Feeling misplaced within the foreign exchange market? You’re not alone. Many merchants get overwhelmed by charts and knowledge. Candlestick patterns will help, however they may appear arduous to study.

Don’t fear, we’ve bought you lined. This information will present you the best way to use candlestick patterns. It should make the market clearer and increase your confidence.

Key Takeaways

- Candlestick patterns present fast value info interpretation

- Understanding fundamental candlestick anatomy is essential

- Bullish and bearish patterns assist predict market traits

- Combining candlesticks with different indicators improves evaluation

- Danger administration is important when buying and selling with candlestick patterns

Understanding Candlestick Fundamentals in Foreign exchange Markets

Candlestick charts are key in foreign currency trading. They present value modifications over time. They assist see market temper and traits.

Anatomy of a Candlestick

A candlestick has three components: the physique, shadow, and shade. The physique exhibits the value vary. The shadow exhibits the excessive and low costs. The colour tells if costs went up or down.

Colour Coding and Value Motion

Inexperienced or white candlesticks imply costs went up. Pink or black ones imply costs went down. The physique’s size exhibits pattern power.

Studying Time Frames on Candlestick Charts

Candlestick charts present value modifications from seconds to months. Brief instances present fast modifications. Lengthy instances present traits higher.

| Time Body | Description | Greatest Use |

|---|---|---|

| 1-Half-hour | Brief-term value motion | Day buying and selling |

| 1-4 hours | Medium-term traits | Swing buying and selling |

| Each day, Weekly, Month-to-month | Lengthy-term traits | Place buying and selling |

Understanding these fundamentals helps merchants perceive the market. It helps them make higher buying and selling selections.

Find out how to Use Candlestick Patterns in Foreign exchange Buying and selling

Candlestick patterns are key in foreign currency trading. They present market temper and future value strikes. Merchants use them to identify help and resistance ranges. These ranges are important for a lot of foreign exchange methods.

Utilizing candlestick patterns begins with recognizing particular patterns. Every candlestick exhibits 4 necessary costs: open, shut, excessive, and low. These patterns can sign when the market may change route or hold going.

As an example, a hammer sample at a downtrend’s backside hints at a potential upturn. However, a dangling man sample at an uptrend’s high may sign a downturn. These indicators assist merchants make higher selections.

| Sample | Place | Sign |

|---|---|---|

| Hammer | Backside of downtrend | Potential upward reversal |

| Hanging Man | High of uptrend | Potential downward reversal |

| Morning Star | Finish of downtrend | Robust bullish reversal |

| Night Star | Finish of uptrend | Robust bearish reversal |

Good candlestick sample use is extra than simply seeing patterns. It’s about utilizing these patterns with different instruments to test traits. This combine is essential to a powerful foreign exchange technique.

Important Bullish Candlestick Patterns

Bullish patterns are key in foreign currency trading. They usually present when the market may flip up. Listed here are 4 necessary bullish patterns for recognizing shopping for possibilities.

Hammer Sample

The hammer sample exhibits up after a downtrend. It has a small physique with an extended decrease shadow, no less than twice so long as the physique. This implies patrons are taking again management. The following day’s candle must be inexperienced to verify.

Morning Star Formation

The morning star has three candles: an extended crimson, a short-bodied, and an extended inexperienced. It’s a powerful signal of a bullish reversal. The third candle should engulf the second to point out robust shopping for.

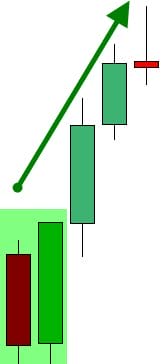

Bullish Engulfing Sample

A bullish engulfing sample has two candles: a brief crimson physique engulfed by a bigger inexperienced one. It exhibits robust shopping for strain, much more so with excessive quantity. This sample usually occurs at help ranges, ending a downtrend.

A bullish engulfing sample has two candles: a brief crimson physique engulfed by a bigger inexperienced one. It exhibits robust shopping for strain, much more so with excessive quantity. This sample usually occurs at help ranges, ending a downtrend.

Instance

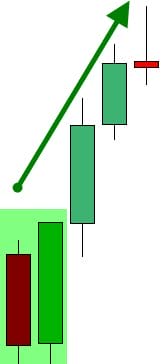

Bearish Engulfing Sample

A bearish engulfing sample has two candles: a Lengthy inexperienced physique engulfed by a bigger crimson one. It exhibits robust promoting strain, much more so with excessive quantity. This sample usually occurs at help ranges, ending a downtrend.

