Revealed on October 17, 2025, by Nathan Parsh

Excessive-yield shares pay out dividends which might be considerably larger than the market common. For instance, the S&P 500’s present yield is simply ~1.2%, a product of document highs for the market.

Excessive-yield shares might be notably useful in shoring up earnings after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

We’ve created a spreadsheet of shares (and carefully associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You possibly can obtain your free full listing of all excessive dividend shares with 5%+ yields (together with vital monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

You possibly can obtain your free full listing of all excessive dividend shares with 5%+ yields (together with vital monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

The subsequent article on this collection will evaluation Stellus Capital Funding Corp. (SCM).

Enterprise Overview

Stellus is a Enterprise Growth Firm, or BDC, that views itself as a versatile supply of capital for the center market. The corporate invests in small, predominantly non-public firms which might be normally at an early stage of their progress cycles.

Stellus is a middle-market funding agency that makes fairness and debt investments in non-public middle-market firms. The corporate gives capital options to firms with $5 million to $50 million of EBITDA and does so with numerous devices, nearly all of that are debt.

Stellus gives first lien, second lien, mezzanine, convertible debt, and fairness investments to a various group of shoppers, typically at excessive yields, within the US and Canada.

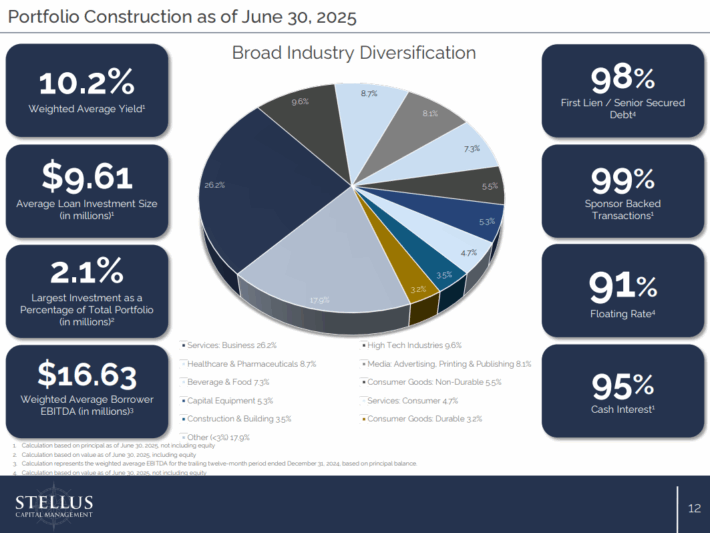

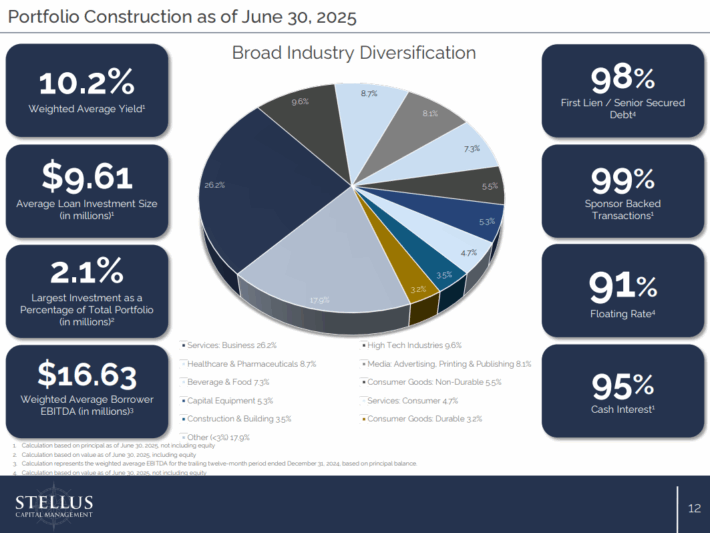

Supply: Investor Presentation

Stellus has a extremely diversified funding portfolio, each by way of trade and geography focus. The corporate provides quite a lot of debt investments, together with first lien, second lien, uni-tranche, and mezzanine financing.

Invested capital is used for a variety of functions, together with acquisitions, progress investments, and extra. The investments are positioned in numerous industries, together with enterprise companies, industrial, healthcare, know-how, power, shopper merchandise, and finance. Stellus is externally managed by Stellus Capital Administration LLC, a registered funding advisor.

The corporate follows a disciplined funding technique. For instance, it closed solely about 2% of offers reviewed over the previous few years. Its relative selectiveness permits the corporate to give attention to the highest-quality investments.

It additionally means the corporate has way more funding alternatives than it wants, enhancing its capability to pick out solely the very best investments. Stellus generates notably excessive yields from its first lien, second lien, and unsecured debt investments. The weighted common yield as of the newest quarterly report was 10.3%.

Progress Prospects

A robust catalyst for Stellus is its rising funding portfolio. Over the previous 5 years, Stellus has seen its portfolio rise quickly, permitting the corporate to earn larger funding earnings.

Nevertheless, this all stopped in 2020 because the coronavirus pandemic despatched the U.S. economic system right into a deep recession, negatively impacting a lot of Stellus’ investments.

Stellus reported second-quarter outcomes on August seventh, 2025, with outcomes near the market’s expectations. Web funding earnings was $0.34, whereas core internet funding earnings of was $0.35. This was down in comparison with the prior yr, nevertheless. Complete funding earnings of $25.7 million decreased from $26.6 million final yr.

