US Greenback Vs Euro, British Pound, Australian Greenback – Value Setups:

- EUR/USD is testing key help, whereas GBP/USD has fallen underneath an important flooring.

- AUD/USD is again on the decrease finish of the latest vary; USD/JPY eyes psychological 150..

- What’s subsequent for EUR/USD, GBP/USD, AUD/USD, and USD/JPY?

Really useful by Manish Jaradi

Enhance your buying and selling with IG Shopper Sentiment Information

The US greenback has damaged key resistance ranges in opposition to a few of its friends as higher-for-longer charges view solidifies after the US Federal Reserve final week signaled yet another fee hike earlier than the top of the 12 months and fewer fee cuts than beforehand indicated. For a extra detailed dialogue, see “US Greenback Will get a Increase from Optimistic Fed; EUR/USD, GBP/USD, AUD/USD,” revealed September 21.

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

EUR/USD: Assessments main help

EUR/USD’s break final week under the higher fringe of a rising channel from early 2023, coinciding with the Could low of 1.0630, confirms the medium-term upward strain has light. The pair is now testing the January low of 1.0480 – a break under would pose a severe risk to the medium-term uptrend that began late final 12 months. Subsequent help is on the decrease fringe of the Ichimoku cloud on the weekly chart (now at about 1.0300). On the upside, EUR/USD wants to interrupt above the September 20 excessive of 1.0735 at minimal for the rapid draw back dangers to dissipate.For a dialogue on fundamentals, see “Euro May Be Due for a Minor Bounce: EUR/USD, EUR/JPY, EUR/GBP, Value Setups,” revealed September 19.

