Let’s discuss what a trading journal is, how to create one, how to use it, and why you need to have one.

Trading journals can play a vital role in investment strategies, regardless of a user’s market expertise. They are useful tools to plan future trades, monitor one’s trading performance, and optimize profits. It also becomes easier to learn from past mistakes when traders bookmark losing trades in their trading journals.

A trading journal is critical for traders to analyze their trade history. Otherwise, it would be difficult to track trading positions-both winning and losing. Let’s discuss what a trading journal is, how to create one, how to use it, and why you need to have one.

A trading journal is a record containing all the relevant details of the trades a user makes and the reason behind those trades. The document contains everything a trader does, from strategy development and risk management to psychology and logic. Serious traders use trading journals to identify patterns in their trading journey and improve their market performance to avoid repeating poor market choices.

Besides trade analysis, a trader may record the factors that led to the final investment decision. This way, the information becomes accessible for analyzing why a trade went wrong or right and how you can improve.

Creating a crypto trading journal doesn’t require any technical skills. Anyone can find trading journal templates on the internet. Some examples include Coin Market Manager, TraderSync, TraderVue, Edgewonk, and Journalytix. While there are free templates, it’s important to build a trading journal customized to your specific trading needs and style.

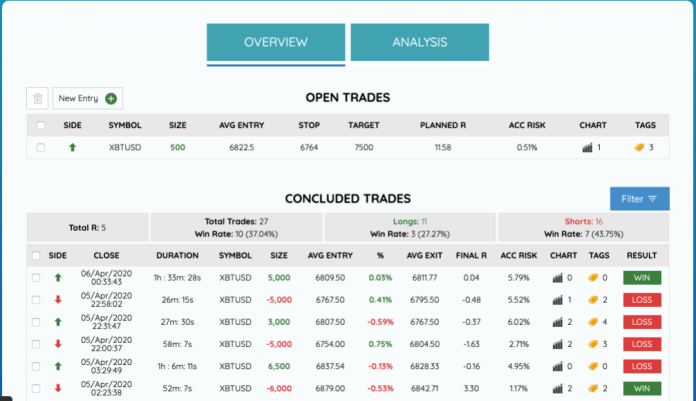

To make a customized journal, first draft a spreadsheet or document to record your trading activities, plans, and decisions. Afterwards, you’ll need to experiment and find a structure that will have the most impact on your trading journey. This means that your spreadsheet or document should contain columns related to every trade made. Some possible data columns include:

You can also include optional columns for screenshots of trades or setup and time frames. The objective is to include all the relevant information that can boost your growth as a trader or investor. It also helps to have an extra tab or section to summarize your ideas and thoughts about every trade, so you can analyze your own trading performance.

Creating a crypto trading journal is the easy part; understanding how to implement it is a bit more difficult. Writing lengthy trading journals regularly helps one become accustomed to them and how they operate. Your trading skills and strategies will generally improve by maintaining a journal and evaluating your trading patterns.

Consider this: you need a good reason to enter a trade, and you get ideas, thoughts, or feelings every time you look at the market. Writing them down can help you spot something that could potentially boost or hurt your trading performance, like past trades, potential trades, general market behavior, and current trades. Additionally, you can jot down the arguments over specific trade ideas, which you can later evaluate.

It’s crucial that the spreadsheet be well-organized and up-to-date. Accurate records help you evaluate the profitability of your ideas. Additionally, recording trades immediately after you execute them will save you time in the future. Looking at your trade portfolio every day will give you insights into your exposure level and new angles to enter trades.

Generally, different trades need different approaches, so having several trading strategies based on market conditions is crucial. Write them in your trading journal for future reference, and to effectively track your progress. It may also prevent you from over-trading, especially when you have multiple positions opened simultaneously. Knowing the number of trades and positions you have that day makes it easier to avoid over-trading.

Keeping track of all the trades you make, even with small investments, is impossible without a trading journal. A trading journal can help you assess your trading account and history, as well as who you are as a trader. The information garnered from successful trades enables you to identify the factors that made the trades excel, especially if the market was volatile.

Additionally, information like entry price, position size, exit price, and trading fees positions you ahead of other market participants.

Having a grasp on every trading activity allows you to enhance your crypto trading skills and improve your decision-making abilities.

Trading journals help users record every piece of information related to the trades they make, from ideas and feelings to trade execution and outcome. Measuring and analyzing this information enables traders to make more informed decisions in the future and enhance their market performance.