Gross bills climbed $600K, or 3.6%, from final yr, whereas charges and bills associated to borrowings elevated from $3.9 million to $4.3 million.

The corporate funded $15 million of recent investments, ending the quarter with a complete portfolio truthful worth of $986 million.

We count on that internet funding earnings will decline 20.7% to $1.30 in 2025.

Aggressive Benefits & Recession Efficiency

Like many BDCs, Stellus doesn’t profit from important aggressive benefits. The corporate provides the identical forms of merchandise that different BDCs do to an identical set of shoppers. We really feel that makes it arduous for BDCs to differentiate themselves an excessive amount of from the trade. Moreover, BDCs usually endure throughout recessions as a result of debtors have a tougher time assembly reimbursement timelines.

Stellus was not round through the 2007 to 2009 interval, because it was not fashioned till 2012. That stated, internet funding earnings dipped from $1.23 to $1.13 in 2020, earlier than making a brand new excessive in 2022. This was an honest consequence in comparison with many BDCs throughout that interval.

One space of concern is that Stellus continues to dilute its share depend. The share depend greater than doubled between 2015 and 2024. We venture that the share depend will greater than triple from 2015 to 2030, which is able to seemingly act as a headwind to internet funding earnings and will put the dividend in danger.

Dividend Evaluation

Stellus, like most BDCs, provides a really excessive yield, which is 13.4% at present.

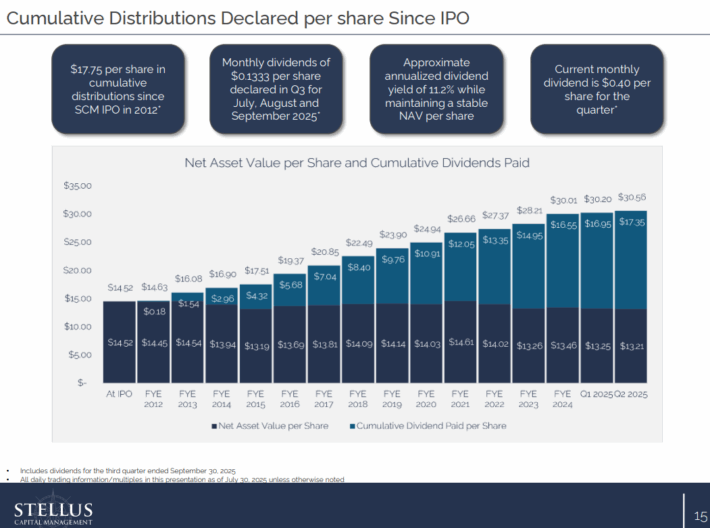

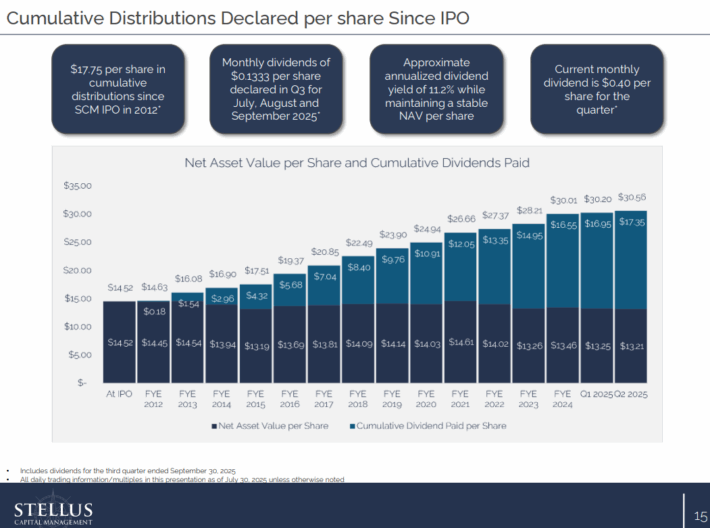

Supply: Investor Presentation

Stellus at present pays a month-to-month dividend of $0.1333 per share, equating to an annualized payout of $1.5996. The corporate minimize its dividend in mid-2020 because of the pandemic, which was seemingly a prudent transfer throughout that interval.

Stellus has paid out particular distributions previously to complement its enticing month-to-month dividend additional, however this final occurred in 2022.

The primary motive traders are interested in BDCs is that they usually present excessive charges of earnings, and Stellus is not any totally different. These excessive yields usually include dangers. Stellus is predicted to see a sizeable decline in NII in 2025, with the projected payout ratio at 123% for this yr. The payout ratio has usually been elevated with Stellus, however this might be the very best fee in additional than a decade and the primary time since 2019 that it exceeded the 100% threshold.

Subsequently, it’s fairly potential that Stellus can be pressured to chop its dividend if internet funding earnings doesn’t return to progress.

Remaining Ideas

Stellus has a reasonably diversified enterprise mannequin and survived the worst of the Covid-19 pandemic significantly better than a lot of its fellow BDCs.

The 13%+ yield could possibly be attractive for earnings traders, however the yield won’t be secure from a possible minimize on condition that Stellus is projected to payout extra in dividends than it generates in internet funding earnings.

We recommend that solely essentially the most risk-tolerant traders take into account proudly owning shares of Stellus.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].