A bearish engulfing sample has two candles: a Lengthy inexperienced physique engulfed by a bigger crimson one. It exhibits robust promoting strain, much more so with excessive quantity. This sample usually occurs at help ranges, ending a downtrend.

Three White Troopers

Three White Troopers

Three consecutive lengthy inexperienced candles with small shadows type the three white troopers’ sample. It’s a powerful signal of an uptrend after a downtrend. It exhibits patrons are pushing arduous over a number of durations.

| Sample | Formation | Significance |

|---|---|---|

| Hammer | Small physique, lengthy decrease shadow | Consumers regaining management |

| Morning Star | Three candles: crimson, brief, inexperienced | Robust bullish reversal |

| Bullish Engulfing | Brief crimson engulfed by giant inexperienced | Robust shopping for strain |

| Three White Troopers | Three lengthy inexperienced candles | Persistent shopping for strain |

Key Bearish Candlestick Patterns

Bearish patterns are key in foreign currency trading. They present downtrends and when to promote. Let’s take a look at some necessary bearish candlestick patterns for buying and selling.

Hanging Man Sample

The Hanging Man sample exhibits up on the finish of an uptrend. It has a small physique and an extended decrease shadow. This implies sellers are taking on.

This sample usually means a market reversal and extra promoting.

Night Star Formation

An Night Star is a three-candle sample on the finish of an uptrend. It begins with an enormous bullish candle, then a small-bodied one, and ends with a bearish candle.

This exhibits a change in market temper from bullish to bearish.

Darkish Cloud Cowl

The Darkish Cloud Cowl is a two-candle sample. It begins with a bullish candle and is adopted by a bearish one. This bearish candle opens above the earlier shut however closes under its midpoint.

This sample exhibits purchaser momentum is weakening and promoting strain is rising.

Three Black Crows

Three consecutive bearish candles with small or no shadows type the Three Black Crows sample. Every candle opens inside the earlier one’s physique and closes close to its low.

This robust bearish sample usually indicators a powerful downtrend.

| Sample | Candles | Development Indication |

|---|---|---|

| Hanging Man | 1 | Potential reversal |

| Night Star | 3 | Finish of uptrend |

| Darkish Cloud Cowl | 2 | Weakening patrons |

| Three Black Crows | 3 | Robust downtrend |

Continuation Patterns for Development Buying and selling

Development continuation patterns are key in foreign currency trading. They assist merchants spot when the market is consolidating or shifting neutrally. Not like reversal patterns, they present the pattern is prone to hold going after a brief pause.

Patterns just like the Doji, Spinning High, and Rising/Falling Three Strategies are frequent. They occur in 1-5 candles. Bigger patterns can final 10-50 candles. Merchants watch for 2-3 candles after a sample to verify it’s actual.

The Rising Three Technique is a bullish sample. It has 5 candles: an extended bar up, then 3 brief bars down, and ends with an extended bar up. The Falling Three Technique is the other for bearish traits.

Continuation patterns are superb at predicting market route:

- Pennants happen in 10-15% of great value actions

- Flags produce profitable breakouts 70% of the time

- Triangle patterns point out continuation with 60-70% accuracy

- Wedge patterns present a 65-75% likelihood of breakouts within the preliminary pattern route

To get essentially the most out of those patterns, merchants ought to take a look at quantity and use different technical indicators. This helps affirm the pattern’s power and makes buying and selling selections higher.

| Sample | Success Charge | Common Consolidation Time |

|---|---|---|

| Bullish Pennant | 70%+ | 1-3 weeks |

| Bearish Pennant | 65% | 1-3 weeks |

| Bullish Rectangle | 55-65% | 3-4 weeks |

| Bearish Rectangle | 55-65% | 3-4 weeks |

A number of Candlestick Patterns and Formations

Foreign exchange merchants use advanced patterns to foretell value motion. These patterns, made from a number of candlesticks, give insights into market traits. Let’s take a look at some key formations that may increase your buying and selling technique.

