The world of cryptocurrency is a rollercoaster of thrilling highs and stomach-churning drops. Everybody hears the success tales, however the concern of creating a pricey mistake retains many on the sidelines. What should you may expertise the market, be taught the ropes, and construct actual buying and selling expertise with out risking a single greenback of your individual cash?

You possibly can. That is the place a crypto buying and selling simulator for paper buying and selling is available in. It’s your no-risk, all-reward coaching floor.

This information will stroll you thru why it is best to follow crypto buying and selling, the various kinds of simulators obtainable, and how one can get began right this moment in your journey from crypto-curious to crypto-confident.

Why Trouble Practising Crypto Buying and selling?

Leaping into the reside crypto market with out expertise is like making an attempt to sail in a storm with out ever having been on a ship. A paper buying and selling account is your calm harbor to be taught earlier than you face the waves.

- Be taught With out Monetary Threat: The obvious profit. A follow account provides you a digital portfolio (WallStreetSurvivor begins you with $100,000) to commerce with. Make a foul commerce? You lose digital money, not your hire cash. This hands-on expertise is invaluable.

- Perceive Market Dynamics: Expertise the volatility firsthand. Watch how information impacts costs and be taught the pure rhythm of the market in a sensible, actual time surroundings with out risking something.

- Construct Confidence: Buying and selling might be emotional. Practising in a demo surroundings helps you construct confidence in your technique and your decision-making, lowering the nervousness that usually results in poor selections in reside buying and selling.

- Grasp Threat Administration: Success in buying and selling isn’t nearly choosing winners; it’s about managing losers. A simulator is the place you’ll be able to follow setting stop-loss orders and figuring out place sizes with out risking your capital.

The Two Forms of Simulators (And Which is Proper for You)

