This week, traders shall control earnings from the 2 behemoths of the retail commerce sector – House Depot and Walmart. House Depot sells instruments, building merchandise, home equipment and providers whereas Walmart operates a series of hypermarkets, low cost malls and grocery shops. By market capitalization in the worldwide retail sector, each have been ranked 3rd and a couple ofnd respectively, proper after Amazon.

As of September 2023, US retail gross sales elevated 3.75% over the identical month within the earlier 12 months, nonetheless under the typical determine 4.83% from 1993 till 2023. Nonetheless, the info recorded a month-to-month upward enhance of 0.7%, beating market forecast (0.3%). This may occasionally level to still-robust shopper spending (however may finally be hampered by higher-for-longer rates of interest). Classes which noticed a rise in gross sales are miscellaneous retailer retailers (3%), non-store retailers (1.1%), motor automobiles and components sellers (1%), gasoline stations (0.9%), meals providers and consuming locations (0.9%), well being and private care shops (0.8%), meals and beverage shops (0.4%) and normal merchandise shops (0.4%). Quite the opposite, classes which noticed a decline in gross sales are furnishings shops, electronics and home equipment, clothes shops, sporting items, pastime, musical instrument and bookstores (-0.8%), in addition to constructing materials and backyard gear (-0.2%).

House Depot

The corporate shall launch its Q3 2023 earnings consequence on 14th November (Tuesday), earlier than market open.

In Q2 2023, House Depot reported income at $42.92B, higher than market expectation ($42.19B) for the primary time in three quarters. Nonetheless, the reported determine was barely down almost -2% from the identical interval final 12 months following continued stress in big-ticket, discretionary classes. Different objects underperformed in comparison with these in Q2 2022, resembling working revenue ($6.59B, down -8.6% (y/y)), web revenue ($4.66B, down -9.9% (y/y)) and diluted EPS ($4.65, down -7.9% (y/y)).

Different headwinds embrace normalization of demand for DIY tasks, weakening housing market, rising costs, shopper spending shift and many others. The administration additionally identified that complete buyer transactions fell by almost –2% in comparison with the identical interval final 12 months. Following a mixture of the aforementioned elements, the administration reiterated its muted forecast for FY2023, with gross sales predicted to say no between 2%-5% in contrast with the year-ago interval., whereas EPS is predicted to be down 7%-13% from the prior 12 months interval.

Consensus estimates for gross sales income of House Depot within the coming announcement stood at $37.6B, down -12.4% from the earlier quarter, and down -3.3% from the identical interval final 12 months.

Alternatively, EPS is predicted to hit $3.77, down almost -19% from the earlier quarter. In Q3 2022, it was $4.24.

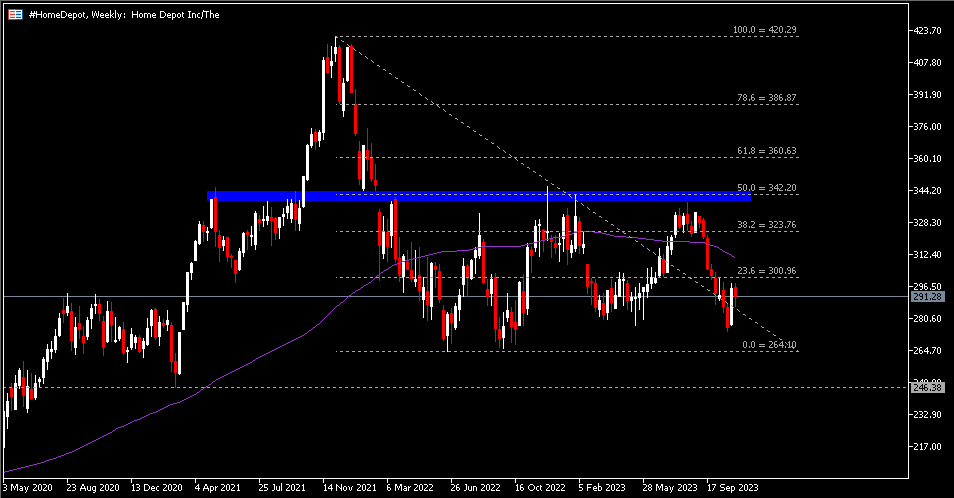

Technical Evaluation:

The #HomeDepot share value stays traded under resistance $301 (FR 23.6% prolonged from the excessive in Dec 2021 to the low in June 2022) and 100-week SMA, after forming a double prime sample when the asset failed to interrupt the FR 50.0% at $342. Nearest help is seen at $264.10 (the low seen in June 2022), adopted by the Feb 2021 lows at $246.38.

Walmart

The corporate is predicted to report its earnings for Q3 2023 on 16th November (Thursday), earlier than the opening bell.

In distinction to House Depot, the important thing monetary metrics of Walmart have been strong within the earlier quarter. Gross sales income have been up 5.7% (y/y) to $161.6B.

The corporate continued to see development in eCommerce domestically (+24% (y/y)) and internationally (+26% (y/y), primarily led by China, Walmex and Flipkart) – the previous was pushed by grocery and Well being & Wellness (regardless of a modest decline on the whole merchandise gross sales), whereas the latter was boosted by energy in store-fulfilled. As well as, a division of Walmart – Sam’s Membership (paid membership based mostly warehouse, which sells groceries and home items in bulk quantities) reported web gross sales barely down -0.3% (y/y) to $21.8B. Nonetheless, the phase reported strong development in membership depend and revenue following continued energy in member development and renewals.

Working revenue was up +6.7% (y/y) to $7.3B. By enterprise segments, fundamental contribution got here from Walmart US ($6.11B, up +7.6% (y/y), whereas Walmart Worldwide noticed a leap of over 14% (y/y) in working revenue at $1.19B. Good points have been barely offset by minor losses reported in Company & Assist.

On the whole, Walmart’s steady innovation and progress in e-commerce is clear to all. A few of the milestones achieved embrace Walmart GoLocal, Walmart Luminate, Walmart Join, Walmart+, Spark Supply, Market and Walmart Achievement Providers. As well as, the corporate has numerous partnerships, investments and buyouts which maintain the corporate at its aggressive edge.

Nonetheless, consensus estimates for gross sales income of Walmart stay flat at $156.8B, in distinction with the administration steerage which anticipated a development of three%.

EPS is predicted to hit $1.48, down over -19% from the earlier quarter. In Q3 2022, reported EPS was $1.50.

Technical Evaluation:

The #Walmart share value has traded in an uptrend since gaining help in Might 2022. ATH is seen at $166.60, earlier than the asset closed the week at $166.05, above help $160.75. Primarily based on the projection of Fibonacci Enlargement, the following resistance to give attention to is $170, adopted by $181.40. Alternatively, a retrace under the stated help could point out technical correction, to check the second larger low (inexperienced zone) at $151.60.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is supplied as a normal advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.