As AI purposes transfer from experimental prototypes to manufacturing environments, organizations face important challenges guaranteeing reliability, visibility, and efficiency. Conventional monitoring instruments fall quick when coping with advanced multi-agent techniques, leaving corporations unable to successfully debug or enhance their AI implementations. HoneyHive supplies an AI agent observability and analysis platform that permits organizations to systematically check, consider, and monitor AI brokers all through their complete lifecycle. Constructed on OpenTelemetry requirements, the platform gives complete visibility into AI techniques, displaying not simply outputs however the complete determination journey—revealing how conclusions had been reached, the place techniques falter, and what patterns result in failures. By closing the loop between manufacturing incidents and growth, HoneyHive creates a whole system of file that variations all traces, prompts, instruments, datasets, and evaluations, enabling enterprises to deploy AI with confidence and obtain actual ROI from their investments.

AlleyWatch sat down with HoneyHive CEO and Founder Mohak Sharma to be taught extra concerning the firm’s launch, enterprise, its future plans, and up to date funding spherical.

Who had been your traders and the way a lot did you elevate?

We raised a complete of $7.4M in Seed funding, consisting of a $5.5M Seed spherical led by Perception Companions and our beforehand unannounced $1.9M Pre-Seed spherical led by Zero Prime Ventures. Our Seed spherical noticed participation from Zero Prime Ventures, 468 Capital, and MVP Ventures, whereas our Pre-Seed included AIX Ventures, Firestreak Ventures, and notable angel traders like Jordan Tigani (CEO at Motherduck) and Savin Goyal (CTO at Outerbounds). We’re significantly excited to welcome George Mathew, Managing Director at Perception Companions, to our board of administrators.

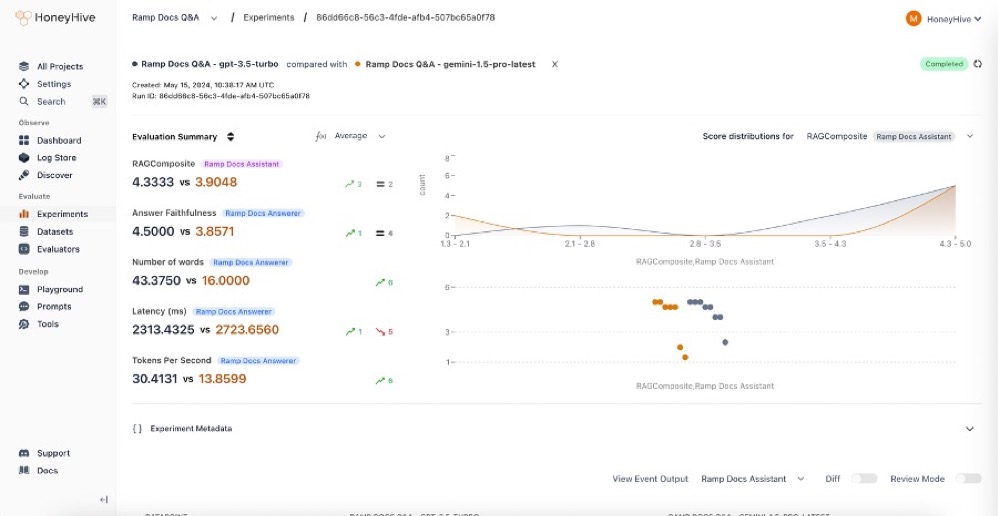

Inform us concerning the services or products that HoneyHive gives.

At HoneyHive, we offer an AI agent observability and analysis platform that helps organizations construct dependable AI-powered merchandise. Our platform permits groups to systematically consider AI brokers all through the complete lifecycle – from preliminary growth by manufacturing deployment. Constructed on OpenTelemetry requirements, we provide complete visibility into AI techniques, displaying not simply outputs however how conclusions had been reached, the place techniques get caught, and what patterns result in failures. We shut the loop between manufacturing incidents and growth by capturing failure situations, creating check circumstances, and guaranteeing future iterations don’t repeat errors. Our platform serves as a whole system of file that variations all traces, prompts, instruments, datasets, and evaluators all through the AI growth lifecycle.

What impressed the beginning of HoneyHive?

Dhruv (Druv Singh, Cofounder) and I met as roommates at Columbia College the place we regularly mentioned beginning an organization collectively. After commencement, we gained expertise in several areas of AI and knowledge science. I labored at Templafy, constructing out knowledge and AI platforms, whereas Dhruv labored at Microsoft, together with on the OpenAI Innovation Crew inside the Workplace of the CTO that was accountable for primarily collaborating with OpenAI. Our experiences revealed a major hole between AI prototypes and production-ready techniques. We noticed groups constructing promising AI purposes that will break in surprising methods when deployed, with no correct instruments to grasp what was occurring or easy methods to systematically enhance. This basic problem impressed us to create HoneyHive – a brand new “DevOps stack” for AI focusing particularly on agentic workflows and complicated, multi-step logic.

How is HoneyHive completely different?

HoneyHive differentiates itself in a number of methods:

- It bridges the hole between growth and manufacturing environments, permitting groups to catch regressions and failures rapidly, then systematically repair them.

- It’s designed particularly for multi-step AI pipelines and agentic workflows, monitoring every step as a first-class entity with customized metrics and checks.