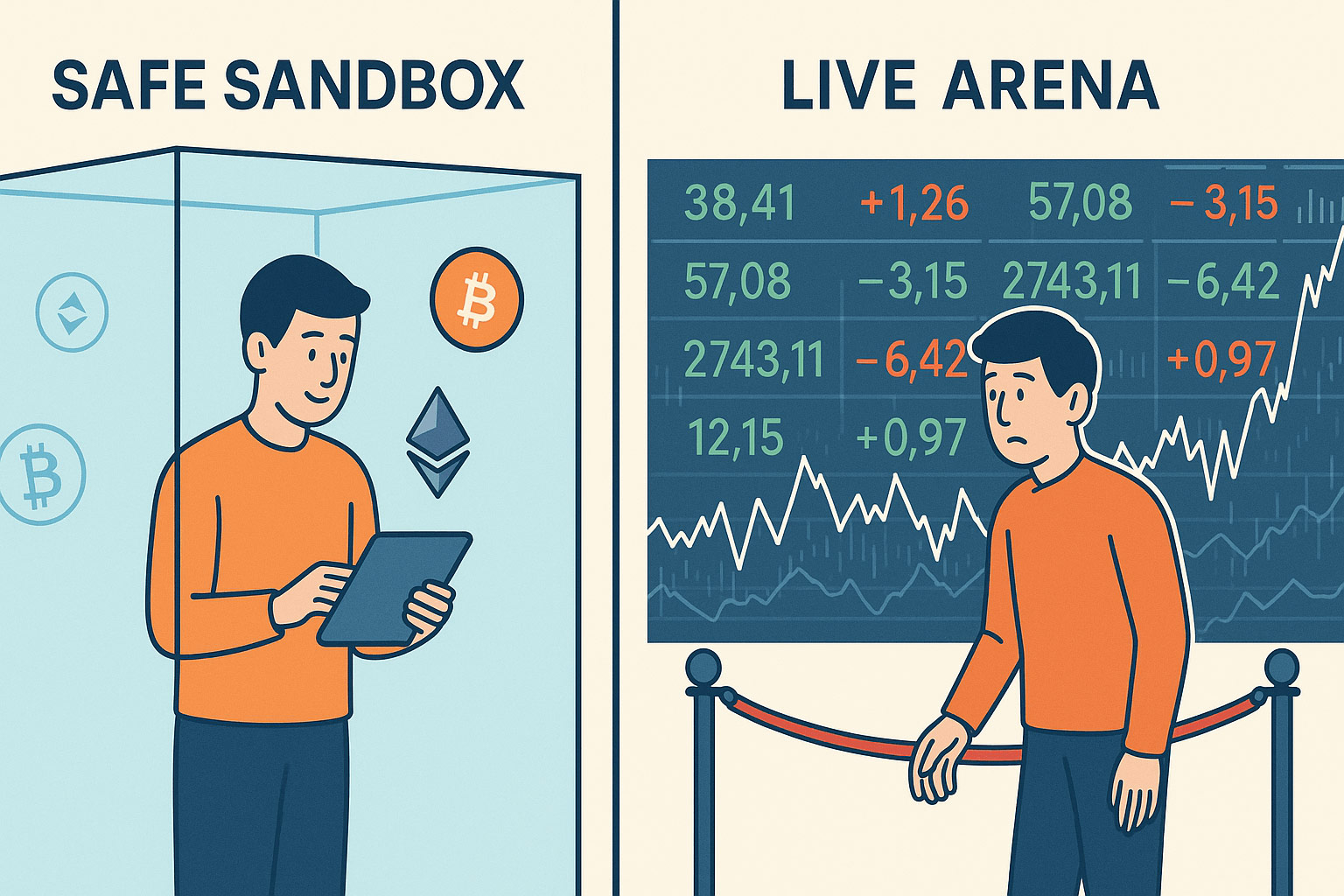

Not all follow platforms are created equal. They often fall into two classes, and selecting the best one for paper buying and selling is dependent upon your expertise degree.

1. Devoted Investor Coaching Platforms

These platforms are constructed from the bottom up as purely academic instruments. They’re utterly separate from any reside alternate.

Key Options

- Zero Connection to Actual Cash: You don’t join a checking account or bank card. There’s completely no option to by accident place an actual commerce or deposit actual funds.

- No KYC (Know Your Buyer): You possibly can enroll with a easy e-mail handle, defending your private data.

- Give attention to Schooling: They mix the buying and selling simulator with programs, articles, and tutorials designed to show you the why behind investing, not simply the how of clicking buttons.

Who it’s for: That is the most suitable option for absolute novices. The sealed-off surroundings supplies complete security, permitting you to focus 100% on studying with out risking something.

2. Alternate-Based mostly Demo Accounts

Platforms like TradingView, eToro, Binance, and the Coinbase Superior Commerce (Sandbox) supply “demo modes” which can be primarily clones of their real-money buying and selling interfaces.

Key Options

- Life like Interface: You be taught the precise structure, order sorts, and instruments of the platform you would possibly use for actual time buying and selling later.

- Typically Requires Full Account: You might must create a full account to entry the demo mode.

- One Click on from Actual Buying and selling: The demo and reside modes are sometimes only a toggle change away, making a danger {that a} newbie would possibly by accident place an actual commerce.

Who it’s for: These are glorious instruments for merchants who already perceive the fundamentals and wish to follow on the particular alternate they plan to make use of. It’s for studying the instrument, not for studying the basics.

Get Your Observe Crypto Buying and selling Account

The neatest option to strategy the crypto market is with training and follow. Don’t let the concern of dropping cash preserve you from studying. A crypto buying and selling simulator is the proper instrument to construct your information and confidence at your individual tempo. Prepared to leap in and begin paper buying and selling?

The place to Begin: The Finest Simulators for Your Targets

The “greatest” crypto buying and selling simulator relies upon completely on what you wish to accomplish. Are you making an attempt to be taught absolutely the fundamentals, grasp advanced charting, or follow on a particular alternate? Every purpose has a instrument that’s proper for the job.

Aim: “I Wish to Be taught the Absolute Fundamentals, Safely.”

That is an important purpose for anybody new to crypto. Your precedence is to be taught the basics—the way to place a commerce, how market volatility feels, and primary danger administration—in an surroundings the place it’s not possible to lose actual cash or compromise your private data.

For this, a devoted investor coaching platform is the only option. Platforms like WallStreetSurvivor are designed as utterly separate “sandboxes.” There is no such thing as a connection to a reside brokerage, no must hyperlink a checking account, and no KYC (Know Your Buyer) identification verification required to begin. This creates a zero-risk surroundings the place you’ll be able to focus completely on studying. In distinction, whereas many exchanges supply demo accounts, they typically require a full account setup and preserve you only one click on away from the reside market, which might be intimidating for newbies.

Aim: “I Wish to Be taught Methods to Learn Charts and Technical Evaluation.”

In case your predominant curiosity is studying the way to learn value charts and use technical indicators to make buying and selling selections, you’ll desire a platform with professional-grade charting instruments.

