Revealed on November eleventh, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which might be considerably larger than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares could be significantly useful in supplementing earnings after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Gladstone Capital (GLAD) is a part of our ‘Excessive Dividend 50’ collection, which covers the 50 highest-yielding shares within the Certain Evaluation Analysis Database.

Now we have created a spreadsheet of shares (and intently associated REITs, MLPs, and so on.) with dividend yields of 5% or extra.

You may obtain your free full record of all securities with 5%+ yields (together with necessary monetary metrics similar to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our record of high-dividend shares to evaluation is Gladstone Capital (GLAD).

Enterprise Overview

Gladstone Capital Company (NASDAQ: GLAD) is a publicly traded enterprise improvement firm (BDC) based mostly in McLean, Virginia. Based in 2001, it offers debt and choose fairness financing to growth-oriented, lower-middle-market U.S. corporations, sometimes with annual revenues of $20–$150 million.

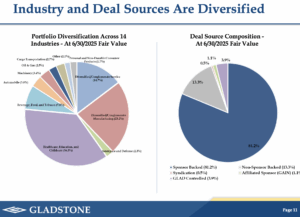

Its investments embrace senior loans, subordinated debt, mezzanine financing, and sometimes most well-liked fairness or warrants. Gladstone is industry-agnostic, specializing in sectors similar to enterprise providers, healthcare, specialty manufacturing, and logistics.

Financially, GLAD generates earnings primarily from curiosity and costs on its mortgage portfolio and distributes a considerable portion to shareholders as common dividends. The corporate has deployed over $3 billion throughout greater than 280 investments since its inception.

Like different BDCs, it faces dangers from credit score cycles, interest-rate adjustments, and liquidity constraints, however its strategic debt issuance and diversified portfolio goal to steadiness yield technology with danger administration.

Supply: Investor Relations

The corporate reported its monetary outcomes for the third quarter ended June 30, 2025, with web funding earnings of $11.3 million, or $0.50 per share, in step with expectations. Complete funding earnings was $21.66 million, reflecting a modest 0.4% enhance from the prior quarter, pushed primarily by larger prepayment charges and dividend earnings, partially offset by a decline in curiosity earnings. Complete bills remained largely unchanged, as reductions in curiosity expense had been balanced by larger administration and incentive charges. The web enhance in web property from operations was $7.45 million, or $0.33 per share, barely decrease than the prior quarter.

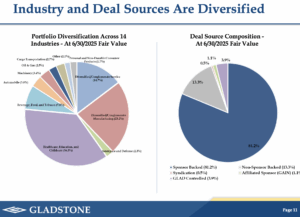

In the course of the quarter, Gladstone actively deployed $58.6 million in new investments and $14.4 million in current portfolio corporations. The portfolio continued to emphasise secured first lien property, which symbolize over 70% of debt investments at value. The corporate additionally strengthened its credit score capability, growing its complete facility dedication to $320 million and lengthening the revolving interval to October 2027, with a closing maturity in October 2029. Complete investments at truthful worth stood at $751.3 million, barely down from $762.6 million within the earlier quarter, whereas web asset worth per share decreased marginally to $21.25.

Subsequent to the quarter, Gladstone continued to increase its portfolio, together with investments in MASSiv Manufacturers, LLC; Alsay, Inc.; Snif-Snax, LLC; and OCI, LLC, totaling over $74 million. The corporate additionally declared quarterly distributions to widespread and most well-liked shareholders, totaling $0.495 and $0.3906 per share, respectively. Gladstone’s president, Bob Marcotte, highlighted the corporate’s sturdy steadiness sheet and funding capability, noting that sturdy portfolio exercise positions the agency to help continued shareholder distributions in upcoming quarters.

Supply: Investor Relations

Development Prospects

Gladstone Capital’s development prospects are modest, with web funding earnings (NII) per share exhibiting little change over the previous decade. This yr’s estimated NII of $2.01 is in step with historic outcomes, and share issuances have elevated complete NII with out considerably boosting per-share earnings.

Annual NII-per-share development is predicted to be simply 0.5%, reflecting restricted enlargement above the corporate’s value of capital.

Regardless of sluggish per-share development, Gladstone has improved portfolio yields to over 12%, serving to offset rising funding prices and help dividends. The corporate’s portfolio continues to develop in greenback phrases, although lending spreads have compressed.

In consequence, month-to-month dividends have elevated from $0.07 to $0.165 ($1.98 yearly), highlighting a secure, income-oriented technique for buyers even amid constrained development.

Aggressive Benefits & Recession Efficiency

Gladstone Capital’s aggressive benefit stems from its deal with lower-middle-market corporations and its disciplined, secured-lending technique. By emphasizing first-lien debt and diversifying throughout sectors like enterprise providers, healthcare, and manufacturing, the corporate reduces credit score danger whereas incomes enticing yields.

Its expertise in structuring debt and fairness offers permits it to focus on secure, cash-flow-positive corporations extra successfully than much less specialised lenders.

The corporate has traditionally proven resilience throughout recessions because of its conservative portfolio and deal with senior-secured loans. Whereas earnings and web property can fluctuate, Gladstone’s first-lien positions and disciplined method assist mitigate losses.

It has constantly generated web funding earnings and maintained dividends, offering stability and confidence for shareholders by way of financial cycles.

Supply: Investor Relations

Dividend Evaluation

The corporate’s annual dividend is $1.98 per share. At its current share worth, the inventory has a excessive yield of 9.3%.

Given the corporate’s 2025 earnings outlook, NII is predicted to be $2.01 per share. In consequence, the corporate is predicted to pay out roughly 99% of its NII to shareholders in dividends.

Last Ideas

We challenge complete annual returns of roughly 10%% within the coming years. Whereas the inventory seems pretty valued, the dividend payout ratio has returned under 100%, offering some help. We consider a 0.5% tailwind from the present valuation, alongside 0.5% anticipated development and a 9.3% dividend yield. Given these elements, the inventory maintains a maintain score, supported by barely larger earnings estimates.

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].