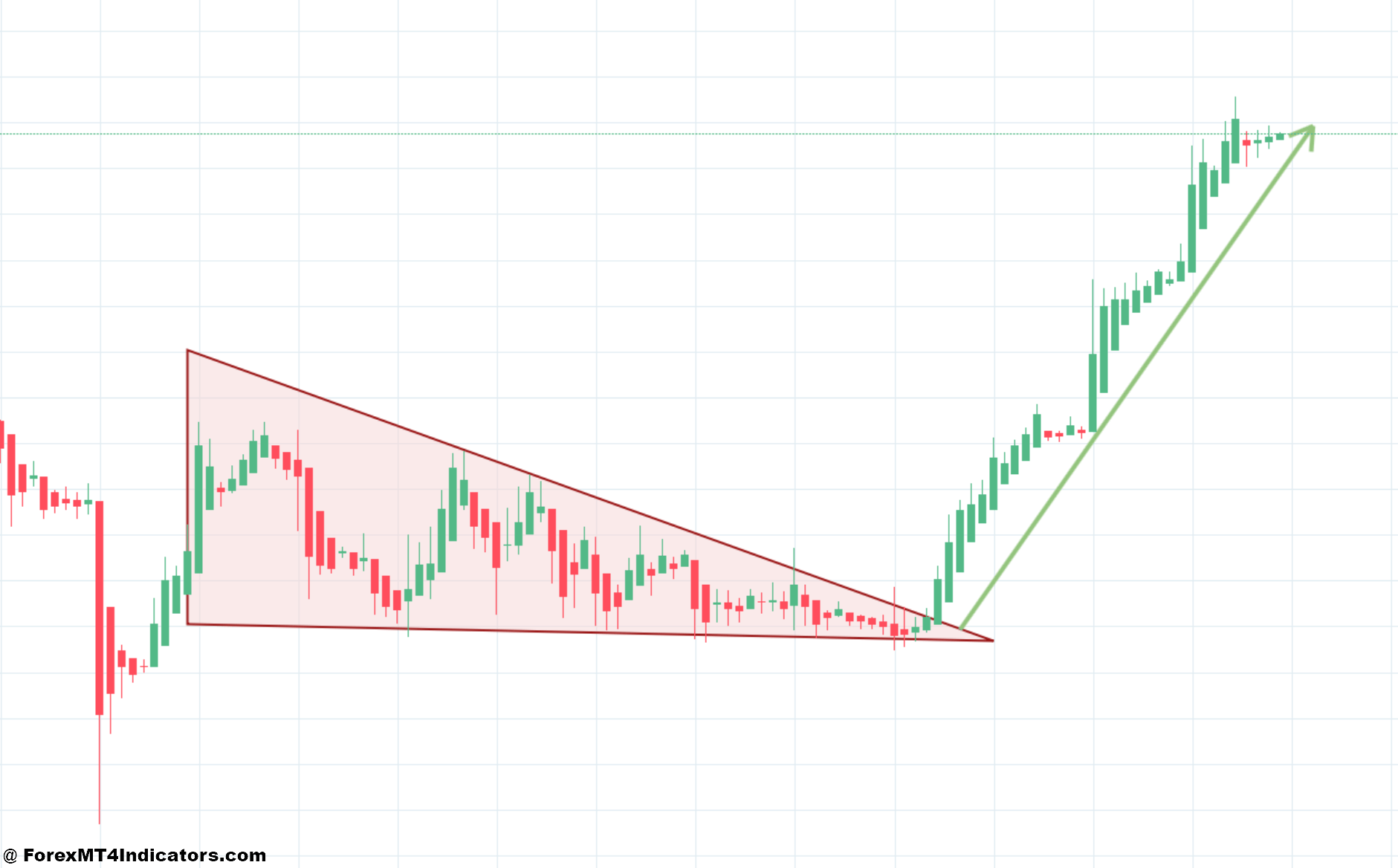

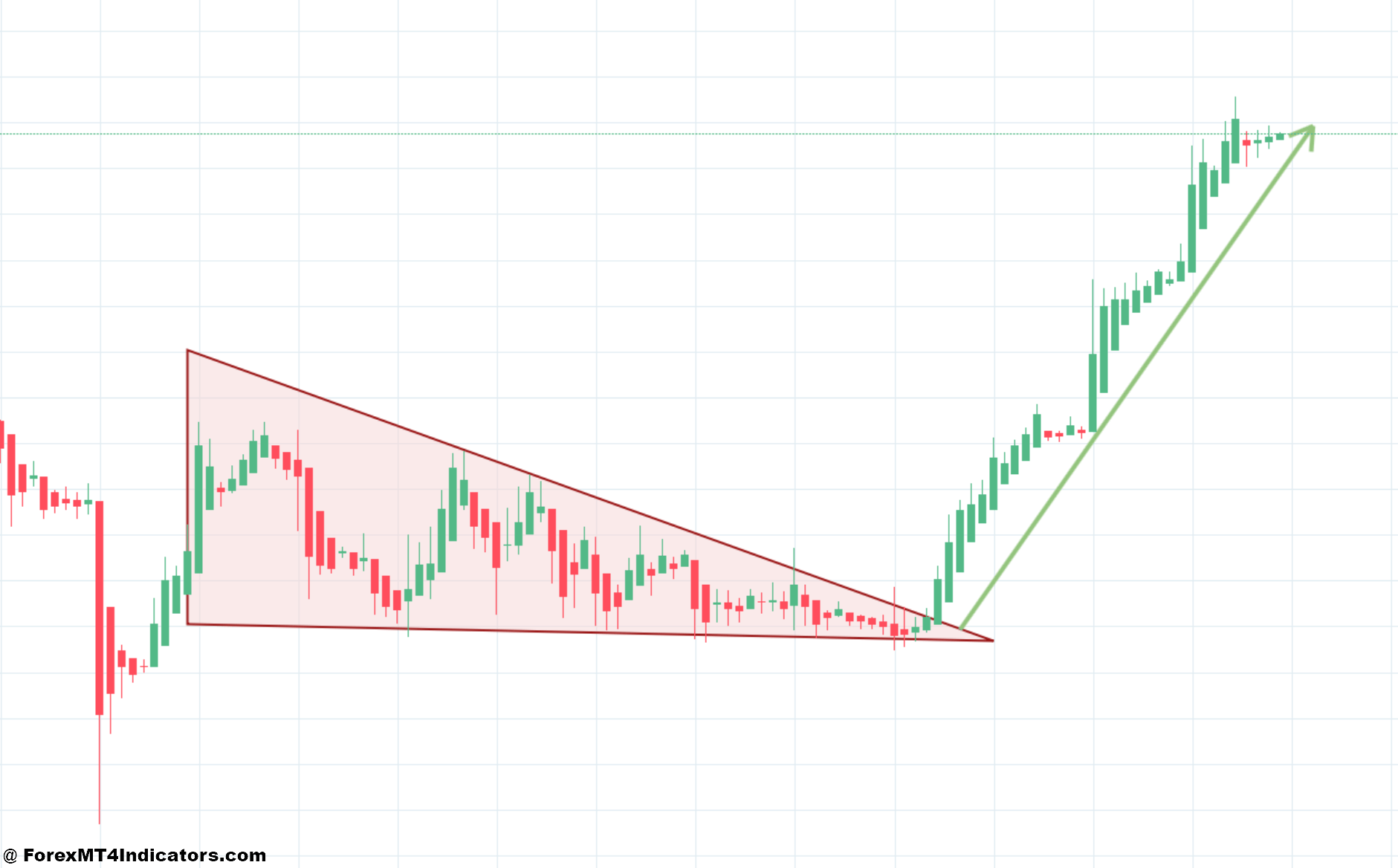

Triangle Patterns

Triangle patterns are frequent in foreign exchange markets. They embrace ascending, descending, and symmetrical sorts. Ascending triangles usually occur after uptrends, exhibiting a pattern will proceed.

Descending triangles seem after downtrends, signaling a potential bear run if help breaks. Symmetrical triangles present market indecision and an enormous transfer is probably going when a pattern line breaks.

Flag Patterns

Flag patterns are short-term consolidation patterns after robust value strikes. Bullish flags comply with upward strikes, and bearish flags comply with downtrends. These patterns usually result in massive value strikes within the earlier pattern’s route.

Wedge Formations

Wedges are like triangles however slope in opposition to the pattern. They will sign reversals or continuations, based mostly on their slope. Throughout a wedge, merchants see falling volatility and quantity, exhibiting market indecision.

| Sample | Incidence | Indication |

|---|---|---|

| Ascending Triangle | After uptrends | Continuation |

| Descending Triangle | After downtrends | Potential reversal |

| Symmetrical Triangle | Any pattern | Indecision |

| Flags | After robust strikes | Brief-term consolidation |

| Wedges | In opposition to pattern | Potential reversal |

Understanding these advanced patterns can significantly enhance your foreign currency trading. Keep in mind, profitable chart evaluation combines sample recognition with technical indicators for higher predictions.

Combining Candlestick Evaluation with Technical Indicators

Candlestick patterns give us nice insights into market traits. Through the use of them with different instruments, merchants could make higher selections. Let’s see the best way to increase candlestick evaluation with necessary buying and selling indicators.

Help and Resistance Ranges

Help and resistance ranges present the place costs may change route. A candlestick sample close to these ranges can imply an enormous pattern change. For instance, a bullish engulfing sample close to a help degree may begin an uptrend.

Quantity Evaluation

The amount exhibits how robust a candlestick sample is. Excessive quantity with a bullish engulfing sample means robust shopping for. This makes an uptrend extra seemingly. The on-balance quantity (OBV) exhibits who’s shopping for and promoting, backing up candlestick indicators.

Development Line Integration

Development traces present market traits clearly. A candlestick sample breaking a pattern line usually means a pattern change. For instance, a bearish engulfing sample breaking an upward pattern line may sign a downtrend.

| Indicator | Perform | Candlestick Synergy |

|---|---|---|

| Transferring Averages | Clean value fluctuations | Verify traits with candlestick patterns |

| RSI | Determine overbought/oversold situations | Strengthen reversal indicators |

| Fibonacci Retracement | Determine potential help/resistance | Enhance accuracy of pattern reversals |

Utilizing these technical indicators with candlestick patterns helps merchants analyze the market higher. This combine makes buying and selling indicators extra correct. It provides merchants a stable solution to make selections in foreign currency trading.

Frequent Buying and selling Errors to Keep away from

Foreign currency trading with candlestick patterns could be difficult. Many merchants fall into frequent traps that damage their success. One massive mistake is relying an excessive amount of on a single sample. This will result in poor selections within the fast-paced foreign exchange market.

One other error is ignoring the larger market image. Candlestick patterns don’t work in a vacuum. They want context to be helpful. Merchants usually overlook different elements like market traits and financial information.

Emotional buying and selling is a serious pitfall. Worry and greed can cloud judgment, resulting in buying and selling errors and losses. It’s key to stay to a well-planned technique and never let feelings drive selections.

Correct danger administration is usually neglected. Many merchants wager an excessive amount of on a single commerce, risking massive losses. Setting stop-losses and managing place sizes are key to long-term success.

- Not confirming indicators with different indicators

- Overtrading based mostly on minor patterns

- Failing to adapt to altering market situations

- Neglecting to maintain a buying and selling journal for overview

By avoiding these frequent errors, merchants can enhance their foreign currency trading expertise. Success comes from sample recognition, market consciousness, and stable danger administration.

Danger Administration Methods with Candlestick Buying and selling

Efficient danger administration is essential in foreign currency trading, utilizing candlestick patterns. Merchants should steadiness income with protecting their capital secure. Let’s take a look at methods to handle danger and use candlestick evaluation.

Place Sizing

Sensible place sizing is essential for long-term success. Restrict every commerce to 1-2% of your whole account steadiness. This retains your capital secure, even when a commerce fails.

For instance, a $10,000 account dangers not more than $200 per commerce.

Cease Loss Placement

Use candlestick patterns to set strategic cease losses. Place stops under help ranges for lengthy trades and above resistance for brief trades. The Hammer sample can sign a potential upward value, making it a very good stop-loss level in bullish trades.

Commerce Entry and Exit Guidelines

Clarify guidelines for getting into and exiting trades based mostly on candlestick indicators. Enter lengthy positions when bullish patterns type close to help ranges—exit when bearish patterns seem or your revenue goal is reached.

| Danger Administration Technique | Key Factors |

|---|---|

| Place Sizing | 1-2% of account steadiness per commerce |

| Cease Loss Placement | Beneath help for lengthy trades, above resistance for brief trades |

| Commerce Entry | Enter on bullish patterns close to help ranges |

| Commerce Exit | Exit on bearish patterns or when the revenue goal is reached |

Good cash administration and buying and selling psychology are as necessary as technical evaluation. By combining these methods with candlestick sample insights, you possibly can construct a stronger buying and selling method. This may assist enhance your probabilities of success within the foreign exchange market.

Conclusion

Candlestick patterns are key in foreign exchange technique. They present value actions clearly. These patterns, made of 4 value factors, assist see market traits and potential modifications.

Inexperienced our bodies imply the market goes up. Pink our bodies present it’s happening. Extra candles in a row make these indicators stronger.

Utilizing candlestick buying and selling with different instruments makes it extra dependable. Patterns just like the Taking pictures Star and Morning Star give necessary clues. Large patterns and longer time frames are normally extra correct.

Good foreign currency trading mixes technical evaluation, danger management, and studying. Candlestick patterns are highly effective however work greatest with different instruments. As merchants get higher, they perceive these patterns higher. This helps them transfer via the advanced foreign exchange market.