Excessive-growth firms usually set vital objectives, realizing full properly that the concept of “in a single day success” is for the storybooks. Nonetheless, there isn’t any higher time than the center of a market downturn to begin planning for the leap from a personal to a public firm.

De-risking the trail to going public requires strategic planning, which takes time. Corporations with objectives to go public in lower than three years should subsequently plan for it now — regardless of the downturn — to get the operating begin they’ll must navigate the open market.

Let’s discover why this adversarial economic system is good for planning an IPO and what to do about it.

Development traders have not too long ago pulled again

Whereas some firms delay their IPOs, others can play catch-up and put together for the time when the open market itches to take a position once more.

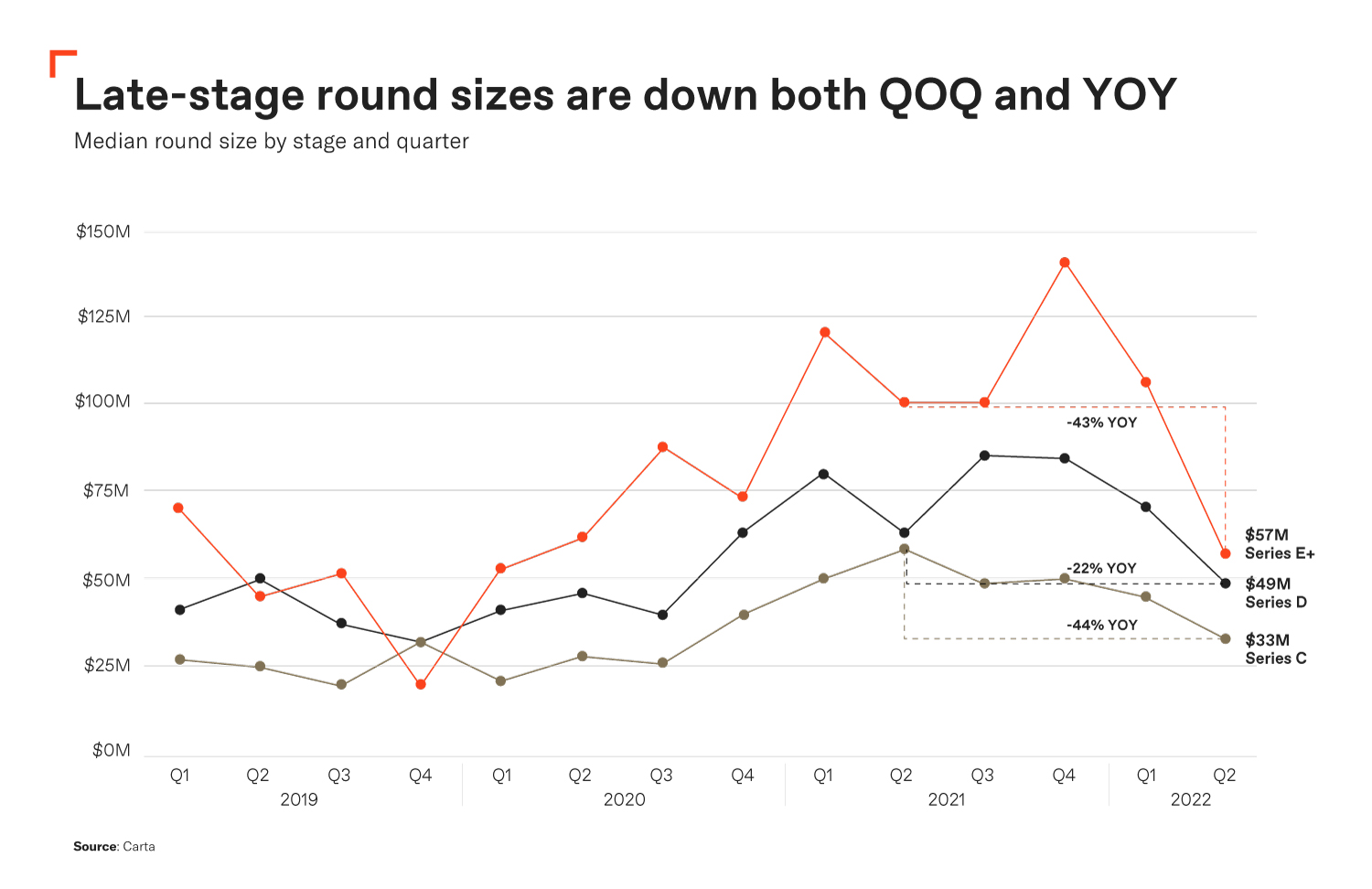

Carta reviews that personal fundraising ranges have declined throughout the U.S. from a record-breaking 2021. Unsurprisingly, late-stage firms have skilled the brunt of this blow.

Market specialists are at the moment encouraging leaders not to pin their hopes on enterprise capital dry powder, though there’s loads of it. Because the graph under signifies, the scale of late-stage funding rounds has shrunk.

Picture Credit: Founder Protect

Though few take pleasure in market downturns, how this one unfolds can ship insights to late-stage firms that concentrate. On one hand, many leaders are embracing the message of the Sequoia memo. We will agree with their concepts to prioritize income over progress — scaling is totally different from what it was, and we should swallow that jagged capsule.

However, cost-cutting and giving up hope of fundraising isn’t all doom and gloom. In spite of everything, when there’s cash to be discovered, some progressive founder will discover it. We see it daily; solely now, the trail seems to be totally different.

Market downturns spur valuation corrections

Course-correcting is an idea regularly mentioned amid market downturns. The pendulum swings a method for a interval, then begins its journey towards a extra balanced commonplace. On this case, the open market thrived on bloated valuations — most startups had been overvalued earlier than 2021.

Moreover, many said that 2021 was a miracle yr, particularly as VC funding practically doubled to $643 billion. The U.S. sprouted greater than 580 new unicorns and noticed over 1,030 IPOs (over half had been SPACs), considerably increased than the yr earlier than. This yr has solely welcomed about 170 public listings.