MicroStockHub

High Yield Stock Watchlist Criteria

The companies listed on this watchlist are stable with a track record of paying and raising their dividends consistently. Each of the companies listed below has a market cap of at least $3 billion. The companies must also have an S&P Capital IQ Earnings and Dividend Ranking of A-, A or A+. This filter helps to establish if the company has achieved, and should continue to achieve, lower price volatility when compared to the broader market.

Next, the current annual dividend yield of the companies on this watchlist is at least 3%. While there could be some debate as to what qualifies a company as “high yield,” 3% is sufficient for me. In addition to the 3% yield, a 10-year dividend growth rate of at least 4% is the next filter used.

Companies I invest in for income should be growing their dividend at least at the rate of inflation and the United States inflation rate has not exceeded 4% in more than 30 years (until 2021). Lastly, a company must be able to maintain a growing dividend for me to consider investing in it, so a trailing twelve-month payout ratio of less than 90% is used as the final filter.

I use dividend yield theory to determine if a stock is potentially undervalued or overvalued. This simple idea suggests a company’s yield should revert to the mean over time. An example below is Amgen Inc (AMGN), the current yield is 3.23% while its five-year average is 2.74%. The difference is 49 basis points or approximately 18%, suggesting the stock could be undervalued. It is worth noting I consider any stock that is overvalued or undervalued by 5% to be approximately fairly valued, see also American Electric Power (AEP) below.

| Company | 10 Year DGR | Dividend Yield (8/31/22) | Div. Yield(5 Yr Avg.) | Overvalued / Undervalued |

