Right here’s a refined abstract of yesterday’s FOMC , as reported by the Kobeissi Letter:

- Fed cuts rates of interest by 50 foundation factors for the primary time since 2020.

- Two extra 25 foundation level cuts anticipated in 2024.

- Governor Bowman dissented for the primary time since 2005, advocating for a 25 foundation level reduce.

- The Fed expresses “higher confidence” that inflation is trending towards 2%.

- They’ll “fastidiously assess incoming information” to regulate their outlook.

- Anticipate 100 foundation factors of cuts in 2025 and 50 foundation factors in 2026.

- The much-anticipated “Fed pivot” has formally begun.

Nevertheless, it’s vital to mood celebrations:

Traditionally, when the Fed applied its first reduce of fifty+ foundation factors:

- On January 3, 2001, the fell about 39% over the subsequent 448 days, resulting in a recession.

- On September 18, 2007, the S&P 500 dropped roughly 54% over the subsequent 372 days, coinciding with a 5.3% rise in unemployment and a recession.

But, the present panorama differs considerably from 2001 and 2008. The tech sector seems extra to be present process a correction than a bubble burst, and there’s no looming actual property disaster or mortgage meltdown.

So, what’s subsequent for this week?

We could expertise a delicate touchdown, and stagflation might emerge as a prevailing theme, with additional easing possible. As I usually point out within the media, stagflation is a pace bump to recession.

Regardless, I’ll be preserving a detailed eye on the Retail ETF (NYSE:).

Over 80 I’m all in on a bull run in equities.

Underneath 70, I’m cautious, if not bearish, in equities.

What About Commodities?

We have now to look at the to see if 100 holds or not.

Until there’s a vital rally, a bounce from right here shouldn’t be too impactful.

Nevertheless, if there’s a enormous drop underneath 100, that would cut back Granny’s buying energy, drive costs greater and provides us that stagflation.

For commodities?

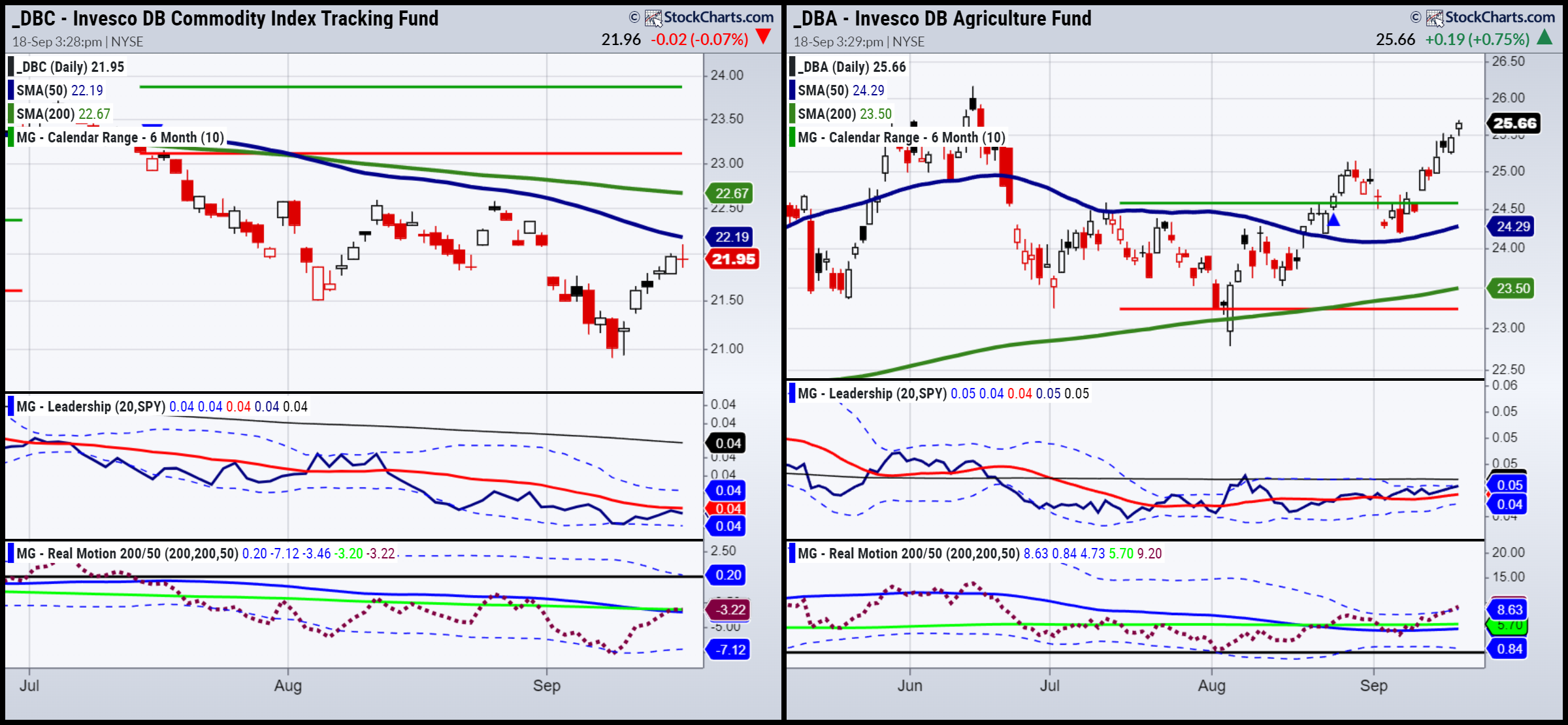

We suggest you watch and .

At this level, DBC (article yesterday) should make up its thoughts.

However DBA appears to be like about to deal with the 2024 highs.

Each will let you know higher than the rest the place laborious belongings are going and in flip, inflation.

ETF Abstract

(Pivotal means short-term bullish above that degree and bearish under)

- S&P 500 (SPY) 560 pivotal

- (IWM) 210 pivotal 220 resistance

- Dow (DIA) New all-time excessive and reverse???

- Nasdaq (QQQ) 465 help 477 resistance

- Regional banks (KRE) 57 pivotal and a sector to look at

- Semiconductors (SMH) 230 help 240 pivotal- a crash right here not wholesome

- Transportation (IYT) 67.00 support-this preferred the speed reduce

- Biotechnology (IBB) 145 help 150 resistance

- Retail (XRT) 73.50 help 77 resistance

- iShares iBoxx Hello Yd Cor Bond ETF (HYG) Made a brand new excessive and closed on the lows of the every day range-keep watching