Shares had a back-and-forth day forward of at the moment’s report, which may tackle some additional weight concerning the outlook for charge cuts.

Expectations are for the to rise by 0.3% m/m, down from 0.4% m/m final month, whereas rising by 3.4%, up from 3.2%. In the meantime, the is forecast to rise by 0.3% m/m, down from 0.4% final month, and by 3.7% y/y, down from 3.8%.

The swaps market has been fairly constant right here and nonetheless thinks the CPI is available in at 3.4% on the y/y headline quantity and by 0.3% m/m.

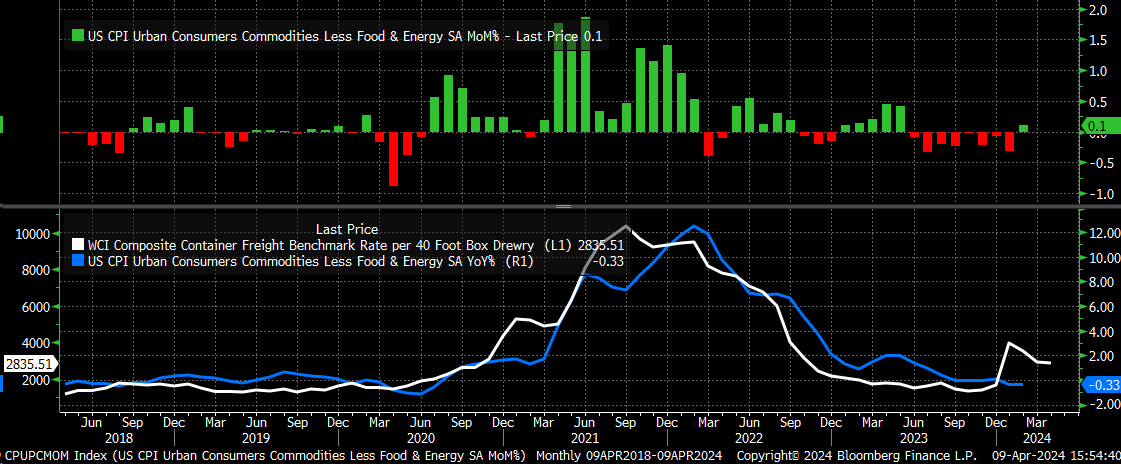

The deciding issue on the headline CPI charge will most likely be power and good costs. These have been the large disinflation narrative in latest months, and gasoline costs have risen considerably in March.

Moreover, we noticed items inflation come again to life in February, which adopted that important enhance in transport prices. Final month was the primary time since Could 2023 that there was a optimistic studying on the CPI commodities, much less meals and power.

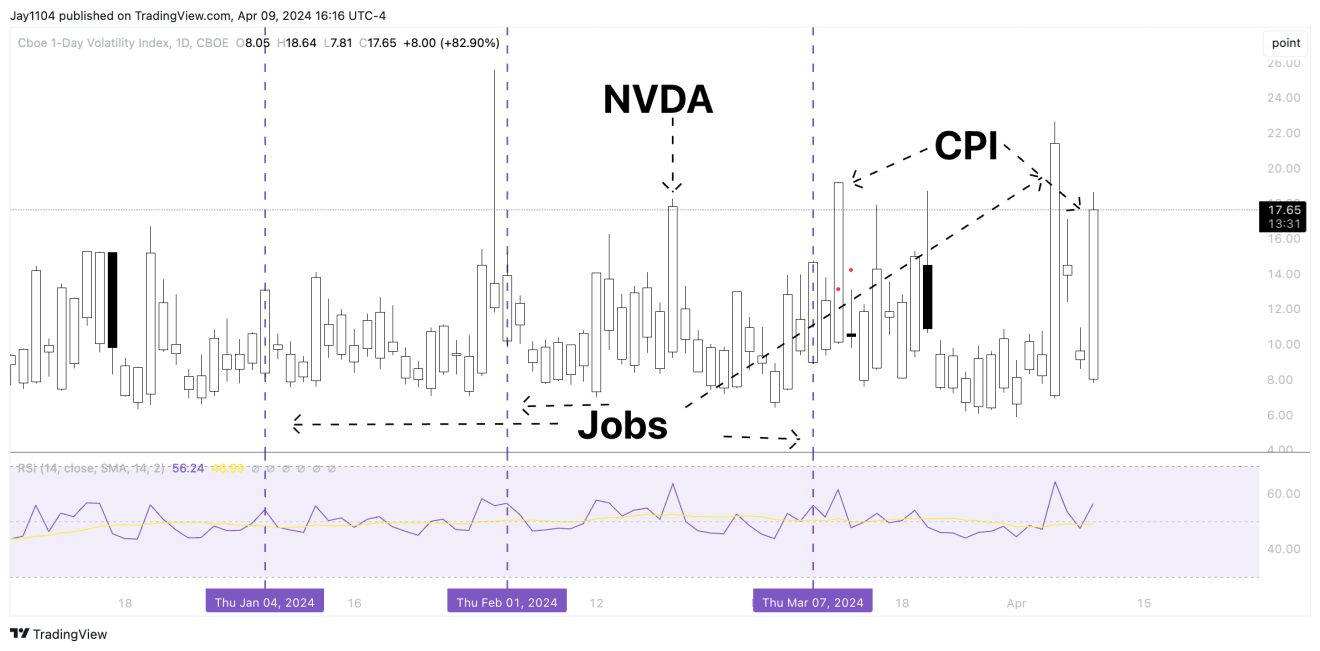

Within the meantime, the was in all places yesterday, opening greater and dropping sharply noon solely to snap again into the shut.

I’m unsure what drove the end-of-day a part of the day. Bostic was making feedback round 3:25 PM ET, however the rally began properly earlier than that.

The 1-day completed greater on the day, closing round 18 and up 8 factors, so it was an enormous transfer. One would count on the VIX 1D worth to drop sharply at the moment; how far it drops will probably decide if the fairness market rallies.

We noticed a rally following the Job report and a rally following final month’s CPI report, so given the VIX 1-day degree yesterday, it appears attainable to see a rally at the moment, even when the CPI quantity isn’t favorable, on a volatility reset.

We can have a public sale at the moment at 1 PM, following the CPI report. The public sale wasn’t nice yesterday with oblique acceptance coming in low at 60%, and the 2 bps tail on the excessive yield charge.

Clearly, with the danger of the CPI report faraway from the equation, we may see a greater public sale at the moment.

The ten-year closed yesterday at 4.36%, so proper on help. It appears evident that if the 10-year break help is at 4.35%, it may drop additional to round 4.15%, with resistance round 4.5% to 4.55%.

Right this moment, we may also get the Fed , which have been principally forgotten, it appears. I believe the minutes will present that the Fed’s consensus was a lot nearer to 2 charge cuts than the three charge cuts seen within the dot plot. Moreover, it ought to give us some clues on the tempo of the QT slowdown.

Authentic Publish