A proven strategy to acquire customer knowledge

After shipping 20+ Minimum Viable Products (MVPs) over the past 5 years, I’ve tried so many things that failing +80% of the time started to feel fun. I quickly determined the success of MVPs to rely on initial traction: how many people actually downloaded or started using the product on any plan, free or paid.

In it all, I noticed there are 2 ways of going about early validation:

- Build the product first, then learn from users with a scrappy solution.

- Speak to users first, then build the product around first-hand insights.

Both are reasonable, but their success will depend on what you are more effective at. If you can build an MVP in under a week, great. If you can’t, speak to early adopters first and let them inform your build.

Nevertheless, speaking with users to understand their needs and then building the product around the resulting insights should be a conscious norm. Customer Development in any kind of business is a vital ingredient of lasting success because customer knowledge = great decisions. And “your decisions are only as good as your information,” as Salim Virani, co-author of The Mom Test, describes so eloquently.

This is one of many approaches to acquiring customer knowledge. Without it, you will be unable to uncover real problems and build relevant solutions.

Preceding continuous Customer Development, you need to do a Customer Discovery. Its purpose is to find Problem-Solution-Fit. You do this by conducting interviews with people before or after the MVP is built.

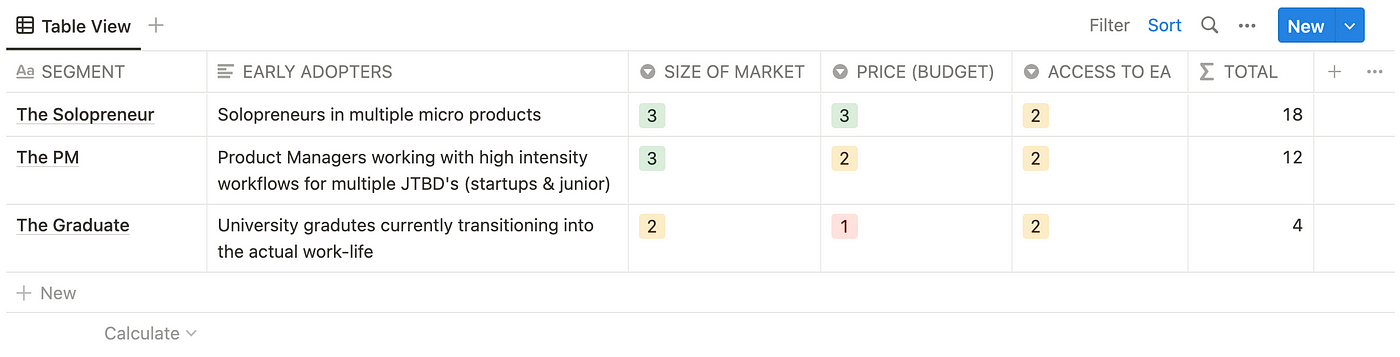

Obvious tips are trying to understand how people already deal with the problem, not pitching your solution, or letting them tell their story. But it’s essential to define who the ideal early adopters are. A simple approach for this is a SPA Treatment. This helps you decide on the highest return on time spent in conversations. In this framework, you go through 15+ Segments and the early adopters within them. Then you define the Size of the Market, Price Availability, and your Access To Early Adopters.

Scoring each of these 3 metrics on a scale of 1–3 and multiplying their sum gives you a final total, of which the highest becomes the most relevant early adopter group to prioritize. You can get the free SPA Treatment template by bootstrap.supply by clicking this link.

Lasting solutions can only come from relaying with users before, during, and after your product build.

Begin with them.