GBP/USD Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

Really useful by Manish Jaradi

How one can Commerce the “One Look” Indicator, Ichimoku

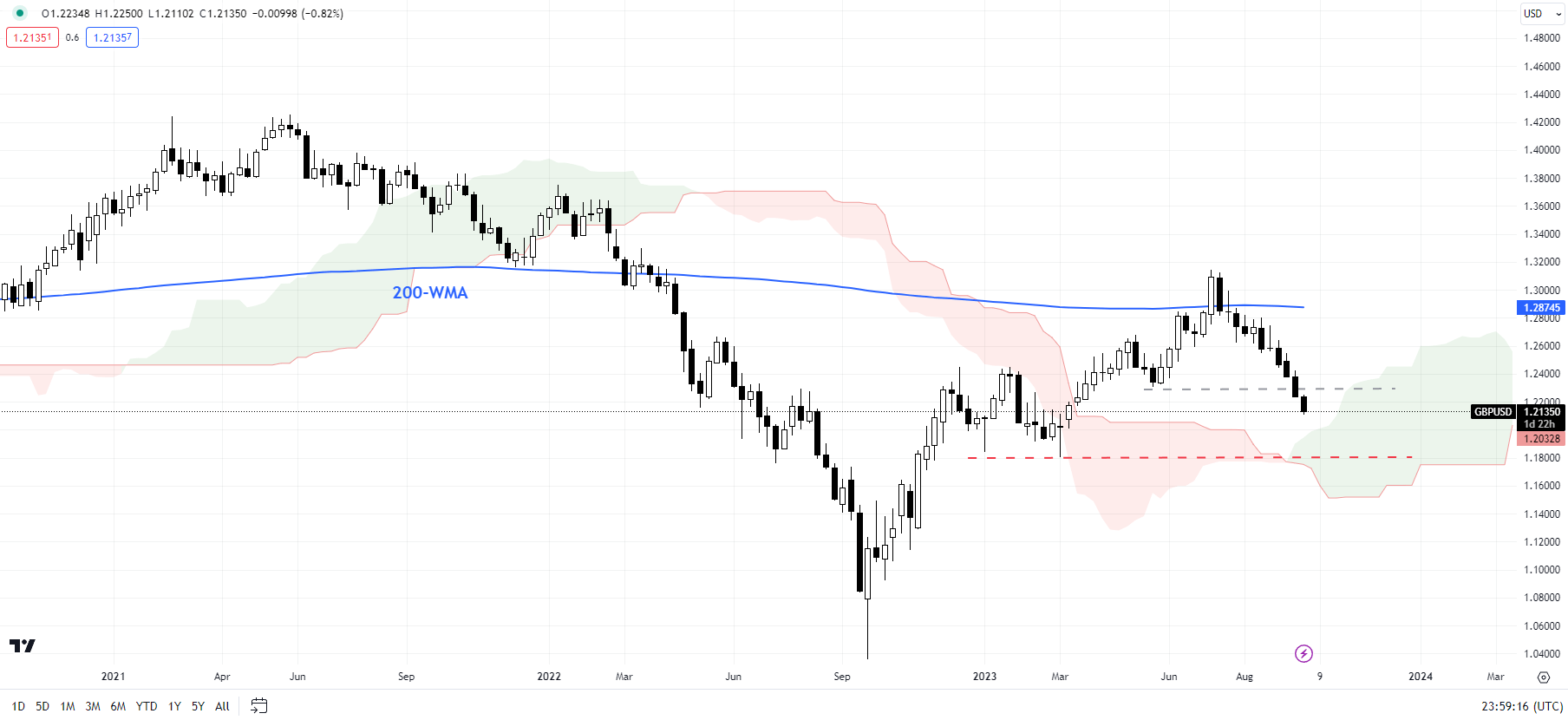

GBPUSD: Bearish bias intact

GBP/USD has fallen underneath an important flooring on the Could low of 1.2300, briefly disrupting the higher-low-higher-high sequence since late 2022. The retreat in July from the 200-week shifting common and the following sharp decline raises the percentages that the retracement is the correction of the rally that began a 12 months in the past. For extra dialogue, see “Pound’s Resilience Masks Broader Fatigue: GBP/USD, EUR/GBP, GBP/JPY Setups,” revealed August 23. The subsequent vital help is on the March low of 1.1800. A fall under 1.1600-1.1800 would pose a danger to the broader restoration that began in 2022.

AUD/USD Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

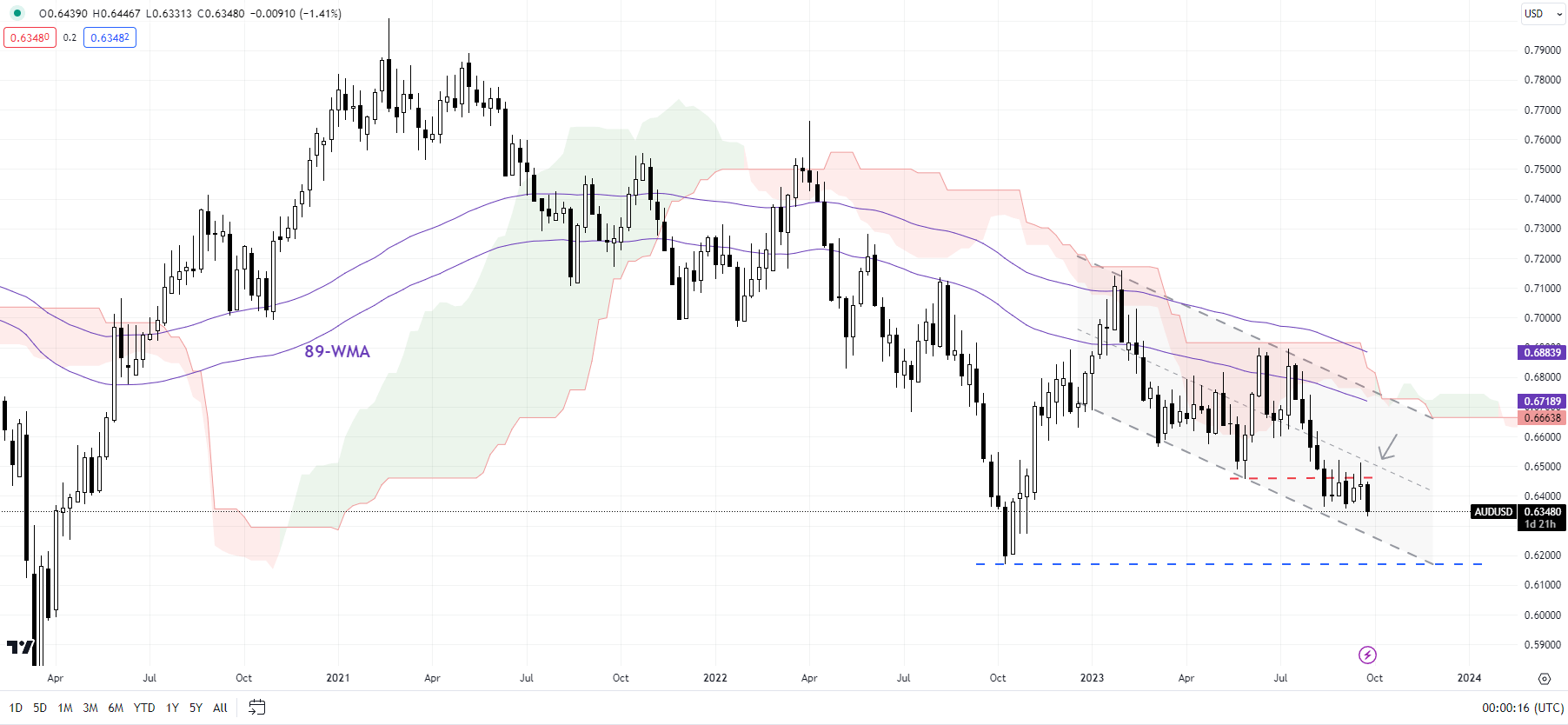

AUD/USD: Retests the decrease finish of the latest vary

AUD/USD is making an attempt to interrupt under the decrease finish of the latest vary at 0.6350. This follows a retreat from pretty robust converged resistance on the August excessive of 0.6525, coinciding with the higher fringe of a rising channel since early September. Any break under 0.6350 may expose draw back dangers towards the November 2022 low of 0.6270. Under that the subsequent help is on the October low of 0.6170.

