Japanese Yen (USD/JPY) Evaluation

- Greenback response to sizzling CPI knowledge sends USD/JPY larger

- USD/JPY enters a hazard zone because the FX intervention risk looms

- Greenback yen breaks 152.00 and enters overbought territory

- Elevate your buying and selling expertise and achieve a aggressive edge. Get your palms on the Japanese Yen Q2 outlook as we speak for unique insights into key market catalysts that needs to be on each dealer’s radar:

Really useful by Richard Snow

Get Your Free JPY Forecast

Greenback Response to Sizzling CPI Knowledge Sends USD/JPY Greater

The disconnect between the greenback and US yields in current buying and selling classes offered a chance for USD bulls to bridge the hole if inflationary pressures confirmed up within the March CPI report. Certainly, US CPI beat consensus estimates throughout the board with headline and core inflation surpassing expectations on each the year-on-year in addition to month-on-month readings.

Within the buildup to the information, US 10 and 2-year treasury yields had been rising steadily whereas the US greenback – through the US greenback basket (DXY) – was experiencing a decline. In response to the inflation knowledge, US yields shot up much more, compelling the greenback to observe swimsuit, leading to the next USD/JPY worth. The chart beneath highlights the transfer in USD/JPY and the growing yield differential between the US and Japan which helps to drive the carry commerce.

USD/JPY Day by day Chart with the US/Japan 10-year yield differential

Supply: TradingView, ready by Richard Snow

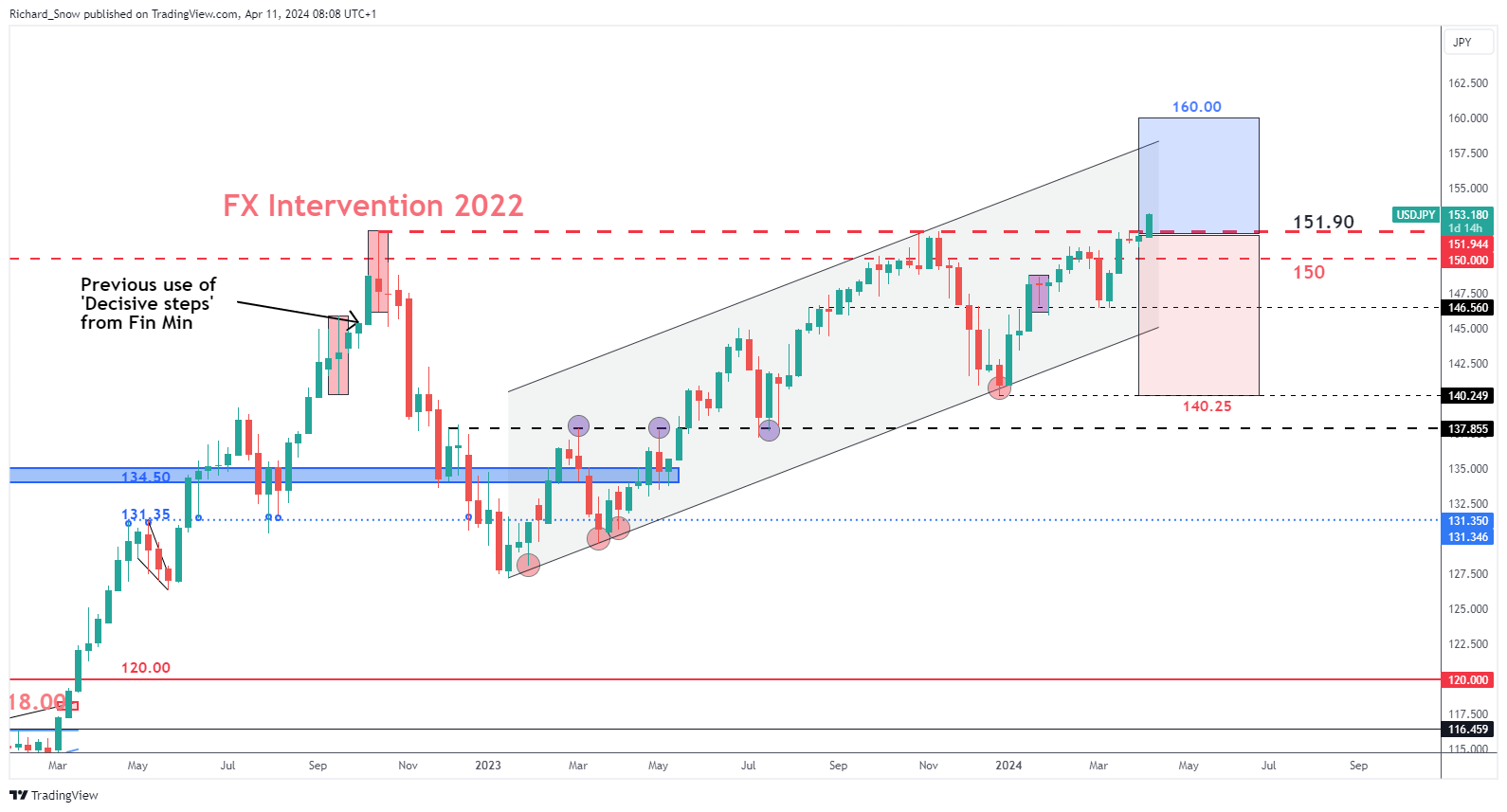

USD/JPY Enters a Hazard Zone because the FX Intervention Risk Looms

With USD/JPY round 153.00, each the finance minister and deputy finance minister issued their displeasure on the unfavourable volatility related to the yen’s current decline. The messages echoed what we’ve heard earlier than nonetheless, the finance minister Mr Suzuki addressed the degrees of 152.00 and 153.00 when explaining it isn’t the extent of greenback yen that’s in focus, relatively the background that has led to the weak point. However, USDJPY trades above the prior intervention stage (152.00) and seems to carry comfortably round 153.00.

