Printed on November eleventh, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably larger than the market common. For instance, the S&P 500’s present yield is simply ~1.2%.

Excessive-yield shares may be notably helpful in supplementing revenue after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Gladstone Business Company (GOOD) is a part of our ‘Excessive Dividend 50’ sequence, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

We’ve got created a spreadsheet of shares (and carefully associated REITs, MLPs, and so forth.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with essential monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our listing of high-dividend shares to overview is Gladstone Business Company (GOOD).

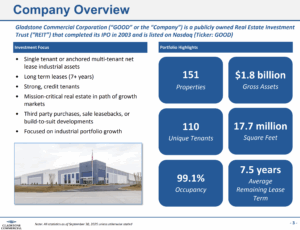

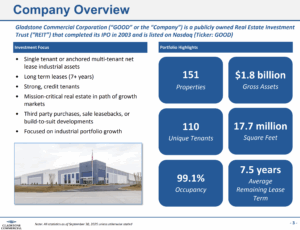

Enterprise Overview

Gladstone Business Company (NASDAQ: GOOD) is an actual property funding belief (REIT) that focuses on buying, proudly owning, and managing single-tenant and anchored multi-tenant net-leased workplace and industrial properties throughout the USA. Based in 2003, the corporate’s portfolio contains 151 properties in 27 states, totaling roughly 17 million sq. toes and leased to over 100 tenants. Its technique emphasizes long-term leases with creditworthy tenants, concentrating on secure revenue and diversification throughout industries and geographies.

The corporate is thought for delivering constant revenue to shareholders by month-to-month money distributions and sustaining excessive occupancy ranges, which stood at 99.1% as of mid-2025. Gladstone Business is more and more specializing in industrial belongings, which now account for about 67% of its annualized hire, reflecting a strategic shift away from non-core workplace properties. This focus positions the REIT for regular rental revenue and modest, dependable progress, interesting primarily to income-oriented traders in search of stability.

Supply: Investor Relations

Gladstone Business Company reported third-quarter 2025 outcomes with complete working income of $40.8 million, up 3.3% from the prior quarter. Internet revenue accessible to widespread stockholders was $1.0 million, or $0.02 per share, down 32.5%, whereas Core FFO rose 1.8% to $16.4 million, or $0.35 per share, pushed by acquisitions and leasing exercise.

Throughout the quarter, the corporate collected 100% of rents, acquired a six-property, 693,236-square-foot portfolio for $54.8 million, bought a non-core industrial property for $3.0 million, and accomplished leasing on 734,464 sq. toes throughout 14 properties. It additionally raised $23.0 million by its at-the-market inventory program and continued month-to-month money distributions to shareholders.

After the quarter, Gladstone expanded its credit score facility to $600 million, prolonged mortgage maturities, repaid $3.1 million of mortgage debt, and maintained full hire assortment. These actions reinforce the corporate’s concentrate on secure revenue, disciplined capital administration, and strategic portfolio progress.

Supply: Investor Relations

Progress Prospects

Gladstone Business is positioned for regular progress by its strategic concentrate on industrial properties, which now make up about 67% of its annualized hire. By buying absolutely leased, long-term industrial belongings and disposing of non-core workplace properties, the corporate is bettering portfolio high quality and money move stability.

Excessive occupancy ranges, close to 98–99%, and lengthy common lease phrases assist constant hire assortment and scale back emptiness danger.

Progress is anticipated to be modest however secure. Core FFO rose 1.8% in Q3 2025 to $16.4 million ($0.35 per share), reflecting contributions from acquisitions and leasing, although per-share progress is tempered by fairness issuance and rising prices.

Key dangers embody larger rates of interest and challenges within the workplace sector. For traders, Gladstone’s enchantment lies in dependable revenue and incremental portfolio progress somewhat than speedy enlargement.

Aggressive Benefits & Recession Efficiency

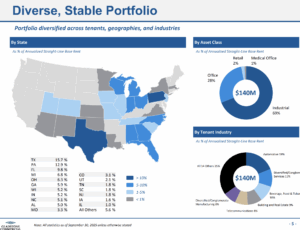

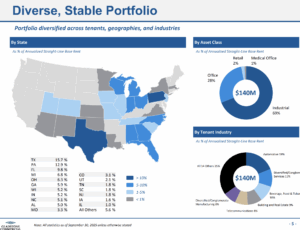

Gladstone Business’s aggressive benefits stem from its concentrate on high-quality, net-leased industrial and workplace properties with creditworthy tenants and long-term leases. This technique ensures predictable money move and reduces tenant turnover, whereas its disciplined acquisition method targets absolutely leased properties in progress markets.

The corporate additionally maintains a diversified portfolio throughout industries and geographies, mitigating focus danger and offering stability in various market situations.

The corporate has traditionally demonstrated resilience throughout financial downturns as a consequence of its sturdy tenant base, lengthy lease phrases, and web lease construction, which shifts most property bills to tenants.

Occupancy has remained persistently excessive—close to 98–99%—even in slower financial intervals, permitting Gladstone to maintain money distributions and Core FFO. This mixture of secure revenue, diversified holdings, and conservative monetary administration helps the REIT climate recessions higher than many friends.

Supply: Investor Relations

Dividend Evaluation

The corporate’s annual dividend is $1.20 per share. At its current share worth, the inventory has a excessive yield of 10.9%.

Given the corporate’s 2025 earnings outlook, FFO is anticipated to be $1.45 per share. In consequence, the corporate is anticipated to pay out roughly 83% of its FFO to shareholders in dividends.

Last Ideas

We mission complete annual returns of 13% for Gladstone Business going ahead. With a present yield of 10.9%, the inventory seems undervalued. We view the corporate’s sturdy recession resilience and constant FFO per share positively, although we assign a promote ranking as a result of lack of current dividend will increase.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].