USD/JPY Weekly Chart

Chart Created by Manish Jaradi Utilizing TradingView

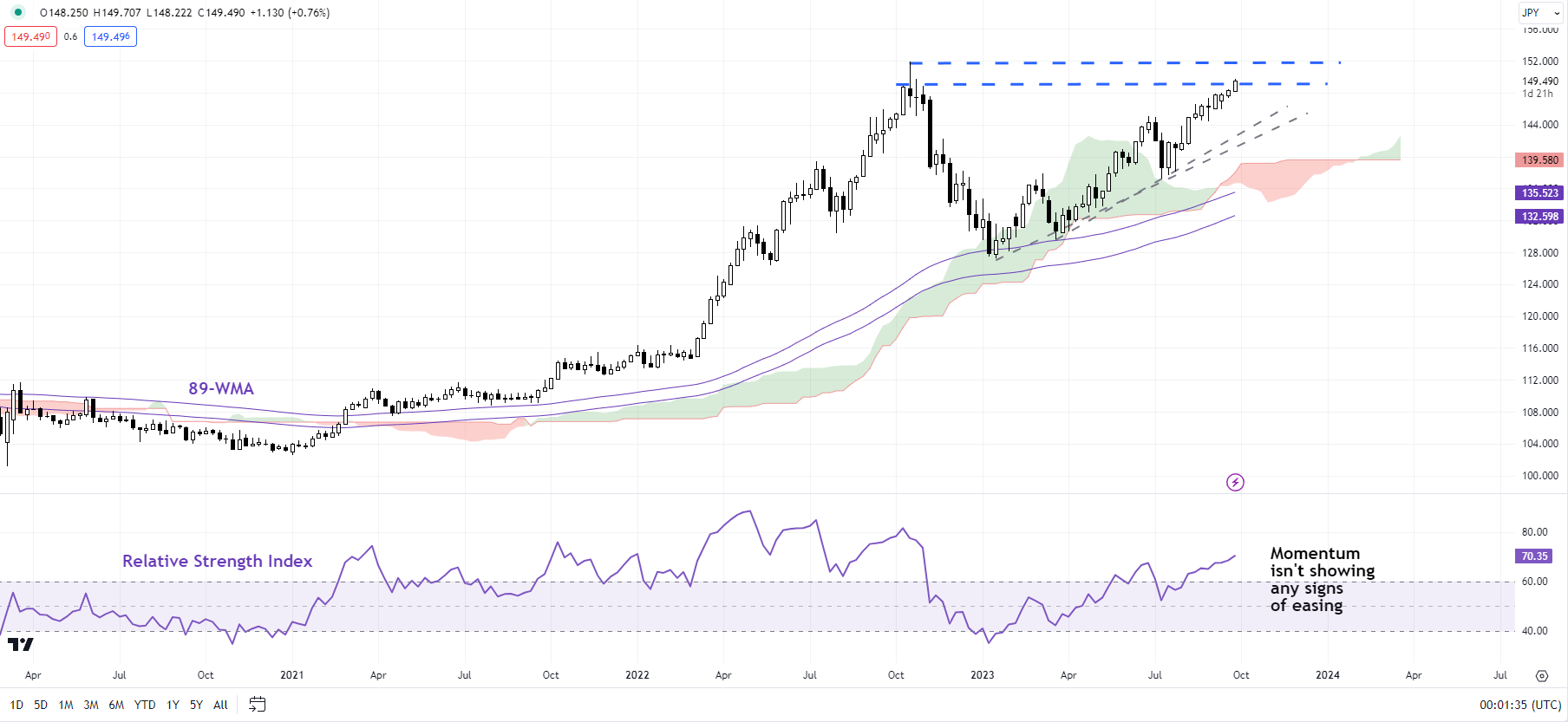

USD/JPY: Psychological barrier at 150

USD/JPY is approaching the psychological barrier at 150, not too removed from the 2022 excessive of 152.00. There isn’t a signal of reversal of the uptrend, whereas momentum on the weekly charts isn’t exhibiting any indicators of fatigue. This implies the pair may give a shot at 152.00. For the rapid upward strain to start easing, USD/JPY would wish to fall under the early-September excessive of 147.75. Above 152.00, the subsequent stage to observe can be the 1990 excessive of 160.35. For extra dialogue, see “Japanese Yen After BOJ: What Has Modified in USD/JPY, EUR/JPY, AUD/JPY?” revealed September 25.

Really useful by Manish Jaradi

Traits of Profitable Merchants

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and observe Jaradi on Twitter: @JaradiManish