TradingView is the business commonplace on this class. Its platform gives an unbelievable suite of highly effective charting instruments, and its “Paper Buying and selling” function allows you to follow shopping for and promoting instantly on these charts with a digital portfolio. It’s an distinctive instrument for anybody critical about technical evaluation. Whereas platforms like WallStreetSurvivor present all of the important charting capabilities a newbie must follow figuring out help and resistance, TradingView gives a far deeper degree of complexity for individuals who wish to concentrate on chart evaluation.

Aim: “I Wish to Observe on the Precise Alternate I Plan to Use.”

This can be a logical step for somebody who has already discovered the fundamentals and has determined which alternate they’ll use for actual buying and selling. The purpose right here is to get accustomed to the particular interface, order sorts, and payment construction of that platform.

For this, utilizing the alternate’s built-in demo mode or “testnet” is the best choice. Binance, Bybit, and the Coinbase Superior Commerce (Sandbox) all supply strong demo environments that completely mirror their reside platforms. This is a wonderful option to keep away from pricey errors once you transition to actual cash. Nonetheless, remember that these platforms usually are not designed to educate you the way to make investments; they’re designed to show you the way to use their software program. Their interfaces might be overwhelmingly advanced for a first-time consumer.

Aim: “I Wish to Be taught and Compete with Mates.”

Studying is commonly more practical and interesting when it’s a social exercise. If you wish to create a personal league to be taught alongside buddies, problem your colleagues, and even arrange a classroom venture, you’ll want a simulator with sturdy group options.

This can be a standout function of WallStreetSurvivor. It means that you can create absolutely customizable, non-public buying and selling competitions the place you set the principles, beginning money, and invite your folks. You possibly can monitor one another’s progress on a reside leaderboard, making it a enjoyable and motivating option to be taught collectively. Most exchange-based demo accounts are solitary experiences and lack this skill to create non-public, structured studying video games.

What To Do With Your Observe Account

Okay, you’ve signed up, and you’ve got a $100,000 digital portfolio. Now what? Looking at a clean display screen might be intimidating.

The purpose of a simulator isn’t simply to click on buttons; it’s to construct expertise and habits that can shield you in the actual world. Right here’s a easy sport plan to get you began.

Observe Totally different Buying and selling Methods

Don’t attempt to turn into a professional in a single day. Begin by testing two of probably the most elementary approaches to the market.

The “HODL” Technique (Purchase and Maintain)

That is the best technique and an effective way to grasp long-term market volatility.

Use your digital funds to purchase a number of main cryptocurrencies you’ve heard of (like Bitcoin and Ethereum). Then, don’t contact them for a number of weeks. Log in every day to see how your portfolio worth adjustments.

What You’ll Be taught: You’ll expertise the emotional highs and lows of seeing your stability swing with none actual danger. It teaches persistence and helps you abdomen the volatility that scares many new buyers away.

The “Commerce the Information” Technique

This can be a extra lively strategy that teaches you the way markets react to real-world occasions.

Control crypto information. Did a significant firm simply announce a partnership with Solana? Did a brand new regulation about crypto move? When massive information hits, place a small digital commerce on the affected coin and watch what occurs subsequent.

What You’ll Be taught: You’ll start to grasp market sentiment and the way information (each good and unhealthy) may cause costs to maneuver, typically in a short time.

Be taught Fundamental Chart Studying

“Technical evaluation” sounds advanced, however it’s simply the follow of utilizing charts to identify patterns and make predictions. You possibly can be taught absolutely the fundamentals in your simulator.

Give attention to Candlestick Charts

These are the commonest charts you’ll see. All you should know to begin is that inexperienced candles imply the worth went up throughout that interval, and pink candles imply the worth went down.

Discover the Ground and the Ceiling

Within the simulator, pull up a chart for Bitcoin. Have a look at the previous couple of months. Are you able to draw a tough horizontal line connecting the bottom factors the worth has hit? That’s a possible help degree. Now do the identical for the best factors. That’s your resistance. Practising this helps you establish potential entry and exit factors.

Assist (The Ground): A value degree the place a downtrend tends to pause or reverse due to shopping for curiosity. Consider it as a flooring the worth has hassle breaking by.

Resistance (The Ceiling): A value degree the place an uptrend tends to pause or reverse. It’s a ceiling the worth struggles to push previous.

Observe Threat Administration Methods

A simulator is the proper place to construct low-risk habits with out getting harm.

Rule #1: Place Sizing

By no means put all of your digital eggs in a single basket.

On each single follow commerce you make, observe this rule: By no means make investments greater than 5% of your complete portfolio worth in a single cryptocurrency. You probably have $100,000, your most commerce measurement is $5,000. This behavior alone will forestall a single unhealthy resolution from wiping you out.

Rule #2: Use Cease-Loss Orders

Consider this as your computerized eject button.

A stop-loss is an order you place that robotically sells your crypto if it drops to a particular value. Its job is to chop your losses earlier than they turn into catastrophic.

In your subsequent follow commerce, set a stop-loss order 10% beneath the worth to procure at. When you purchase Bitcoin at $70,000, set your stop-loss at $63,000. This supplies a security internet and removes the emotion from the choice to promote. Practising this makes it a non-negotiable behavior for actual buying and selling.

Your Guidelines: What Makes a Nice Crypto Simulator?

For a newbie targeted on working towards investing in cryptocurrencies, listed below are the non-negotiable options to search for:

✅ Full Separation from Actual Cash

That is an important function for a real newbie. A devoted simulator like WallStreetSurvivor has no connection to your checking account and requires no KYC (Know Your Buyer) identification verification. This implies there’s zero danger of by accident inserting an actual commerce or compromising your monetary information.

✅ Actual-Time Market Information

The simulator ought to use reside or near-live costs. Practising with delayed information is like coaching for a race with a sluggish watch—it doesn’t put together you for the actual factor.

✅ A Huge Number of Cryptocurrencies

You must be capable of follow buying and selling not simply Bitcoin and Ethereum, but additionally different common altcoins like Solana, Cardano, and XRP. This helps you perceive how totally different elements of the market transfer.

✅ Constructed-In Academic Sources

An ideal platform doesn’t simply offer you a instrument; it teaches you the way to use it. Search for built-in programs, articles, and tutorials that designate the ideas you’re working towards, from blockchain fundamentals to buying and selling methods.

✅ Instruments for Analytics and Evaluate

You want to have the ability to look again at your paper buying and selling historical past to see what labored and what didn’t. Search for efficiency charts and commerce journals that assist you be taught out of your errors and successes.

Prepared for Actual Cash? The Finest Exchanges for Newcomers

After you’ve frolicked with paper buying and selling in a simulator, constructed confidence, and developed your buying and selling expertise, you would possibly really feel prepared to speculate actual, albeit small, quantities of cash.

- For Merchants within the US: Our prime suggestion is Robinhood, adopted by Coinbase.

- For Merchants Outdoors the US: Coinbase is probably the most accessible and widely-trusted choice.

Why Robinhood Over Coinbase for Newcomers?

While you’re prepared to speculate actual cash, each fraction of a p.c issues. The first motive we advocate Robinhood for US novices comes right down to a easy final result: you typically get extra crypto to your greenback.

Whereas Coinbase fees clear (however typically excessive) buying and selling charges on every transaction, Robinhood’s mannequin avoids these commissions. This distinction sometimes leads to a greater “fill value” to your commerce.

However don’t simply take our phrase for it. We ran a side-by-side take a look at, shopping for the identical quantity of Bitcoin on each platforms at the very same second. The distinction in how a lot crypto we obtained was important. To see the detailed breakdown, take a look at our information: Is Robinhood Secure for Crypto? A Complete Information.

The Finest Crypto Brokerages as of September 30, 2025

Rating of High Crypto Brokerages Based mostly on Charges, Options, and Signal-Up Bonuses

We’re skilled customers of dozens of crypto platforms. We keep updated on these platforms’ service choices, subscription charges, commerce commissions, and welcome bonuses. The brokerages listed beneath are for crypto buyers, and are ranked so as of total worth obtained after benefiting from their sign-up and/or referral gives.

Options:

✅ 36 cryptos

✅ No fee

✅ Crypto value alert

Signal-up Bonus:

Stand up to 1.6% extra crypto.

Be taught extra

Options:

✅ Newbie-friendly UI, easy & superior buying and selling modes

✅ Entry to over 250 cryptocurrencies

✅ 24/7 buyer help for verified customers

Signal-up Bonus:

$3-$200 in free Bitcoin in your first commerce with “spin the wheel” promo.

Be taught extra

Charges:

Easy: 1.49% + flat charges.

ActiveTrader: begins at 0.40%

Full Evaluate

Options:

✅ ActiveTrader platform with superior instruments

✅ Institutional-grade custody companies with SOC 2 compliance

✅ Crypto rewards bank card with BTC/ETH again

Signal-up Bonus:

$25 in crypto after buying and selling $100 (referral required).

Be taught extra

Charges, options, sign-up bonuses, and referral bonuses are correct as of September 30, 2025. All data listed above is topic to alter.