Are you struggling to earn money in foreign currency trading? You’re not alone. The foreign exchange market’s excessive leverage and fixed motion can result in frustration and losses. With 90% of merchants failing, it’s straightforward to really feel overwhelmed.

However don’t surrender but! By creating a constant buying and selling technique and mastering danger administration, you possibly can be a part of the ranks of profitable foreign exchange merchants. This information will present you how one can navigate the world’s largest monetary market and obtain regular income.

Key Takeaways

- Develop a constant buying and selling technique for long-term success

- Grasp danger administration strategies to guard your capital

- Preserve emotional management and buying and selling self-discipline

- Use technical evaluation instruments successfully

- Implement capital preservation methods

- Constantly analyze market traits and adapt your strategy

Understanding the Foreign exchange Market Fundamentals

The foreign exchange market is big, a lot larger than different markets. Each second, $850 million is traded. This provides as much as $7.5 trillion day by day, displaying how huge foreign currency trading is.

The Scale and Scope of Foreign exchange Buying and selling

Foreign currency trading occurs all day, day-after-day, besides weekends. This 24-hour market lets merchants act on information anytime. Due to its excessive liquidity, currencies may be traded with out huge worth adjustments.

Key Market Contributors

Many sorts of folks and teams form the foreign exchange market. These embody:

- Banks

- Companies

- Funding companies

- Central banks

- Particular person merchants

Every group has its position, making the market advanced and deep.

Market Hours and Buying and selling Classes

Foreign currency trading covers the world, following the solar:

- Asian Session

- European Session

- North American Session

These periods overlap, creating busy and risky occasions. Realizing about these periods and who trades is vital to understanding the market.

Creating a Constant Buying and selling Technique

A great foreign exchange technique is vital to being profitable within the fast-changing forex markets. Merchants who succeed know that random buying and selling is like playing. It results in unpredictable outcomes. By having a transparent buying and selling plan and doing deep market evaluation, merchants can do higher.

Take into consideration your buying and selling fashion and the way a lot danger you possibly can take. Some merchants make many trades in a short while. Others take an extended view. For instance, scalpers purpose for about 10 pips per commerce. They search for the perfect occasions to commerce, like between 8 am – 12 midday EST and a pair of am – 4 am EST.

Utilizing technical indicators could make your buying and selling plan higher. The Relative Energy Index (RSI) exhibits when costs are too excessive or too low. It’s above 70% for overbought and under 30% for oversold. Fibonacci ranges at 23.6%, 38.2%, 50%, 61.8%, and 100% assist discover good occasions to enter and exit trades.

To remain constant, maintain a buying and selling journal. Write down each commerce and what was occurring round it. This helps you enhance your technique. A powerful foreign exchange technique ought to change with the market. It would use totally different strategies to make more cash whereas conserving dangers low.

Important Threat Administration Strategies

Threat administration is vital to profitable foreign currency trading. It’s not nearly being profitable. It’s additionally about conserving your capital secure and making certain long-term success. Let’s have a look at some essential strategies for managing danger within the foreign exchange market.

Place Sizing and Leverage Management

Place sizing is essential in foreign currency trading. Skilled merchants normally danger solely 1-2% of their buying and selling stability per commerce. This is named the 1% or 2% rule, which helps shield your account from huge losses.

For instance, with a $10,000 account, you’d danger not more than $200 per commerce utilizing the two% rule. This implies you might lose as much as $200 on a commerce.

Leverage may be good and unhealthy. It may well make income larger, nevertheless it additionally will increase danger. A 100:1 leverage enables you to management a $100,000 place with simply $1,000. Watch out with leverage, even should you’re skilled.

Cease-Loss Placement Methods

Cease-loss orders are important for managing danger. They shut your place routinely when the market strikes in opposition to you by a set quantity. For instance, should you purchase EUR/USD at 1.2000, you would possibly set a stop-loss at 1.1950.

Threat-Reward Ratio Implementation

A standard risk-reward ratio in foreign currency trading is 1:2. This implies for each greenback risked, you purpose for a revenue of two {dollars}. Utilizing this ratio will help you earn money even should you win lower than half the time.

For instance, should you danger $100 on a commerce, your take-profit order ought to be set to safe $200 in income. This manner, you can also make extra money than you danger.

By utilizing these danger administration strategies on a regular basis, you possibly can maintain your buying and selling capital secure. This will increase your probabilities of success within the foreign exchange market over the long run.

The best way to Make Constant Earnings in Foreign exchange Buying and selling

Making constant income in Foreign currency trading wants technique, self-discipline, and all the time getting higher. Profitable merchants use a scientific buying and selling methodology. This methodology matches the market and their objectives.

Constructing a Systematic Method

A scientific Foreign currency trading methodology is a structured strategy to analyze markets and make trades. It contains:

- Setting clear guidelines for when to enter and exit trades

- Having guidelines for managing danger

- Choosing the right timeframes and forex pairs

Merchants with good programs typically do effectively available in the market. A great buying and selling system can win 65% of the time. This exhibits that even with losses, you possibly can keep constant.

Sustaining Buying and selling Self-discipline

Buying and selling self-discipline is vital for lasting success. It means following your plan and never making rash choices. Essential components of self-discipline embody:

- Sticking to your guidelines for coming into and exiting trades

- Following your danger administration plan

- Preserving calm throughout market ups and downs

Efficiency Monitoring and Adjustment

Monitoring your efficiency is significant for getting higher at buying and selling. Merchants ought to:

- Preserve an in depth journal of their trades

- Take a look at their win/loss ratios and common income

- Change their methods as wanted

Testing your technique with totally different forex pairs and timeframes is useful. It helps you see how effectively your technique works. This helps you enhance and alter to market adjustments.

| Side | Significance | Implementation |

|---|---|---|

| Threat Administration | Vital | 1-2% rule per commerce |

| Emotional Management | Excessive | Preserve self-discipline and endurance |

| Steady Studying | Important | Learn books, take programs, be a part of communities |