- In contrast to conventional software program observability instruments, HoneyHive is constructed to deal with big volumes of AI “occasions,” together with multi-megabyte spans from massive context home windows.

- It’s actually enterprise-ready, providing numerous deployment choices together with commonplace SaaS, single-tenant SaaS, and on-premises deployments in prospects’ personal VPCs behind their firewalls.

- It’s constructed on OpenTelemetry requirements to combine with present infrastructure slightly than changing it.

The platform creates a collaborative system of file for AI growth, guaranteeing full auditability and traceability.

What market does HoneyHive goal and the way large is it?

We goal organizations constructing and deploying AI purposes, starting from small startups to Fortune 100 enterprises. Initially, we centered on smaller AI startups, however by 2024, we expanded to serve Fortune 100 insurance coverage corporations and banks trying to deploy generative AI in manufacturing with reliability and compliance. Our platform is especially precious for groups constructing advanced AI pipelines with multi-step logic, retrieval from vector databases, and agentic workflows. The enterprise AI market is substantial and rising quickly as extra corporations transfer from experimental AI initiatives to manufacturing deployments in search of actual ROI.

We count on our whole TAM to be $36.2B however given AI remains to be in its nascent stage, the true market alternative is probably going bigger.

What’s your enterprise mannequin?

We provide usage-based pricing mannequin with completely different deployment choices for enterprises, together with commonplace SaaS, single-tenant SaaS, and on-premises deployments. We’ve designed our pricing construction to be accessible for each startups and Fortune 100 corporations because it’s based mostly off of utilization, i.e. quantity of telemetry logged out of your AI brokers.

How are you making ready for a possible financial slowdown?

We’re centered on constructing a sustainable enterprise that delivers clear ROI for our prospects. By serving to corporations deploy AI that truly works in manufacturing, we’re straight tied to their capacity to generate worth from AI investments, which stays a precedence even in difficult financial occasions since AI is usually seemed upon as a technique to cut back working expenditure. We’re additionally sustaining excessive capital effectivity whereas we develop and guaranteeing we’ve a number of years of runway to climate any market situations.

What was the funding course of like?

Our funding course of was pushed by robust product-market match and buyer validation. We had been lucky to attach with traders who deeply understood the AI house and acknowledged the essential want for analysis and observability as AI strikes into manufacturing environments. Our Seed spherical got here collectively in lower than 3 weeks with a number of term-sheets as traders noticed the traction we had been gaining with early prospects, significantly inside the Fortune 500.

What are the largest challenges that you just confronted whereas elevating capital?

The largest problem was conveying the technical complexity of what we’re fixing in a means that was accessible to traders. AI observability isn’t as easy as conventional software program monitoring, particularly when coping with multi-step agent workflows and the probabilistic nature of enormous language fashions. We wanted to assist traders perceive why present DevOps instruments fall quick for AI and why our strategy gives a basically higher resolution.

What components about your enterprise led your traders to write down the examine?

I consider a number of components influenced our traders’ selections. First, our robust progress trajectory – we noticed over 50x improve in requests logged in 2024 alone. Second, our capacity to safe enterprise prospects early, together with Fortune 100 corporations. Third, our technical strategy of leveraging traces for evaluations and monitoring multi-agent architectures, which additionally spoke to our workforce’s deep technical experience and execution capabilities in a quickly evolving house. Our workforce consists of seasoned engineers from corporations like Microsoft, Amazon, JP Morgan, Patreon, and others which offered additional validation.

What are the milestones you propose to realize within the subsequent six months?

Over the subsequent six months, we’re centered on enabling enterprise-wide AI deployment by expanded integrations and deployment fashions, together with supporting numerous new enterprise pilots in pipeline. We’re constructing superior analysis tooling for working multi-turn agent simulations, ensuring advanced brokers like Devin may be completely examined utilizing a know-how much like the likes of Waymo and different self-driving corporations. We’re additionally accelerating our product growth to satisfy rising market demand and increasing our workforce in key areas like product engineering, techniques infrastructure, and developer relations.

What recommendation are you able to supply corporations in New York that would not have a recent injection of capital within the financial institution?

Focus relentlessly on buyer worth and construct one thing folks actually need. Once we began HoneyHive, we spent numerous hours speaking to AI engineers and groups to deeply perceive their ache factors. This customer-centric strategy helped us construct one thing folks truly needed, which in flip made fundraising simpler. In at present’s atmosphere, capital effectivity is essential – prioritize what actually strikes the needle for patrons and be keen to adapt rapidly based mostly on their suggestions.

The place do you see the corporate going within the close to time period?

Within the close to time period, we’re centered on scaling our product and workforce following our normal availability launch. We’re significantly centered on advancing our analysis capabilities for rising agent architectures, increasing our observability options, and deepening our enterprise integration choices. Our mission is to assist extra organizations bridge the hole between AI prototypes and dependable manufacturing techniques, and this funding will speed up our capacity to ship on that mission.

What’s your favourite spring vacation spot in and across the metropolis?

After I can discover time away from constructing HoneyHive, I like visiting Jones Seashore State Park in spring and summer time. The seashore is spectacular, surprisingly near the town, and it’s an ideal place to clear your head and achieve some perspective while you’re deep within the startup grind.