The chart beneath supplies context for the pair, charting a brand new path at such elevated ranges. The blue and purple rectangles have been used as guides primarily based on the typical worth transfer exhibited over the past two quarters. The potential upside goal seems unrealistic because the finance ministry and BoJ are prone to intervene properly earlier than costs get that top, whereas the draw back stage might come into play ought to FX intervention be deployed to strengthen the yen amid the prospect of one other charge lower from the BoJ later this 12 months. One factor that continues to work in opposition to the yen is the truth that the carry commerce continues to be very interesting, borrowing yen at low rates of interest to put money into the higher-yielding USD. Moreover, given sturdy financial, jobs and inflation knowledge, the Fed is prone to think about fewer charge cuts this 12 months and probably deciding to carry charges at present ranges.

USD/JPY Weekly Chart

Supply: TradingView, ready by Richard Snow

The greenback yen pair is likely one of the most liquid, most extremely trades pairs within the phrase. It has sturdy hyperlinks to worldwide commerce and is well-known for facilitating the ‘carry commerce’ . Discover out extra by studying the DailyFX information beneath:

Really useful by Richard Snow

The way to Commerce USD/JPY

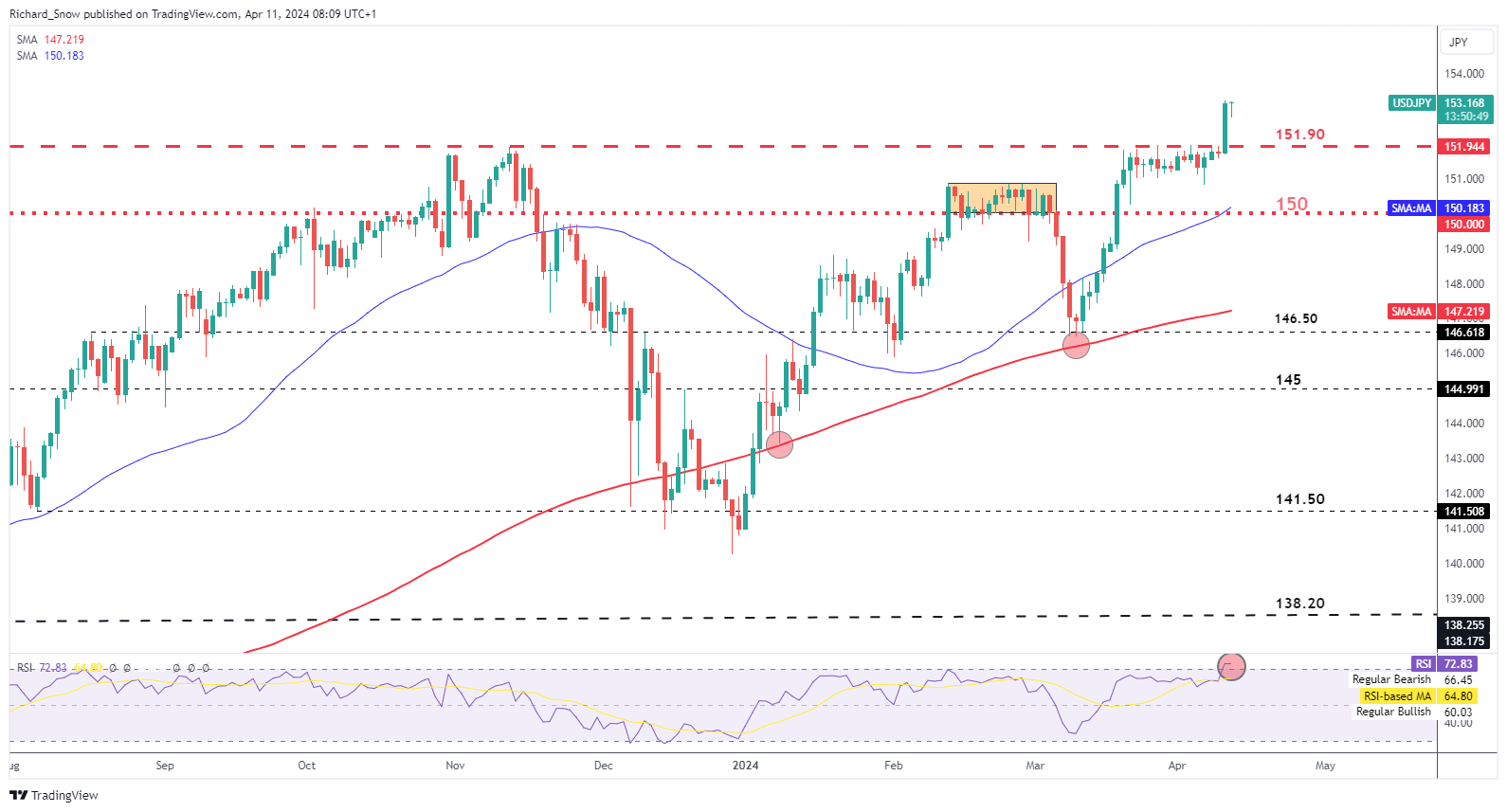

USD/JPY Breaks 152.00 and Enters Overbought Territory

USD/JPY held the in a single day stage, round 153.00 because the pair enters overbought territory. Earlier than the bullish catalyst, the pair had traded inside a slim vary beneath the 152.00 marker. The chance-to-reward ratio of a bullish continuation seems extremely unfavourable at such elevated ranges. Preserve a watch out for communication suggesting the BoJ/finance ministry has contacted banks in search of FX quotes – if the prior intervention playbook can be utilized.

USD/JPY Day by day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX