Out of shares (OOS) and phantom stock (PI). Two phrases that strike concern with any model no matter measurement or affect.

I grappled with each for 16 years whereas working for Provide Chain at Procter & Gamble, and now for one more two decades-plus as a co-founder and CEO serving the CPG business via Area Agent and different retail-facing ventures.

OOSs and PI, you’d agree, are particularly top-of-mind at this time, amid a multi-faceted provide chain disaster precipitated by Covid, labor shortages, inflation, and geopolitical instability.

Once we take into consideration the two-headed monster of misplaced retail gross sales (OOS and PI)…

- Buyers can’t purchase what isn’t obtainable, whether or not in-store or on-line (out of shares)

- Retailers received’t reorder what the “system is saying” is meant to be on-shelf or on-hand, even when it truly isn’t (phantom stock)

Now we have intuitively identified for years that OOSs and PI are distinguished points throughout the bigger area of on-shelf availability (OSA). An area of essential significance to manufacturers, particularly as provide chain points proceed to be an issue at retail.

- However simply how urgent are the issues of out of shares and phantom stock?

- And what can manufacturers do to fight this two-headed monster?

We teamed up with our associates at SupplyPike, an modern firm providing cloud-based instruments to assist CPGs handle and monitor their relationships with retailers, to discover this urgent subject.

We even performed an audit of three stock-keeping-units (SKUs) throughout 85 Walmart Supercenters.

Our outcomes are in, so let’s get proper all the way down to it. First, although, a short video the place I share a number of observations about OSA, OOSs, and PI from my profession in CPG retail…

Auditing On-Shelf Availability: 3 SKUs, 85 Shops

SupplyPike introduced the analytics.

We, Area Agent, introduced the OSA-auditing capabilities.

First, utilizing its retail intelligence system, SupplyPike recognized three SKUs throughout 85 Walmart Supercenters and, for every SKU-store combo, approximated an “in-stock likelihood” based mostly on Retail Hyperlink knowledge.

We can not supply exact identifying-information in regards to the three SKUs analyzed by SupplyPike, however, typically, they is perhaps described as:

- A “checkout” station merchandise – sturdy, roughly $10

- A “sporting items” merchandise – sturdy, roughly $20

- A “child toy” merchandise – sturdy, roughly $12

Second, via the Area Agent Market, we launched an OSA audit of all 255 SKU-store mixtures—taking photographs of inventory ranges and counting the precise variety of SKUs obtainable on-shelf. The audit was accomplished March 19-27, 2022.

Lastly, we decided the presence of OOSs and, working with SupplyPike, confirmed whether or not phantom stock existed.

What did we discover?

Listed here are the outcomes, adopted by some sensible observations and recommendation from my years of observing and managing OSA.

Outcomes: Out of Shares

In Area Agent’s OSA audit of three SKUs, together with a “checkout” merchandise, a sporting items merchandise, and a child toy merchandise, we requested our auditors, or “brokers,” to first find the product in a particular part of their assigned Walmart Supercenter.

After finding the merchandise (or discovering the place the merchandise was presupposed to be), brokers used the Area Agent app to take an image of the SKU and enter the variety of items obtainable on-shelf.

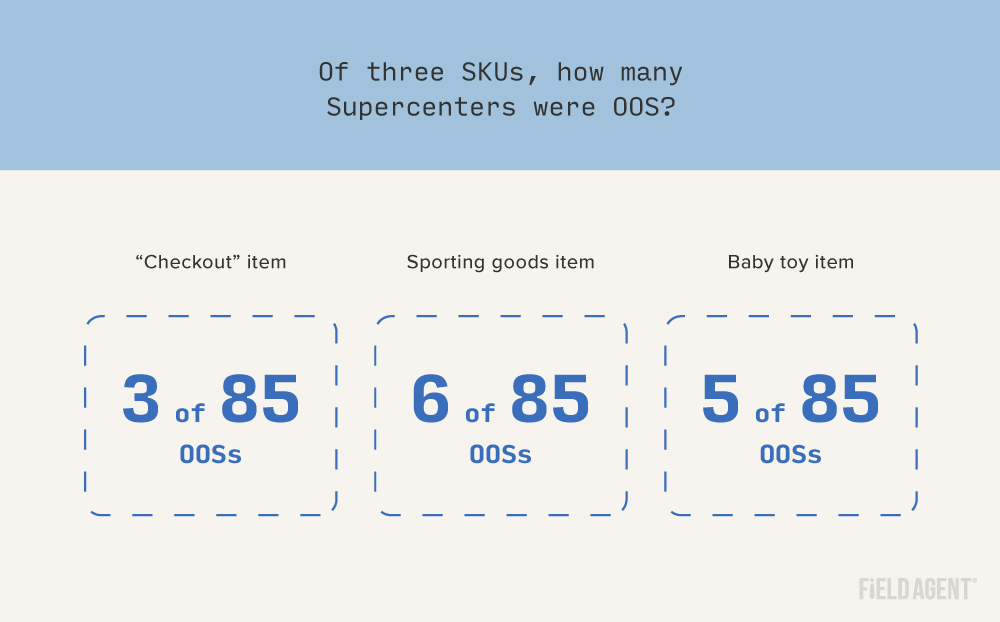

So, of the three SKUs, what number of Supercenters had been out of inventory? We discovered…

- “Checkout” merchandise – 3 OOSs

- Sporting items merchandise – 6 OOSs

- Child toy merchandise – 5 OOSs

But that’s hardly the complete story, as a result of a few of these objects had been lacking from retailer cabinets totally. In different phrases, our brokers couldn’t even discover the shelf tag the place they had been presupposed to be, as follows:

- “Checkout” merchandise – 6 distinctive cabinets with no tags

- Sporting items merchandise – 6 no-tags

- Child toy merchandise – 26 no-tags

Altogether, between OOSs and no-tags, about 20% of 255 whole SKU-store mixtures had been unavailable for buy. Put merely, in 1-of-5 audited shops, a client would not have been in a position to buy the required SKU – even when they wished to.

Moreover, one other 17% had been critically low on stock (i.e., solely 1-2 items obtainable), as follows:

- “Checkout” merchandise – 5 critically low

- Sporting items merchandise – 15 critically low

- Child toy merchandise – 23 critically low

However, a query stays: Have been these OOSs and/or low-inventory ranges anticipated? In different phrases, had been items (or extra items) anticipated to be on-shelf—however the in-store actuality was completely different?

For that, let’s flip to phantom stock and SupplyPike’s evaluation of our audit knowledge.

Outcomes: Phantom Stock

Phantom stock [cue sinister laugh] is an all-too-common scenario the place a retailer’s stock system studies items on-shelf or on-hand, however the precise quantity on-shelf/on-hand is definitely smaller.

And there are a number of frequent causes of phantom stock: replenishment errors, shrink, scanning errors, improper dealing with of merchandise, and many others.

Regardless of the trigger, nevertheless, the impact is misplaced gross sales, in a number of methods:

- Manufacturers and retailers fail to comprehend when out of shares exist on-shelf

- Retailers aren’t triggered to reorder

- Fewer gross sales suppress gross sales forecasts

So, did we—SupplyPike and Area Brokers—stumble upon any phantom stock on this OSA audit of three SKUs?

Quick reply, sure. Lots.

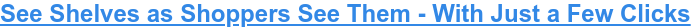

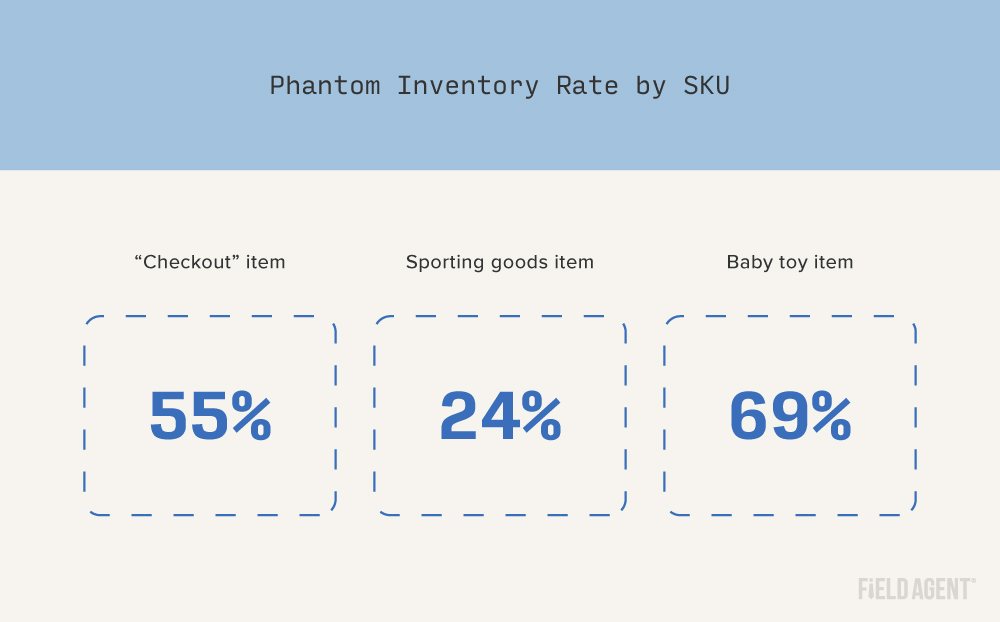

- For the “checkout” merchandise: Retail Hyperlink reported 3,417 items on-hand, whereas Area Agent’s auditors discovered 1,522 items truly on-shelf. That is a distinction of 1,895 items, or 55% of what Retail Hyperlink recommended can be obtainable

- For the sporting items merchandise: Retail Hyperlink reported 576 items on-hand; auditors counted 440 items; distinction of 136 items, or 24%

- For child toy merchandise: Retail Hyperlink reported 547 items on-hand; auditors counted 172 items; distinction of 375 items, or 69%

Wanting on the outcomes, Stacy Tan, senior director of retail technique at SupplyPike, referenced a quote made by John Furner, president and CEO of Walmart US, on the current Walmart Provider Development Discussion board:

“We don’t have an issue with demand, we’ve got an issue with provide,” Furner mentioned.

One thing to which the outcomes above clearly attest.

“We all know Walmart is constant to put further give attention to in-stocks and on-shelf availability,” Tan mentioned, “marking each as strategic keys to their development within the upcoming yr. It’s crucial that suppliers preserve their eye on the prize as effectively. Not solely is it essential to know and perceive your pipeline, however to be proactive about addressing challenges with Walmart as effectively.”

Be proactive. That is the essential level.

However let me break down our grudge-match with poor OSA even farther – and even supply some recommendation on what manufacturers can do to beat points with OOSs, PI, and OSA,

3 Observations about On-Shelf Availability

For a lot of my profession, I’ve been aware of and anxious with on-shelf availability.

What have I discovered on this time about managing OSA, OOSs, and PI?

Let’s boil it down to three issues:

1. Sluggish-moving SKUs are particularly susceptible

Fast-paced SKUs will deal with themselves over a brief time period, particularly these which might be replenished on the warehouse degree.

Nevertheless, slow-moving SKUs—these most frequently replenished by way of the meeting course of (like these audited above, almost certainly)—face essentially the most issues with on-shelf availability. Let’s simply say, they’re most susceptible to out of shares, phantom stock, and different OSA points.

Even with a wonderful system (like Provide Pike) you’ll run the chance of being fully out of stock by the point the system identifies an merchandise has stopped promoting. Then everyone knows what occurs subsequent – the tag is pulled and one other going through is moved over to scrub up the shelf.

So, as described on this primer on retail auditing, having eyes on the shelf at-retail is crucial to staying forward of OOSs and PI points with slow-moving objects.

2. Do not let down your guard with low-performing shops and markets

Historical past tends to repeat itself. If I’ve discovered something over the previous years it’s this: If a retailer/market has a difficulty this month…it would most likely have a difficulty subsequent month.

The identical for the squared-away shops/markets, too. If OOSs are low and there’s no predictor of PI, then, except there’s a main staffing change or shift in neighborhood patterns, that retailer will almost certainly proceed to carry out at a high-level going ahead.

So focusing your sources and time on drawback areas and shops is essential, and software program like Provide Pike will enable you keep forward of the sport and monitor drawback areas.

3. The grace interval has ended for OOSs

Covid and provide chain points have magnified the impression of OOSs and PI at-retail.

Previously, a provider had time to resolve an issue at-shelf.

However, at this time, an empty slot on a shelf is the kiss of loss of life; it is nearly instantly changed by one other merchandise simply to make the shelf look inviting to customers.

Combining a software program alert with an operational affirmation and repair is the brand new modus operandi for any provider severe about eliminating OOS and PI.

And that is in the end how manufacturers fight OOSs, PI, and different points with on-shelf availability…

Utilizing the suitable instruments to remain conscious.

And retail intelligence methods and retail-auditing capabilities provide the consciousness you want.

Take Inventory of On-Shelf Availability. Anyplace. Anytime.

Whether or not you’re apprehensive about out of shares, phantom stock, or one other challenge with on-shelf availability, we’ve developed an OSA audit that manufacturers should buy and launch in only a few minutes.

We will have auditors in-store, usually the exact same day, checking OSA in your SKUs—so you may take fast motion in opposition to circumstances that rob your model of gross sales.

Click on under to launch an OSA Audit at this time.