| American Electric Power Company Inc (AEP) | 4.95% | 3.11% | 3.26% | 5% |

| Amgen Inc (AMGN) | 28.81% | 3.23% | 2.74% | -18% |

| Bank of New York Mellon Corp (BK) | 10.48% | 3.56% | 2.26% | -58% |

| Comerica Inc (CMA) | 21.13% | 3.39% | 3.19% | -6% |

| Evergy Inc (EVRG) | 5.27% | 3.34% | 3.12% | -7% |

| First American Financial Corp (FAF) | 23.24% | 3.89% | 2.99% | -30% |

| Fifth Third Bancorp (FITB) | 15.07% | 3.51% | 2.94% | -19% |

| Fidelity National Financial Inc (FNF) | 12.51% | 4.50% | 3.13% | -44% |

| Interpublic Group of Companies Inc (IPG) | 16.23% | 4.20% | 3.79% | -11% |

| JPMorgan Chase & Co (JPM) | 13.98% | 3.52% | 2.40% | -47% |

| Leggett & Platt Inc (LEG) | 4.20% | 4.60% | 3.58% | -28% |

| Morgan Stanley (MS) | 26.51% | 3.64% | 2.24% | -63% |

| Northern Trust Corp (NTRS) | 9.60% | 3.15% | 2.28% | -38% |

| Omnicom Group Inc (OMC) | 10.65% | 4.19% | 3.47% | -21% |

| Bank OZK (OZK) | 19.86% | 3.16% | 2.49% | -27% |

| Principal Financial Group Inc (PFG) | 13.30% | 3.42% | 3.85% | 11% |

| Packaging Corp of America (PKG) | 17.46% | 3.65% | 2.71% | -35% |

| PNC Financial Services Group Inc (PNC) | 15.36% | 3.80% | 2.56% | -48% |

| Pinnacle West Capital Corp (PNW) | 4.75% | 4.51% | 3.69% | -22% |

| T. Rowe Price Group Inc (TROW) | 13.29% | 4.00% | 2.46% | -63% |

| UGI Corp (UGI) | 23.13% | 3.65% | 2.62% | -39% |

| U.S. Bancorp (USB) | 13.15% | 4.03% | 2.83% | -42% |

| Watsco Inc (WSO) | 13.08% | 3.23% | 3.16% | -2% |

Goal

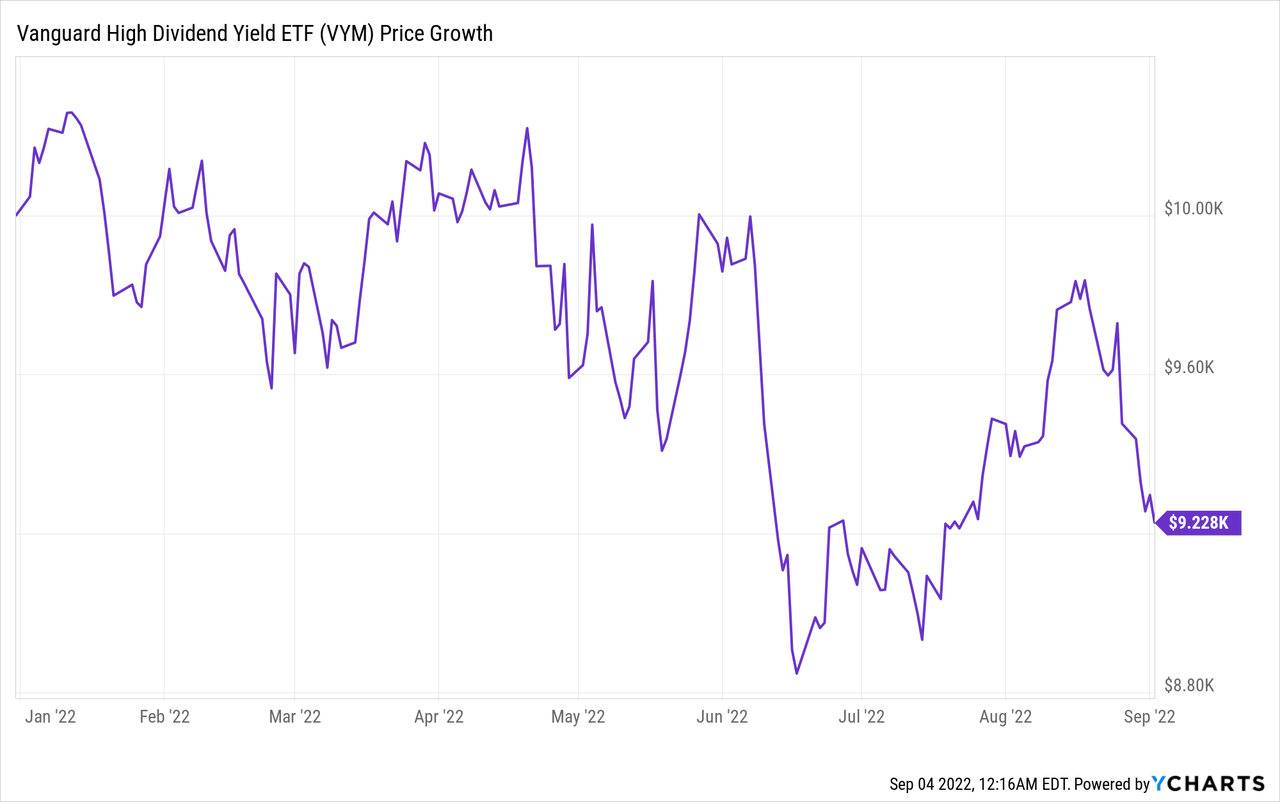

The goal of my high yield watchlist is to discover companies to add to my dividend growth portfolio in an attempt to consistently exceed the market return of the Vanguard High Dividend Yield ETF (VYM). Through August 2022, an equally weighted portfolio of these 23 stocks mentioned above would have underperformed the VYM by about 5%. VYM is down 6.11% year to date while the stocks above have lost 11.42%.

| Symbol | AugustReturns | YTD Return through August |

| AEP | 2.45% | 15.38% |

| AMGN | -2.15% | 9.44% |

| BK | -4.44% | -26.87% |

| CMA | 3.25% | -6.17% |

| EVRG | 1.21% | 2.47% |

| FAF | -7.76% | -30.48% |

| FITB | 0.09% | -20.36% |

| FNF | -2.15% | -23.49% |

| IPG | -6.49% | -24.13% |

| JPM | -1.41% | -26.55% |

| LEG | -3.58% | -4.85% |

| MS | 1.09% | -11.03% |

| NTRS | -4.70% | -19.45% |

| OMC | -4.21% | -6.94% |

| OZK | 1.07% | -10.90% |

| PFG | 11.68% | 5.29% |

| PKG | -2.62% | 2.09% |

| PNC | -4.78% | -19.34% |

| PNW | 2.56% | 10.60% |

| TROW | -2.81% | -37.75% |

| UGI | -8.48% | -12.33% |

| USB | -3.37% | -17.31% |

| WSO | -0.70% | -11.06% |

| VYM | -2.45% | -6.11% |

New Options

Five new financial/banking institutions are making an appearance for the first time, in no particular order, they are Bank of New York Mellon, First American Financial Corp, Fifth Third Bancorp, Northern Trust Corp and Bank OZK. All of them sport a current dividend yield of more than 3% and all of them are undervalued, with the average being about 34%.

Packaging Corporation of America also appeared on the watchlist for the first time in 2022 and is currently undervalued by 35%. PKG is one of the few stocks on the watchlist to have a positive year to date return through August, up just over 2%. Lastly, PKG’s 10 year dividend growth rate is 17.46%, nearly 3% more than the average 10 year dividend growth rate for the stocks on the watchlist.

Final Thoughts

This high yield dividend watchlist is used to identify companies worthy of further research. Stock prices fluctuate continuously, and although there are legitimate reasons for an increase or decrease, occasionally there are times the market is just overreacting to a short-term issue. I believe if you can identify the reason(s) and determine for yourself if a decline in stock price is justified, you can minimize risk in your portfolio by purchasing a company’s stock when their yield is higher than normal.