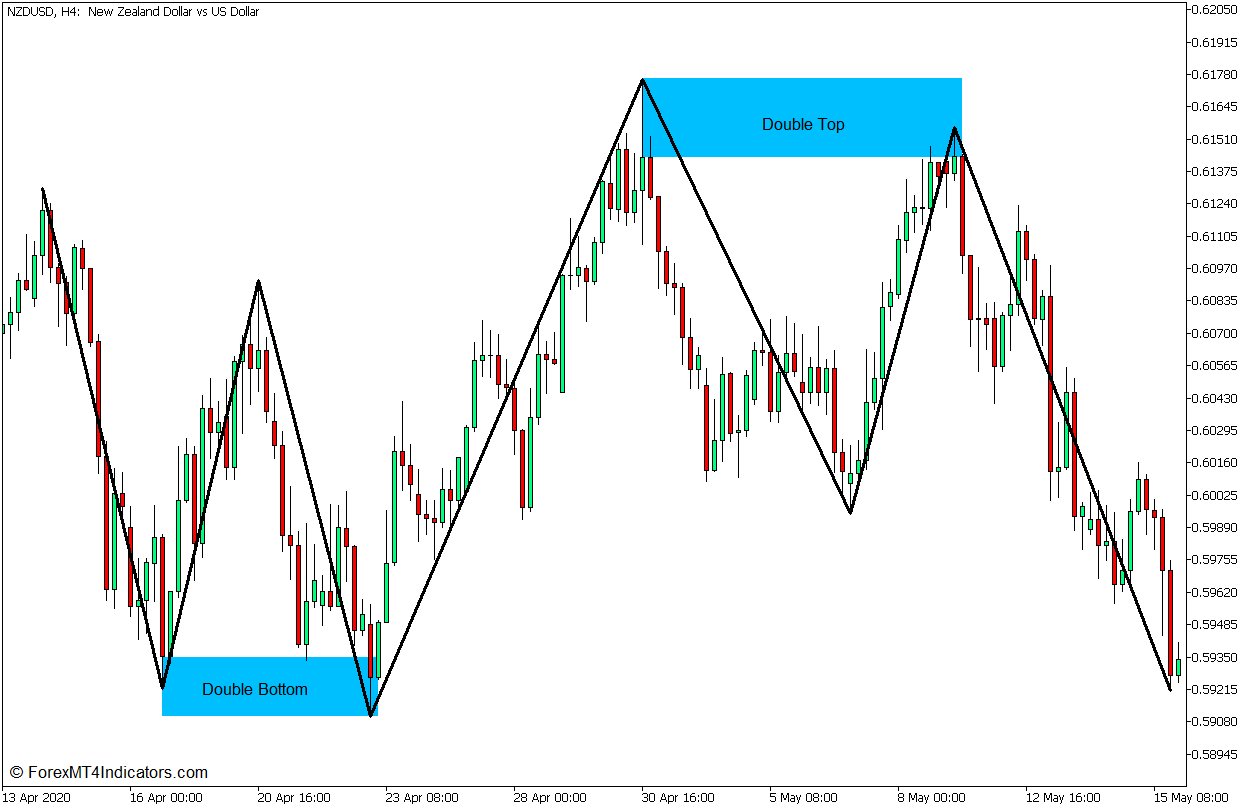

Figuring out Main Tops and Bottoms

Step one is to search out main tops and bottoms. For uptrends, join no less than two excessive factors. For downtrends, hyperlink two or extra low factors. Extra factors make the development line stronger.

Connecting Value Factors Accurately

When linking worth factors, take a look at the worth motion. Upward traces imply the market is bullish. Downward traces present it’s bearish. Steeper traces may imply costs gained’t preserve going.

Validating Pattern Line Power

How sturdy a development line is issues. Extra touches with out breaks imply it’s stronger. Longer timeframes give extra dependable traces. However, excessive volatility could make a line weaker.

| Pattern Line Kind | Market Indication | Drawing Technique |

|---|---|---|

| Upward | Bullish | Join increased lows |

| Downward | Bearish | Join decrease highs |

Begin with a development line drawing on demo accounts. Then, use them with different instruments like RSI or transferring averages. This manner, you get a greater view of the market and might handle dangers higher.

Drawing Strategies for Efficient Pattern Traces

Studying how to attract development traces is essential for good foreign exchange charting. This half talks about superior methods to make dependable development traces. It helps you make higher buying and selling selections.

Utilizing Candlestick Wicks vs Our bodies

Merchants argue over utilizing wicks or our bodies for development traces in candlestick evaluation. Wicks give exact worth ranges, whereas our bodies present market emotions. Your selection is dependent upon your buying and selling type and the market.

Correct Angle and Slope Choice

The angle of your development line issues so much. Steeper traces may break, however gentler ones last more. A great development line connects no less than two key worth factors with out crossing via candle our bodies.

A number of Contact Level Affirmation

Extra contact factors make a development line stronger. Three or extra touches imply a powerful development. This system confirms commerce setups.

| Variety of Contact Factors | Pattern Line Power | Buying and selling Confidence |

|---|---|---|

| 2 | Weak | Low |

| 3 | Reasonable | Medium |

| 4+ | Sturdy | Excessive |

Utilizing these methods, you’ll make extra correct development traces. This results in smarter buying and selling selections within the foreign exchange market.

Superior Pattern Line Patterns

Studying superior development line patterns is essential for foreign currency trading success. These patterns give insights into market traits and worth actions. Try some essential development line patterns to spice up your chart evaluation and buying and selling.

Wedges, channels, and triangles are prime superior patterns. Wedges type when development traces meet, hinting at a reversal. Channels present costs transferring in a variety, nice for buying and selling inside that vary. Triangles type when traces get nearer, usually earlier than massive worth strikes.

Pattern line breaks are key alerts. An increase above resistance means a bullish development. A fall beneath assist exhibits bearish sentiment. Ready for affirmation after a break can result in an 80% success fee in recognizing actual market adjustments.

| Sample | Formation | Buying and selling Implication |

|---|---|---|

| Wedge | Converging development traces | Potential reversal |

| Channel | Parallel development traces | Vary buying and selling alternatives |

| Triangle | Narrowing development traces | Doable breakout |

Utilizing these superior patterns in your buying and selling could make a giant distinction. Over 90% of profitable merchants depend on development traces. By studying these patterns, you’ll be prepared to identify advanced market traits and discover nice buying and selling possibilities.

Buying and selling Methods Utilizing Pattern Traces

Pattern line methods are key for foreign currency trading. They assist merchants discover the most effective instances to purchase or promote. Let’s take a look at use development traces to make good buying and selling selections.

Entry and Exit Factors

Pattern traces present when to purchase or promote. When costs hit a assist line in an uptrend, it’s an excellent time to purchase. Close to a resistance line in a downtrend, it’s time to promote.

Exit factors are when development traces are damaged or if you attain your revenue objective.

Assist and Resistance Flips

Assist and resistance buying and selling is about when development traces change roles. A damaged resistance line turns into assist. A damaged assist line turns into resistance.

This helps merchants know when to enter or exit trades and handle dangers.

Breakout Buying and selling Alternatives

Breakouts occur when costs go previous development traces. They present massive adjustments or continuations in traits. Merchants enter within the breakout course, with stop-losses simply past the road.

This technique goals to catch massive worth swings as new traits begin.

| Technique | Key Factors | Finest Timeframe |

|---|---|---|

| Pattern Following | Enter trades within the development course | Day by day |

| Trendline Bounce | Commerce at assist/resistance | Hourly (H1) |

| Breakout Buying and selling | Enter on-trend line breaks | 4-hour |

Profitable development line buying and selling wants observe and evaluation. Through the use of these methods and managing dangers, merchants can enhance their foreign exchange efficiency.

Frequent Pattern Line Buying and selling Errors to Keep away from

Pattern line evaluation is a strong device in foreign currency trading. However, it’s straightforward to fall into widespread pitfalls. Understanding these errors may help you keep away from expensive errors and enhance your buying and selling psychology.

One massive mistake is forcing traces to suit the market. This could result in flawed conclusions in 70% of circumstances. Good development traces join no less than two clear swing factors, making the evaluation extra correct.

Ignoring the bigger market development is one other massive error. About 65% of swing merchants make poor selections by specializing in short-term adjustments. Day by day development traces are normally extra essential than these on shorter time frames.

- Overcomplicating evaluation with too many development traces confuses 60% of merchants

- Failing to regulate development traces as market circumstances change will increase loss charges by 80%

- 75% of merchants don’t observe established traits, considerably rising attainable losses

Overtrading is a typical difficulty, with 50% of merchants reacting to small worth adjustments. This could result in increased transaction prices, chopping earnings by 5-15%. A great threat administration technique can reduce losses by 40%.

By recognizing these trendline pitfalls and dealing in your buying and selling psychology, you may enhance. Apply drawing development traces throughout totally different market circumstances. This can enable you get higher and enhance your probabilities of success.

Combining Pattern Traces with Different Technical Instruments

Pattern traces are highly effective when used with different instruments. They make buying and selling methods stronger and assist merchants really feel extra assured. Let’s see mix development traces with key indicators for higher outcomes.

Utilizing Momentum Indicators

Momentum instruments like RSI and MACD are nice with development traces. They assist affirm when a development is powerful or when it’d change. For instance, if a foreign money pair breaks a development line and the RSI is excessive, it is perhaps a powerful purchase sign.

Quantity Evaluation Integration

Quantity provides depth to development line alerts. Large quantity when a development line is damaged exhibits an actual transfer. A small quantity may imply it’s only a fake-out. Merchants use this to know if a development change is powerful.

Value Motion Affirmation

Value motion patterns again up development line alerts. Candlestick patterns close to development traces can present if a development will preserve going or change. A bullish engulfing sample at an uptrend line is perhaps an excellent time to purchase.

| Software | Use with Pattern Traces | Profit |

|---|---|---|

| RSI | Verify overbought/oversold ranges | Spot attainable reversals |

| MACD | Sign line crossovers close to development traces | Validate development power |

| Quantity | Verify the quantity on development line breaks | Verify breakout validity |

| Candlesticks | Search for patterns at trendline touches | Predict worth course |

By combining development traces with these indicators, merchants get a clearer view of the market. This helps in creating sturdy buying and selling methods and making higher selections.

Conclusion

Studying to make use of development traces is essential for good foreign currency trading expertise. This information lined the fundamentals of development traces and use them. Pattern traces assist spot market traits, assist, and resistance ranges.

They make it simpler to make good buying and selling selections. Pattern traces are essential in foreign currency trading. They assist discover assist and resistance ranges.

Utilizing development traces with different instruments like transferring averages may help affirm traits. This makes timing trades higher. Pattern traces are only one a part of an even bigger evaluation plan.

They need to be used with threat administration methods. This contains setting stop-loss and take-profit ranges. Pattern traces give priceless insights however are a part of an even bigger plan.

Merchants ought to preserve training with development traces. They should spot breakouts and adapt to market adjustments. With effort and time, development traces is usually a key a part of profitable buying and selling.