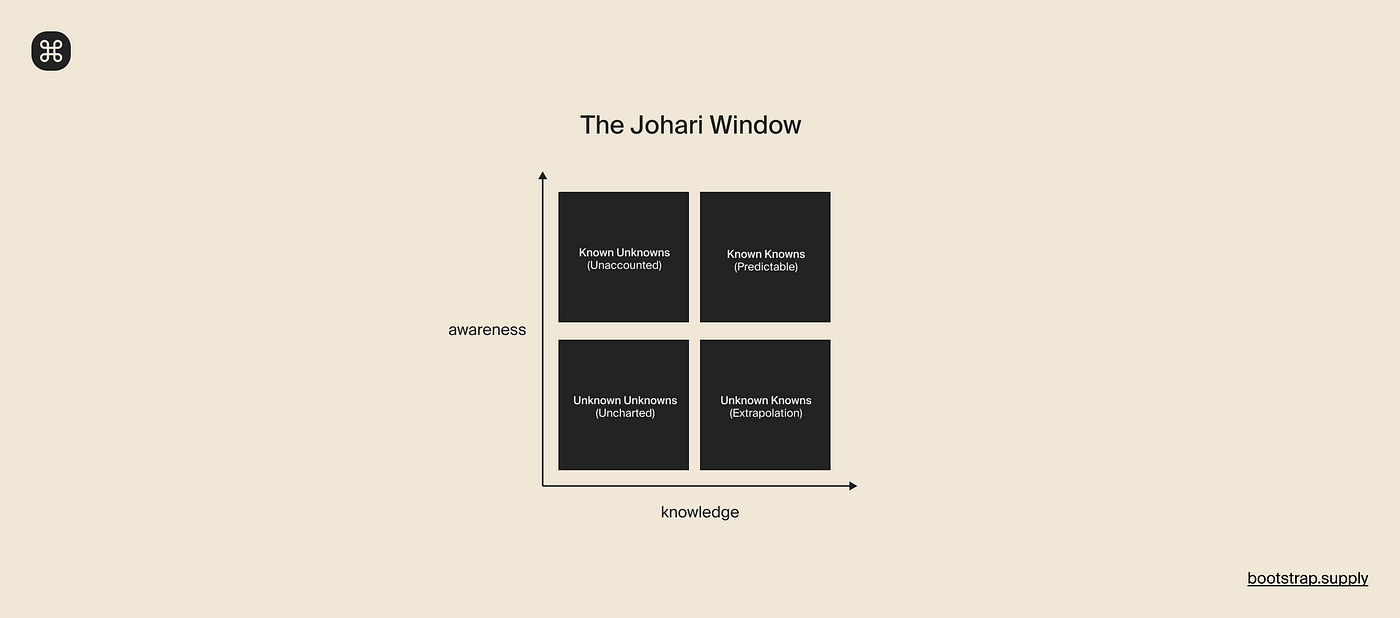

Once you’ve got your SPA Treatment locked in, it’s time to explore The Johari Window, which was originally developed to help you understand your relationship with others. Nowadays, it is applied in self-development practices, but it is advantageous when identifying a problem worth solving in its infancy. The framework is made up of 4 quadrants:

- Known Knowns → things we are aware of and understand as facts.

- Known Unknowns → things we are aware of but don’t understand.

- Unknown Knowns → things we are not aware of but understand.

- Unknown Unknowns → things we are neither aware of nor understand.

As with any early-stage idea, it’s easy to focus on the Known Knowns. That’s where the comfort zone lives, not the golden nuggets we call insights. Instead, you should focus on Known Unknowns & Unknown Knowns. Every single one of your questions & actions should be directed toward learning something so valuable it will define how your product gets built.

Don’t overcomplicate this. You can either fill out 2–3 bullet points for each quadrant or simply keep it top of mind when speaking with users.

As an entrepreneur, our duty is to empathize and understand early adopters better than they can express themselves.

Avoid thinking you know what people want.

Sales has a brilliant heuristic that goes something like this: spend only 20% talking and the remaining 80% engage in active listening.

Speaking to users early is no different. But to get the most out of your and their time, questions need to be prepped, concise, and tactical. A good rule of thumb is to ensure each question has three things:

- It explores the interviewee’s past.

- It seeks out authentic personal experiences.

- It avoids misunderstandings via hyper-specificity.

But can’t you get good results from a survey? The answer is not really. Customer Discovery is dependent on the emotional vulnerability of the interviewee. Only this can lead to a deep level of understanding.

Your skill as an entrepreneur depends on how well you can translate what you learn & hear into actionable insights.

Preparation is the end-all-be-all here.

Once you’ve formed a definite list of 10+ tactical questions that tackle the aforementioned aspects of the Johari Window, it’s time to book 15–20min calls with potential early adopters. In BOOTSTRAP OS, this is a guided process that ends up in you taking a ton of notes to capture every detail.

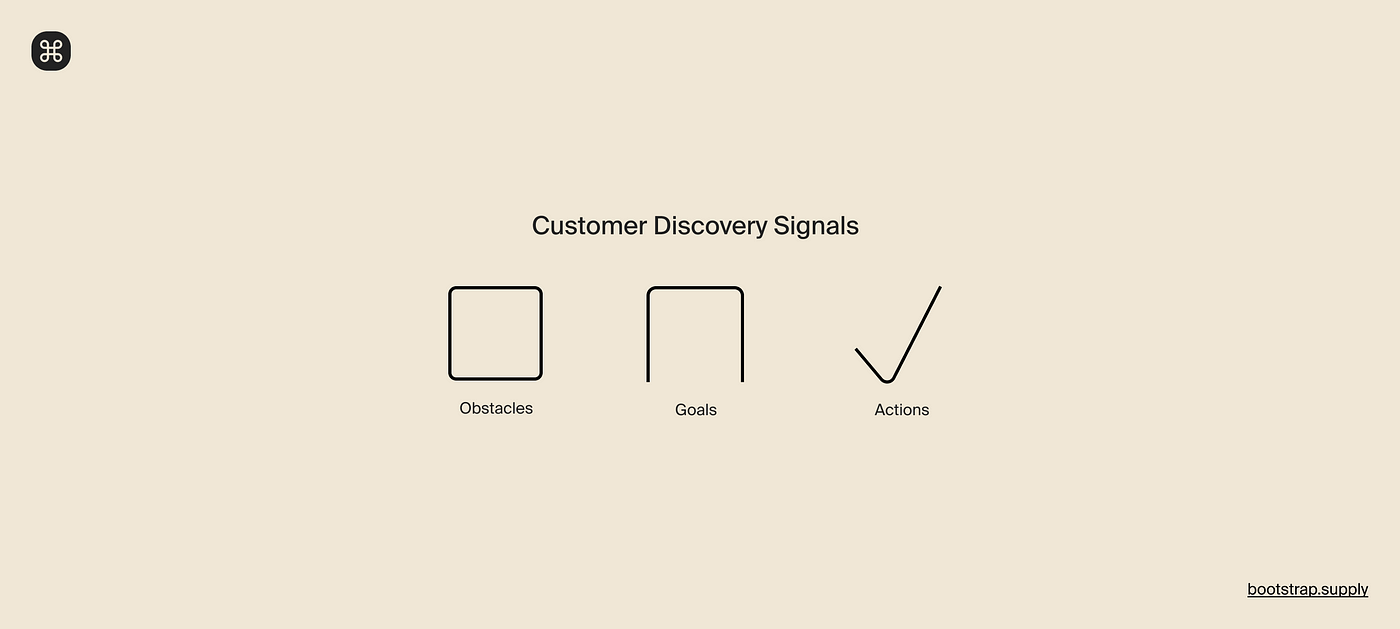

In order to make sense of what you’re hearing and taking note of, it’s helpful to identify three signals as you review your notes post-meeting:

- Obstacles → indicate areas where people experience a pain or problem.

- Goals → always exist before people consider a product. They relate to the jobs to be done and possible gains people are after.

- Actions → Do they care enough that they did something to overcome the obstacles? and did they succeed?

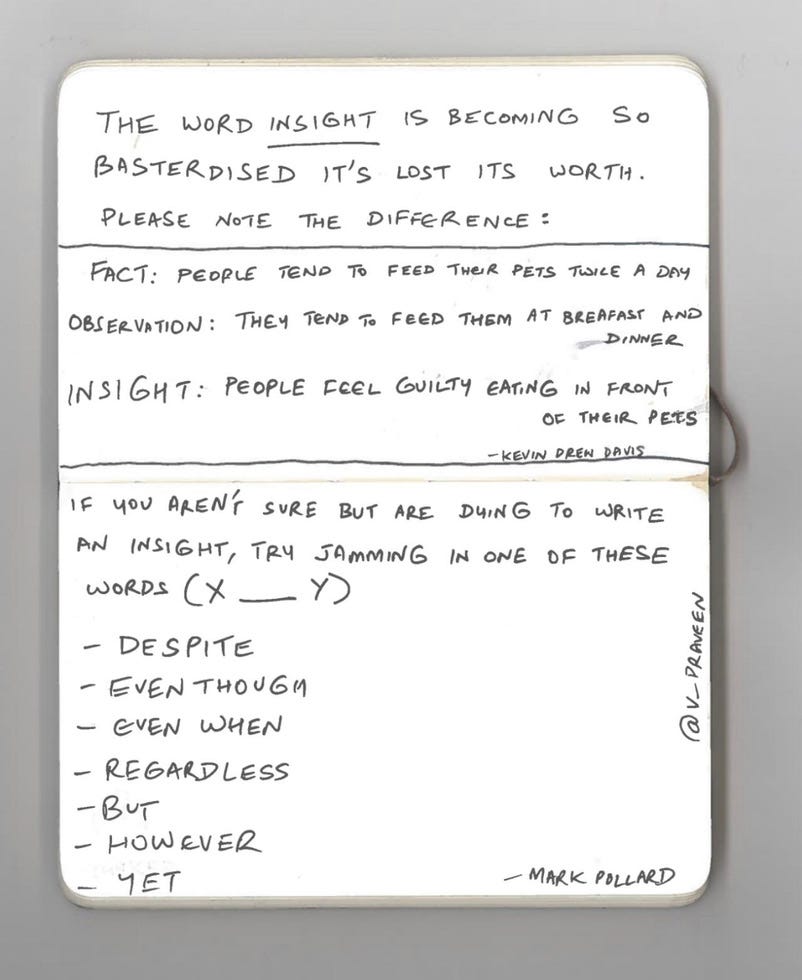

After you’ve conducted your 15–20min interviews and marked signals, it’s time to get into forming real insights based on the three signals you have marked down in your notes review. This is more difficult than it seems.

Mark Pollard, a seasoned strategist understands the nuances:

It’s important the three types of signals you found become succinct and highly relevant insights. Facts, Observations, and Signals are helpful ingredients but only combined with your grasp of human nature can they turn into hardened insights to inform solid product decisions.

Uncovering good insights is a lifelong challenge.