Technical Evaluation Instruments for Worthwhile Buying and selling

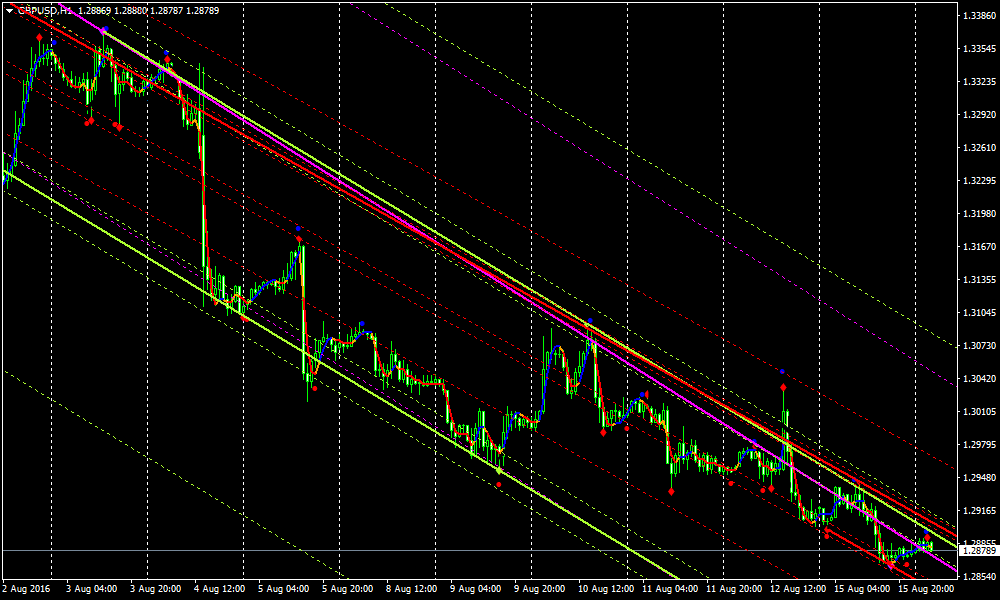

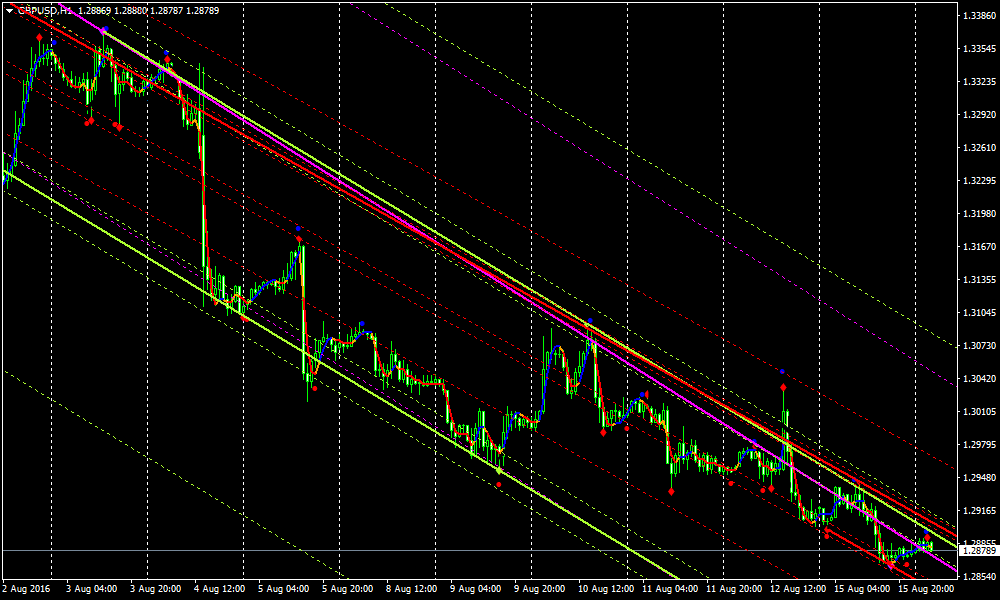

Technical evaluation is vital for a lot of foreign exchange merchants. It helps them perceive market traits and when to purchase or promote. By chart patterns and utilizing indicators, merchants make good selections.

Shifting averages are a fundamental instrument in foreign exchange evaluation. They make worth knowledge easy to indicate traits over time. Easy Shifting Averages (SMA) and Exponential Shifting Averages (EMA) are widespread. EMAs change shortly with worth adjustments, nice for short-term merchants.

Bollinger Bands® are additionally essential. They alter with market volatility. When costs hit the outer bands, it’d imply the market is overbought or oversold. This helps merchants discover when to alter their technique.

The Relative Energy Index (RSI) exhibits how briskly and the way a lot costs are transferring. An RSI above 70 means the market is perhaps overbought. Under 30 means it’s oversold. Merchants use this to search out when traits would possibly change or proceed.

| Indicator | Perform | Key Ranges |

|---|---|---|

| Shifting Averages | Pattern identification | Varies (e.g., 50-day, 200-day) |

| Bollinger Bands | Volatility measurement | Higher and decrease bands |

| RSI | Momentum measurement | 30 (oversold), 70 (overbought) |

These instruments are very helpful however don’t make issues too sophisticated. Utilizing a number of good indicators and recognizing chart patterns is a robust technique. The key to being profitable is to maintain training and all the time be taught extra.

Psychology of Profitable Buying and selling

Buying and selling psychology is vital to foreign exchange success. Emotional management and confidence are what set winners aside from losers. Let’s dive into the thoughts video games that form your buying and selling journey.

Emotional Management in Buying and selling

Controlling feelings is important for being profitable. Worry and greed can wreck your plans. Worry makes you shut offers too quickly, lacking huge wins. Greed, then again, can result in huge losses.

Coping with Losses

Losses are part of buying and selling. Winners settle for them and maintain transferring ahead. Utilizing stop-loss orders and conserving a journal helps handle feelings and be taught from errors.

Constructing Buying and selling Confidence

Confidence grows with data and expertise. Studying extra about foreign currency trading helps you make higher selections. Sticking to a plan and utilizing automated instruments may also assist.

| Psychological Issue | Impression on Buying and selling | Mitigation Technique |

|---|---|---|

| Worry | Untimely place closure | Set clear exit methods |

| Greed | Over-leveraging | Strict danger administration guidelines |

| Overconfidence | Extreme risk-taking | Common efficiency assessment |

| Frustration | Revenge buying and selling | Take breaks after losses |

By tackling these psychological challenges, merchants can construct the psychological energy wanted for fulfillment in foreign exchange.

Capital Preservation Methods

Preserving your capital secure is vital to success in foreign currency trading. Sensible merchants purpose for regular development, not fast income. Let’s have a look at good methods to maintain your capital secure within the foreign exchange market.

Account Steadiness Administration

Managing your account stability effectively is essential. Merchants shouldn’t danger an excessive amount of to maintain their cash secure. The two% rule is an efficient information, not risking greater than 2% of your capital on one commerce.

This rule helps keep away from huge losses and retains you buying and selling for a very long time.

Drawdown Prevention

Managing drawdowns is vital to avoiding huge losses. Utilizing stop-loss orders can shut trades at set costs, controlling losses. It’s additionally good to set a max drawdown, deciding how a lot loss you possibly can take earlier than performing.

Restoration Strategies

Once you lose cash, there are methods to get again on observe. The 5-3-1 foreign currency trading rule helps. It means specializing in 5 forex pairs, three methods, and one buying and selling interval.

This helps you regain confidence and consistency. Additionally, utilizing the appropriate place sizes and never overusing leverage is essential for getting your account again.

| Technique | Description | Profit |

|---|---|---|

| 2% Rule | Threat not more than 2% of capital per commerce | Limits potential losses |

| Cease-Loss Orders | Automated commerce closure at preset worth factors | Prevents huge losses |

| 5-3-1 Rule | Deal with 5 pairs, 3 methods, 1 buying and selling interval | Improves consistency and restoration |

Market Evaluation and Commerce Choice

Market evaluation is vital to profitable foreign currency trading. Merchants want to grasp the financial forces that have an effect on forex values. They research financial indicators like GDP, inflation charges, and employment figures.

These metrics present a rustic’s financial well being. They assist work out a forex’s energy.

Commerce choice relies on accurately decoding these indicators. For instance, a rising GDP means a stronger forex. Nevertheless excessive inflation could make a forex weaker.

Merchants use this data with technical evaluation. This helps them discover the perfect occasions to purchase or promote.

Central financial institution choices are essential in foreign exchange markets. Modifications in rates of interest may cause huge actions in forex values. Merchants who learn about these adjustments can predict market traits higher.

Selecting trades properly additionally means figuring out the dangers. A great technique is to purpose for a revenue that’s not less than 3 times the loss. This manner, even with fewer wins, merchants can keep worthwhile.

Bear in mind, being profitable in foreign currency trading takes endurance and self-discipline. Keep on with your plan and don’t make rash choices. Preserve bettering your evaluation expertise. With time, you’ll spot high-probability trades on this fast-changing market.

Superior Buying and selling Strategies

As foreign exchange merchants get higher, they appear into extra advanced methods to make more cash. Let’s discover some superior buying and selling strategies. They will help you do effectively within the $7.5 trillion day by day foreign exchange market.

Pattern Following Methods

Pattern buying and selling makes use of market actions to earn money. Merchants search for robust traits to comply with. This could result in huge income if the pattern retains going.

Breakout Buying and selling Strategies

Breakout buying and selling occurs when costs go previous a sure stage. It really works effectively when markets are very energetic. This may be throughout huge financial information that adjustments forex values by 1-2%.

Counter-Pattern Approaches

Counter-trend methods attempt to earn money when the market would possibly change course. They’re riskier however can repay effectively if carried out proper. Merchants who use each technical and elementary evaluation in these methods do 30% higher than those that solely use one.

It’s essential to maintain a superb risk-reward ratio, irrespective of your technique. Many professionals purpose for a 1:3 ratio. This implies risking one unit for each three models of potential achieve. This, together with good place sizing, can enhance your buying and selling success.

Conclusion

Making constant income in foreign exchange wants a mixture of technique, self-discipline, and all the time getting higher. The foreign exchange market, with over $6 trillion traded day by day, is stuffed with probabilities for good merchants. However, the journey to success is hard, with 80% of recent merchants failing of their first 12 months.

To succeed, merchants should take a whole strategy. A transparent buying and selling plan will help obtain revenue objectives by 50%. Utilizing robust danger administration, like limiting danger to 1% per commerce, can lower losses by as much as 30%. Specializing in the buying and selling course of over shortly is vital for lasting success.

Preserving feelings in examine is significant, with disciplined merchants making as much as 40% greater than impulsive ones. Preserving a buying and selling journal can enhance efficiency by about 20% over time. With 10 hours per week of studying and evaluation, these habits are the inspiration of lasting success in foreign exchange.

In abstract, whereas the foreign exchange market’s 24/5 availability and large worth swings are tempting, making constant income takes arduous work. By sticking to strong methods, managing dangers, and all the time studying, merchants can purpose for lasting success on this fast-changing monetary world.