we famous two market management indicators, one constructive (Semiconductor and Tech management) and one probably damaging (Healthcare relative to the broad market). The potential backside within the XLV/SPY ratio seems to be like much less of a possible one week later (constructive for the markets) because the would-be low acquired bent off form, and Semi and shorter-term Tech management are nonetheless intact.

This week let’s take a look at a sign displaying that the stresses of 2022 proceed to ease in 2023. Very clearly, high-yield bond spreads are usually not indicating a rush to security or a liquidity disaster of any sort but. In different phrases, from this vantage level, the This autumn-Q1 rally theme lives on.

The 2020 spike within the unfold logically got here with a deflation scare, and the 2022 bear market started together with a grind greater within the unfold. It’s one instrument telling us that it’s nonetheless okay to invest lengthy and never but okay to invest brief except you, in contrast to I, have the abdomen for shorting in opposition to an intermediate bull-trending market with intact indicators like this.

In November, I labeled the projected broad rally the “This autumn-Q1 rally”. It was projected and born of wildly bearish sentiment, projected inflationary reduction and, by extension Fed hawk reduction, and the post-election sample, which is constructive on common over the following 12 months.

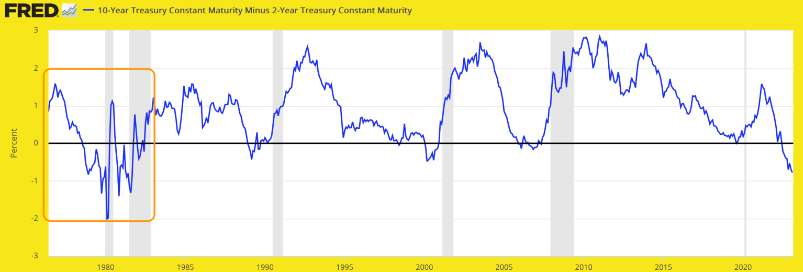

What we’d wish to do is use an image just like the above to a) notice that an unbiased view of the scenario exhibits an intact and helpful backdrop from an essential macro indicator and b) to be on alert for any modifications within the standing of this and different indicators (one biggie that involves thoughts could be a future reversal from inverting to steepening of the and different yield curves).

Backside Line

The Excessive Yield Unfold indicator at present advantages the U.S.-based parts (no less than) of the broad inventory rally. If this and different helpful situations endure, the rally ought to endure. And simply because I labeled it the This autumn-Q1 rally months in the past doesn’t imply it can not prolong past March. However we’ll let varied indications (e.g., technical, sentiment, macro) information as typical.

In the meantime, talking of the yield curve, let’s depart the phase with the long-term view proven final week. The curve is inverting ever deeper, and it isn’t often the inversion part when the enjoyable* begins; it’s when the following steepener begins that we’ll see upheaval in all of the pre-programmed considering by at this time’s market gamers; man, girl, machine, Ma, Pa & on line casino patron alike.

So this line burrowing southward could be interpreted as aligned with the mild downtrend within the Excessive Yield unfold above. It’s after they conclude their downtrends that the motion begins.

* Enjoyable is outlined right here as mayhem, which can be enjoyable for some who’ve ready the suitable method however painful for a lot of extra.